IRS Form W4 2025 – Are you feeling overwhelmed by the thought of filling out your IRS Form W4 2025? Don’t worry, you’re not alone! Understanding tax forms can be a daunting task, but with a little guidance, you can conquer your taxes with ease. In this article, we will unravel the mystery of the IRS Form W4 2025 and provide you with simple tips to simplify your tax season.

Unraveling the Mystery of IRS Form W4 2025

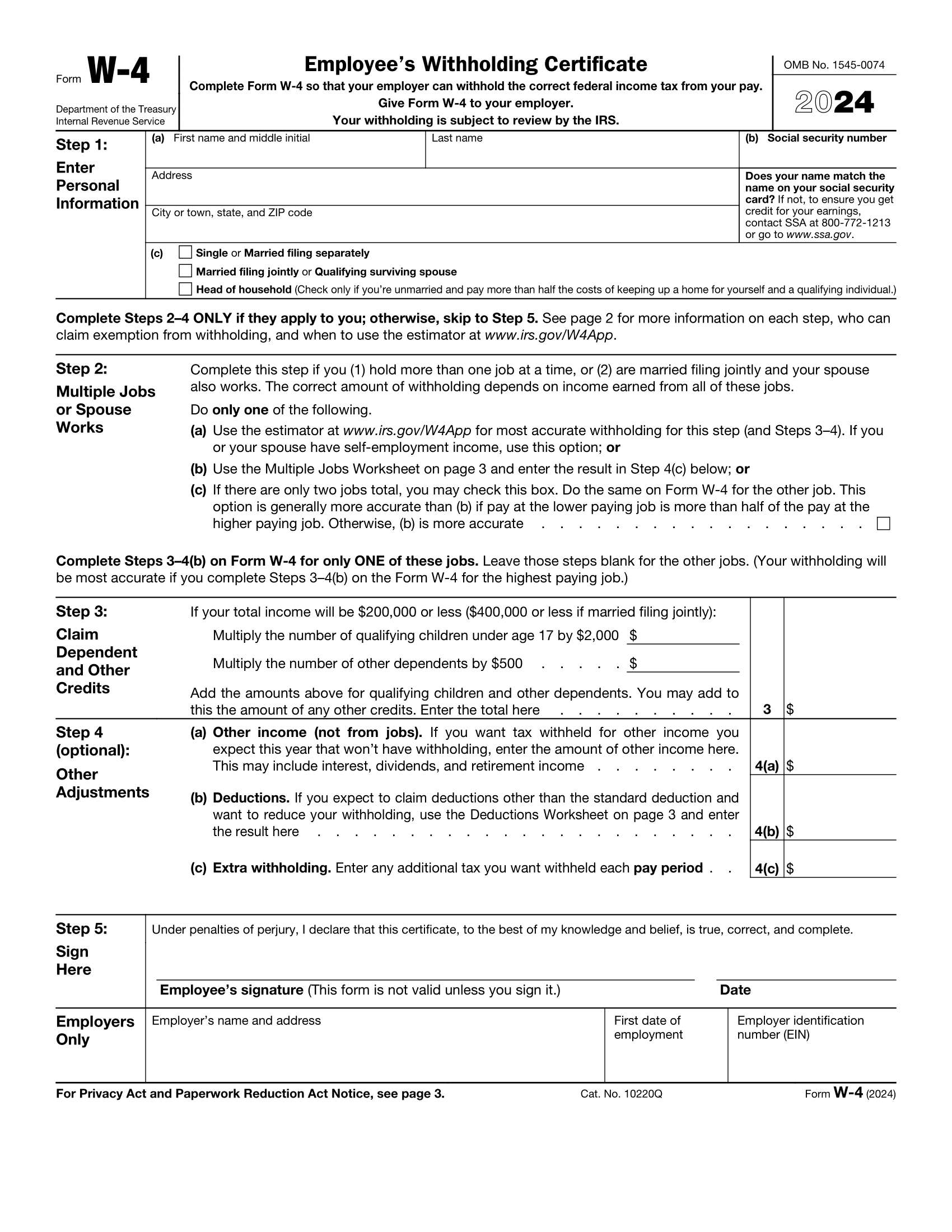

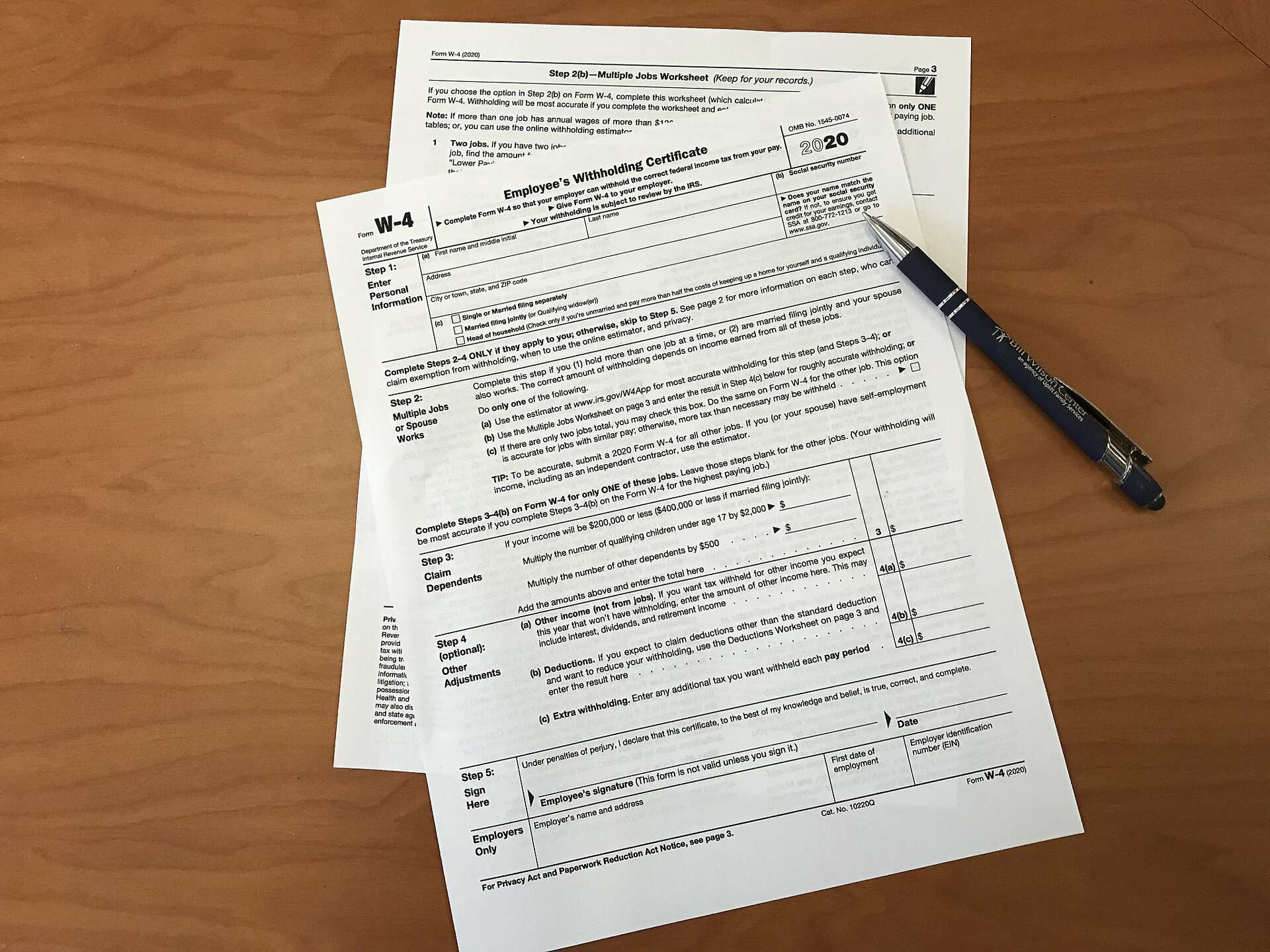

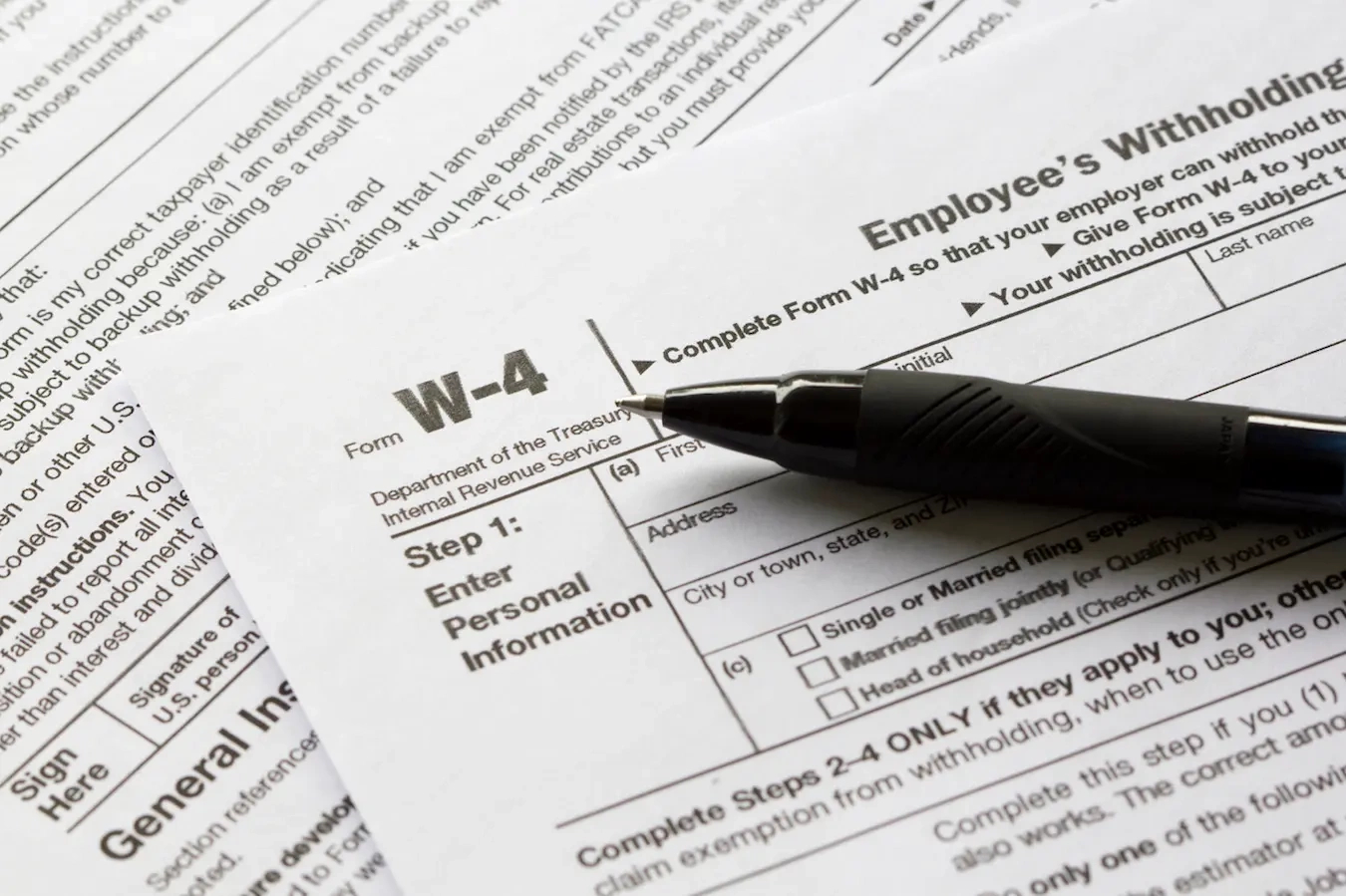

