Maryland W4 Form 2025 – Are you ready to take control of your taxes and financial future in 2025? Look no further than the Maryland W4 form! This seemingly complex document holds the key to ensuring you have the right amount of taxes withheld from your paycheck throughout the year. By mastering the Maryland W4 form, you can maximize your take-home pay and avoid any surprises come tax season. Let’s dive into the secrets of the Maryland W4 form and get ready to conquer your finances in the new year!

Unveiling the Secrets of the Maryland W4 Form!

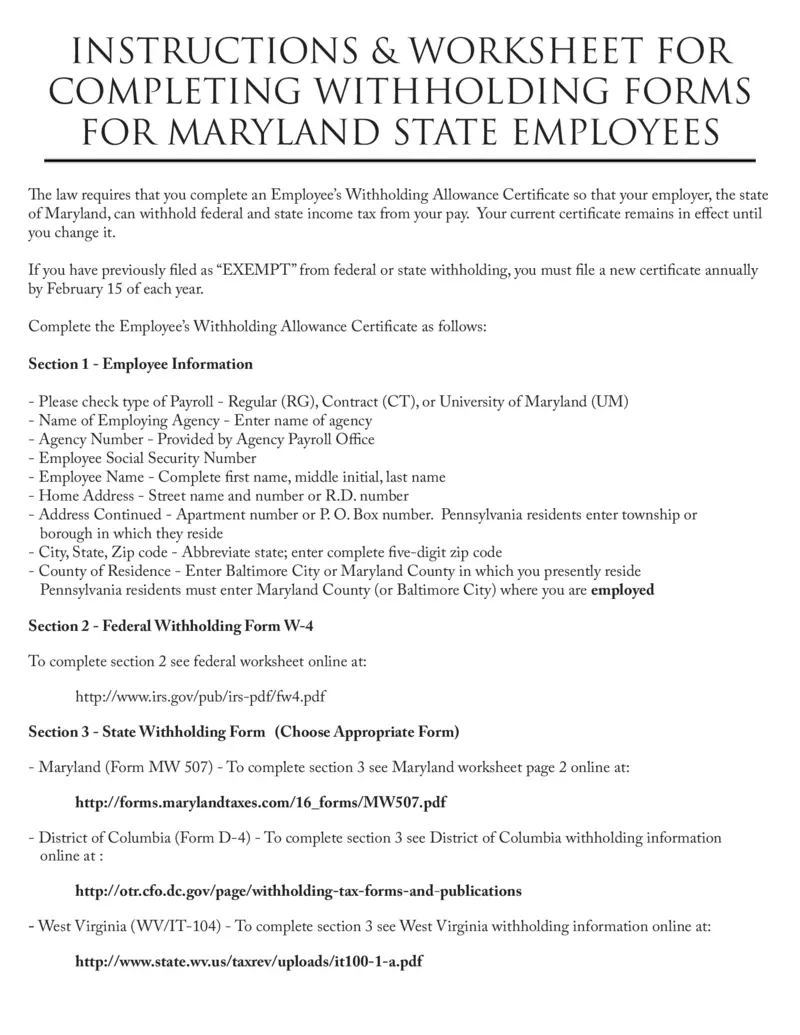

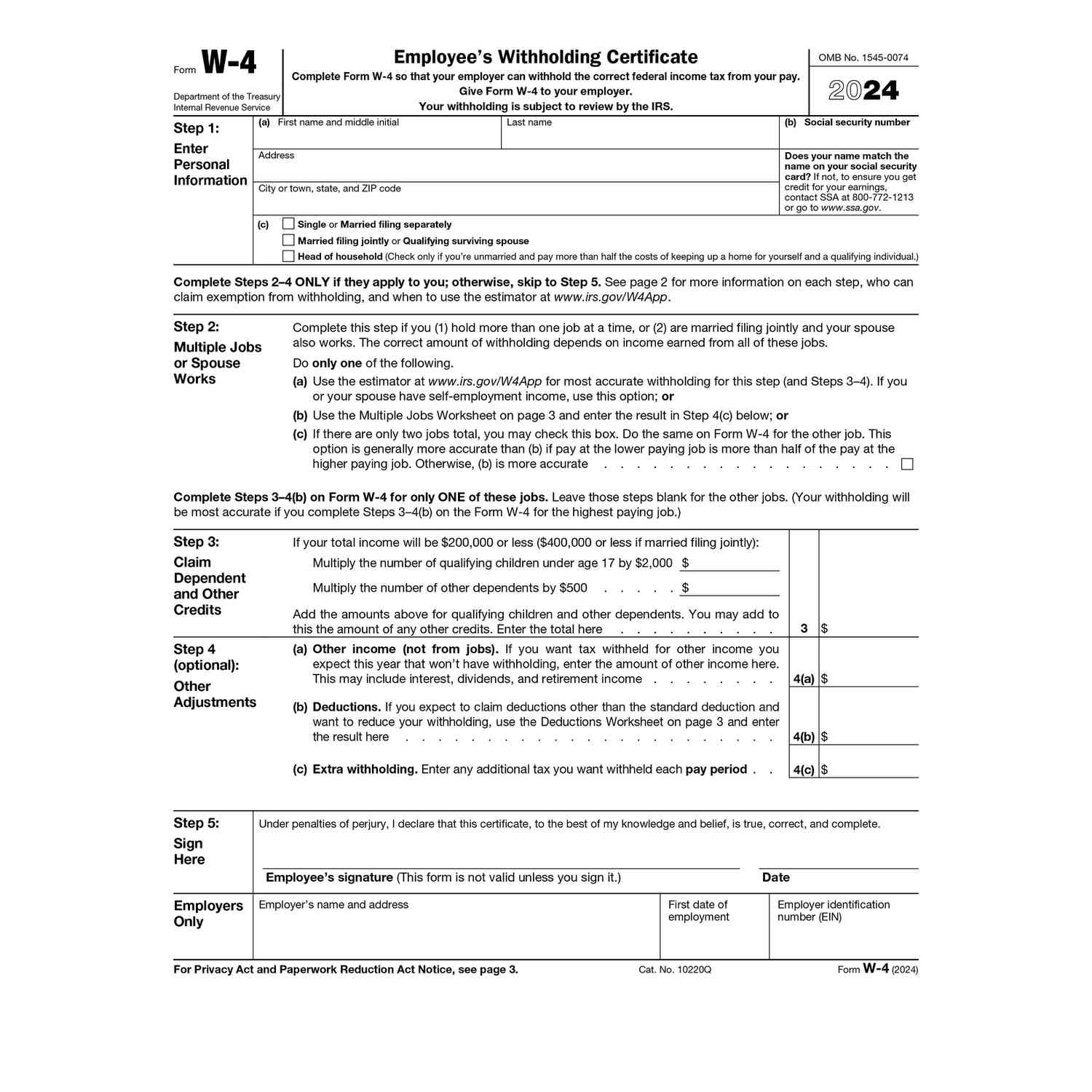

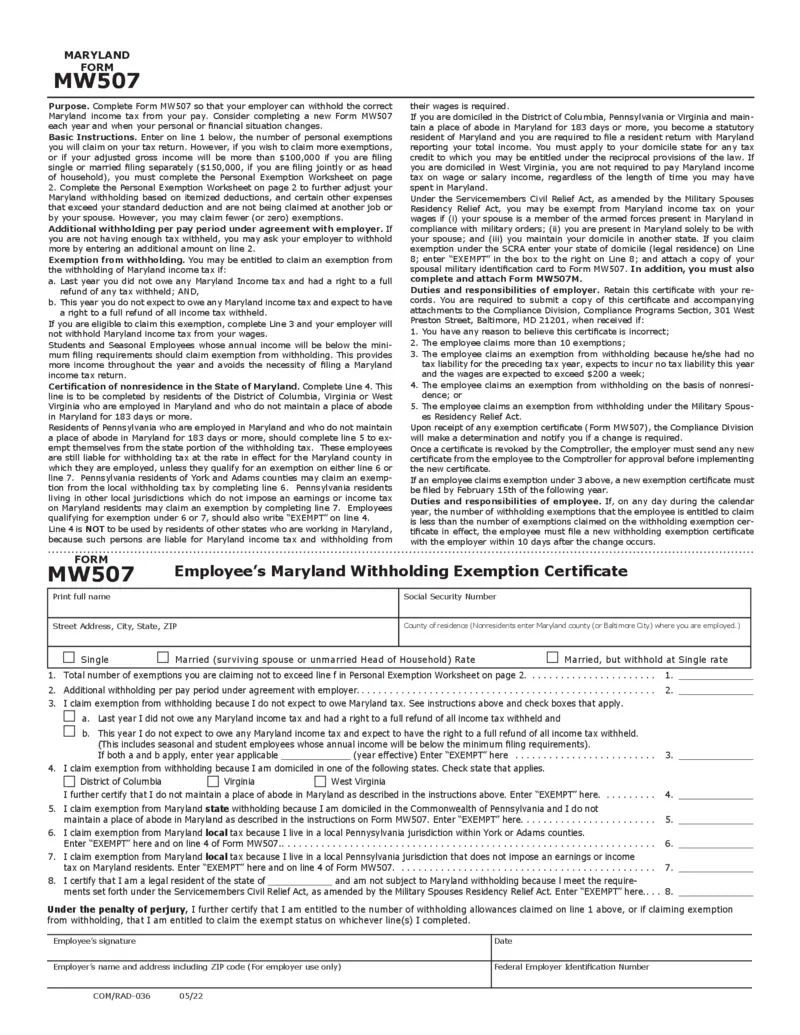

The Maryland W4 form may seem intimidating at first glance, but fear not – we’re here to guide you through the process! This form allows you to specify how much tax should be withheld from your paycheck based on your personal and financial situation. By understanding the various sections of