Texas W4 Form 2025 – Are you ready to take control of your taxes and maximize your refund this year? Look no further than the Texas W4 Form 2025! This seemingly complex document doesn’t have to be a mystery. With a little know-how and some expert tips, you’ll be well on your way to mastering the Texas W4 Form 2025 and setting yourself up for tax success!

Unraveling the Mystery of the Texas W4 Form 2025!

The Texas W4 Form 2025 may appear daunting at first glance, but fear not! This form is your key to adjusting your tax withholdings and ensuring you don’t end up with a big bill come tax season. By carefully filling out each section and understanding the implications of your choices, you can take control of your tax situation and potentially increase your refund. Don’t let the complexity intimidate you – with a little guidance, you’ll be a pro at navigating the Texas W4 Form 2025 in no time.

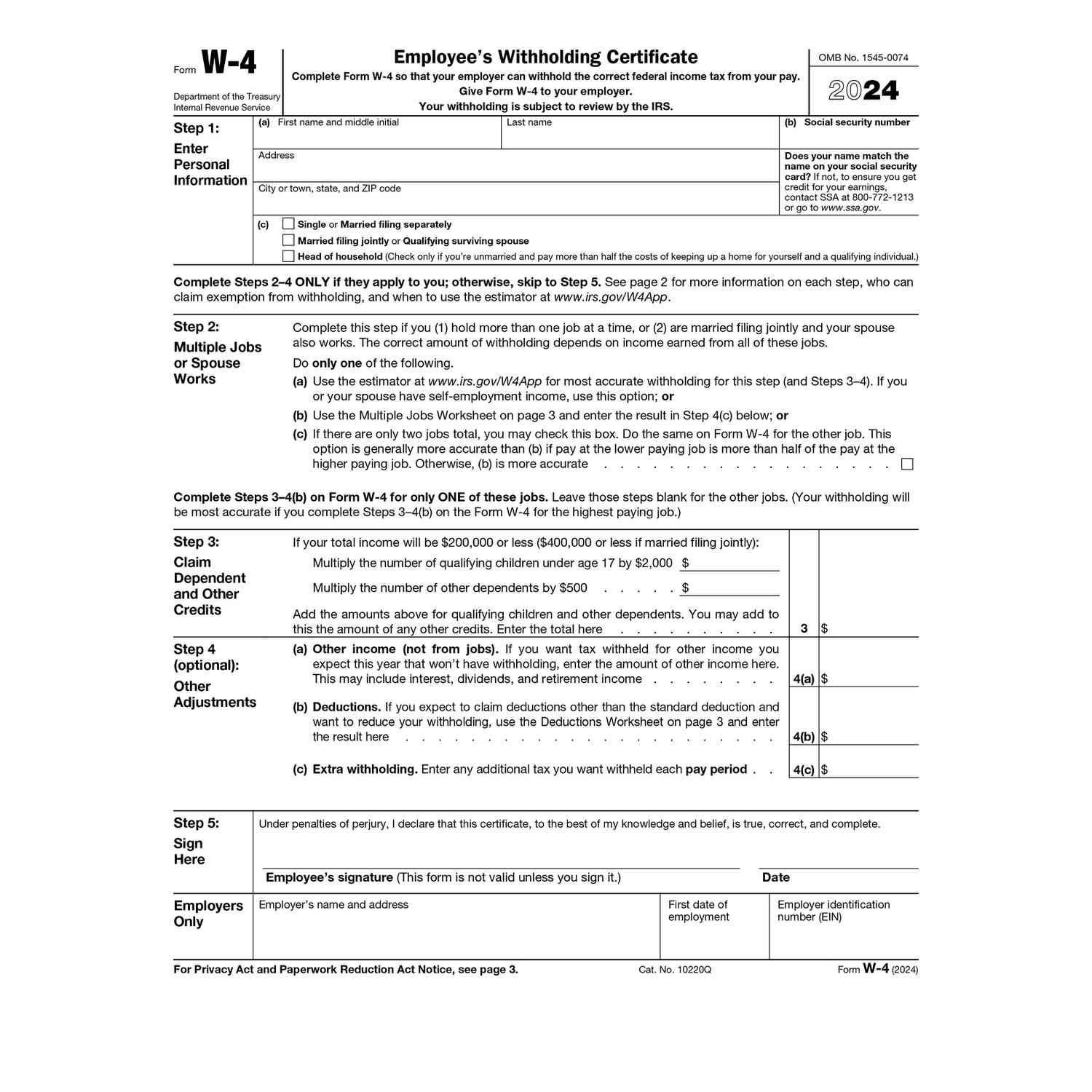

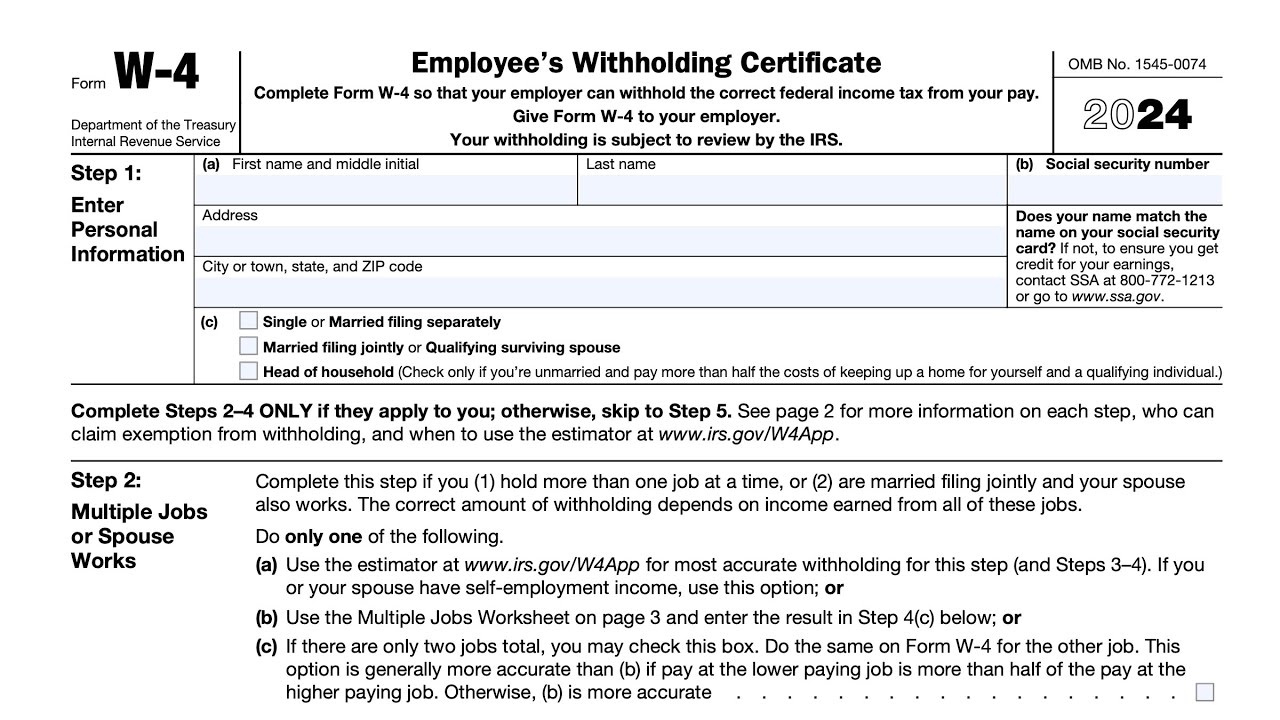

When tackling the Texas W4 Form 2025, it’s important to pay close attention to details such as your filing status, number of allowances, and any additional withholdings you may want to claim. By accurately inputting this information, you can ensure that your employer withholds the correct amount from each paycheck, preventing any surprises when it’s time to file your taxes. Take the time to review each section carefully and don’t hesitate to seek help from a tax professional if you’re unsure about how to proceed. With a clear understanding of the Texas W4 Form 2025, you’ll be well-equipped to make informed decisions about your tax withholdings and optimize your financial situation.

Turbocharge Your Tax Knowledge with These Tips!

