IRS W4 Form 2025 – Are you ready to take charge of your financial future? Well, look no further than the IRS W4 Form 2025! This form may seem daunting at first, but with the right guidance, you can unlock its secrets and master your money like never before. In this guide, we will show you how to take control of your finances and make the most out of this essential document. So, grab a cup of coffee, sit back, and let’s dive into the wonderful world of the IRS W4 Form 2025!

Unlock the Secrets of the IRS W4 Form 2025!

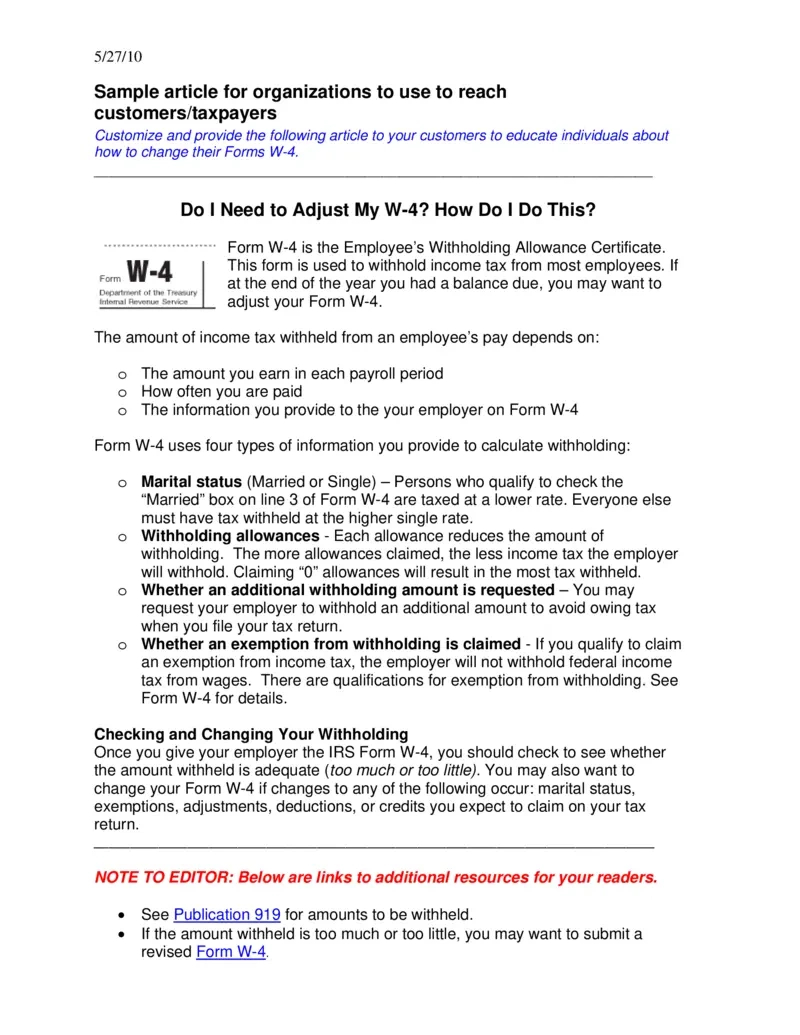

