W4 Form 2025 Missouri – Tax season is upon us, and for many people, that means one thing: maximizing your tax refund! If you’re a resident of Missouri, you may be wondering how you can make the most out of your tax return this year. Luckily, we’re here to help simplify the process for you. By understanding how to fill out your W4 form correctly, you can ensure that you’re getting the biggest refund possible. So let’s dive in and discover how you can boost your refund with ease!

Maximize Your Tax Refund: W4 Form 2025 Missouri Made Easy!

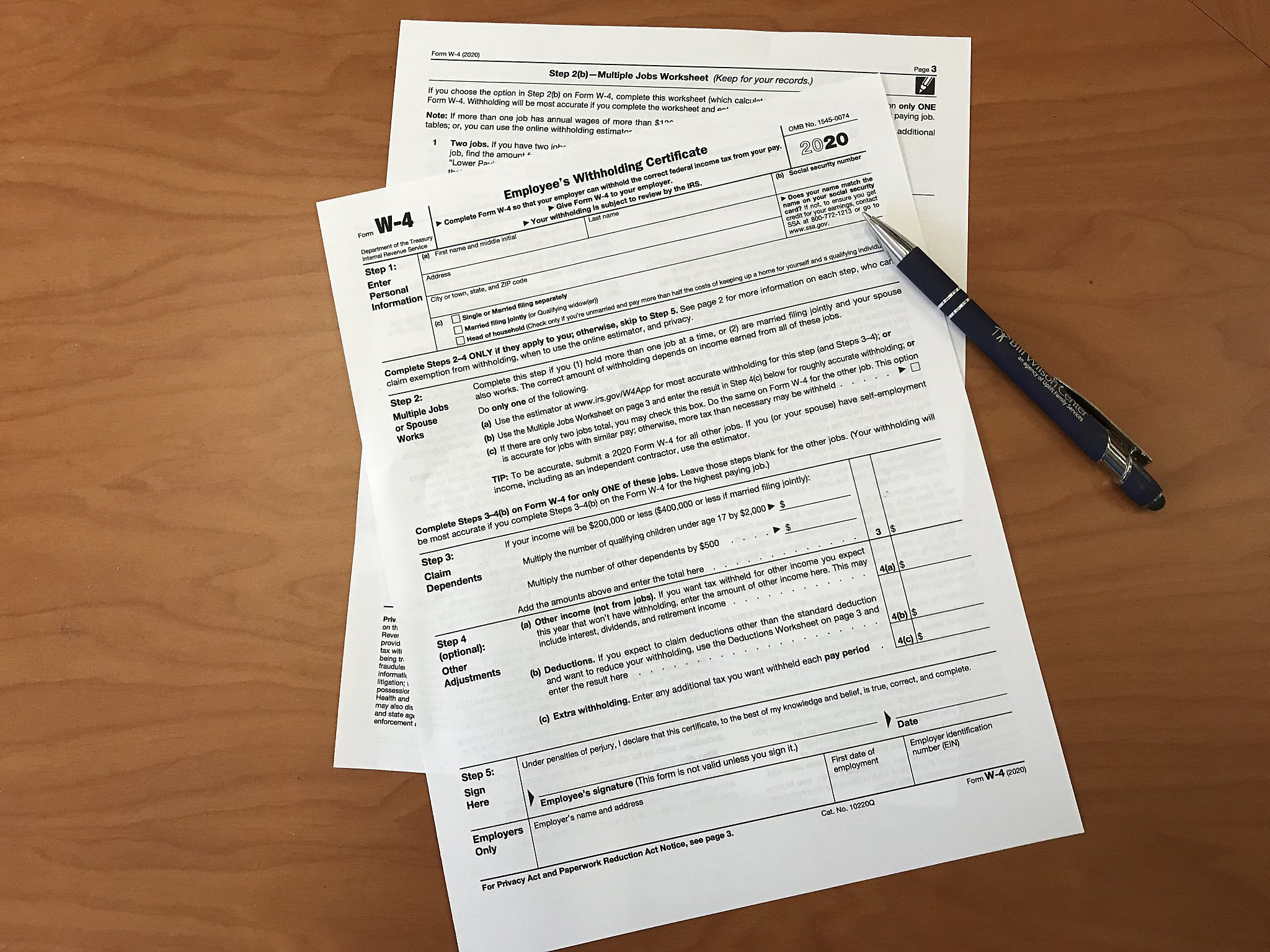

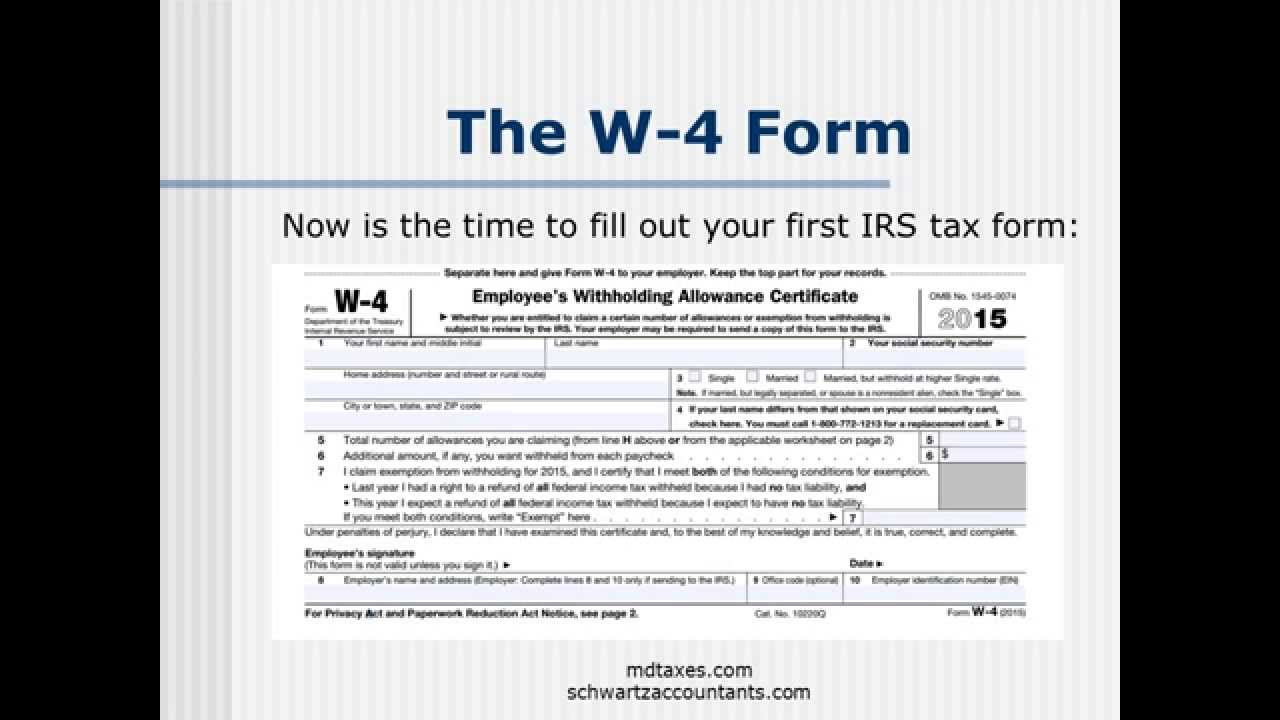

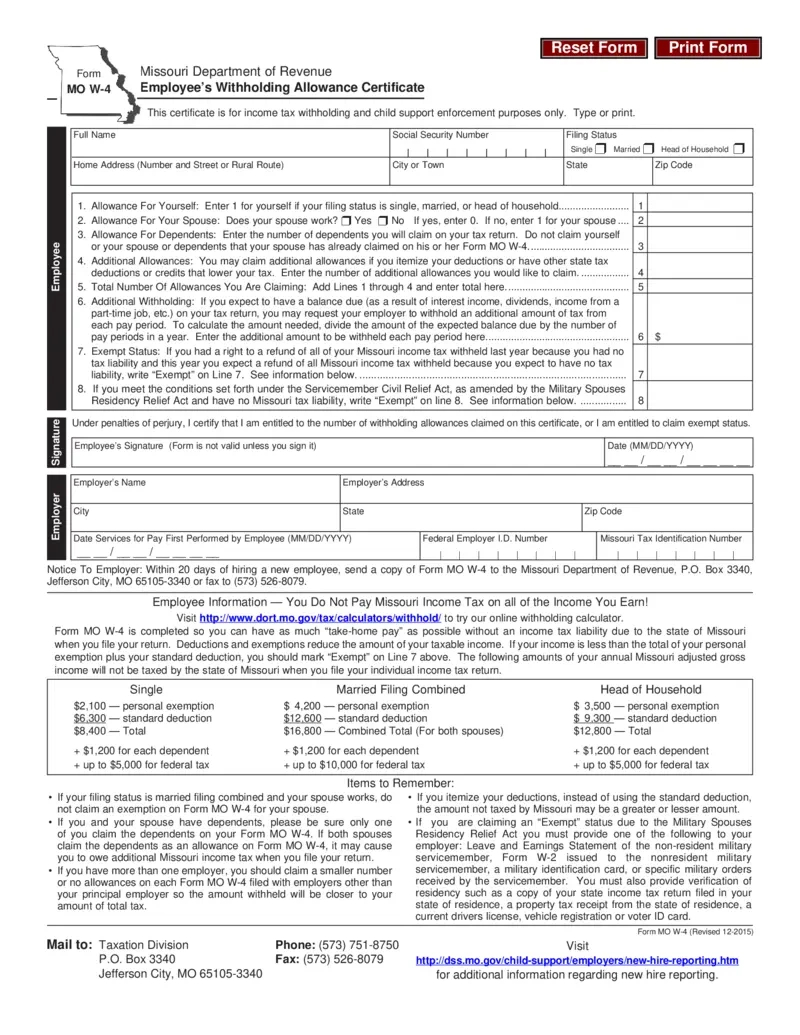