Ready to take your tax game to the next level? Consider these expert tips for mastering the Texas W4 Form 2025 and maximizing your tax refund potential. Start by conducting a mid-year checkup to ensure your withholdings are on track and make any necessary adjustments to avoid underpayment penalties. Additionally, take advantage of online tax calculators and resources to help you estimate your tax liability and make informed decisions about your withholdings. By staying proactive and informed, you can make the most of the Texas W4 Form 2025 and set yourself up for tax success.

Confused about how to fill out the Texas W4 Form 2025? Don’t worry – you’re not alone! Consider reaching out to your employer’s HR department for guidance or consulting with a tax professional for expert advice. By seeking assistance and asking questions when needed, you can ensure that you’re accurately completing the form and maximizing your tax-saving opportunities. Remember, the Texas W4 Form 2025 is a valuable tool for managing your tax withholdings, so don’t hesitate to seek help to ensure you’re making the most of it. With a little support and guidance, you’ll be well on your way to tax success in no time!

Mastering the Texas W4 Form 2025 doesn’t have to be a daunting task. By taking the time to understand the form’s intricacies and following expert tips, you can navigate it with confidence and set yourself up for tax success. Remember to pay attention to details, seek help when needed, and stay proactive in managing your withholdings. With a little effort and know-how, you’ll be well on your way to maximizing your tax refund potential and taking control of your financial future. So grab your pencils and get ready to conquer the Texas W4 Form 2025 – your ticket to tax success awaits!