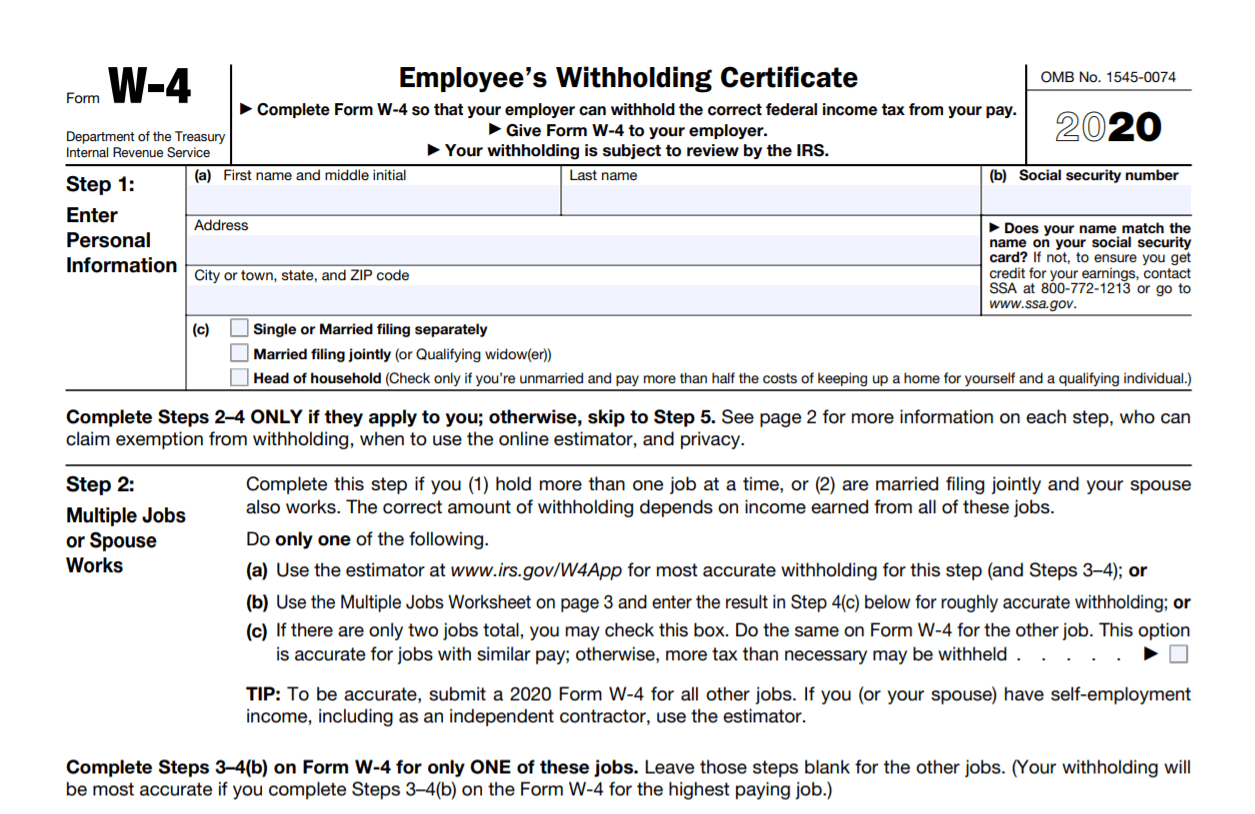

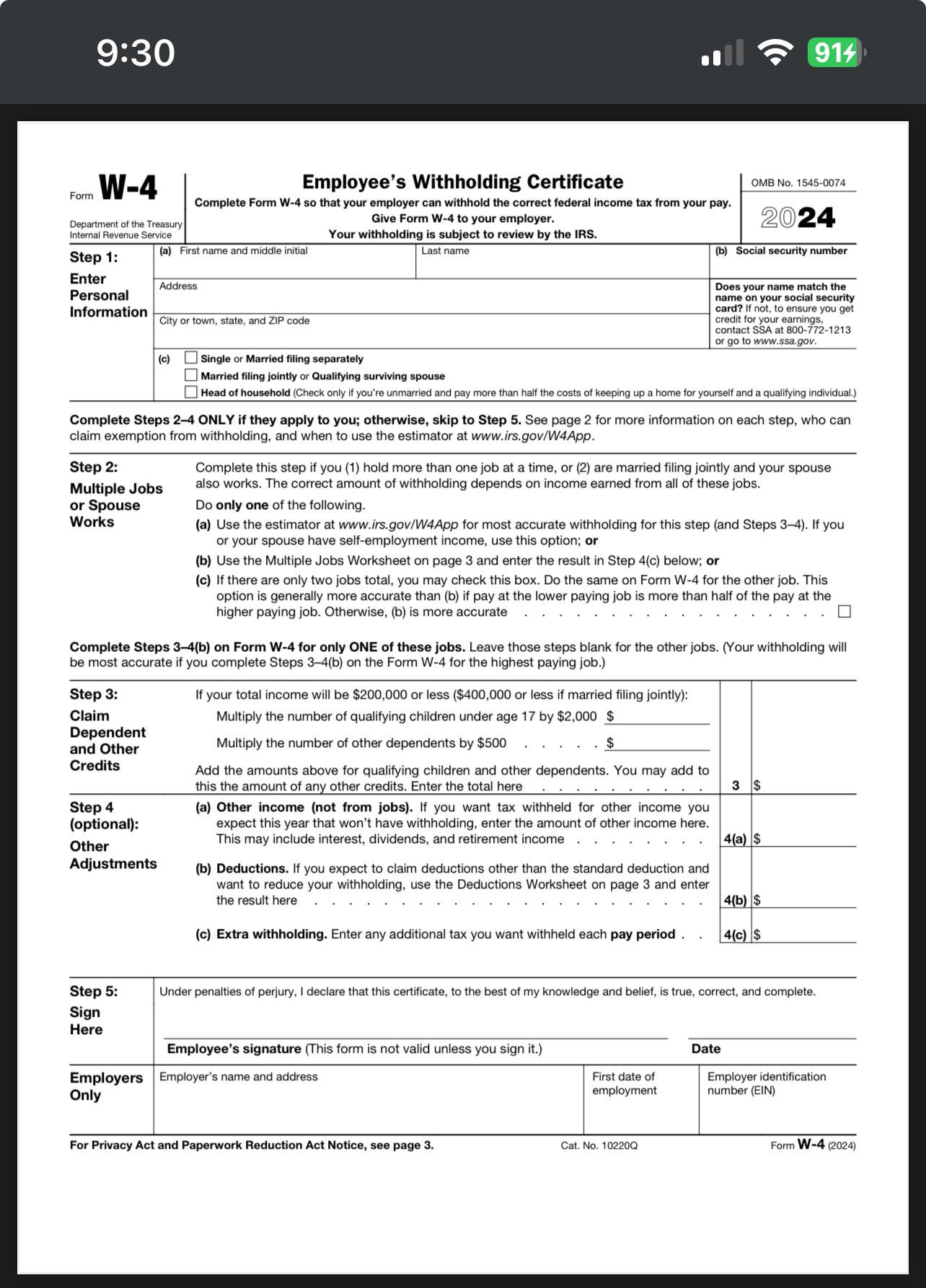

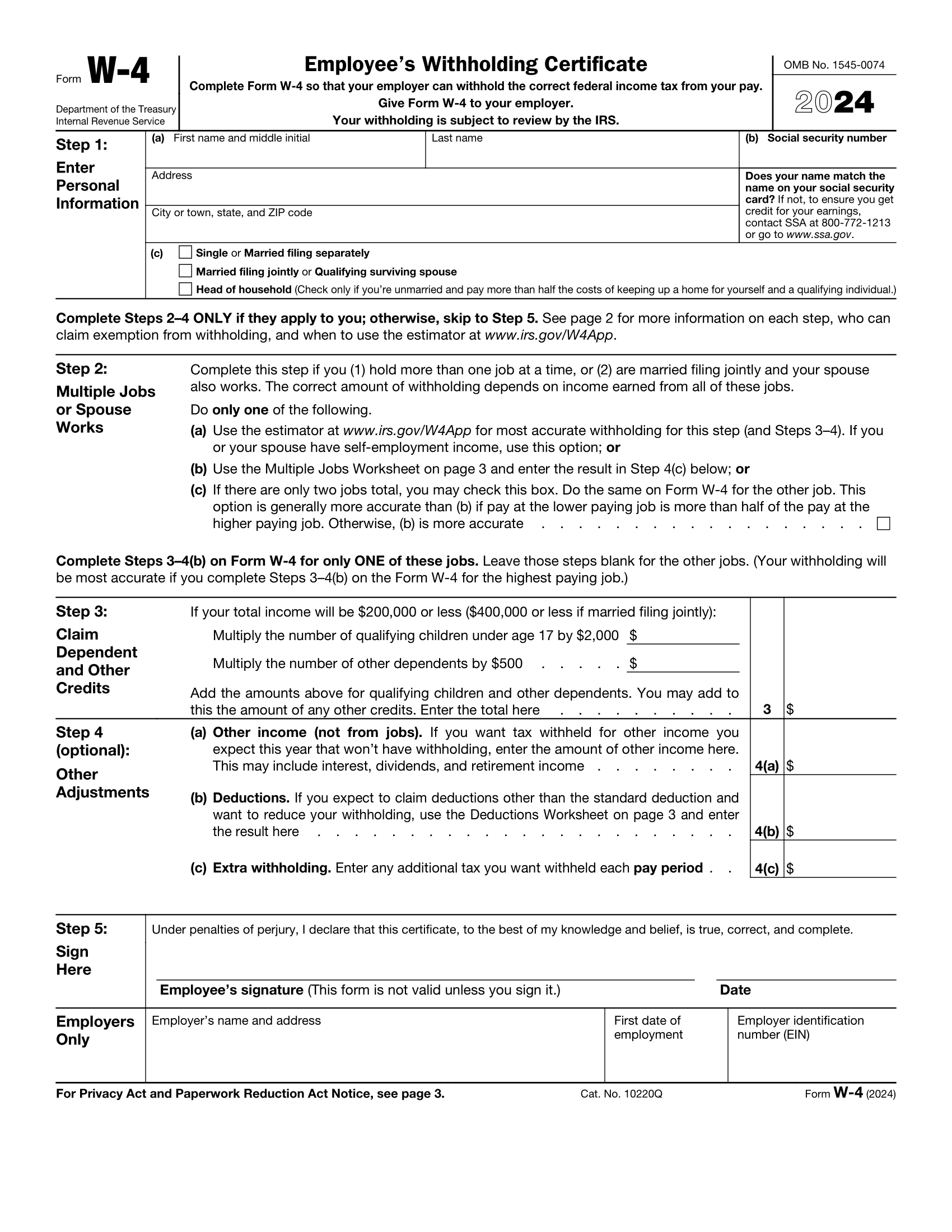

The IRS W4 Form 2025 is a crucial document that determines how much federal income tax is withheld from your paycheck. By filling out this form correctly, you can ensure that you are not overpaying or underpaying your taxes throughout the year. The key to mastering this form is to understand the various sections and how they impact your tax liability. From personal allowances to additional income, each line on the form plays a vital role in determining your tax withholdings.

