What Is Standard Deduction – When you file your tax responsibility, the standard deduction is a advantage offered to minimize your taxed earnings. There are 2 choices readily available relating to the deduction– either to claim the standard quantity or obtain itemized deductions that you’re entitled to.

The Standard Tax Deduction—How It Works And How To Use It

The Standard Tax Deduction—How It Works And How To Use It

Before you are going to submit your specific income tax return this period, it’s best if you knew one of the most current standard deduction price. It will assist you to make sound decisions regarding whether getting a standard or itemizing deduction would be a lot more beneficial.

Standard Deduction

A section of your taxable revenue have to be sent to the state or federal government, and also this portion is called earnings tax. The reason why the income is separated like this is that government grants a component of your total income to be subtracted or deducted from tax.

Now, this part of your income that didn’t obtain tired is called standard deduction. The prices are released by the IRS (Internal Revenue Service). Just how much quantity of price that you are certified to get is based upon your age, submitting standing, whether you are sent as someone else’s reliant for a income tax return, as well as whether you have a disability or otherwise.

Standard deduction, you may pick to get your deduction to be itemized. Getting itemized deduction means that all tax-deductible expenses of your own ( any kind of expenses that majorly influence the amount of your tax) such as medical spending, residential property tax, certified charity donations, etc., will be noted and also taxed separately.