Related Forms…

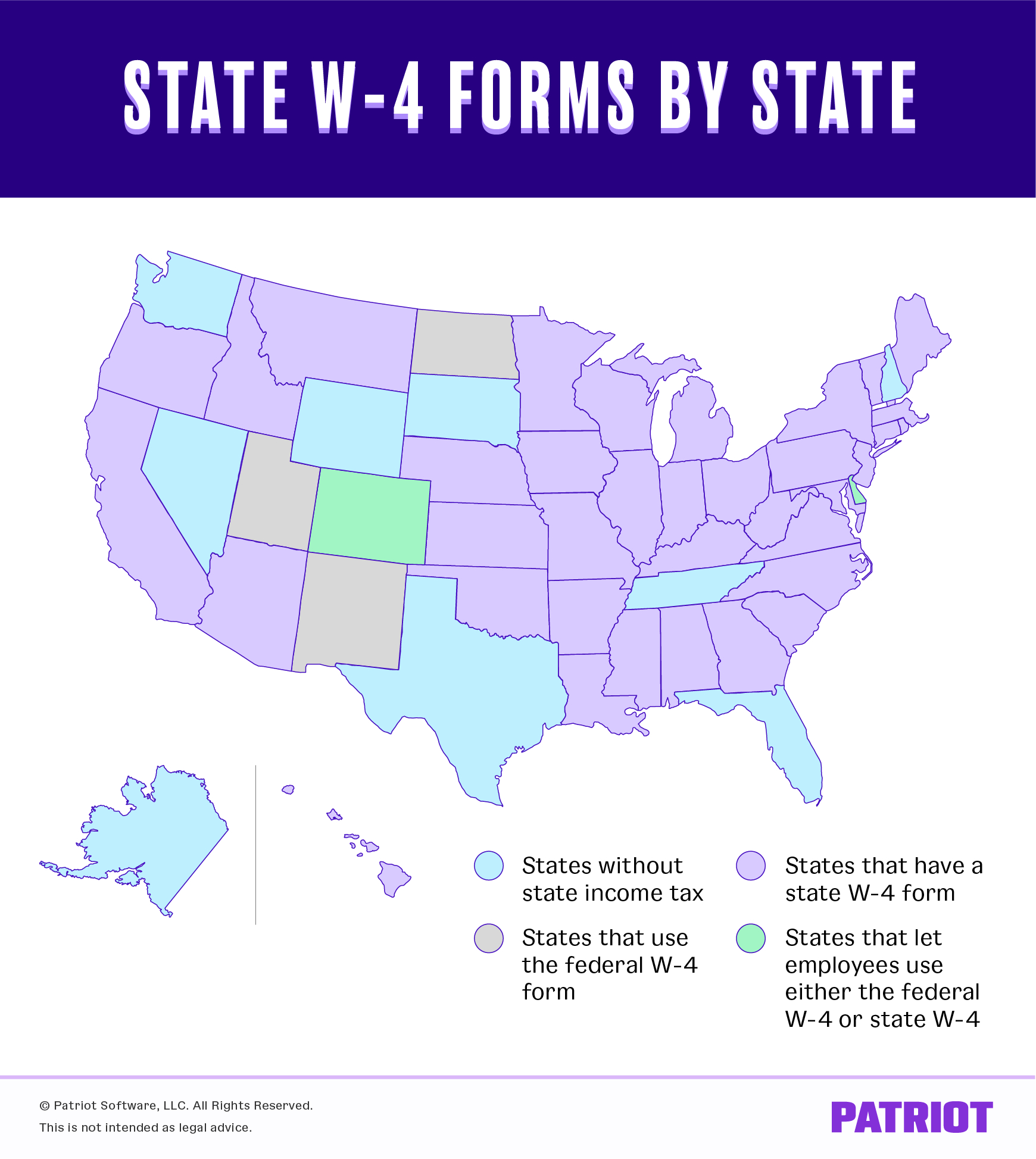

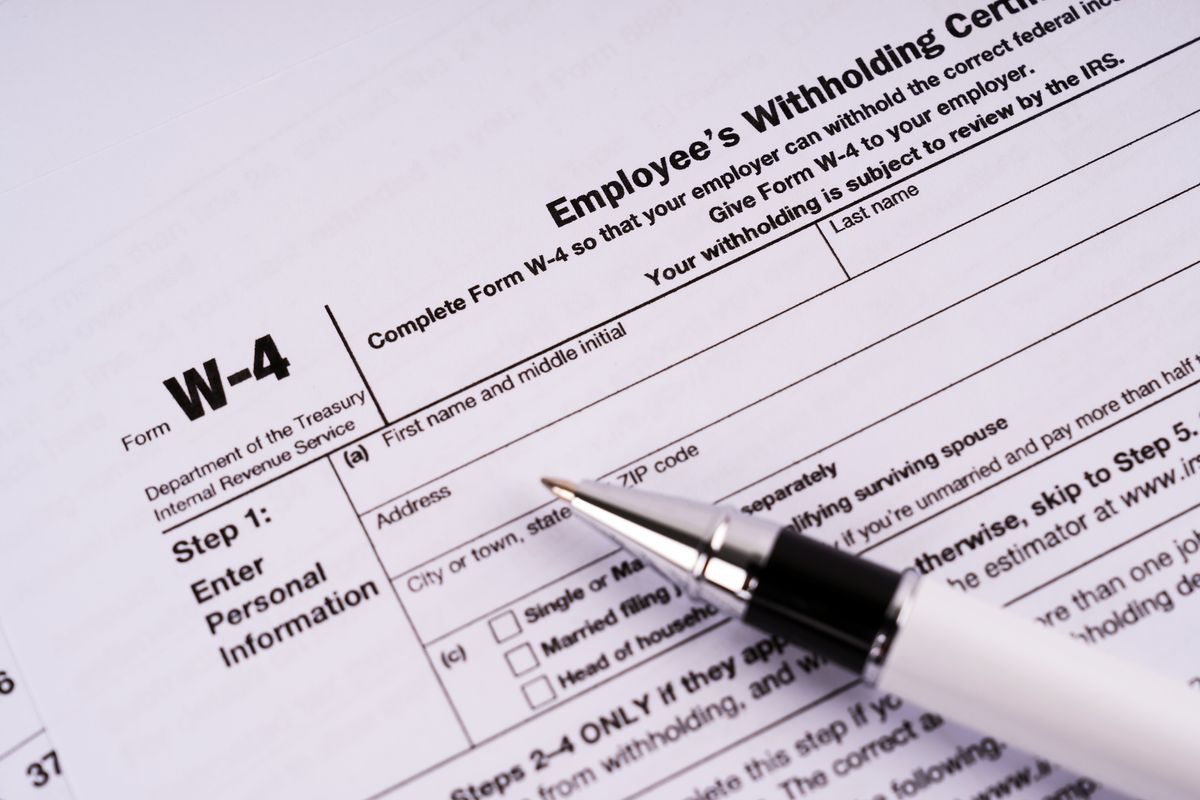

Texas W4 Form 2025 Images