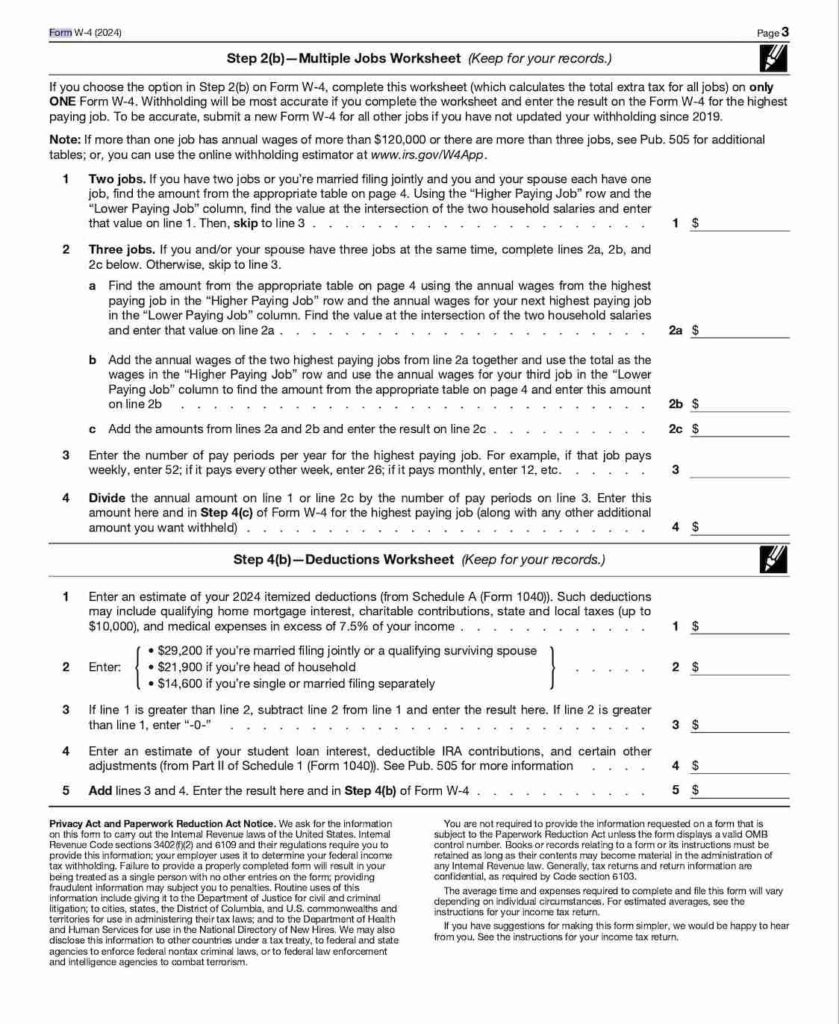

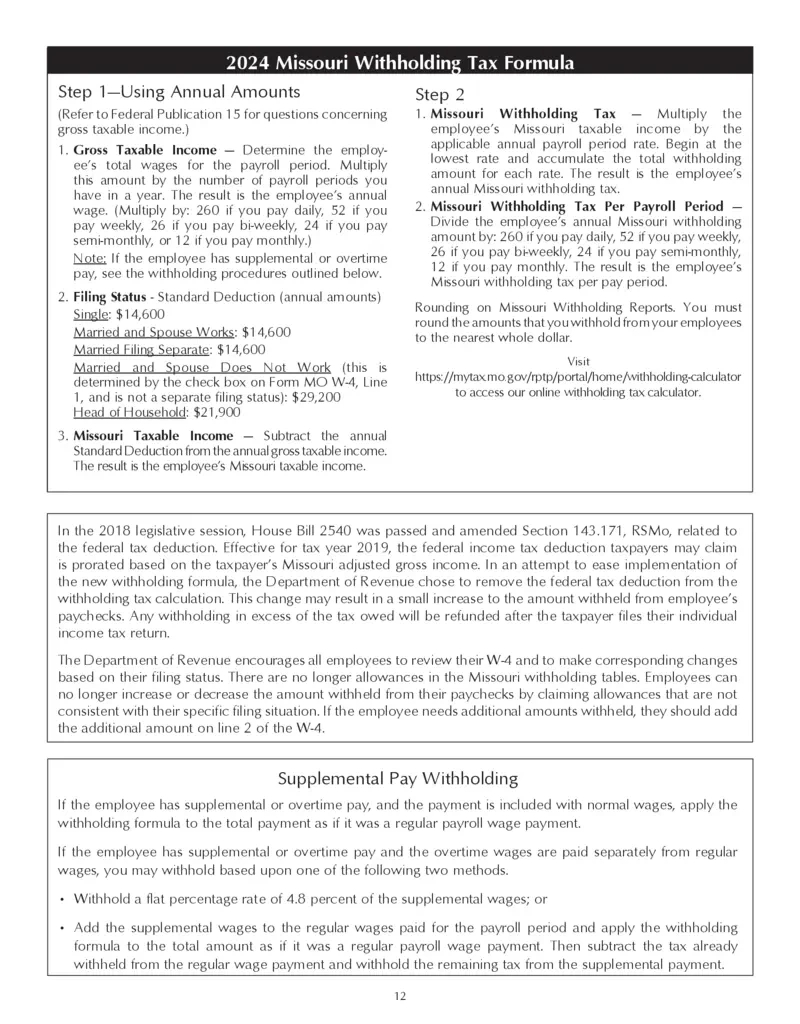

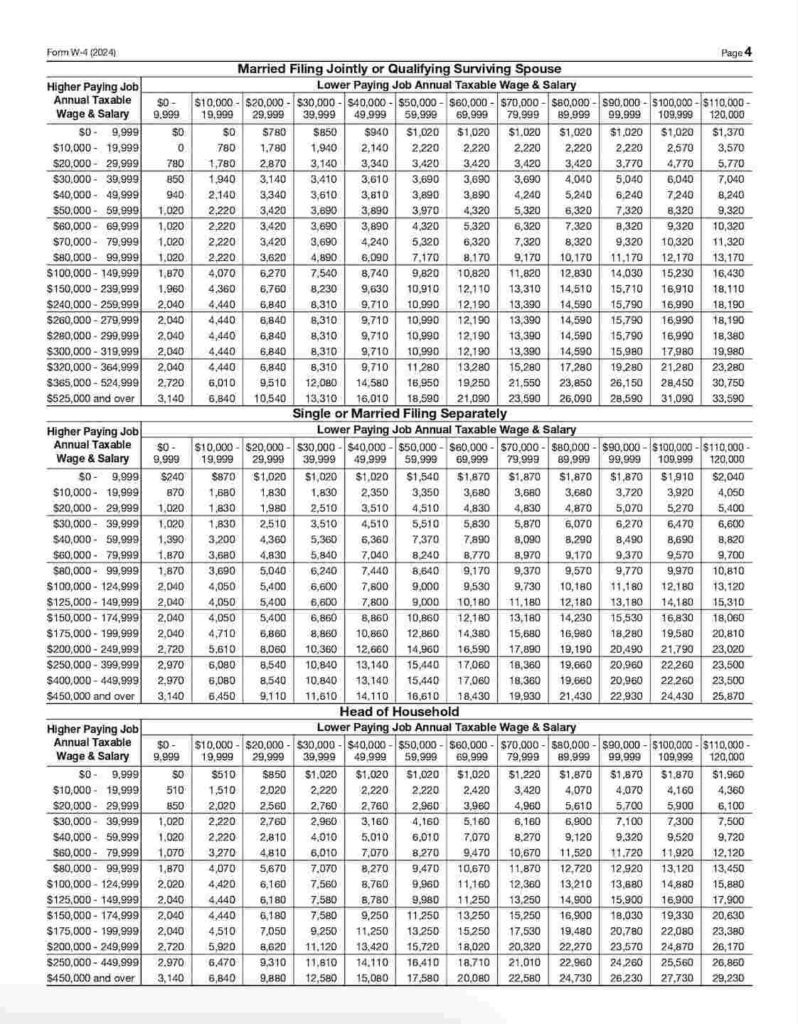

The first step to maximizing your tax refund is to make sure you’re filling out your W4 form correctly. This form determines how much federal income tax is withheld from your paycheck, so it’s crucial to get it right. To ensure you’re getting the most out of your refund, take the time to review your financial situation and make any necessary adjustments to your withholding allowances. By accurately completing your W4 form, you can avoid overpaying in taxes and put more money back in your pocket come tax time.

