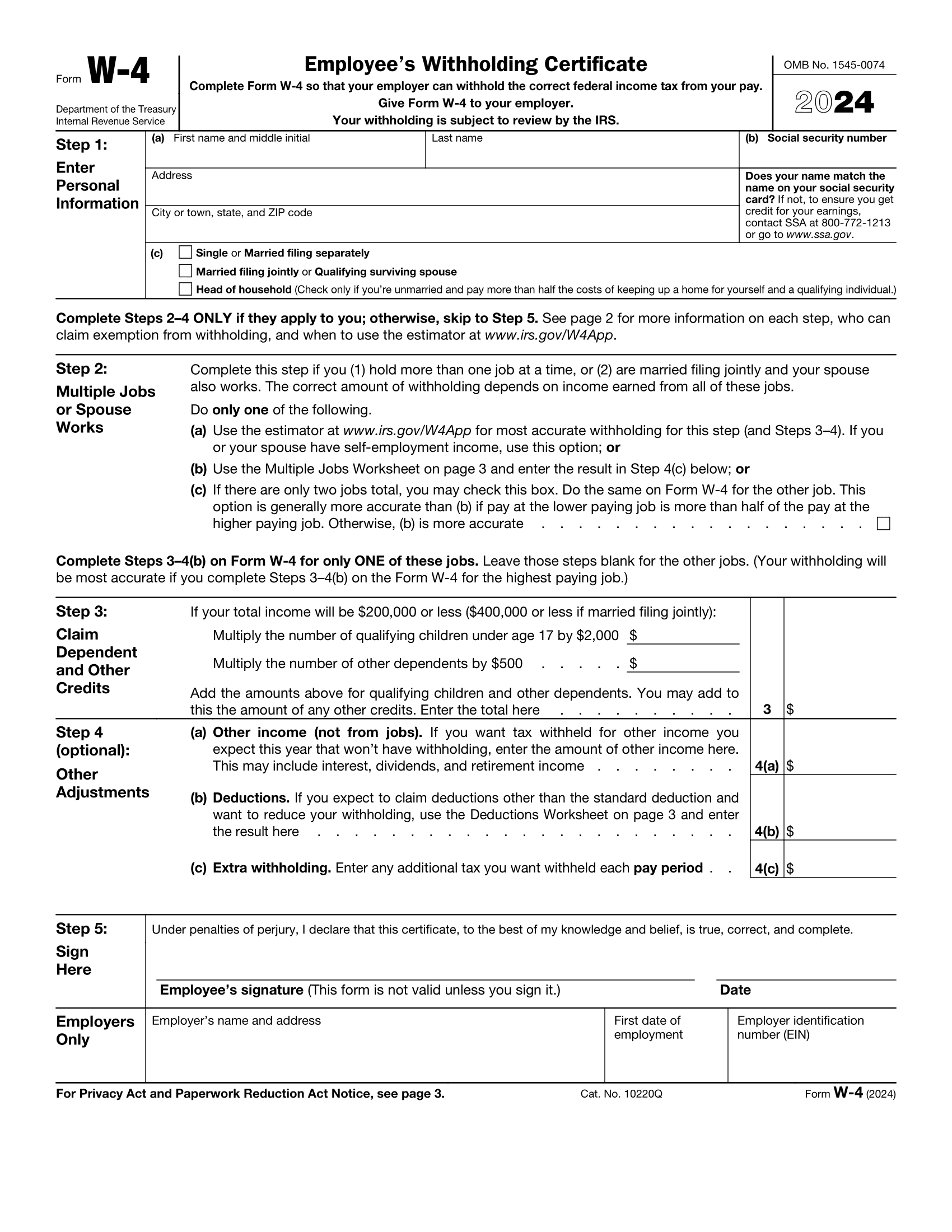

W4 2025 Form – Are you ready to breeze through tax season without the headache of confusing forms? Say hello to the revamped W4 form for 2025! The IRS has made significant changes to the form to simplify the process for both employers and employees. No more second-guessing how to fill out your W4 – the new form is designed to be more user-friendly and straightforward. So get ready to bid farewell to confusion and hello to a stress-free tax season!

