SC W4 Form 2025 – Are you ready to take control of your taxes and maximize your refund for the upcoming tax season? Look no further than the SC W4 Form! By filling out this form accurately and thoroughly, you can ensure that you are withholding the right amount of taxes from your paycheck. This means you could potentially receive a larger refund when you file your taxes. Don’t leave money on the table – get ahead of the game and start planning for a bigger refund with the SC W4 Form!

With the SC W4 Form, you can make sure you are not overpaying or underpaying your taxes throughout the year. By adjusting your withholding allowances on this form, you can tailor your tax payments to fit your individual financial situation. Whether you have dependents, multiple jobs, or other sources of income, the SC W4 Form allows you to account for all of these factors. Say goodbye to tax season stress and hello to a simplified tax filing process with the help of the SC W4 Form!

Simplify Your Taxes for 2025 with SC W4 Form!

Say goodbye to confusing tax forms and lengthy calculations – the SC W4 Form is here to simplify your taxes for 2025! This user-friendly form walks you through the process of determining the right amount of taxes to withhold from your paycheck, making tax season a breeze. With clear instructions and helpful tips, you can easily navigate the SC W4 Form and ensure that your tax payments are accurate and up-to-date. Don’t let tax season overwhelm you – take control of your finances with the SC W4 Form!

By utilizing the SC W4 Form, you can proactively plan for tax season and avoid any surprises when it comes time to file your taxes. This form allows you to adjust your withholding allowances as needed, giving you the flexibility to account for changes in your financial situation throughout the year. Whether you experience a significant life event or simply want to optimize your tax refund, the SC W4 Form empowers you to take charge of your taxes. Get ahead of the game and start preparing for a stress-free tax season with the help of the SC W4 Form!

In conclusion, the SC W4 Form is your key to a successful and stress-free tax season in 2025. By maximizing your refund and simplifying your taxes with this form, you can take control of your financial future and ensure that you are in good standing with the IRS. Say goodbye to tax season headaches and hello to a smoother filing process with the SC W4 Form. Get ready to tackle tax season like a pro and make the most of your hard-earned money with the help of this essential tool!

