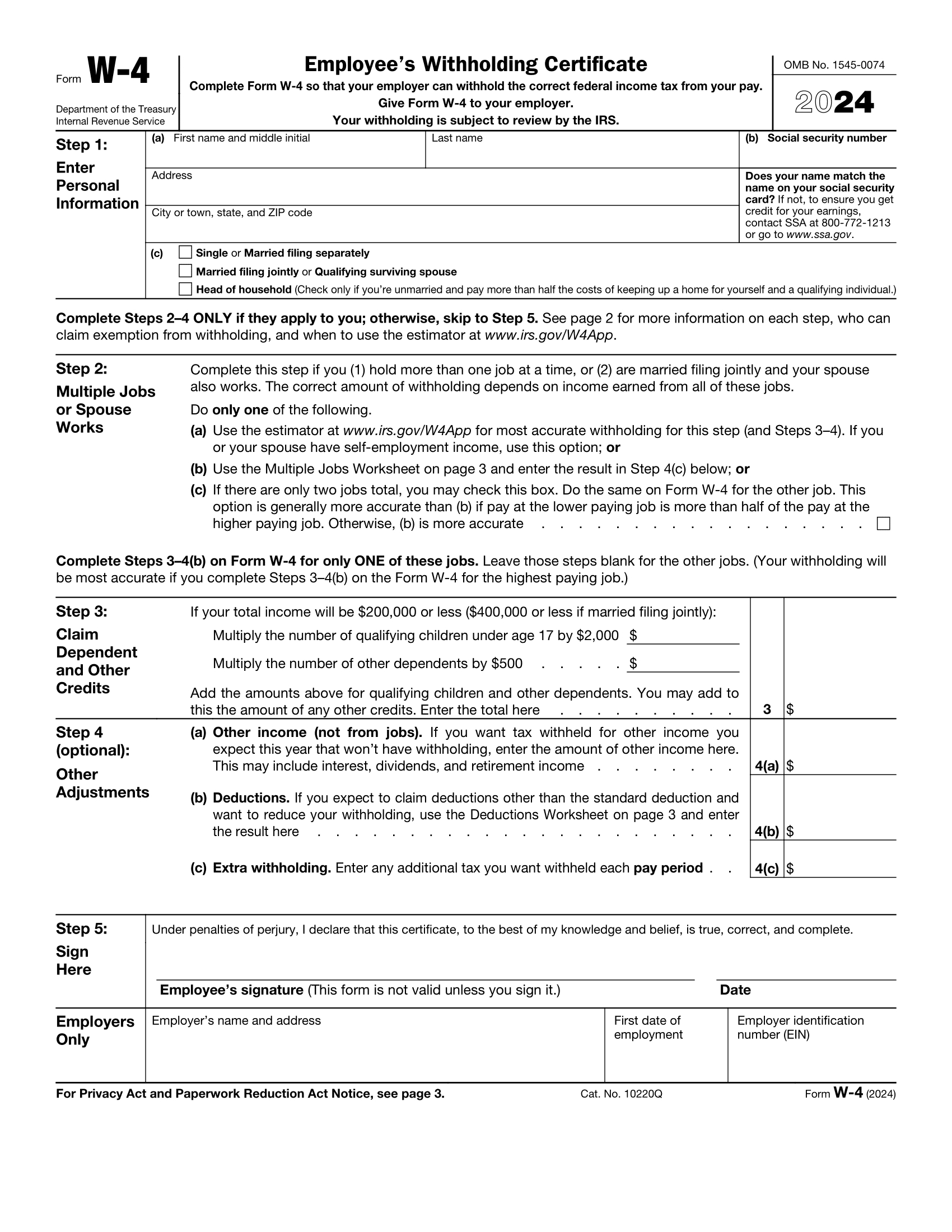

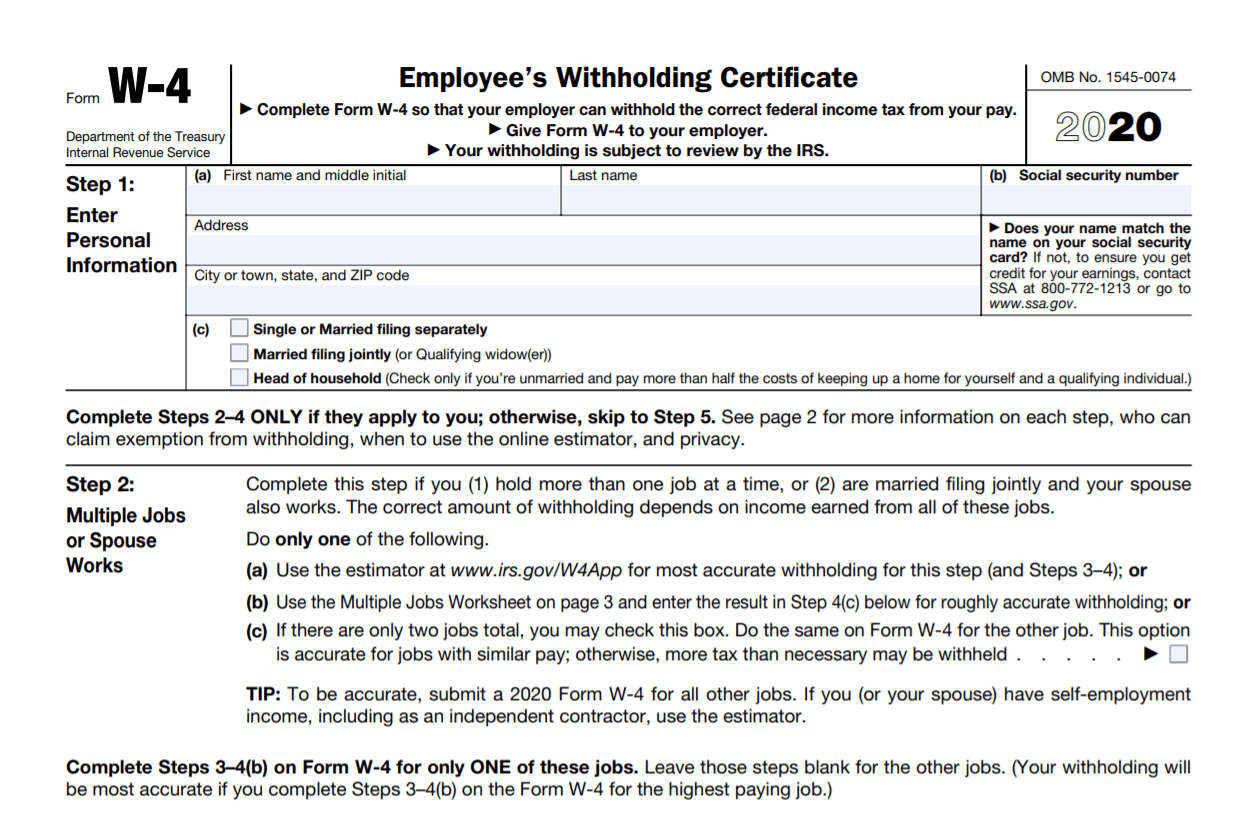

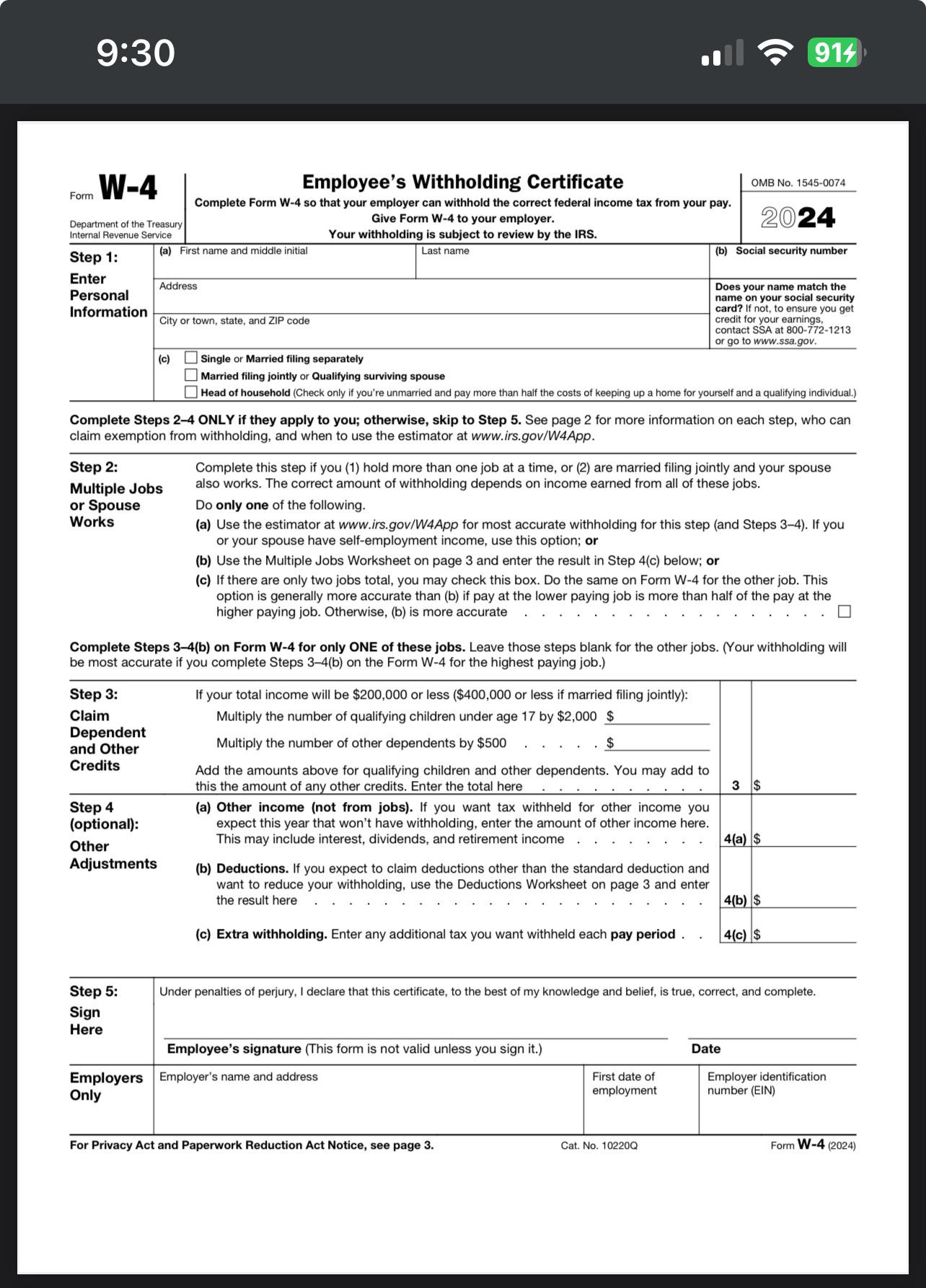

W4 Form 2025 Married Filing Jointly – Are you ready to say I do to maximizing your tax benefits? Look no further than the W4 Form 2025! This form is the key to unlocking tax savings for you and your partner, allowing you to make the most of your joint finances. By understanding how to fill out the W4 Form 2025 correctly, you can ensure that you are taking advantage of all available deductions and credits, maximizing your tax refund or minimizing the amount you owe.

A Happily Ever After with W4 Form 2025!

Picture this – a happily ever after where you and your partner are making the most of your tax situation, thanks to the W4 Form 2025. By properly completing this form, you can adjust the amount of tax withheld from your paychecks, ensuring that you are not overpaying throughout the year. This can result in a larger tax refund at the end of the year, giving you more money to put towards your joint financial goals. Plus, by maximizing your tax benefits, you can free up more of your hard-earned money to enjoy life together.

Whether you are newlyweds or have been together for years, the W4 Form 2025 can help you and your partner make the most of your tax situation. By working together to understand your individual incomes, deductions, and credits, you can optimize your tax withholding to maximize your tax benefits. Say goodbye to unnecessary tax payments and hello to a brighter financial future with the W4 Form 2025. With a little planning and collaboration, you can achieve a happily ever after when it comes to your taxes.

In conclusion, don’t let tax season stress you out – embrace the W4 Form 2025 and maximize your tax benefits with your partner by your side. By taking the time to fill out this form accurately and adjusting your withholding as needed, you can ensure that you are making the most of your joint finances. Say goodbye to missed opportunities for tax savings and hello to a brighter financial future together. Jointly ever after has never looked so good!

W4 Form 2025 Married Filing Jointly

Related Forms…

W4 Form 2025 Married Filing Jointly Images