I9 and W4 Forms 2025 – In the ever-evolving landscape of employment paperwork, mastering the I-9 and W-4 forms is essential for both employees and employers. These forms are crucial for verifying employment eligibility and withholding the correct amount of taxes from your paycheck. As we head into 2025, it’s time to brush up on your knowledge of these forms and navigate them with confidence!

Mastering the I-9 and W-4 Forms for 2025!

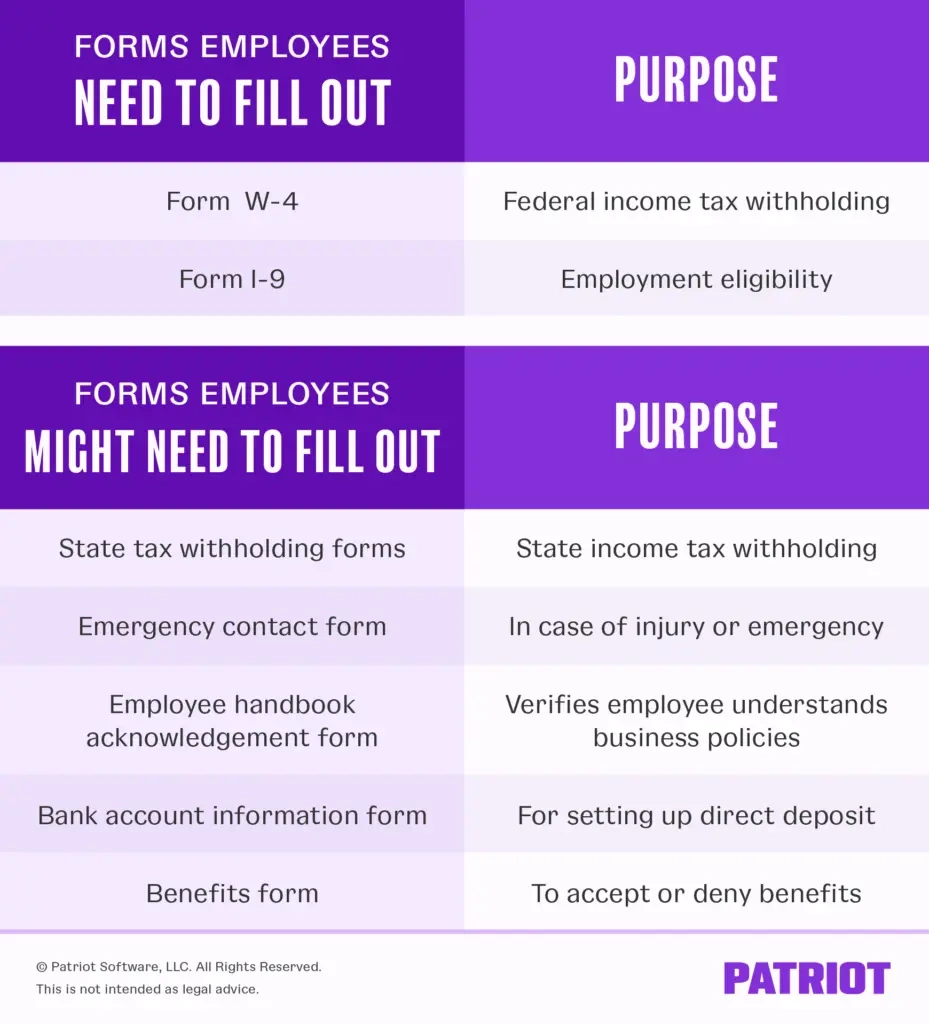

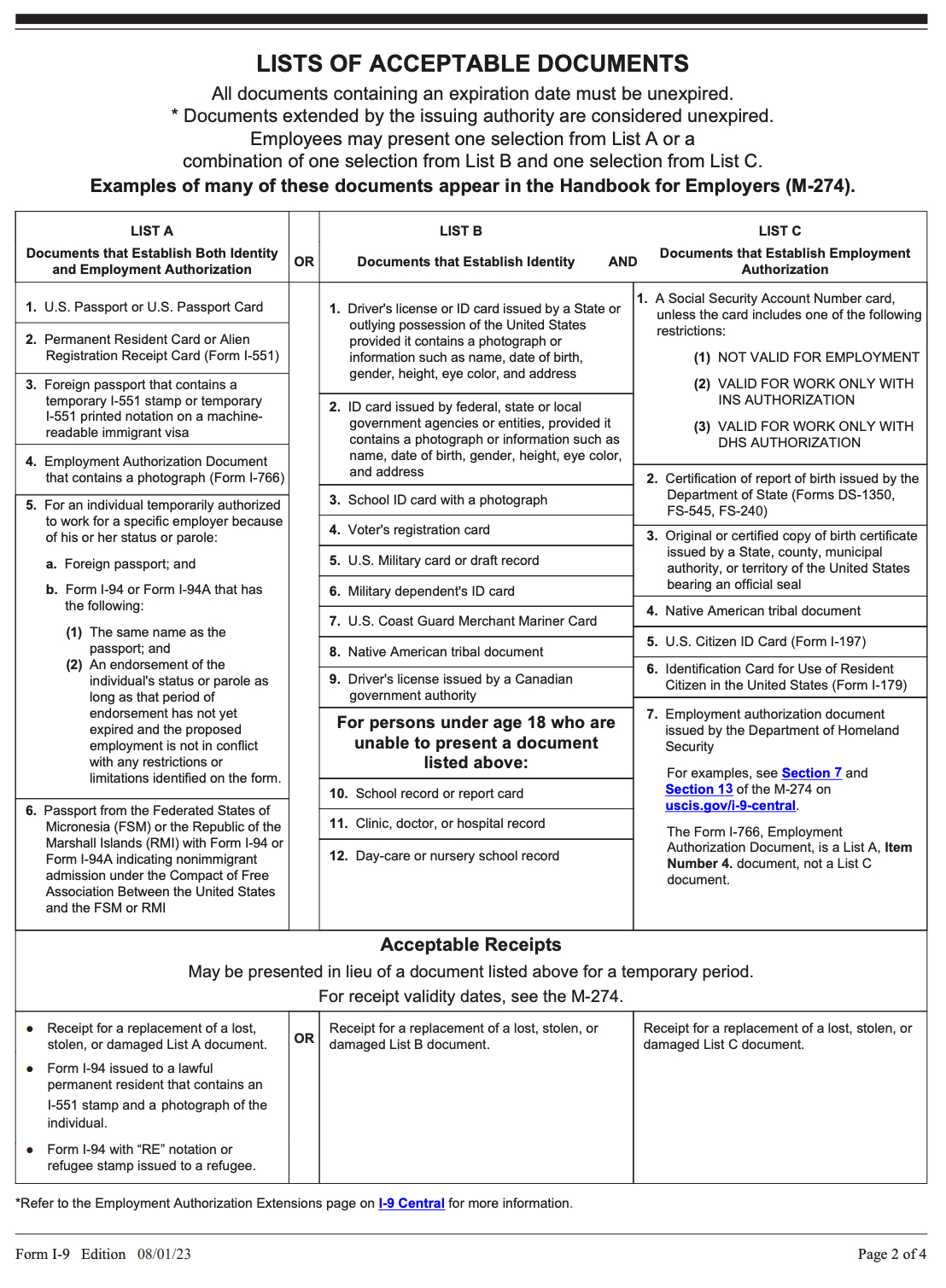

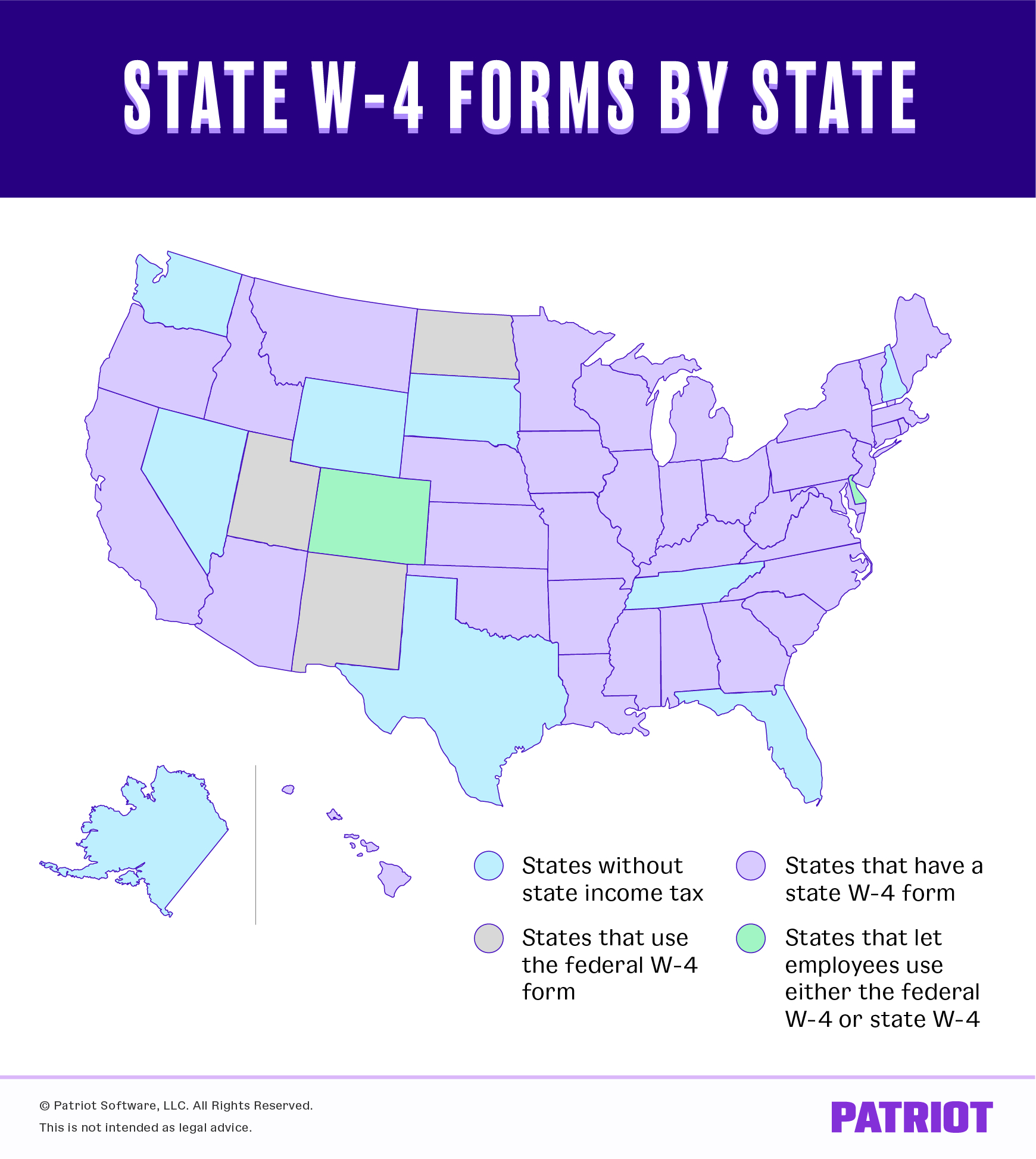

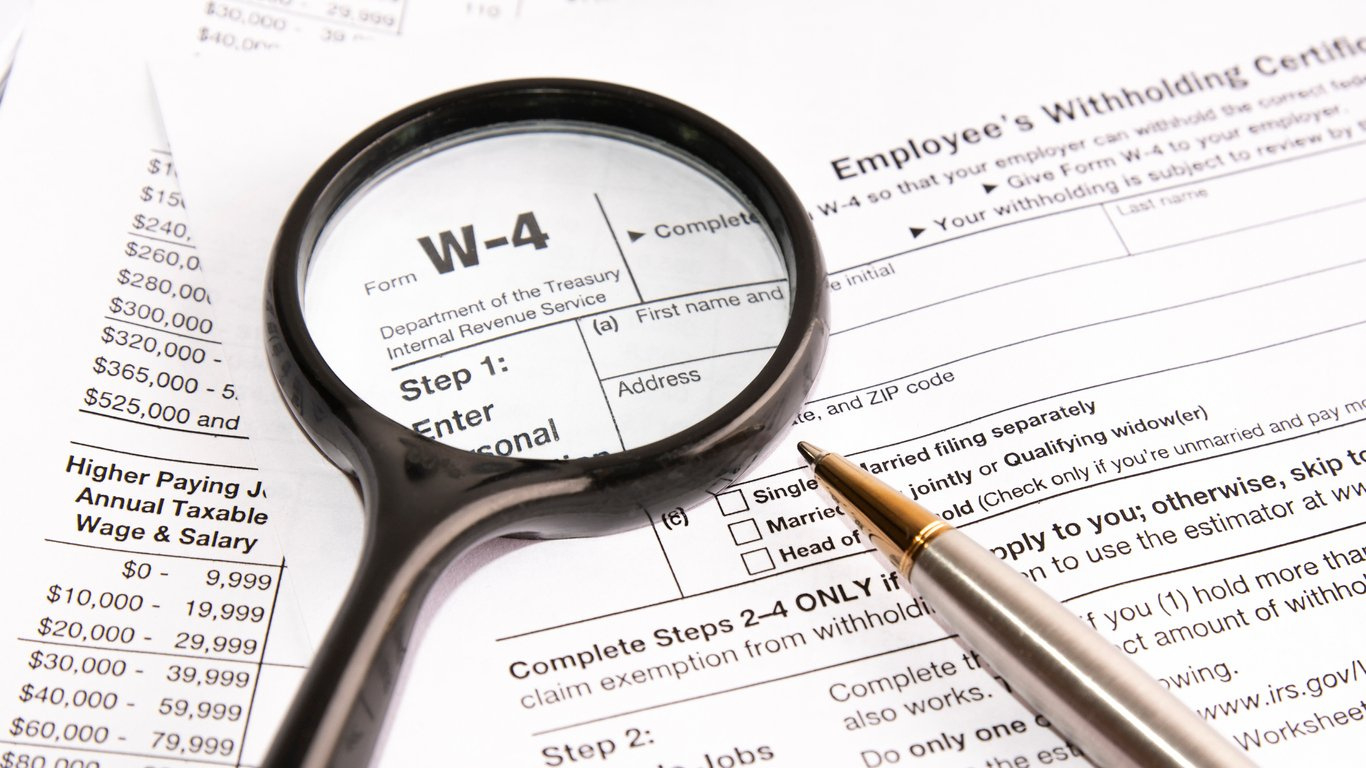

The I-9 form is used to verify the identity and employment eligibility of individuals hired for employment in the United States. It requires employees to provide documents