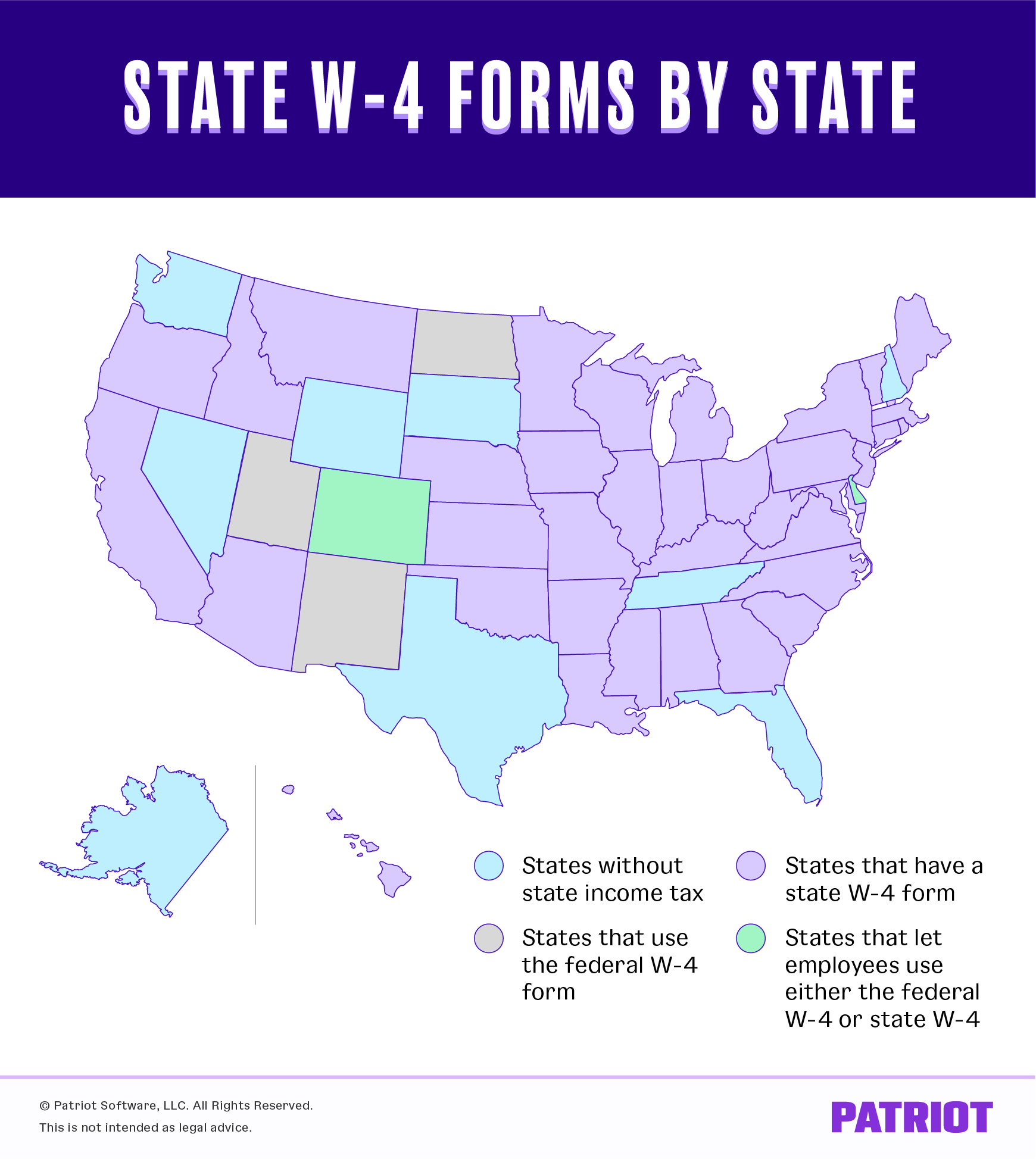

Related Forms…

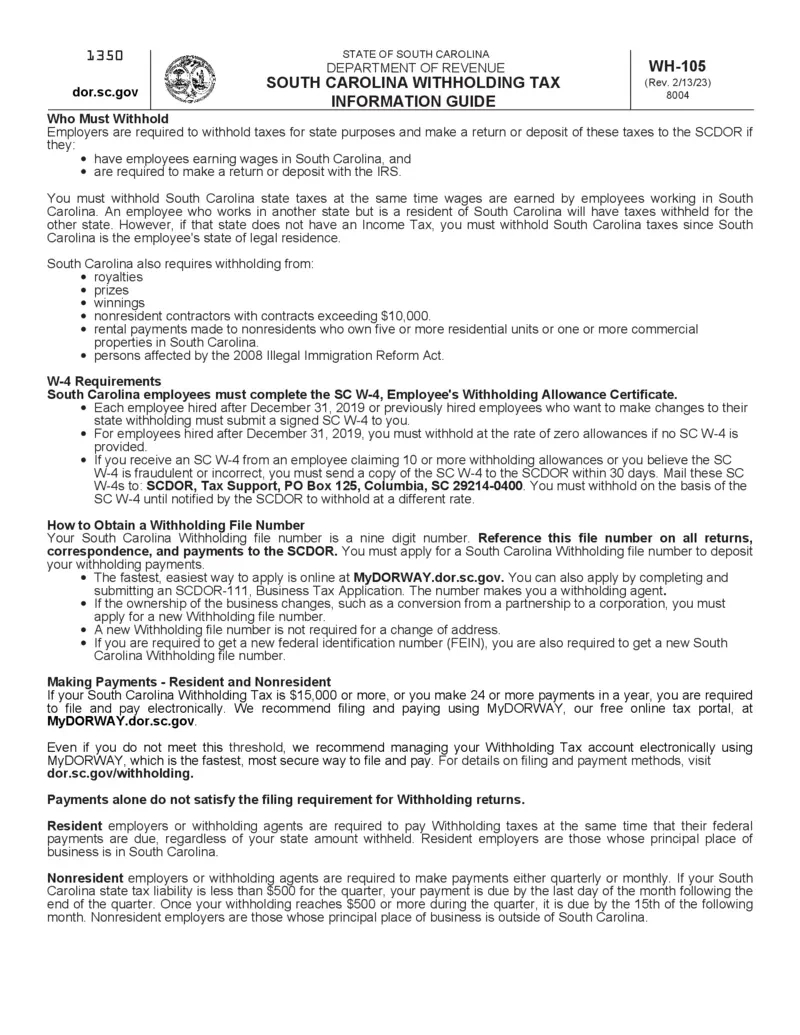

