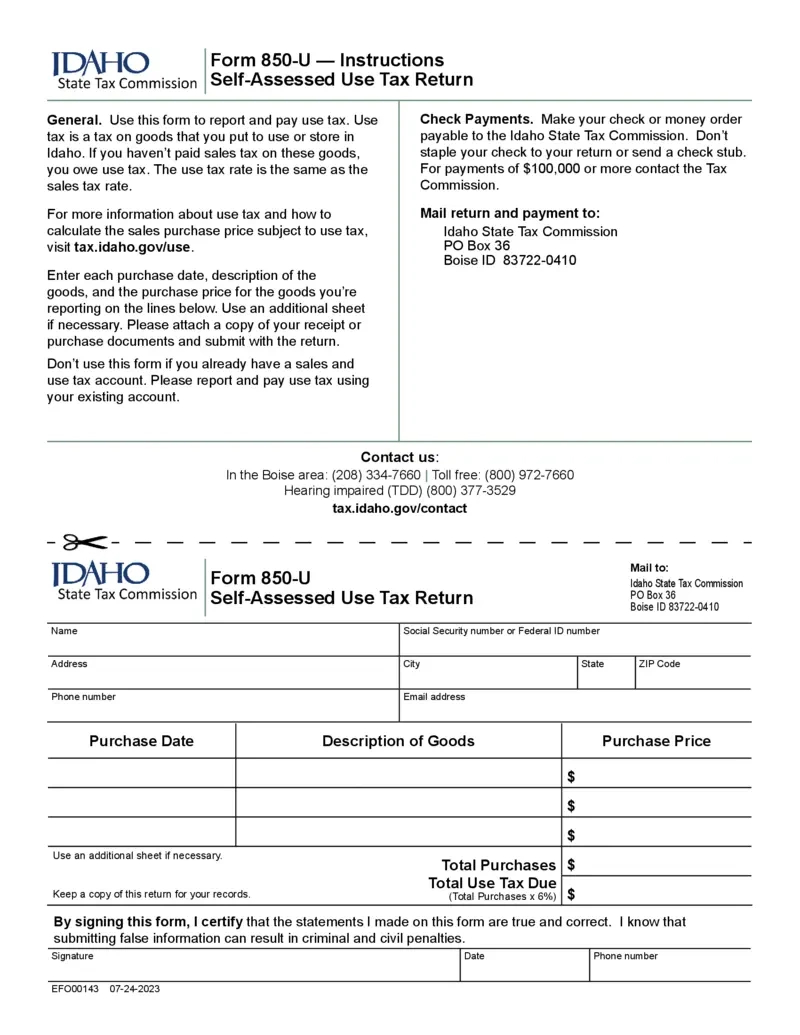

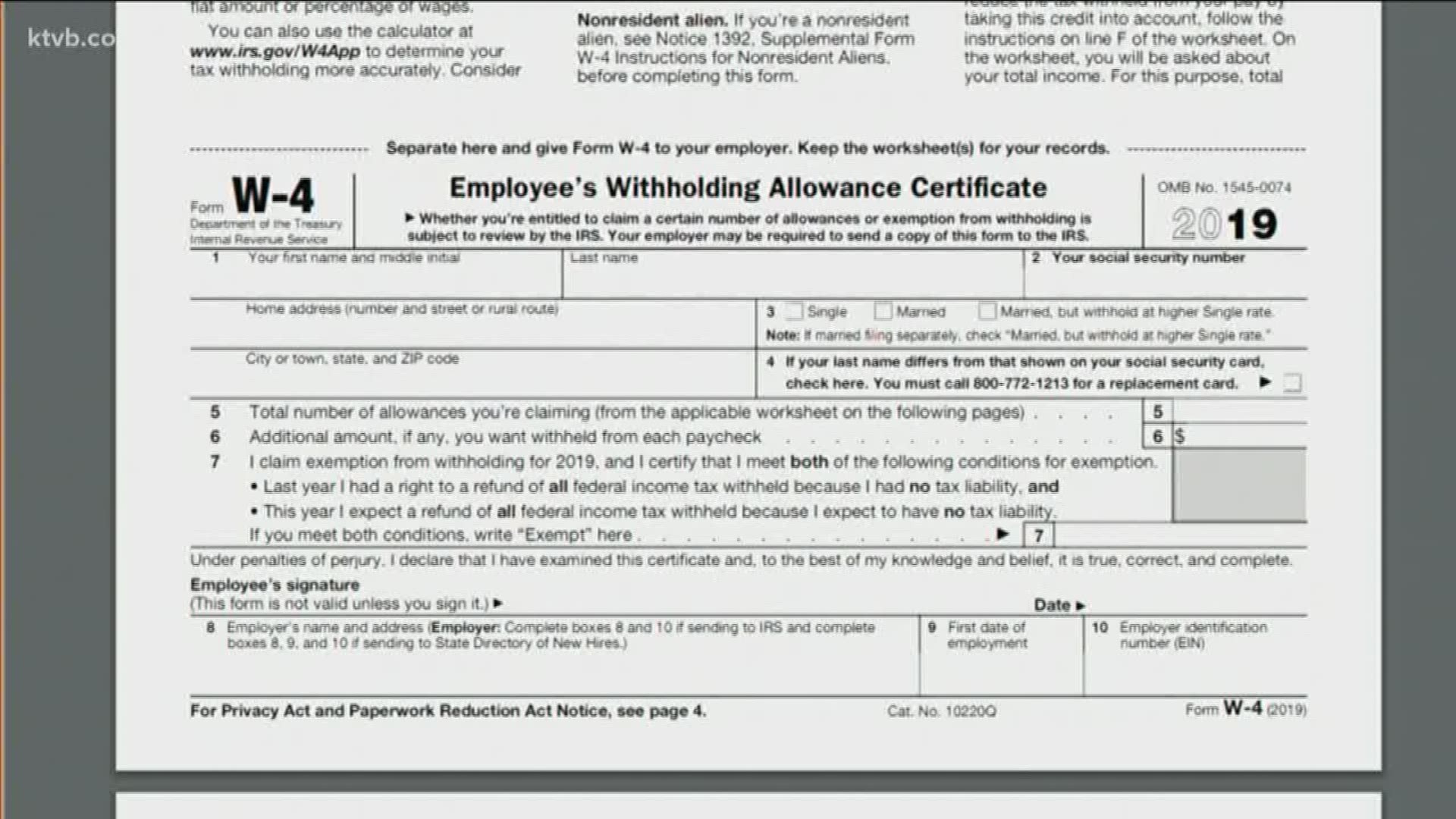

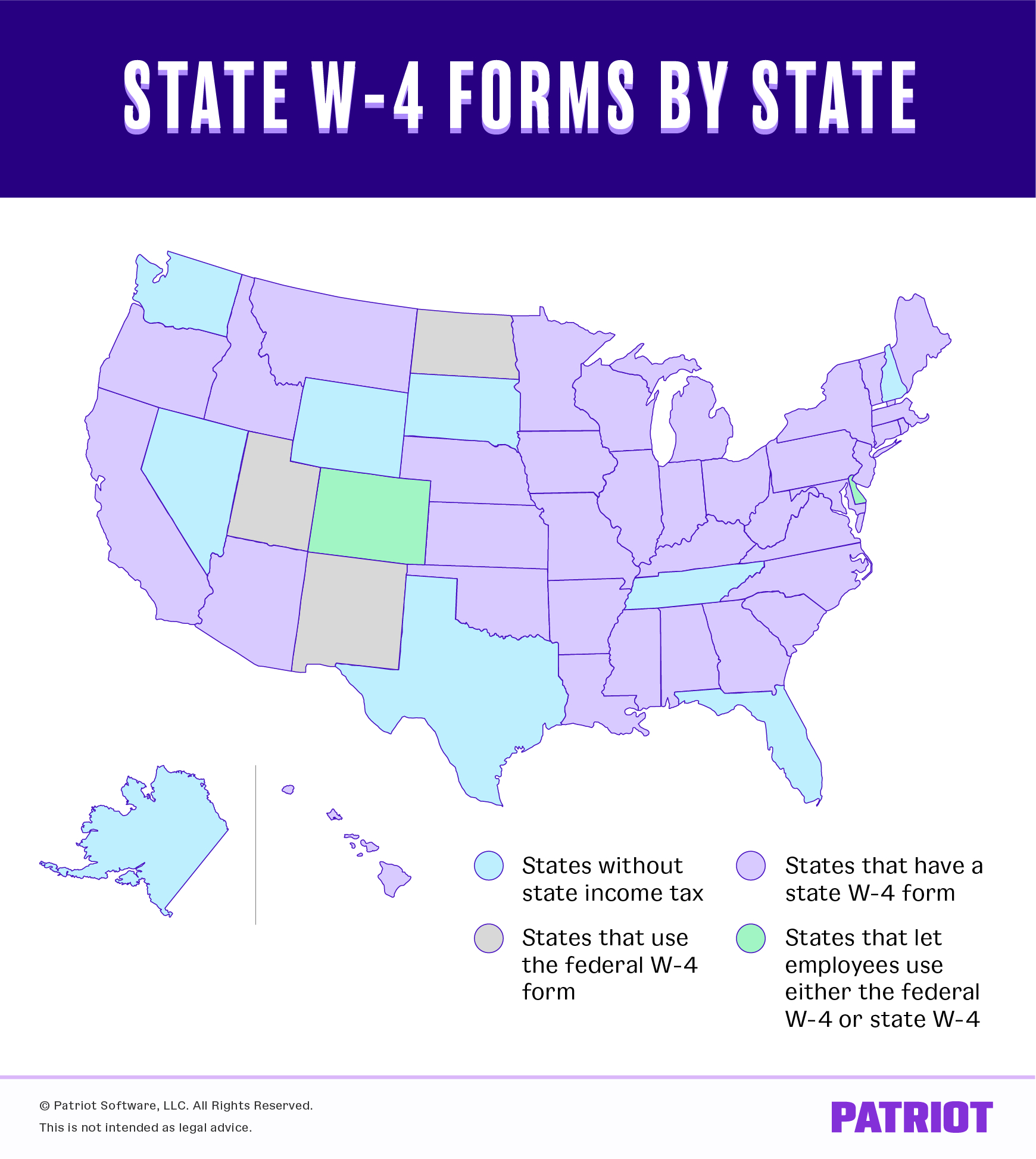

Idaho W4 Form 2025 – Tax season can be a stressful time for many people, but it doesn’t have to be! With the Idaho W4 Form 2025, you can maximize your tax refund and keep more money in your pocket. This form allows you to adjust your withholding allowances, ensuring that you are not overpaying on your taxes throughout the year. By filling out the Idaho W4 Form 2025 accurately, you can take advantage of all available deductions and credits, ultimately leading to a larger tax refund when you file your return.

Not only does the Idaho W4 Form 2025 help you maximize your tax refund, but it also makes the tax preparation process simpler and more straightforward. By accurately completing this form, you can avoid any potential errors or discrepancies that may delay the processing of your return. With clear instructions