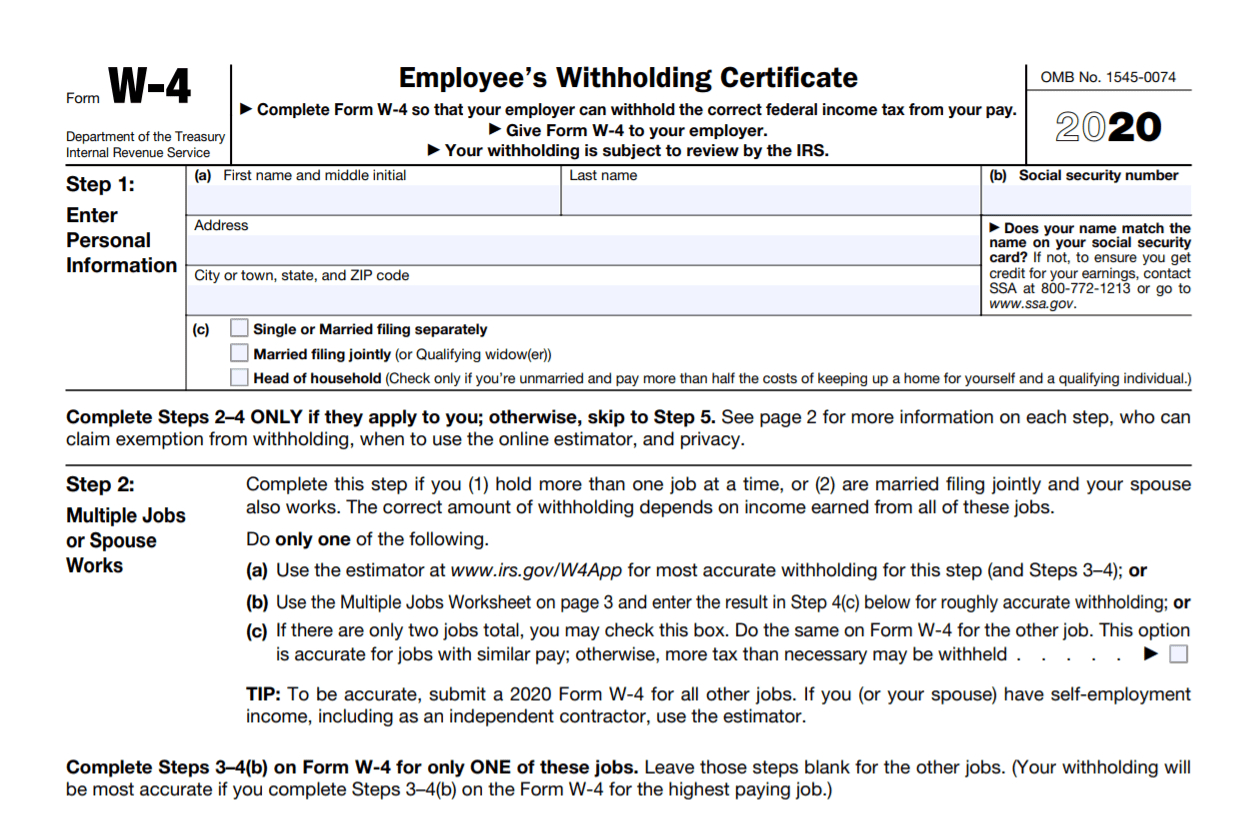

One of the most exciting changes to the W4 form for 2025 is the elimination of withholding allowances. Instead of using a complicated system of allowances to determine how much tax to withhold from your paycheck, the new form uses a simple five-step process. This means less room for error and more accurate withholding. The IRS has listened to feedback from taxpayers and streamlined the form to make it easier to understand and complete. So say goodbye to the old, confusing W4 and embrace the new and improved version for 2025!

With the new W4 form for 2025, it’s never been easier to take control of your tax situation. The revamped form allows you to customize your withholding based on your individual circumstances, such as multiple jobs, dependents, and other sources of income. By providing more accurate information upfront, you can avoid surprises come tax time. So don’t wait until the last minute – get familiar with the new W4 form now and make tax season a breeze in 2025!

