W4 Form In Spanish 2025 – Are you ready to take your career to the next level? Say ¡Hola! to success with the new and improved W4 Form in Spanish for 2025! This updated form is designed to help you unlock your potential and make sure you’re getting the most out of your tax withholdings. By mastering the W4 Form in Spanish, you’ll be setting yourself up for financial success and taking control of your future.

Unlock Your Potential with the W4 Form in Spanish 2025!

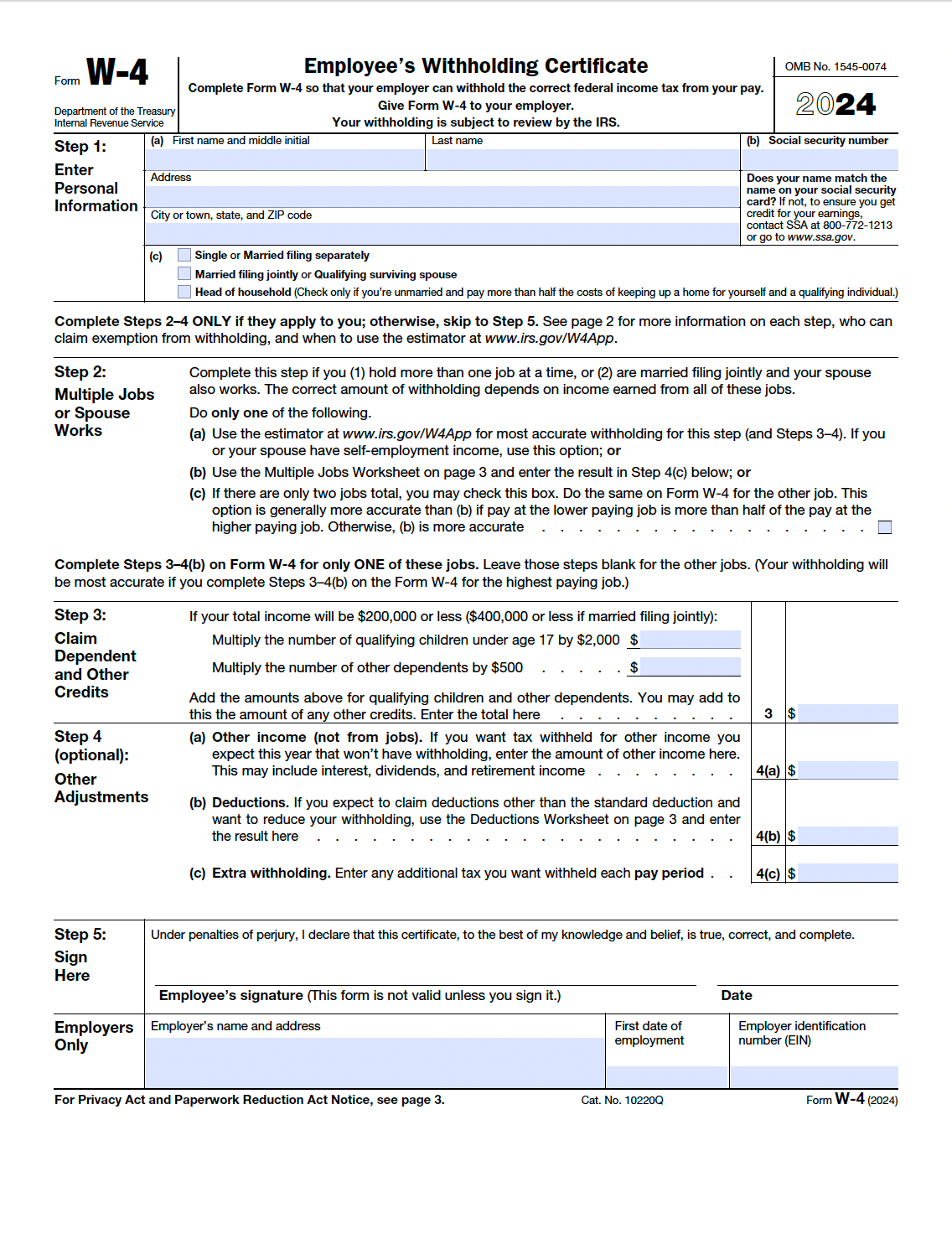

The W4 Form can be a daunting task for many individuals, but with the new Spanish version for 2025, it’s never been easier to navigate. By mastering this form, you’ll be able to accurately report your income and deductions, ensuring that you’re not overpaying or underpaying your taxes. This will not only save you money in the long run, but it will also give you peace of mind knowing that you’re on top of your financial obligations.