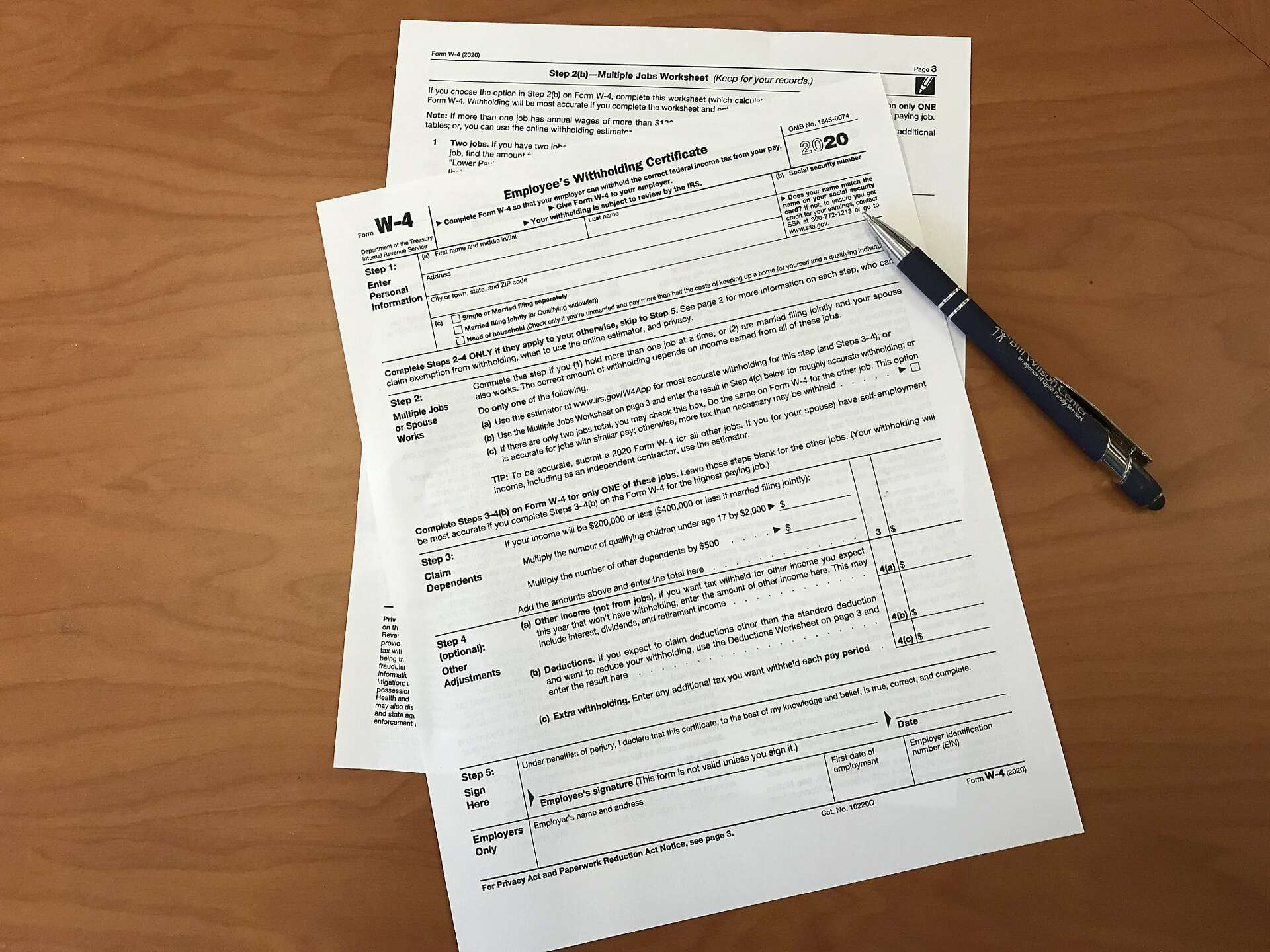

One of the most important sections of the IRS W4 Form 2025 is the Personal Allowances Worksheet. This worksheet helps you calculate how many allowances you are eligible for based on your filing status, dependents, and other factors. By accurately filling out this section, you can ensure that the right amount of tax is withheld from your paycheck each pay period. Remember, the goal is to get as close as possible to your actual tax liability to avoid any surprises come tax season.

Another key aspect of the IRS W4 Form 2025 is the section on Additional Income and Adjustments. This section allows you to account for any additional income you may have, such as interest, dividends, or freelance earnings. By including this information on your W4 form, you can adjust your tax withholdings to account for these extra sources of income. This will help you avoid owing a large tax bill at the end of the year and keep your finances in check.

Take Control of Your Finances with This Guide!

Now that you have a better understanding of the IRS W4 Form 2025, it’s time to take control of your finances and master your money. By carefully filling out this form and adjusting your withholdings as needed, you can ensure that you are maximizing your take-home pay while also staying on top of your tax obligations. Remember, the more you know about your finances, the better equipped you are to make informed decisions and secure a bright financial future.

So, grab your calculator, gather your financial documents, and get ready to conquer the IRS W4 Form 2025 like a pro. With the right knowledge and a little bit of effort, you can take charge of your finances and set yourself up for success. Don’t let this form intimidate you – embrace it as a tool to help you achieve your financial goals and live your best life. Here’s to mastering your money and unlocking the secrets of the IRS W4 Form 2025!

Related Forms…

IRS W4 Form 2025 Images