Get a Head Start on Tax Season: Tips for Navigating the W4 Form Changes

Ready to tackle the new W4 form for 2025 like a pro? Start by familiarizing yourself with the changes and understanding how they will impact your tax withholding. Take the time to review the form and gather any necessary information, such as your filing status, income, and deductions. By getting a head start on the new form, you can avoid any last-minute stress and ensure a smooth tax season.

To make navigating the new W4 form even easier, consider using the IRS’s online withholding calculator. This tool can help you determine the right amount of tax to withhold from your paycheck based on your individual circumstances. By inputting accurate information, you can ensure that you’re not overpaying or underpaying throughout the year. Take advantage of this resource to maximize your tax savings and avoid any surprises when it comes time to file.

Lastly, don’t hesitate to seek assistance if you’re unsure about how to complete the new W4 form. Whether you consult with a tax professional or reach out to the IRS for guidance, it’s important to get the help you need to ensure accuracy. By staying proactive and informed, you can navigate the changes to the W4 form with confidence and ease. So get ready to tackle tax season 2025 head-on and make the most of the revamped W4 form!

In conclusion, the new and improved W4 form for 2025 is a game-changer for simplifying the tax withholding process. With its user-friendly design and updated features, taxpayers can expect a smoother and more accurate experience when filling out their W4. By getting a head start on understanding the changes and utilizing resources available, you can navigate the new form with ease and confidence. So get ready to say goodbye to confusion and hello to a stress-free tax season in 2025!