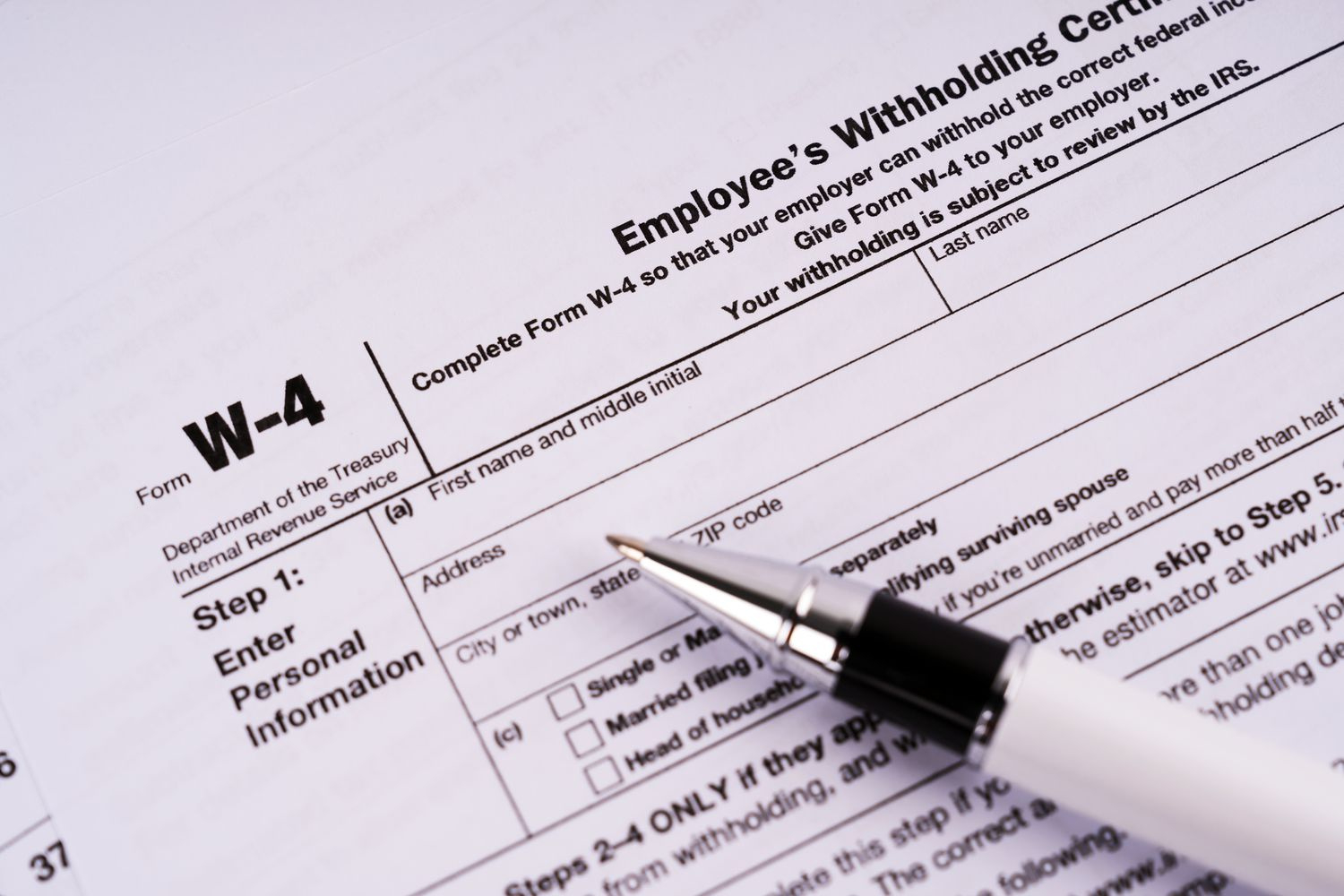

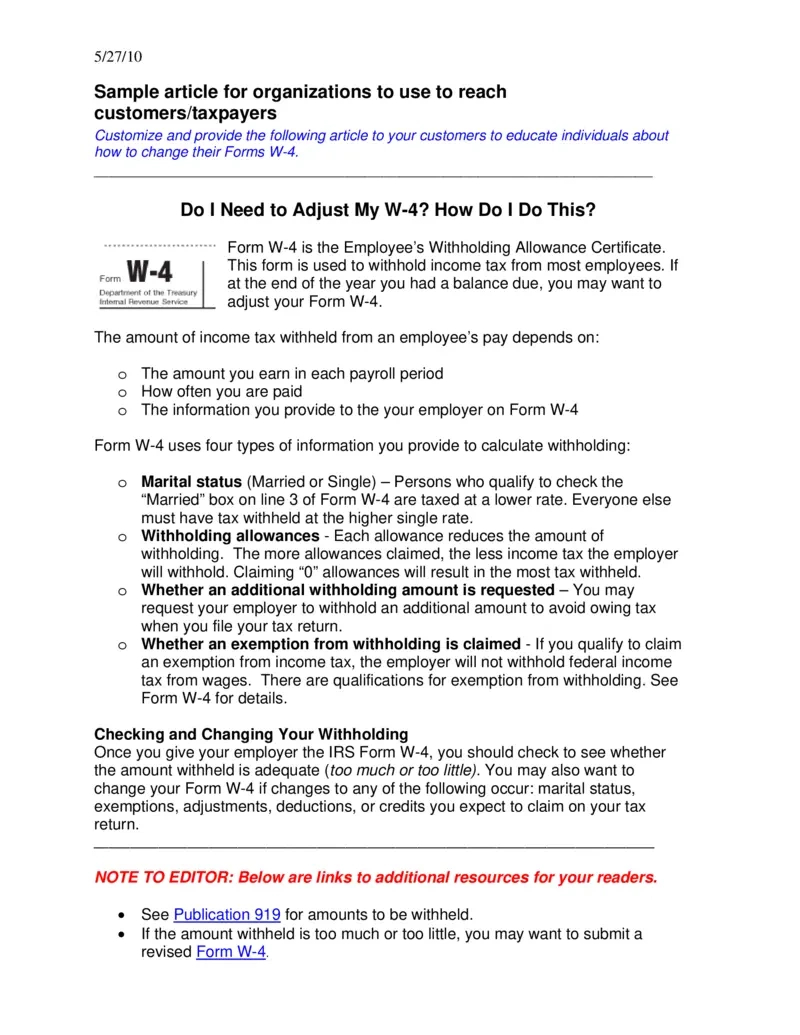

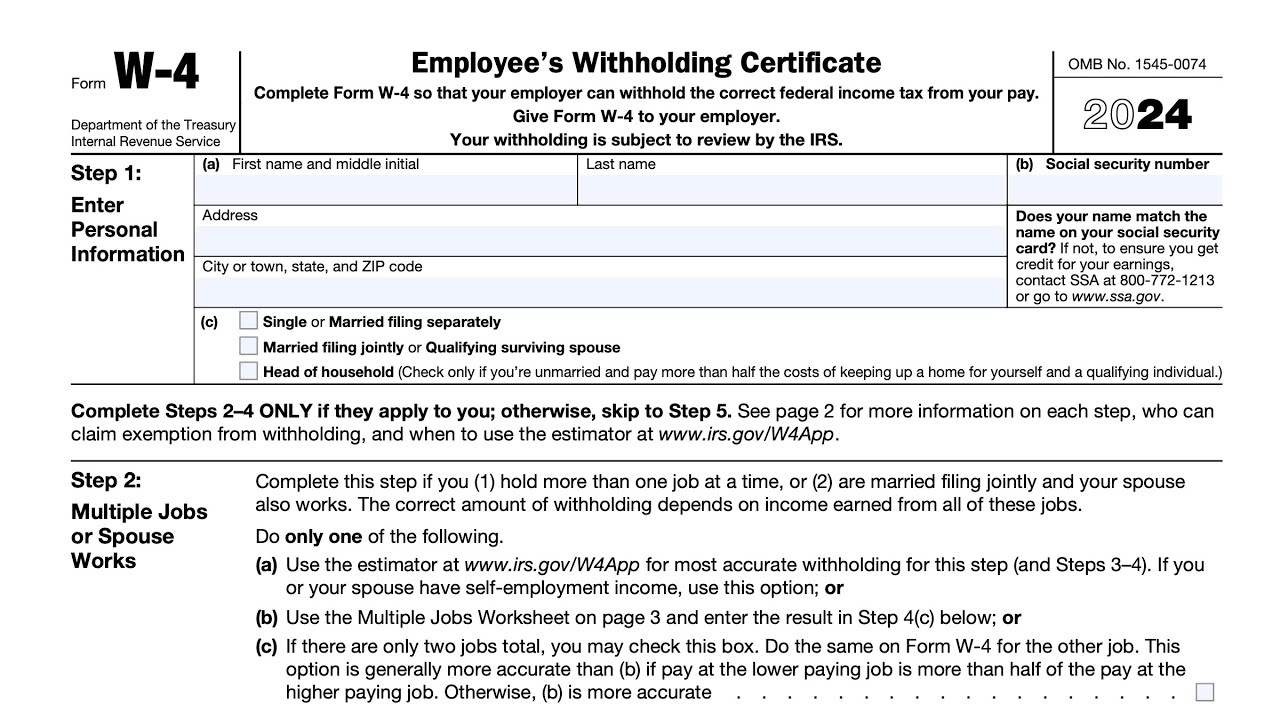

The IRS Form W4 2025 is a crucial document that determines how much federal income tax is withheld from your paycheck. Filling out this form accurately ensures that you are not overpaying or underpaying your taxes throughout the year. The form consists of various sections, including personal information, filing status, and allowances. By carefully reviewing each section and providing accurate information, you can ensure that your tax withholding is calculated correctly.