the Maryland W4 form, such as the personal allowances worksheet and additional withholding section, you can customize your withholding to suit your needs. Whether you’re a single filer, married with children, or have multiple sources of income, the Maryland W4 form has options for everyone.

When filling out the Maryland W4 form, it’s important to provide accurate information to ensure the correct amount of taxes are withheld from your paycheck. By carefully reviewing each section and following the instructions provided, you can avoid underpaying or overpaying your taxes throughout the year. Remember, updating your Maryland W4 form as your financial situation changes – such as getting married, having a child, or taking on a second job – is crucial to staying on top of your tax obligations. With our ultimate guide to the Maryland W4 form, you’ll have the knowledge and confidence to navigate this process with ease.

Get Ready for 2025 with Our Ultimate Guide!

As we approach the new year, now is the perfect time to master the Maryland W4 form and set yourself up for financial success in 2025. By taking the time to understand this important document and how it impacts your taxes, you can make informed decisions that benefit your bottom line. So grab your Maryland W4 form, follow our step-by-step guide, and take control of your tax withholding today. Here’s to a prosperous and financially savvy 2025!

In conclusion, mastering the Maryland W4 form is a crucial step in managing your taxes and finances effectively. By unraveling the secrets of this document and following our ultimate guide, you can ensure that the right amount of taxes is withheld from your paycheck each pay period. Don’t let the Maryland W4 form intimidate you – with a little knowledge and preparation, you’ll be well on your way to a successful 2025. So grab your W4 form, put on your financial superhero cape, and conquer your taxes with confidence!