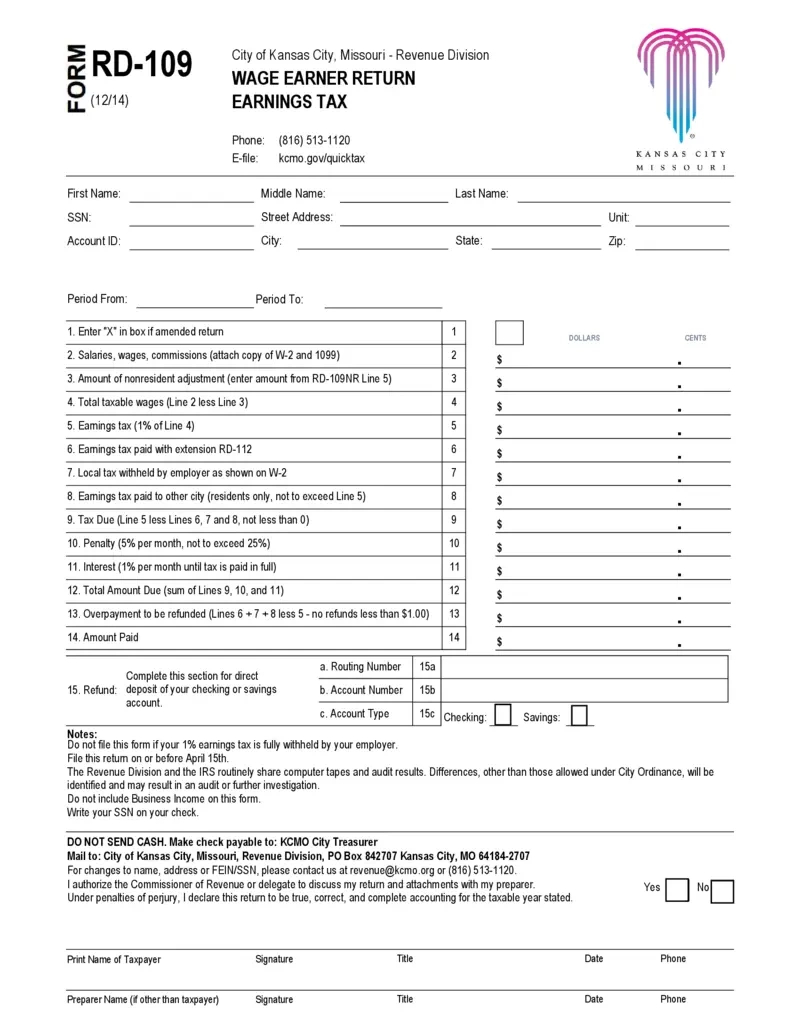

Another way to boost your refund is to take advantage of any available tax credits and deductions. Missouri offers several tax credits for things like education expenses, child care costs, and home energy improvements. By claiming these credits on your tax return, you can reduce your tax liability and increase your refund amount. Be sure to keep detailed records of any expenses that may qualify for these credits, and consult with a tax professional if you’re unsure of how to claim them on your return.

Simplifying Your W4 Form in Missouri.

Filling out your W4 form doesn’t have to be a daunting task. In fact, by following a few simple steps, you can make the process quick and easy. Start by carefully reading each section of the form and providing accurate information about your filing status, income, and deductions. If you’re unsure about how to complete any part of the form, don’t hesitate to ask for help from a tax professional or use online resources for guidance. Remember, the more accurate your W4 form is, the better chance you have of maximizing your refund.

Finally, once you’ve completed your W4 form, be sure to review it carefully before submitting it to your employer. Double-check your calculations and make sure all the information is correct. Any mistakes on your W4 form could result in an incorrect withholding amount, which could affect the size of your refund. By taking the time to review your form and ensure its accuracy, you can feel confident that you’re on the right track to maximizing your tax refund in Missouri.

In conclusion, maximizing your tax refund in Missouri is easier than you think. By understanding how to fill out your W4 form correctly and taking advantage of available tax credits and deductions, you can ensure that you’re getting the biggest refund possible. So don’t delay – get started on boosting your refund today!

Related Forms:

W4 Form 2025 Missouri Images