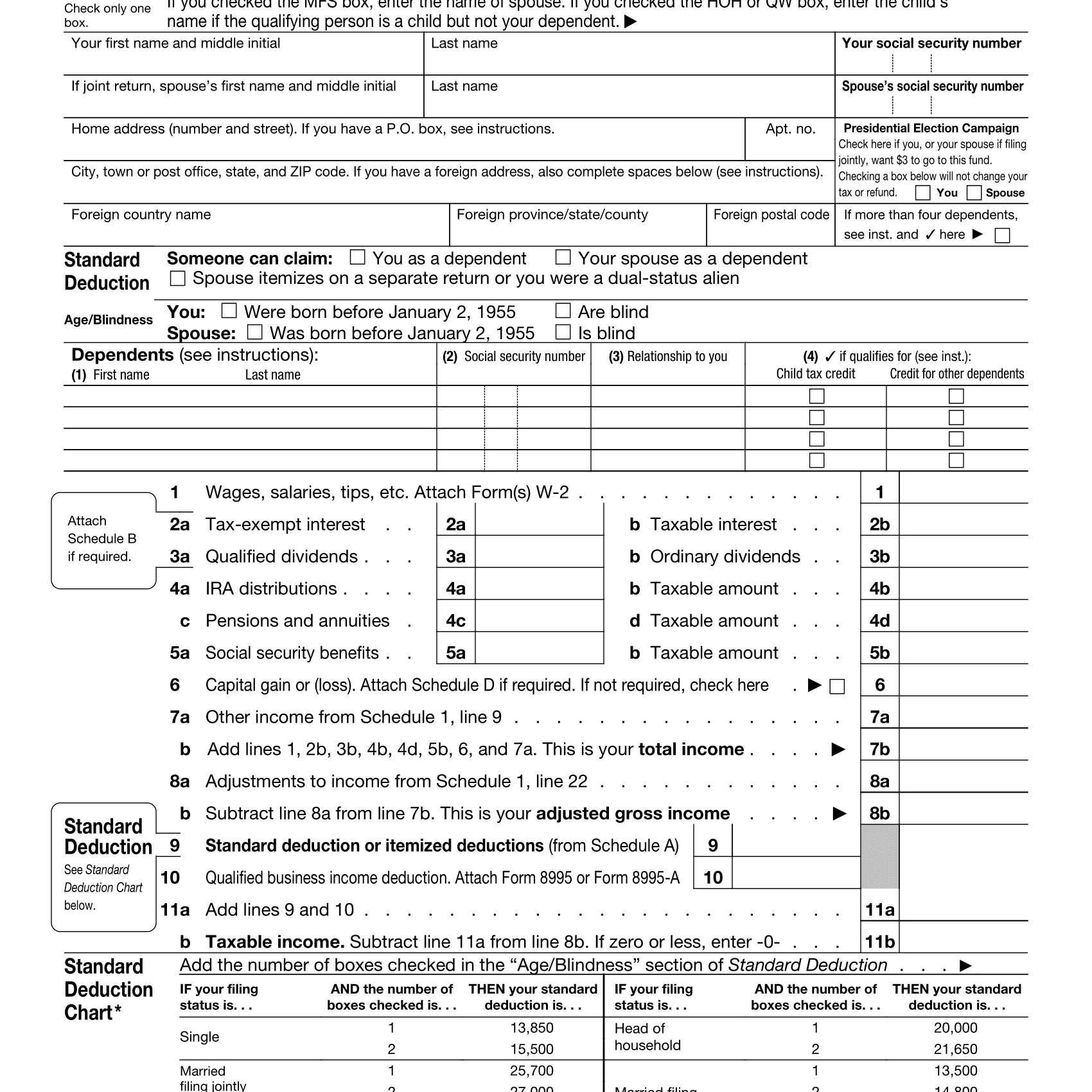

2021 Standard Deduction For Seniors – The standard deduction is a benefit provided to reduce your taxable income when you submit your tax responsibility. There are two options offered regarding the deduction– either to declare the standard quantity or obtain itemized deductions that you’re qualified to.