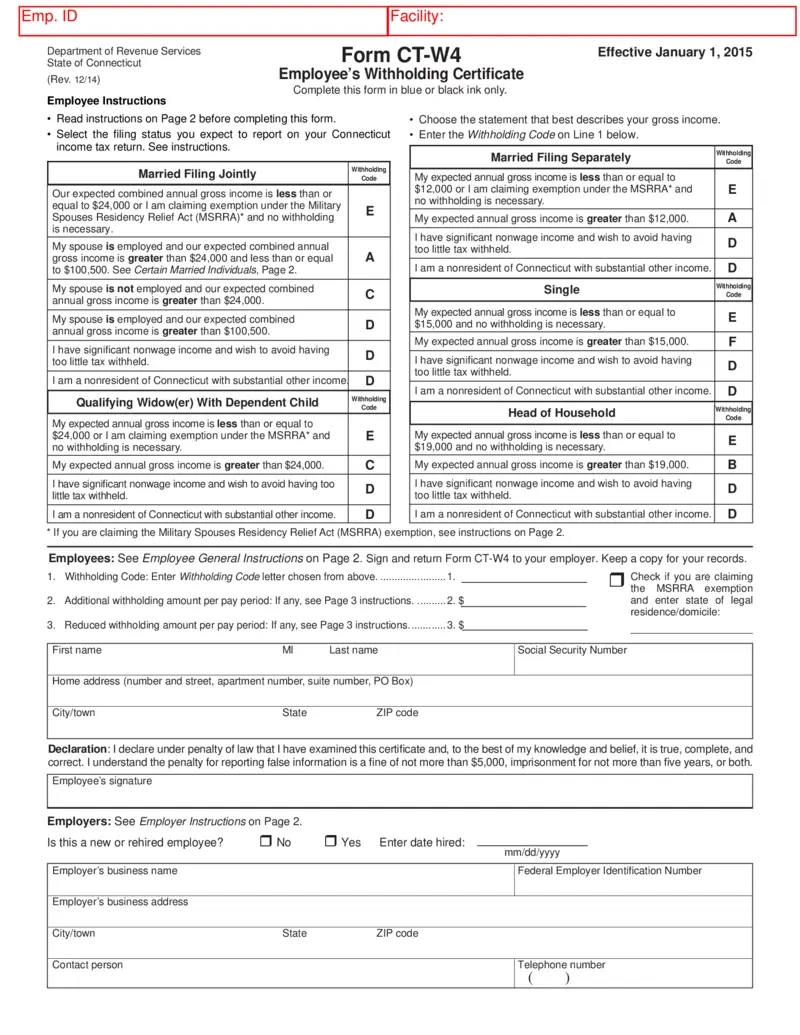

Related Forms…

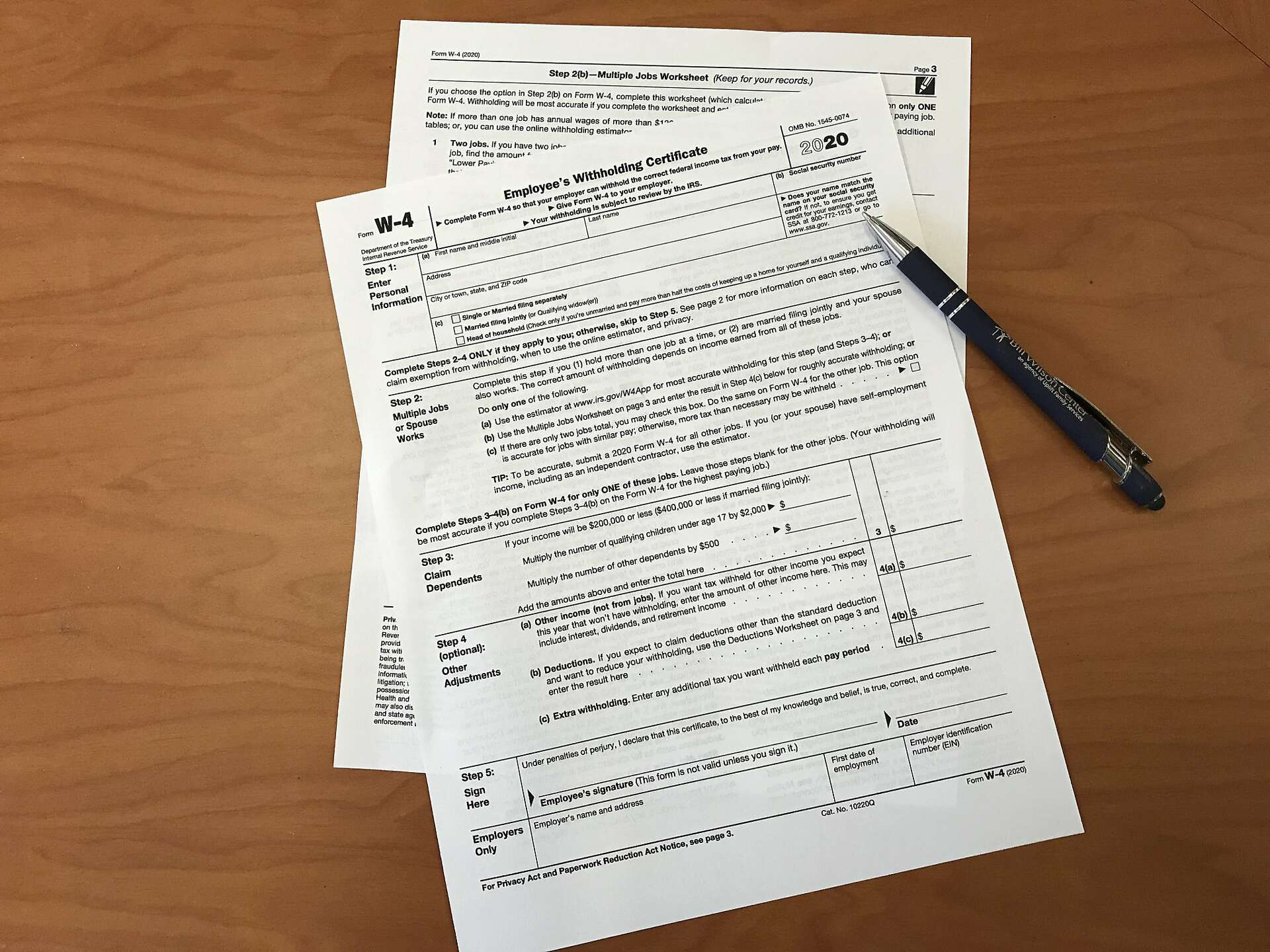

