Help With W4 Form 2025 – Are you tired of feeling stressed out every tax season? Say goodbye to tax stress and take control of your finances with these simple tips for filling out your W4 form in 2025. By understanding how to maximize your refund, you can ensure that you get the most money back possible.

Say Goodbye to Tax Stress!

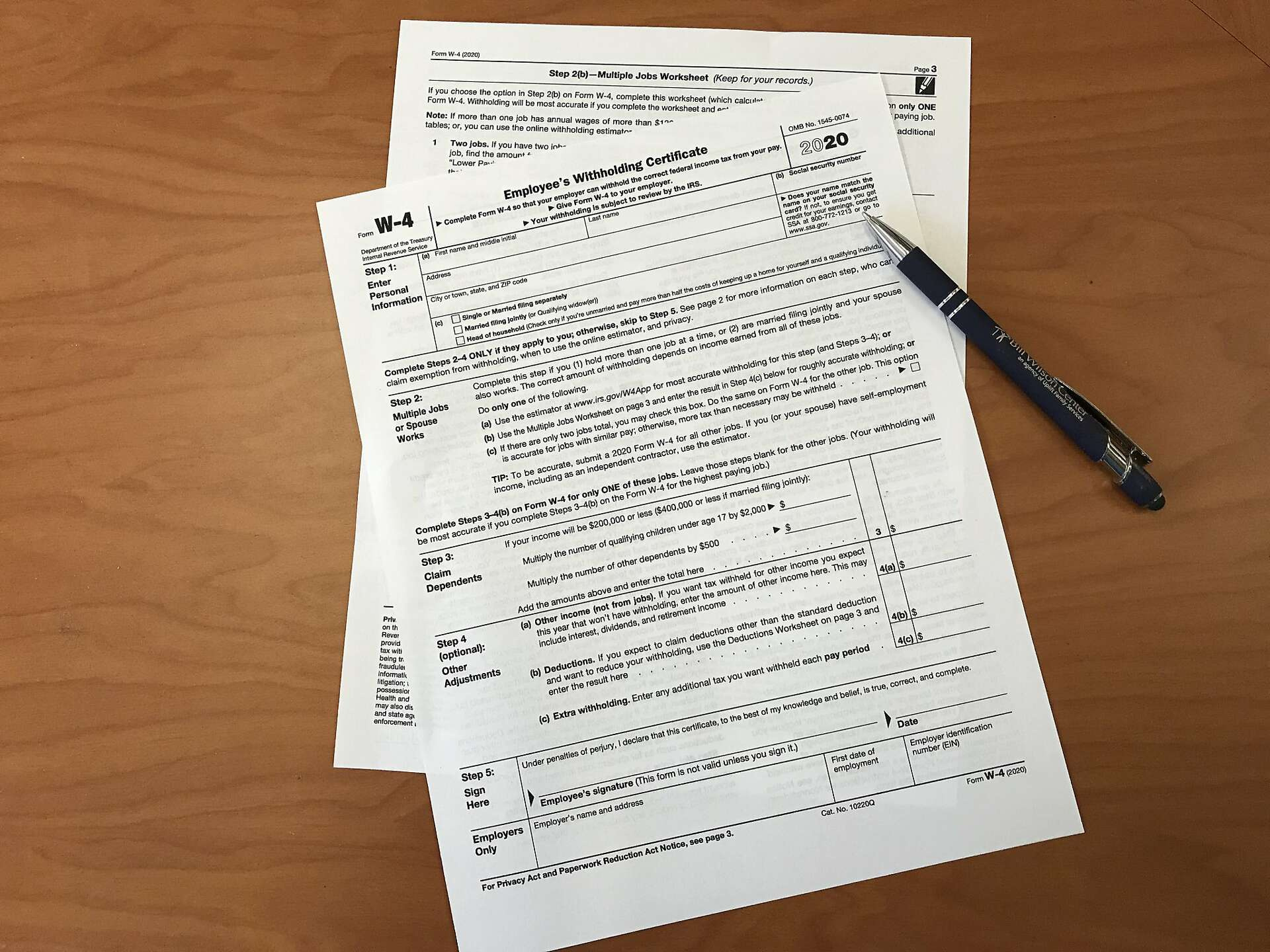

Tax season can be overwhelming for many people, but it doesn’t have to be. By taking the time to carefully fill out your W4 form, you can alleviate some of that stress and ensure that you are getting the most out of your tax return. With the right information and a little bit of planning, you can make tax season a breeze.