that establish their identity and authorization to work. Familiarizing yourself with the list of acceptable documents and completing the form accurately is key to starting your new job on the right foot. On the other hand, the W-4 form determines how much federal income tax will be withheld from your paycheck. Understanding your tax filing status and any deductions you may be eligible for will help you complete this form accurately and avoid any surprises come tax season.

Navigating these forms with confidence will not only streamline the onboarding process but also demonstrate your professionalism and attention to detail to your employer. By taking the time to understand the purpose of each form and providing accurate information, you will establish yourself as a reliable and conscientious employee. Employers also benefit from employees who are well-versed in these forms, as it ensures compliance with federal regulations and minimizes the risk of potential penalties or fines. So, make it a priority to master the I-9 and W-4 forms for 2025 and set yourself up for success in your career!

Boost Your Career by Navigating Forms with Confidence!

As you navigate the world of employment paperwork, don’t underestimate the importance of the I-9 and W-4 forms. These seemingly mundane documents play a significant role in ensuring compliance with federal laws and regulations. By mastering these forms and approaching them with confidence, you can boost your career prospects and stand out as a diligent and responsible employee. So, take the time to familiarize yourself with the requirements of these forms, seek clarification if needed, and submit them accurately and promptly. Your attention to detail and professionalism will not go unnoticed by your employer, setting you on the path to success in 2025 and beyond!

In conclusion, mastering the I-9 and W-4 forms for 2025 is a valuable skill that will benefit both employees and employers. By understanding the purpose of these forms and providing accurate information, you can ensure a smooth onboarding process and demonstrate your commitment to compliance and professionalism. So, take the time to navigate these forms with confidence, and watch as your career prospects soar to new heights in the coming year!

Related Forms…

I9 and W4 Forms 2025 Images