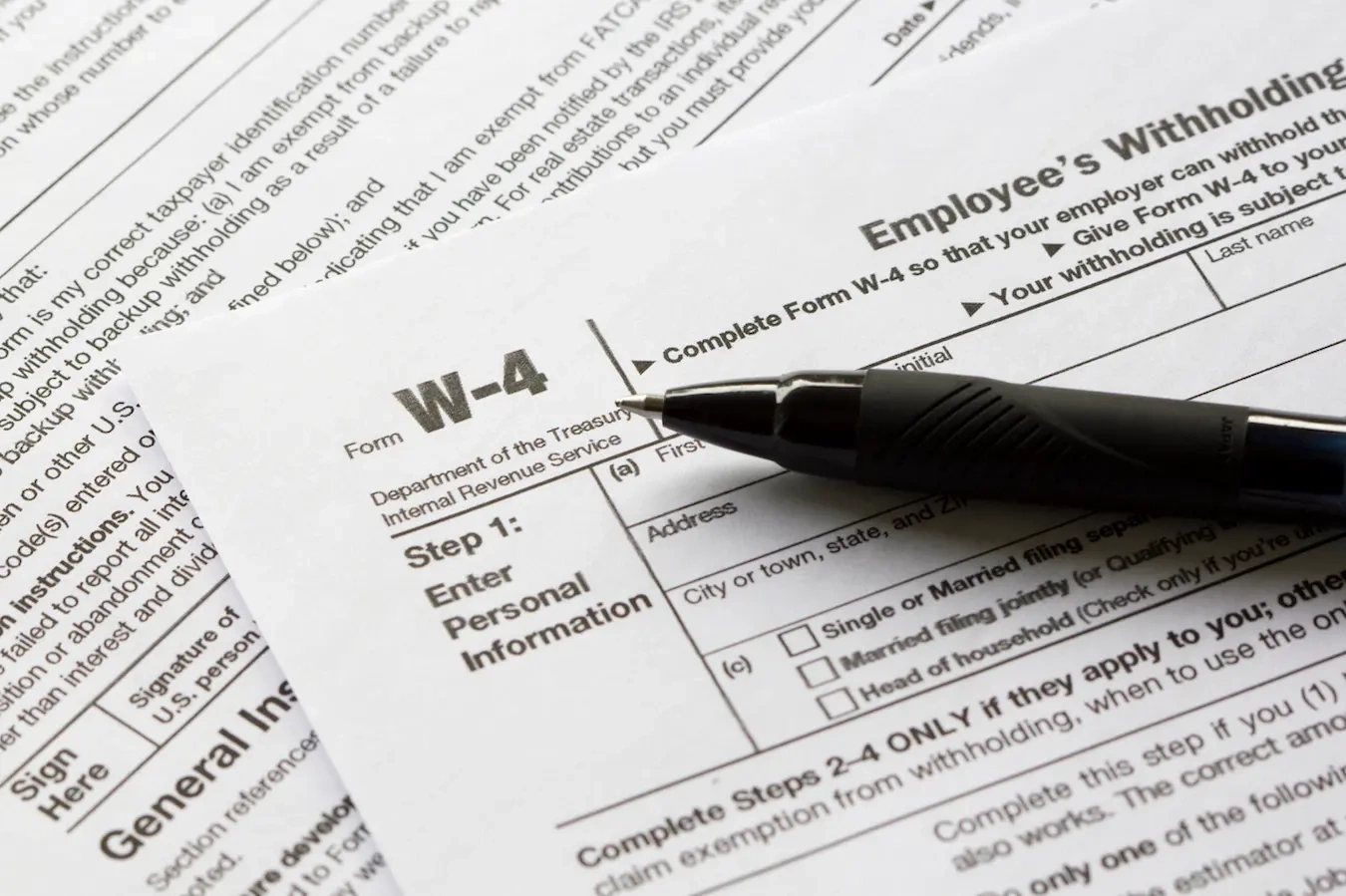

W4 2025 Form Images