One of the best ways to reduce tax stress is to stay organized throughout the year. Keep track of all your income, expenses, and receipts so that you have everything you need when it comes time to file your taxes. By staying on top of your finances, you can avoid any last-minute scrambling and ensure that you are getting the maximum refund possible.

When it comes to filling out your W4 form, don’t be afraid to ask for help if you need it. There are plenty of resources available to assist you, whether it’s a tax professional, online guides, or even friends and family who have experience with taxes. By seeking out help when you need it, you can make the process much easier and less stressful.

Take Control with W4 Form Tips!

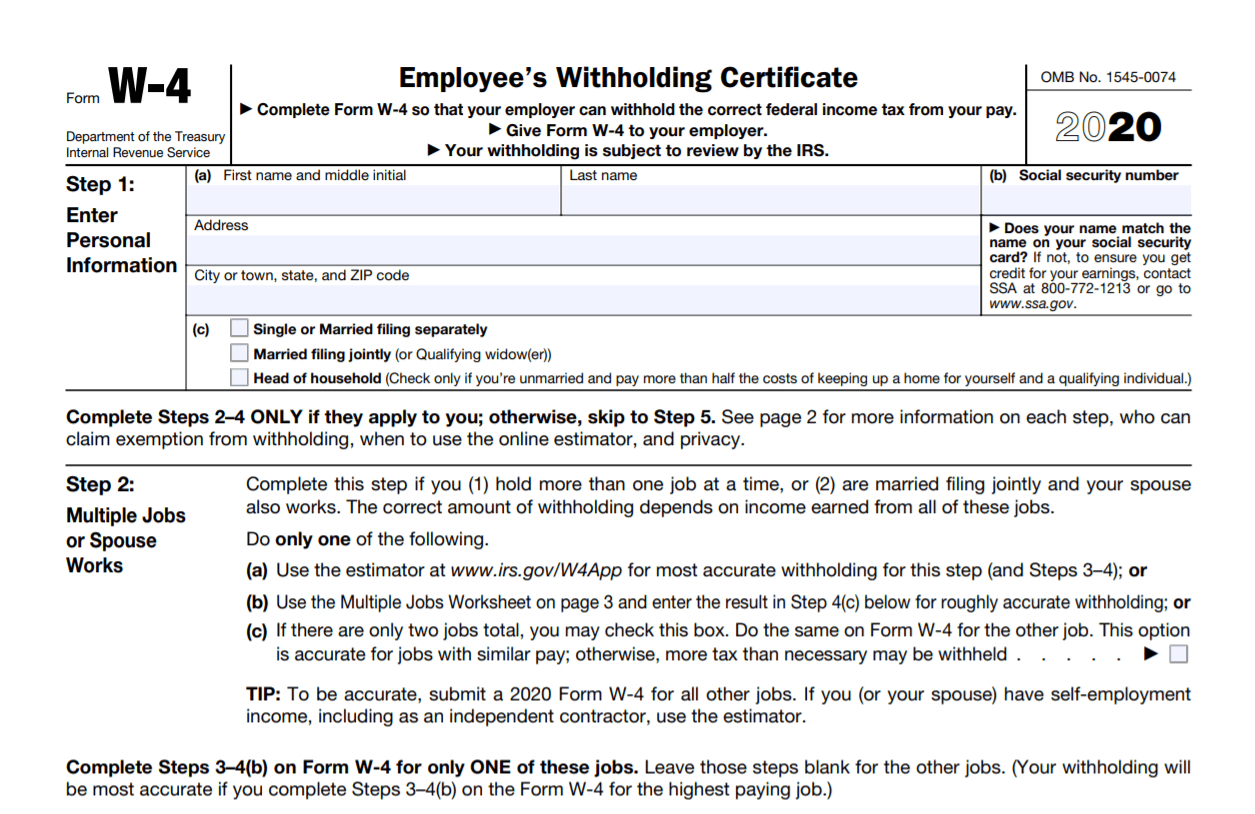

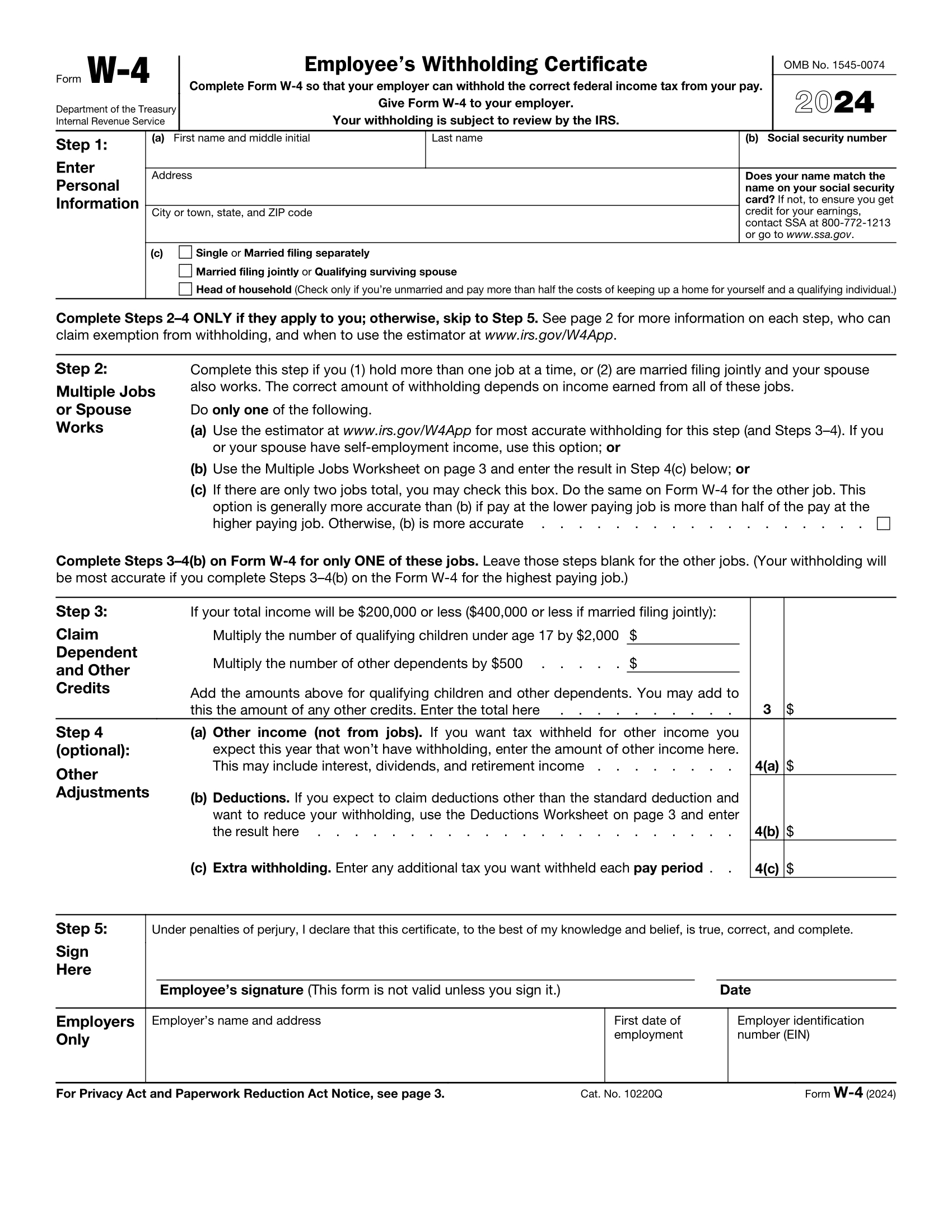

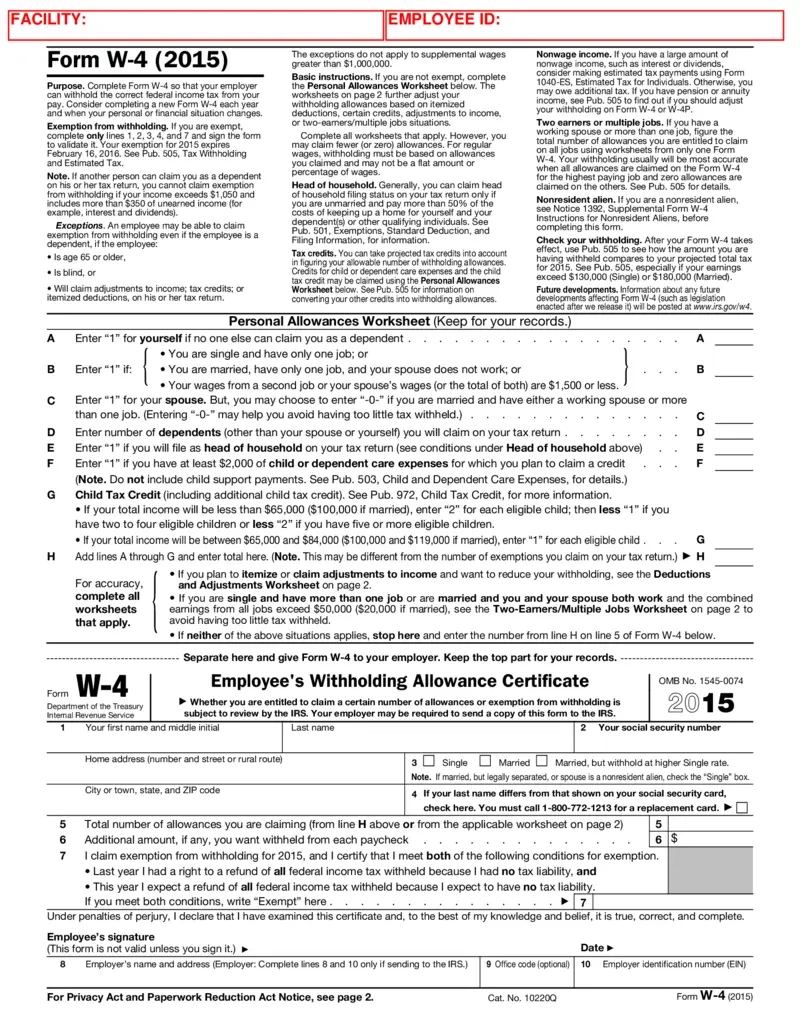

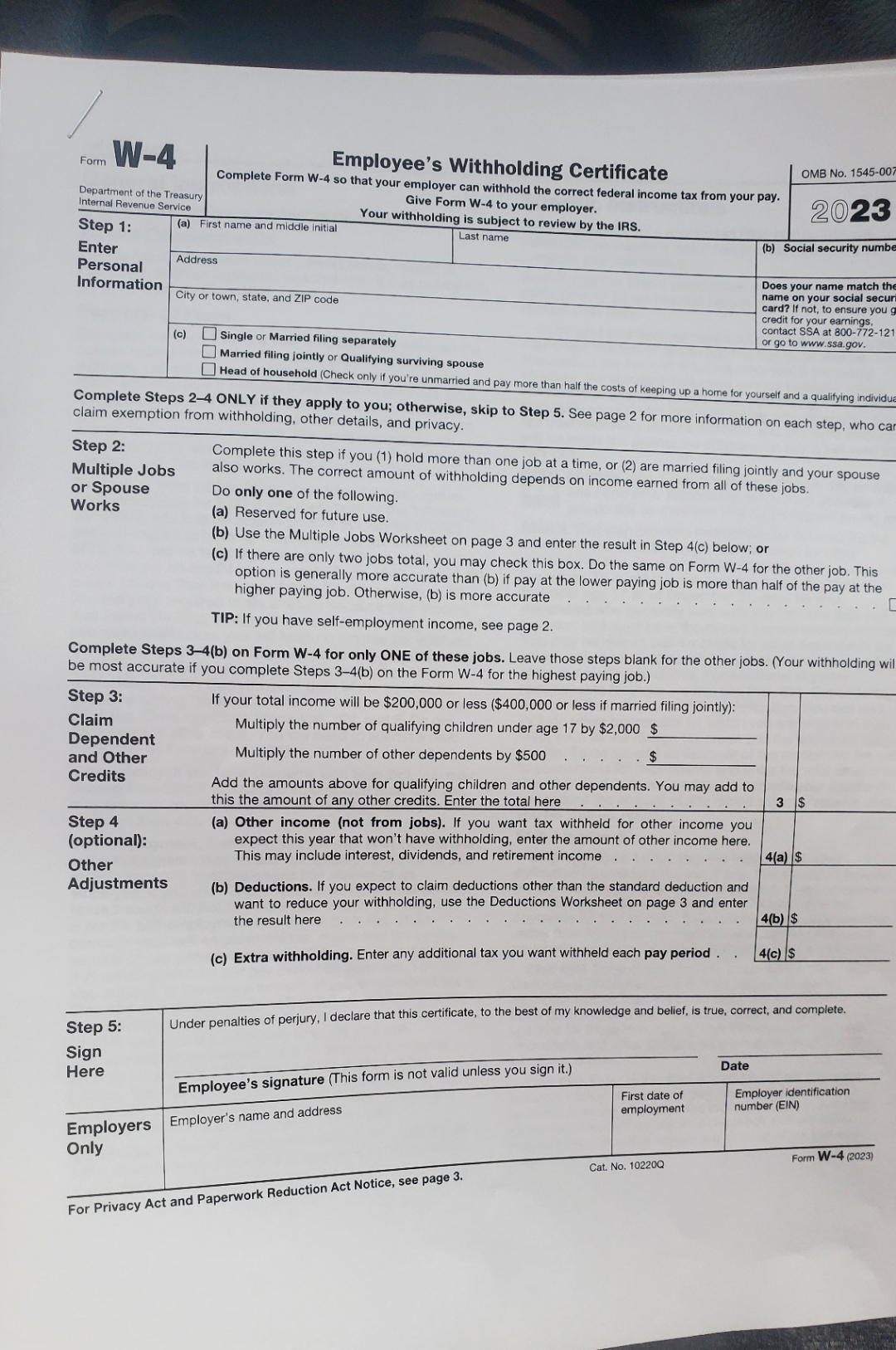

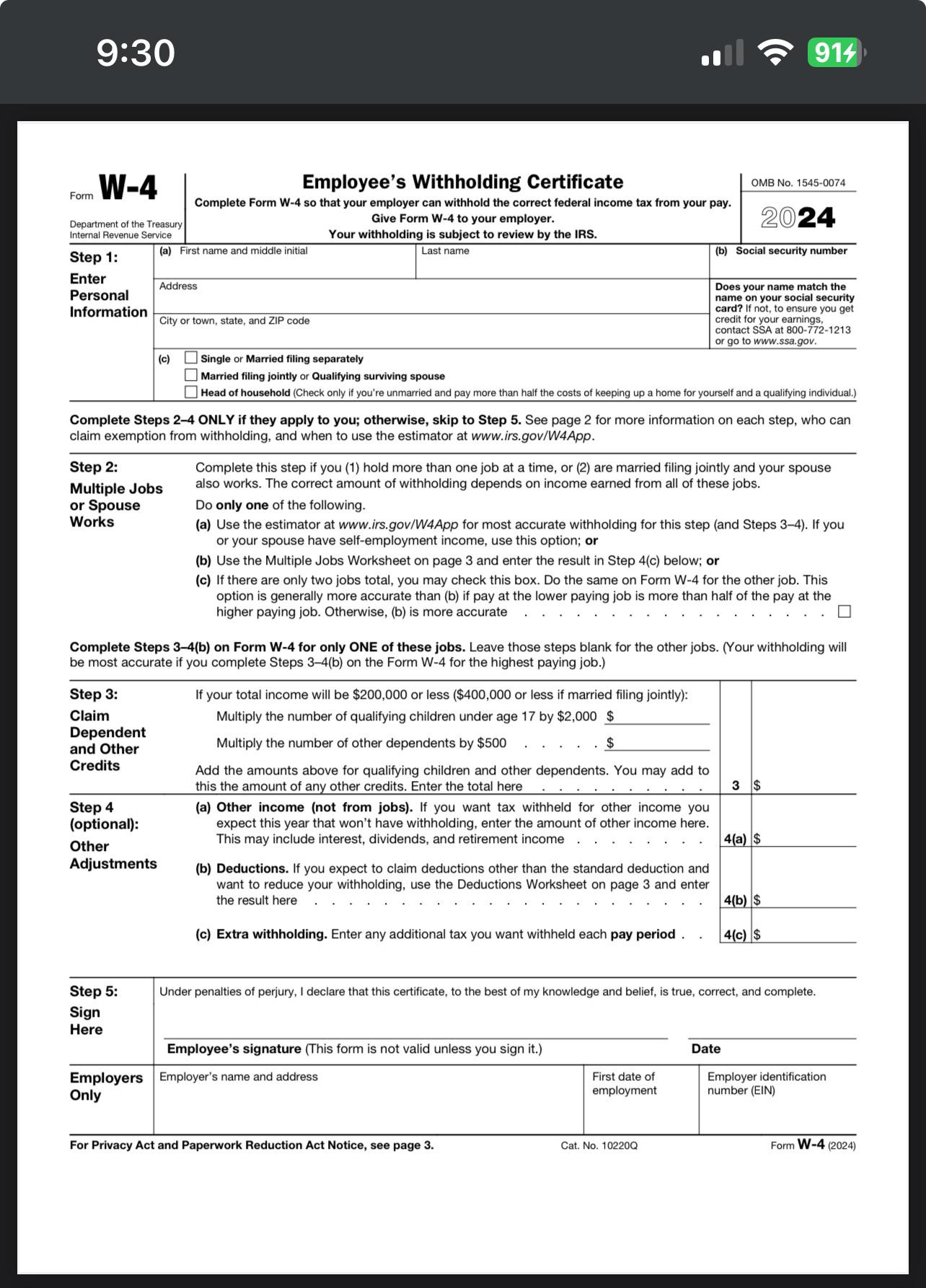

Taking control of your finances starts with understanding your W4 form and how it can impact your tax refund. By making small adjustments to your withholding allowances, you can maximize your refund and keep more money in your pocket throughout the year. Take the time to review your W4 form regularly and make any necessary updates to ensure that you are getting the most out of your tax return.

One tip for maximizing your refund is to adjust your withholding allowances based on your personal and financial situation. If you have experienced any major life changes, such as getting married, having a baby, or buying a home, you may need to update your W4 form to reflect these changes. By keeping your information up to date, you can ensure that you are not overpaying or underpaying your taxes.

Another tip for maximizing your refund is to take advantage of any tax credits or deductions that you may be eligible for. By doing a little bit of research and staying informed about tax laws and regulations, you can identify opportunities to save money on your taxes. Whether it’s claiming education credits, deducting charitable donations, or taking advantage of retirement savings incentives, there are plenty of ways to maximize your refund and keep more money in your pocket.

In conclusion, maximizing your refund with your W4 form doesn’t have to be complicated or stressful. By staying organized, seeking help when needed, and making smart adjustments to your withholding allowances, you can take control of your finances and ensure that you are getting the most out of your tax return. Say goodbye to tax stress and hello to a bigger refund in 2025!

Related Forms…

Help With W4 Form 2025 Images