But mastering the W4 Form in Spanish isn’t just about saving money – it’s also about taking control of your financial future. By understanding how to properly fill out this form, you’ll be able to make informed decisions about your tax withholdings and plan for your financial goals. Whether you’re saving for a new home, planning for retirement, or just trying to make ends meet, mastering the W4 Form in Spanish will give you the tools you need to succeed.

Say ¡Hola! to Success: Mastering the W4 Form in Spanish

So why wait? Say ¡Hola! to success by mastering the W4 Form in Spanish for 2025. Take control of your financial future and unlock your potential by ensuring that you’re getting the most out of your tax withholdings. With this new and improved form, you’ll be able to confidently navigate the world of taxes and make smart decisions about your finances. Don’t let the W4 Form intimidate you – embrace it as a tool for success and take charge of your financial future today!

In conclusion, mastering the W4 Form in Spanish for 2025 is a crucial step towards financial success and stability. By understanding this form and using it to your advantage, you’ll be able to make informed decisions about your tax withholdings and plan for your future with confidence. So say ¡Hola! to success and unlock your potential by mastering the W4 Form in Spanish today!

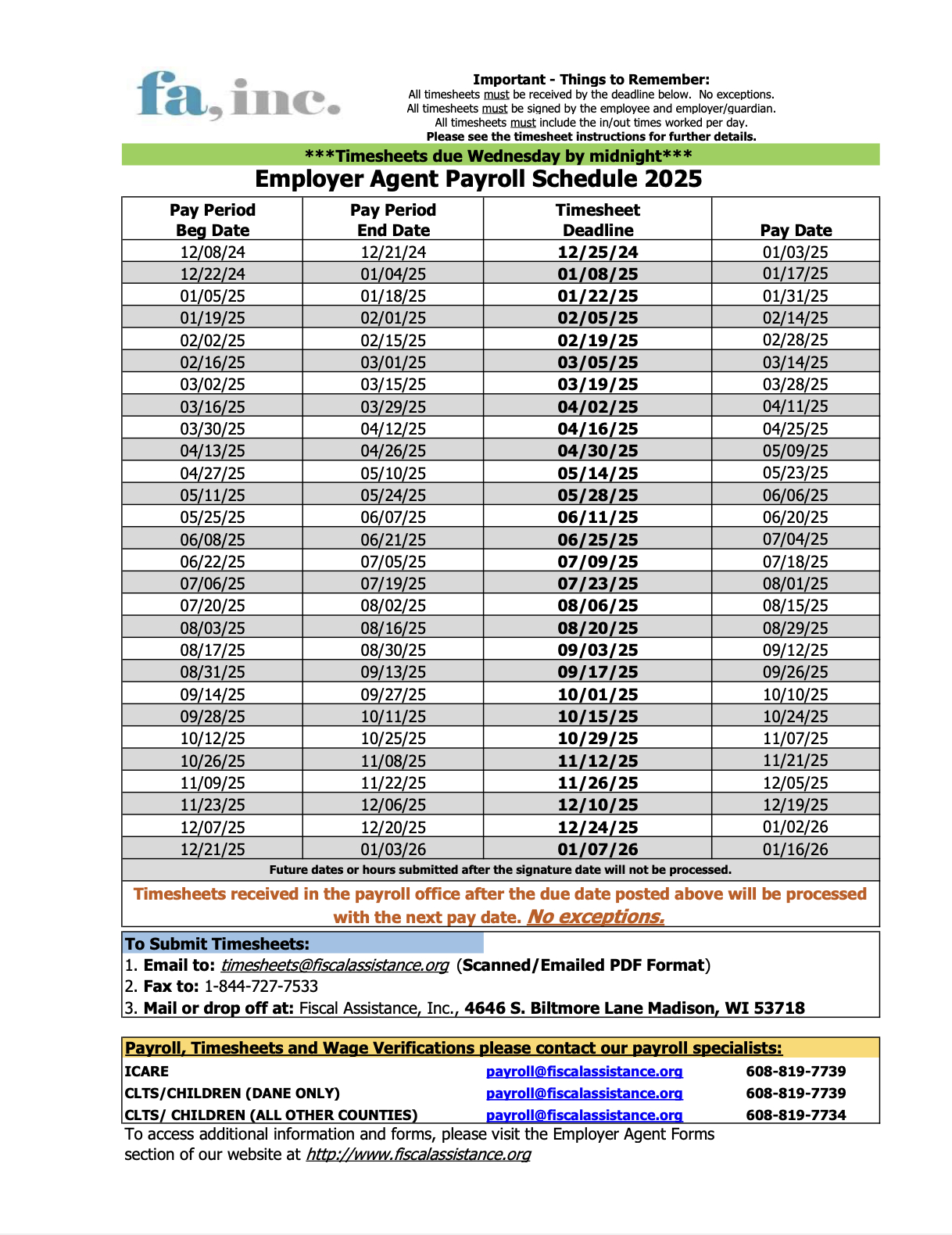

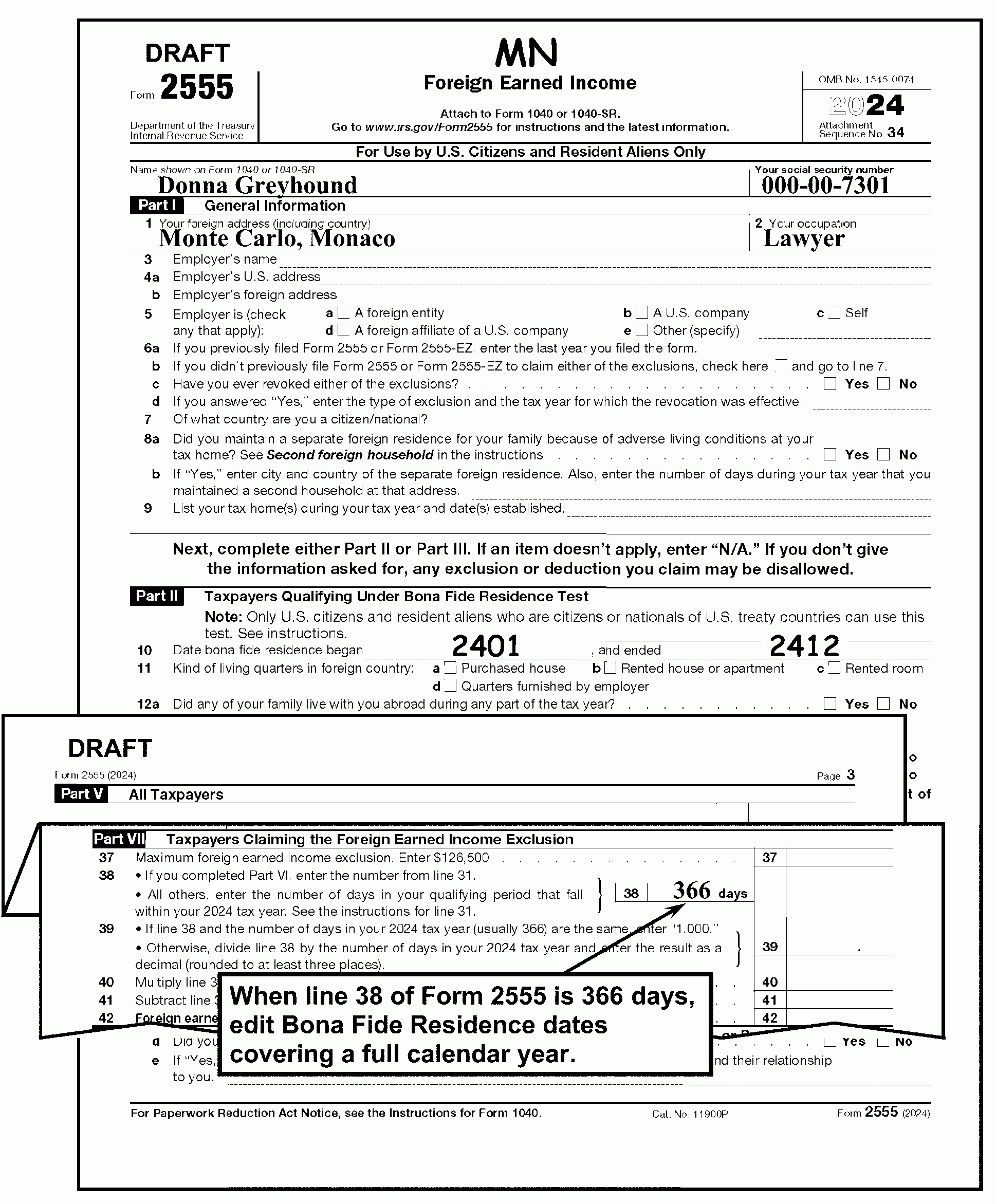

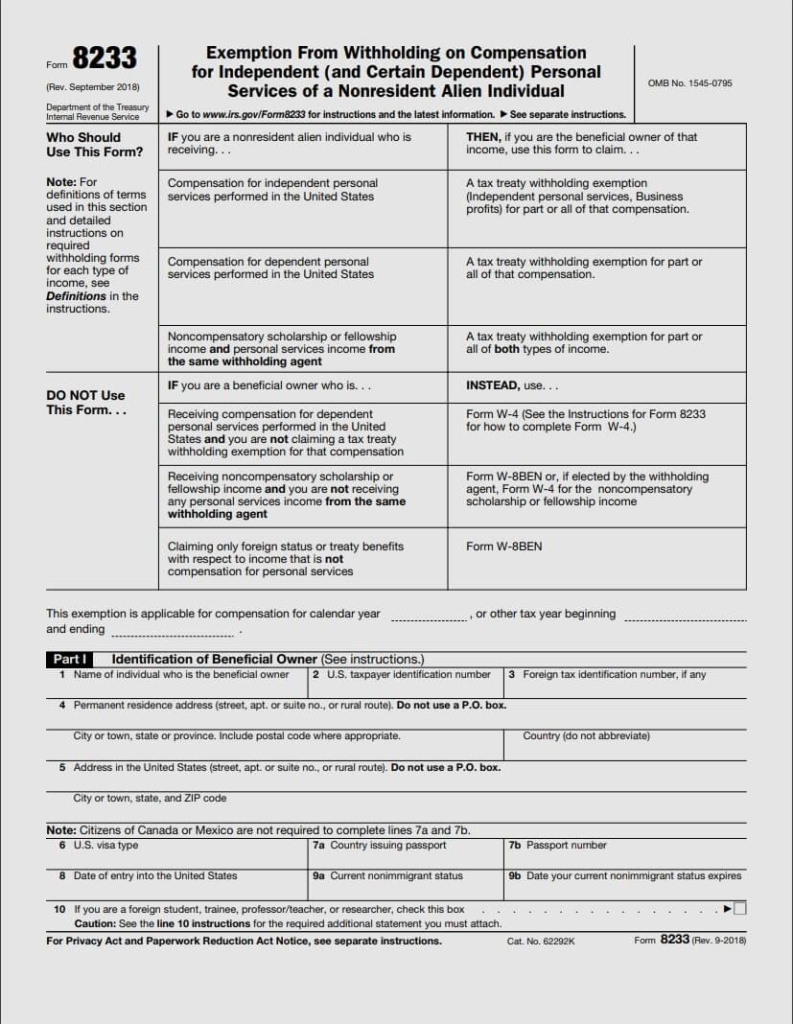

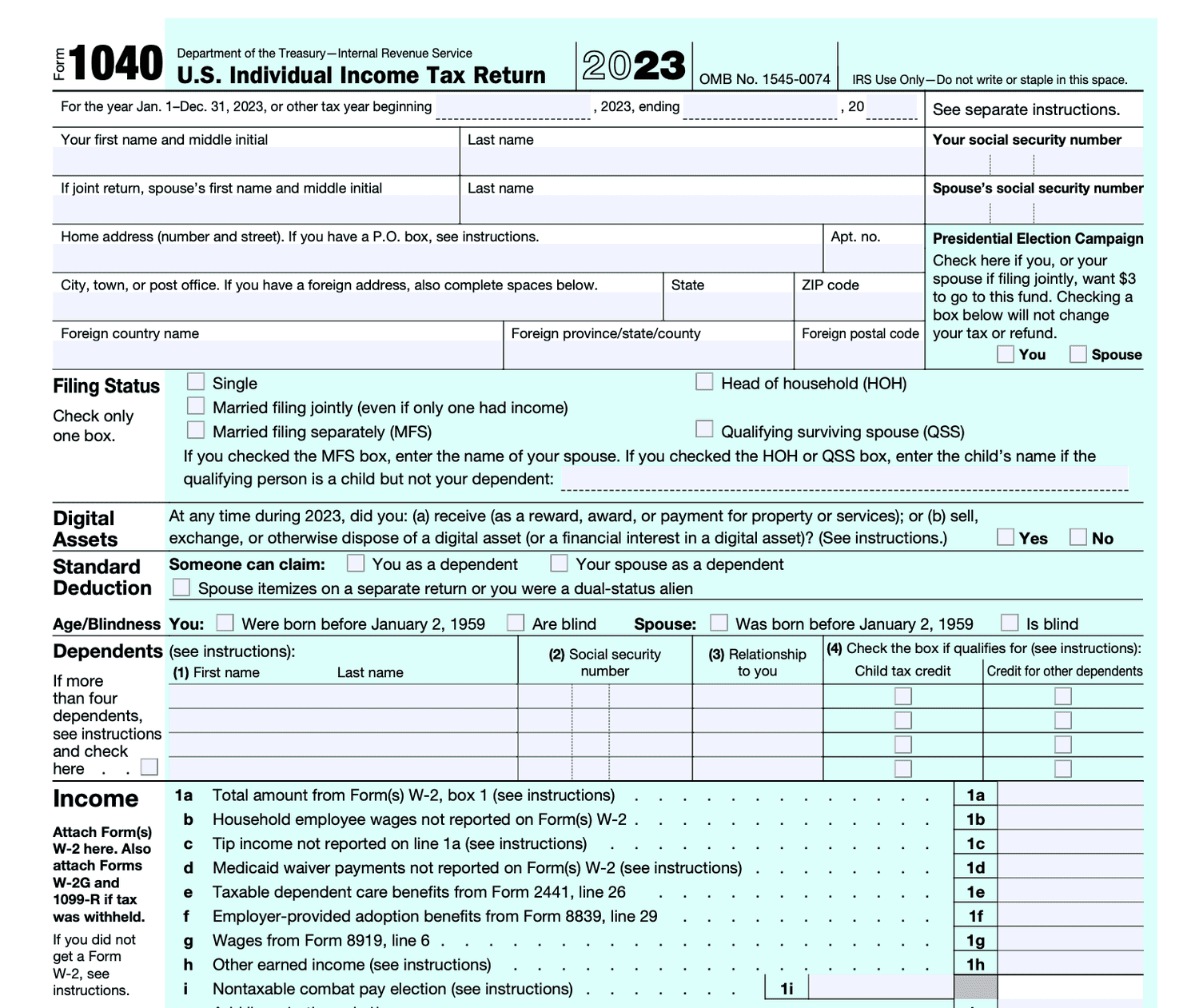

Related Forms…

W4 Form In Spanish 2025 Images