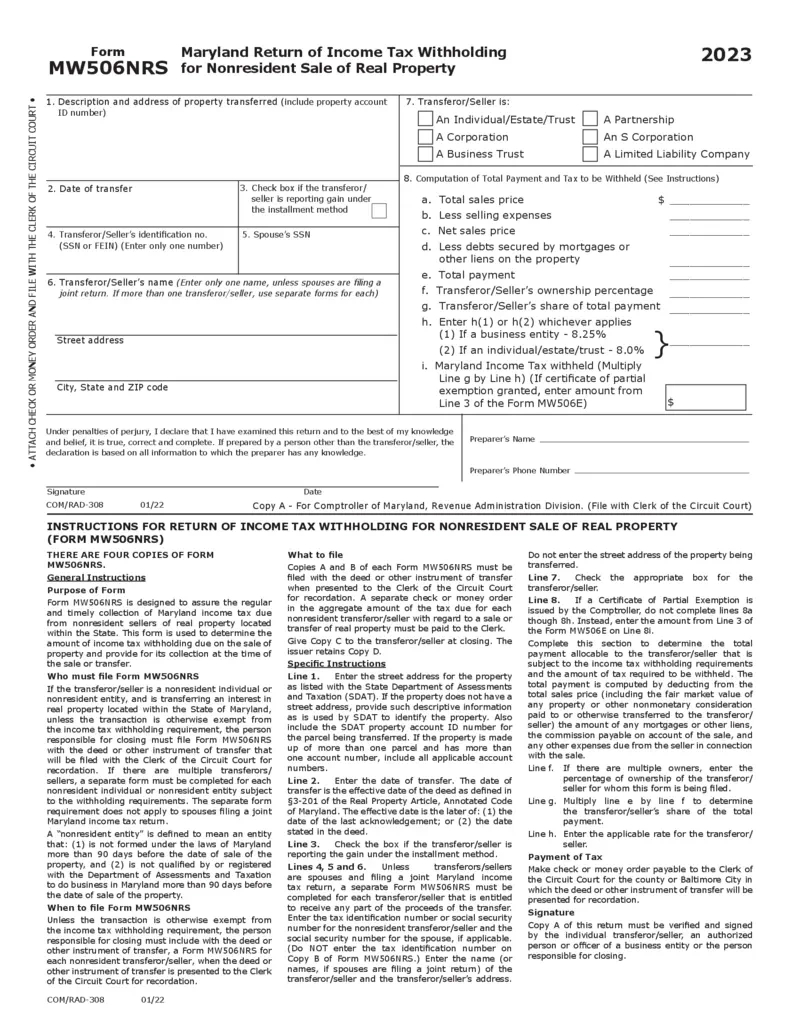

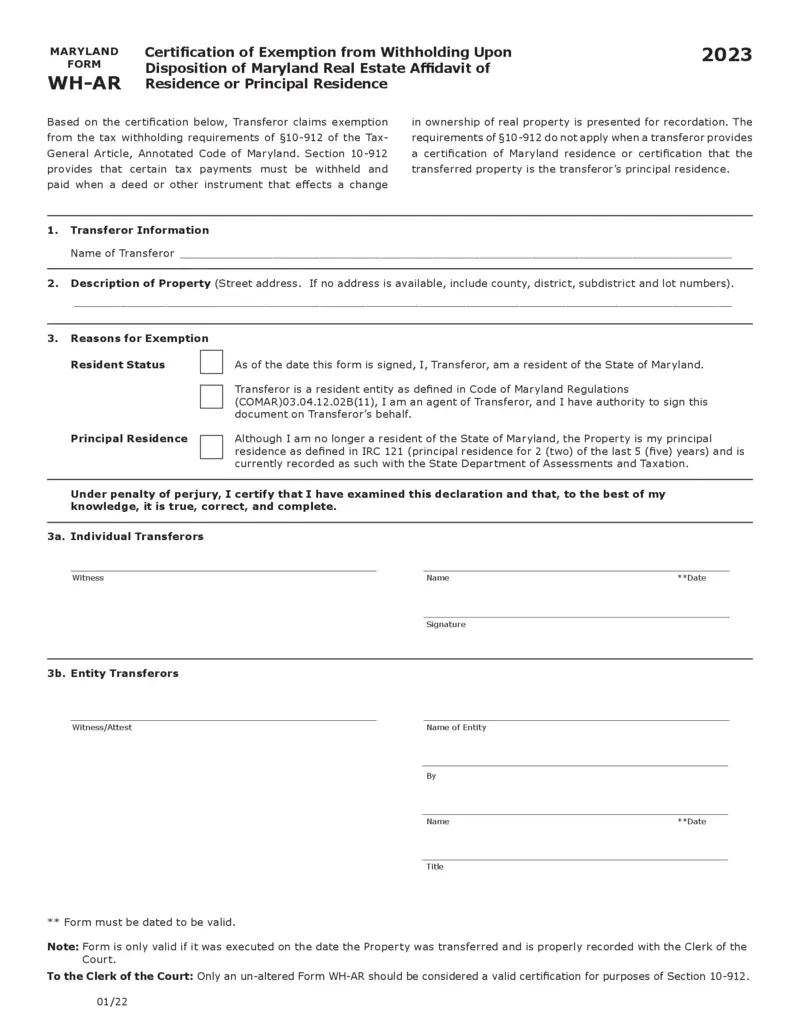