and easy-to-follow guidelines, the Idaho W4 Form 2025 takes the guesswork out of tax preparation, ensuring that you are providing all the necessary information for an accurate and timely filing. Say goodbye to the stress and confusion of tax season with the Idaho W4 Form 2025!

Simplify Your Tax Preparation with the Idaho W4 Form 2025!

Gone are the days of sifting through endless piles of paperwork and trying to make sense of complicated tax forms. With the Idaho W4 Form 2025, tax preparation has never been easier. This form is designed to streamline the process, allowing you to quickly and accurately input your information without any hassle. Whether you are a seasoned tax filer or a first-time taxpayer, the Idaho W4 Form 2025 is the perfect tool to simplify your tax preparation and ensure a stress-free filing experience.

In addition to simplifying your tax preparation, the Idaho W4 Form 2025 also helps you stay organized throughout the year. By updating your withholding allowances on this form, you can ensure that you are paying the correct amount of taxes each pay period. This proactive approach not only helps you avoid any surprises come tax season but also allows you to better plan and budget for any potential tax liabilities. With the Idaho W4 Form 2025, you can take control of your taxes and set yourself up for financial success in the year ahead.

In conclusion, the Idaho W4 Form 2025 is a valuable tool for anyone looking to maximize their tax refund and simplify their tax preparation. By taking the time to accurately complete this form, you can ensure that you are not overpaying on your taxes and that you have all the necessary information for a smooth filing process. Say goodbye to the stress and confusion of tax season and hello to a simpler, more efficient way of handling your taxes with the Idaho W4 Form 2025!

Related Forms…

Idaho W4 Form 2025 Images