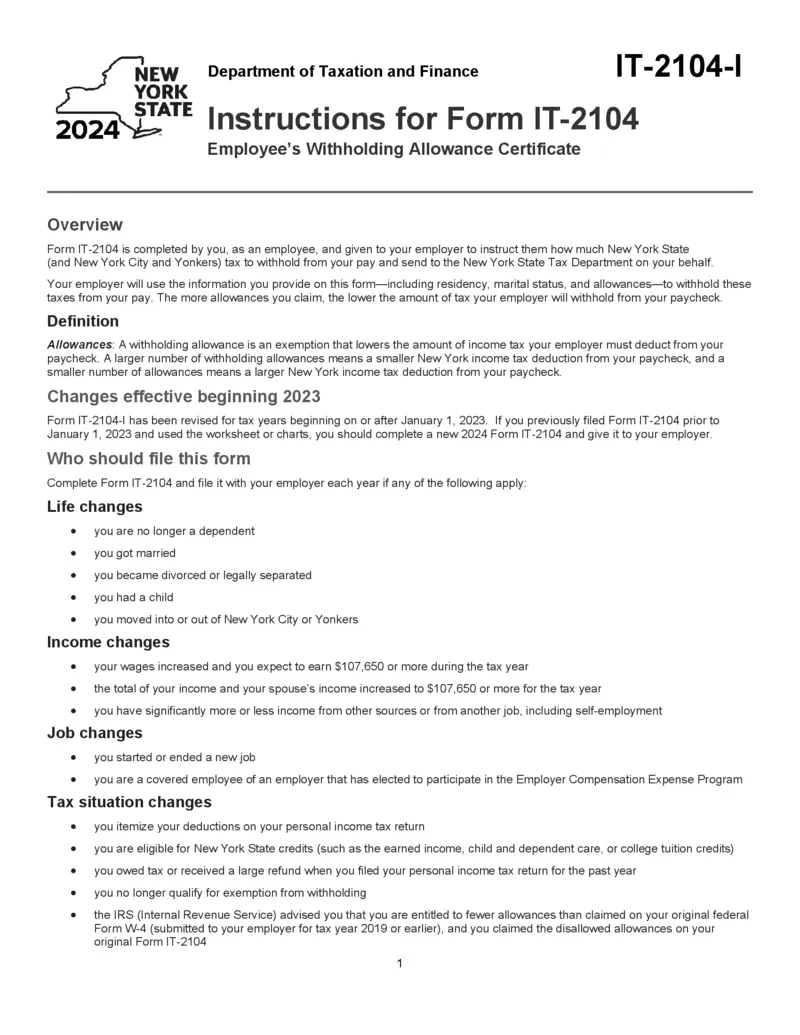

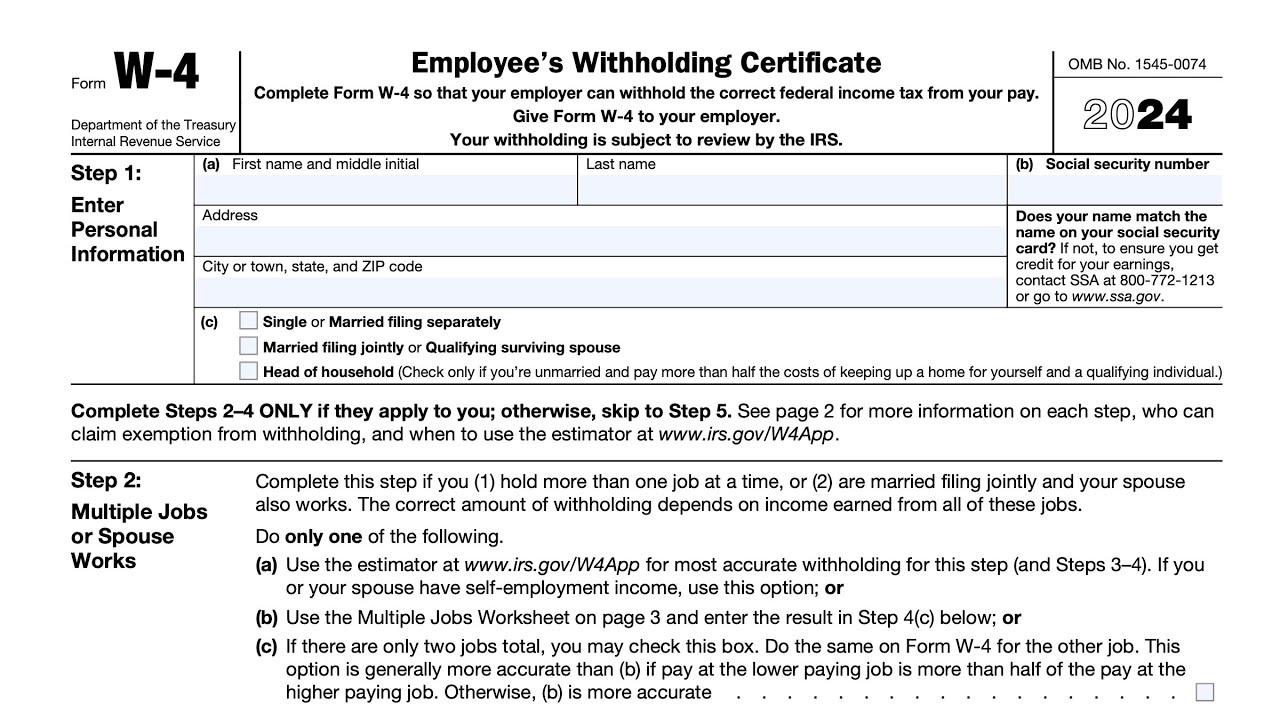

SC W4 Form 2025 Images