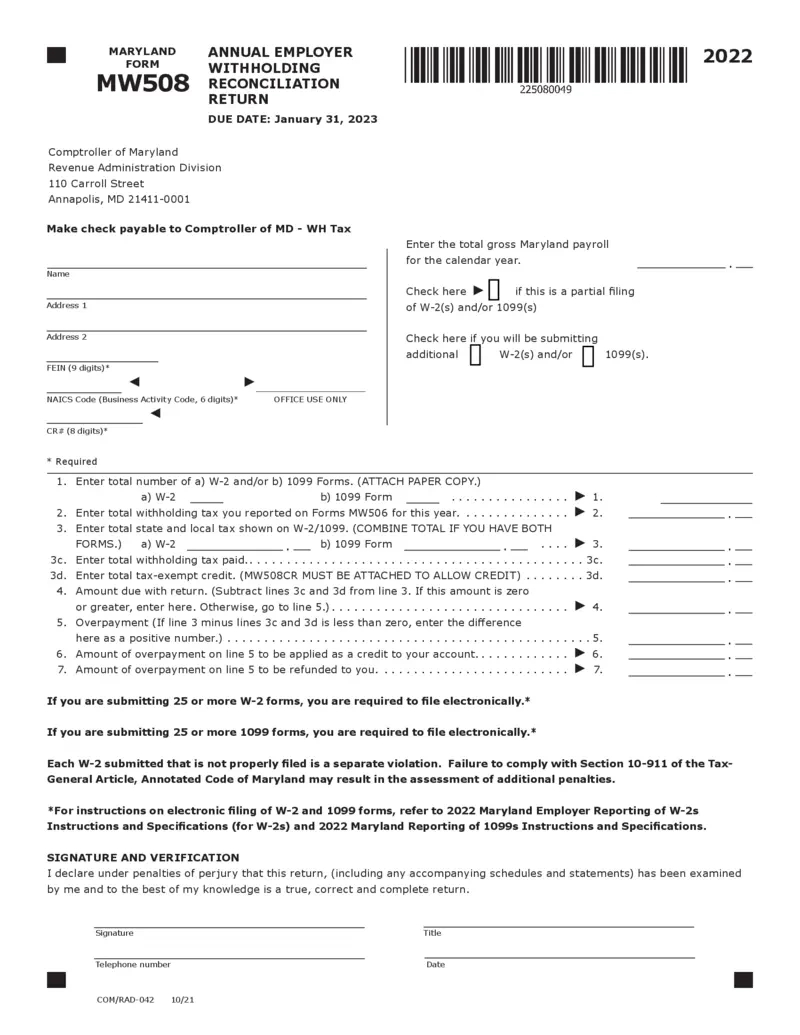