Standard Deduction 2020

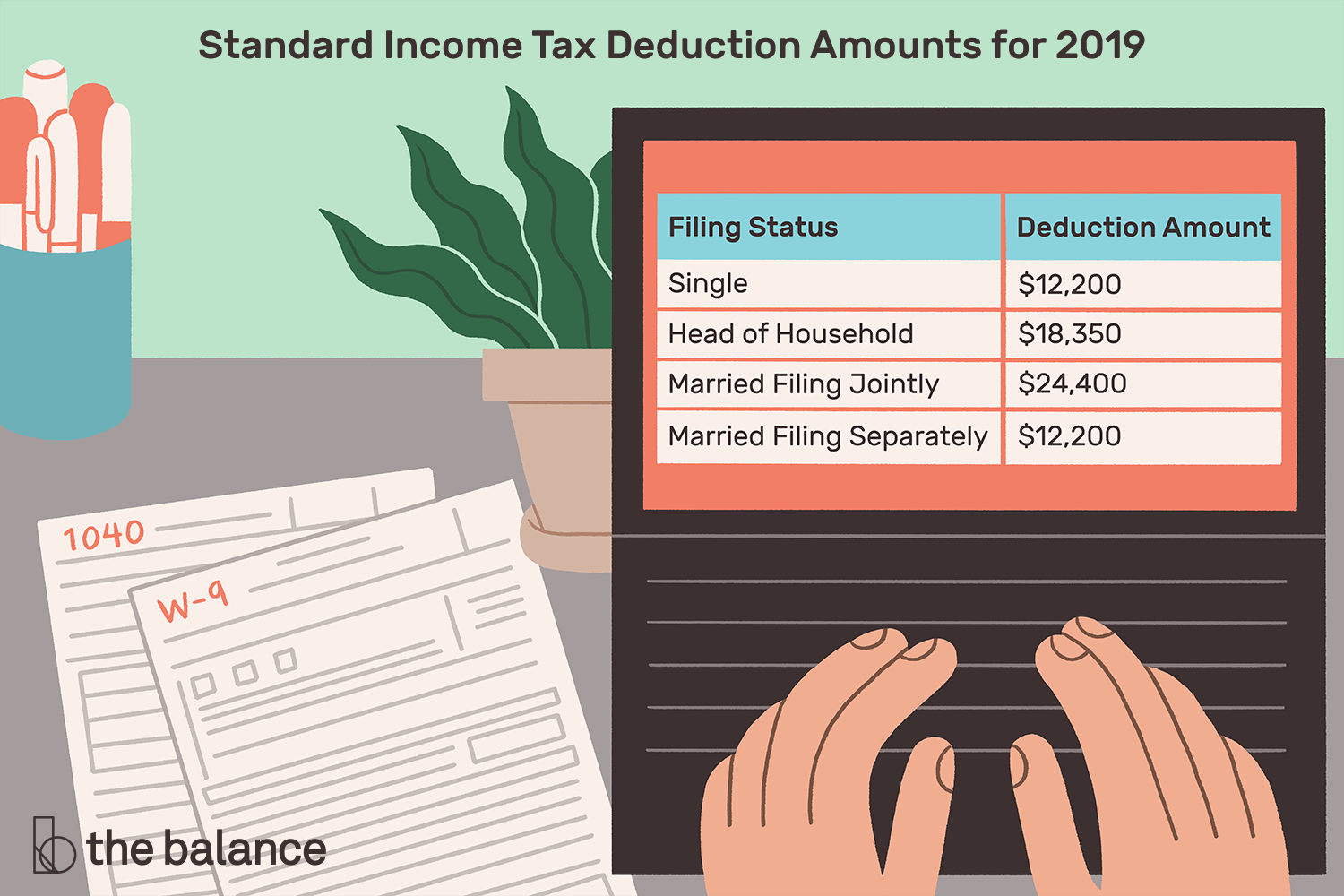

Below is the list of Internal Revenue Service (IRS) standard deductions for 2020 to be submitted on the next year of 2021, based upon your filing status:

- Single taxpayers get $12,400 of deductions, which is a raising from $12,200 in the past year.

- Married| taxpayers that submitted independently get $12,400 of deductions, which is a raising from $12,200 in the previous year.

- Married taxpayers that submitted collectively obtain $24,800 of deductions, which is a raise from $24,400 in the previous year.

- Heads of households obtain $18,650 of deductions, which is a raising from $18,350 in the previous year.

- Qualifying widowers receive $24,800 of deductions, which is a raise from $24,400 in the past year.

| Filing Status | Standard Deduction |

| Single | $12,400 |

| Married Filing Jointly | $24,800 |

| Married Filing Separately | $12,400 |

| Head of Household | $18,650 |

| Over 65 Age |

|

| Dependents | Additional $1,100 or individual income plus $350 |

Standard Deduction 2021

As the freshly changed standard deduction is typically released in the latter part of the year, the prices for 2021 is yet to be recognized. Nonetheless, it is still feasible to predict the amount based upon forecasted trends from prior years.

Below is the listing of Internal Revenue Service standard deductions for 2021 to be submitted in the next year of 2022 based upon your filing status. The modification is produced as a prediction, however it shouldn’t be far off from the future releases:

- Single| taxpayers get $12,550 of deductions, which is a raise from $12,400 in the previous year.

- Married taxpayers that submitted individually obtain $12,550 of deductions, which is a raise from $12,400 in the previous year.

- Married taxpayers that submitted collectively receive $25,100 of deductions, which is a raise from $24,800 in the previous year.

- Heads of households get $18,800 of deductions, which is a raise from $18,650 in the past year.

- Qualifying widowers obtain $25,100 of deductions, which is a raising from $24,800 in the past year.

| 2018 | 2019 | 2020 | 2021 | |

| Single | $12,000 | $12,200 | $12,400 | $12,550 |

| Married Filing Jointly | $24,000 | $24,400 | $24,800 | $25,100 |

| Married Filing Separately | $12,000 | $12,200 | $12,400 | $12,550 |

| Head of Household | $18,000 | $18,350 | $18,650 | $18,800 |

| Over 65 Age |

|

|

|

|

| Dependents | Additional $1,050 or individual income plus $350 | Additional $1,100 or individual income plus $350 | Additional $1,100 or individual income plus $350 | Additional $1,100 or individual income plus $350 |

To understand the estimate of your standard deductions each year early, you may wish to make use of a tax calculator. It is readily available totally free online on different websites including the main website of the IRS (Internal Revenue Service).