Salary Standard Deduction For Ay 2021-22 – When you submit your tax commitment, the standard deduction is a benefit provided to lower your taxed revenue. There are 2 choices offered regarding the deduction– either to claim the standard quantity or obtain itemized deductions that you’re qualified to.

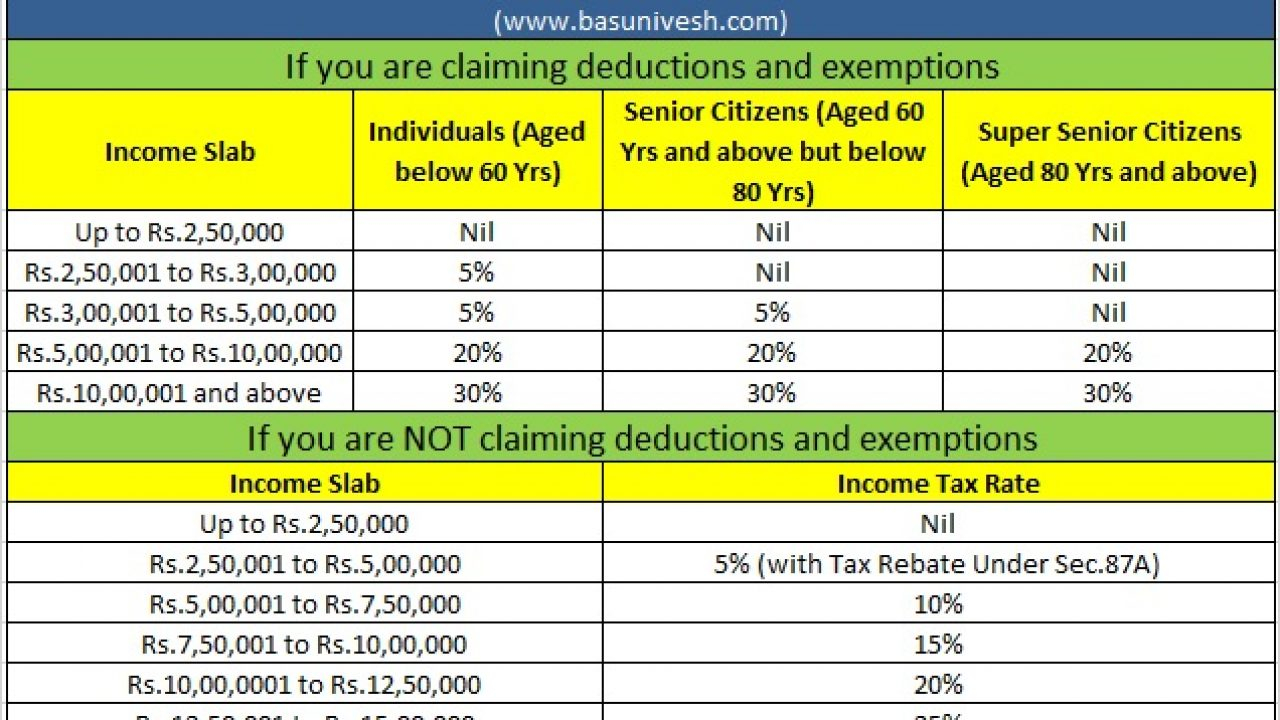

Latest Income Tax Slab Rates Fy 2020-21 (Ay 2021-22

Latest Income Tax Slab Rates Fy 2020-21 (Ay 2021-22

Prior to you are going to file your individual income tax return this season, it’s finest if you understood one of the most recent standard deduction price. It will assist you to make sound choices regarding whether getting a standard or itemizing deduction would be more helpful.

Standard Deduction

Your complete revenue is divided right into 2 different parts: taxed as well as nontaxable income. A part of your gross income should be submitted to the state or federal government, and this part is called income tax. The reason why the revenue is separated similar to this is that federal government grants a part of your overall revenue to be subtracted or deducted from tax. It serves a fairly considerable benefit due to the fact that as a taxpayer, your tax expense will be decreased.

Currently, this part of your earnings that didn’t get taxed is called standard deduction. The prices are issued by the IRS (Internal Revenue Service). Just how much amount of rate that you are qualified to obtain is based on your age, filing status, whether you are submitted as somebody else’s reliant for a tax return, and whether you have a disability or otherwise.

Standard deduction, you may choose to get your deduction to be itemized. Obtaining itemized deduction means that all tax-deductible expenses of yours (any costs that majorly influence the quantity of your tax) such as clinical costs, building tax, qualified charity contributions, and so on, will be provided and exhausted individually.

Standard Deduction 2020

Below is the checklist of IRS (Internal Revenue Service) standard deductions for 2020 to be submitted on the following year of 2021, based upon your declaring status:

- Single taxpayers get $12,400 of deductions, which is a raising from $12,200 in the previous year.

- Married| taxpayers that submitted independently receive $12,400 of deductions, which is a raising from $12,200 in the previous year.

- Married taxpayers that submitted collectively receive $24,800 of deductions, which is a raising from $24,400 in the previous year.

- Heads of households obtain $18,650 of deductions, which is a raise from $18,350 in the past year.

- Qualifying widowers obtain $24,800 of deductions, which is a raise from $24,400 in the previous year.

| Filing Status | Standard Deduction |

| Single | $12,400 |

| Married Filing Jointly | $24,800 |

| Married Filing Separately | $12,400 |

| Head of Household | $18,650 |

| Over 65 Age |

|

| Dependents | Additional $1,100 or individual income plus $350 |

Standard Deduction 2021

As the newly readjusted standard deduction is usually released in the last part of the year, the rates for 2021 is yet to be known. It is still feasible to anticipate the amount based on projected trends from previous years.

Below is the list of Internal Revenue Service standard deductions for 2021 to be submitted in the following year of 2022 based upon your filing status. The adjustment is developed as a prediction, however it should not be far off from the future launches:

- Single| taxpayers get $12,550 of deductions, which is a raising from $12,400 in the previous year.

- Married taxpayers that submitted individually get $12,550 of deductions, which is a raising from $12,400 in the previous year.

- Married taxpayers that filed collectively receive $25,100 of deductions, which is a raise from $24,800 in the past year.

- Heads of households obtain $18,800 of deductions, which is a raise from $18,650 in the past year.

- Qualifying widowers get $25,100 of deductions, which is a raising from $24,800 in the past year.

| 2018 | 2019 | 2020 | 2021 | |

| Single | $12,000 | $12,200 | $12,400 | $12,550 |

| Married Filing Jointly | $24,000 | $24,400 | $24,800 | $25,100 |

| Married Filing Separately | $12,000 | $12,200 | $12,400 | $12,550 |

| Head of Household | $18,000 | $18,350 | $18,650 | $18,800 |

| Over 65 Age |

|

|

|

|

| Dependents | Additional $1,050 or individual income plus $350 | Additional $1,100 or individual income plus $350 | Additional $1,100 or individual income plus $350 | Additional $1,100 or individual income plus $350 |

To understand the evaluation of your standard deductions each year early, you might want to utilize a tax calculator. It is available totally free online on numerous sites including the official site of the Internal Revenue Service (IRS).