One key aspect of the IRS Form W4 2025 is the allowances section. This section allows you to claim exemptions based on your personal situation, such as your marital status, dependents, and other factors. The more allowances you claim, the less tax will be withheld from your paycheck. It’s important to assess your individual circumstances and determine the appropriate number of allowances to claim to avoid any surprises come tax season.

When filling out the IRS Form W4 2025, it’s essential to keep in mind any life changes that may impact your tax situation. Events such as getting married, having children, or changing jobs can all affect your tax withholding. By staying informed and updating your form as needed, you can ensure that your taxes are accurately calculated throughout the year. Remember, it’s always better to be proactive and make adjustments as necessary to avoid any potential tax issues.

Simplifying Your Tax Season with Easy Tips!

To simplify your tax season and make the process of filling out the IRS Form W4 2025 easier, consider using online tax tools and calculators. These resources can help you estimate your tax liability and determine the appropriate number of allowances to claim. Additionally, consider consulting with a tax professional for personalized advice and guidance on completing your tax forms accurately.

Another tip for mastering your taxes is to keep detailed records of your income, expenses, and deductions throughout the year. By maintaining organized records, you can easily reference information when filling out your tax forms and ensure that you are claiming all eligible deductions. Remember, the more organized you are, the smoother your tax season will be.

In conclusion, mastering your taxes and understanding the IRS Form W4 2025 doesn’t have to be a daunting task. By following the tips outlined in this article, you can simplify your tax season and ensure that your tax withholding is accurate. Remember, staying informed and making adjustments as needed will help you navigate the tax process with confidence. So, take charge of your taxes and conquer tax season like a pro!

Related Forms…

IRS Form W4 2025 Images