Form 1040-Sr: Seniors Get A New Simplified Tax Form For 2019

Form 1040-Sr: Seniors Get A New Simplified Tax Form For 2019

Before you are mosting likely to file your specific income tax return this season, it’s ideal if you knew one of the most current standard deduction price. It will certainly help you to make sound decisions concerning whether getting a standard or itemizing deduction would be extra advantageous.

Standard Deduction

Your overall earnings is separated into two various components: nontaxable and taxed revenue. A section of your taxable income have to be submitted to the state or federal government, as well as this part is called income tax. The reason that the revenue is divided like this is that federal government gives a part of your overall earnings to be subtracted or deducted from tax. It serves a fairly substantial benefit due to the fact that as a taxpayer, your tax bill will certainly be decreased.

Currently, this part of your revenue that didn’t obtain taxed is called standard deduction. The prices are released by the Internal Revenue Service (IRS). Just how much quantity of price that you are certified to obtain is based on your age, filing status, whether you are submitted as someone else’s reliant for a tax return, and also whether you have a impairment or otherwise.

Besides standard deduction, you may select to get your deduction to be itemized. Obtaining itemized deduction means that all tax-deductible expenditures of your own ( any type of costs that majorly affect the quantity of your tax) such as medical spending, property tax, certified charity contributions, and so on, will certainly be provided and taxed independently. It depends on you to choose which choice to take, however it’s not feasible to take both. Commonly, people will certainly pick any type of choices that raise their deduction value.

Standard Deduction 2020

Below is the listing of IRS (Internal Revenue Service) standard deductions for 2020 to be filed on the next year of 2021, based upon your filing standing:

- Single taxpayers receive $12,400 of deductions, which is a raising from $12,200 in the past year.

- Married| taxpayers that submitted individually receive $12,400 of deductions, which is a raising from $12,200 in the previous year.

- Married taxpayers that submitted jointly obtain $24,800 of deductions, which is a raise from $24,400 in the past year.

- Heads of households obtain $18,650 of deductions, which is a raising from $18,350 in the previous year.

- Qualifying widowers get $24,800 of deductions, which is a raising from $24,400 in the past year.

| Filing Status | Standard Deduction |

| Single | $12,400 |

| Married Filing Jointly | $24,800 |

| Married Filing Separately | $12,400 |

| Head of Household | $18,650 |

| Over 65 Age |

|

| Dependents | Additional $1,100 or individual income plus $350 |

Standard Deduction 2021

As the newly readjusted standard deduction is typically released in the latter part of the year, the prices for 2021 is yet to be recognized. It is still possible to forecast the amount based on projected patterns from prior years.

Below is the listing of IRS standard deductions for 2021 to be filed in the next year of 2022 based upon your filing condition. The change is developed as a prediction, yet it shouldn’t be away from the future launches:

- Single| taxpayers receive $12,550 of deductions, which is a raising from $12,400 in the past year.

- Married taxpayers that filed separately receive $12,550 of deductions, which is a raising from $12,400 in the previous year.

- Married taxpayers that submitted jointly get $25,100 of deductions, which is a raise from $24,800 in the previous year.

- Heads of households receive $18,800 of deductions, which is a raise from $18,650 in the previous year.

- Qualifying widowers get $25,100 of deductions, which is a raise from $24,800 in the past year.

| 2018 | 2019 | 2020 | 2021 | |

| Single | $12,000 | $12,200 | $12,400 | $12,550 |

| Married Filing Jointly | $24,000 | $24,400 | $24,800 | $25,100 |

| Married Filing Separately | $12,000 | $12,200 | $12,400 | $12,550 |

| Head of Household | $18,000 | $18,350 | $18,650 | $18,800 |

| Over 65 Age |

|

|

|

|

| Dependents | Additional $1,050 or individual income plus $350 | Additional $1,100 or individual income plus $350 | Additional $1,100 or individual income plus $350 | Additional $1,100 or individual income plus $350 |

To recognize the evaluation of your standard deductions every year early, you may want to utilize a tax calculator. It is available free of charge online on different websites including the main site of the IRS (Internal Revenue Service).