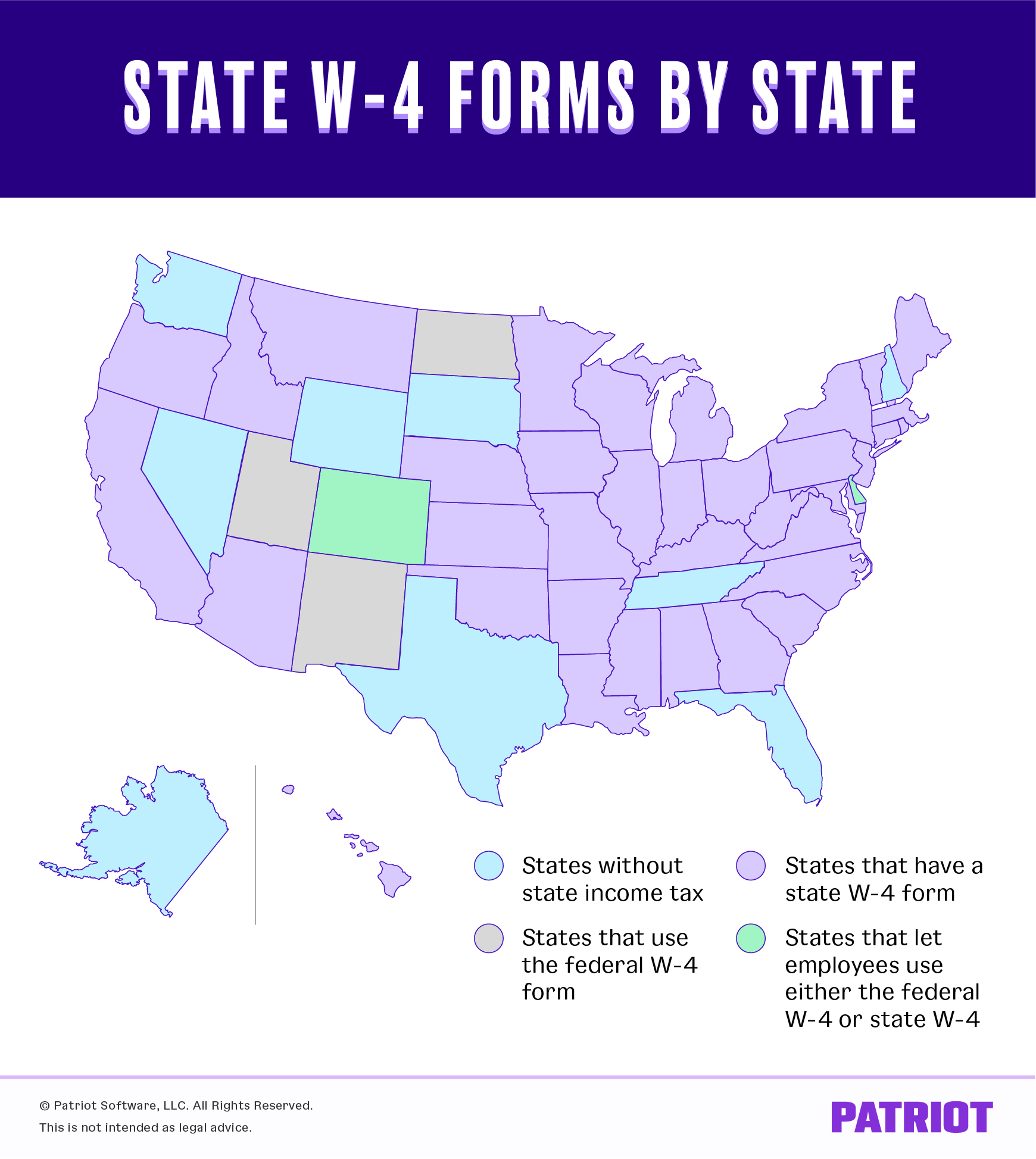

Related Forms…

Maryland W4 Form 2025 Images