W4 Form 2025 Illinois – Are you looking to maximize your tax benefits and unlock your full tax potential in Illinois? Look no further than the W4 Form 2025! This powerful tool allows you to take control of your tax withholding and ensure you are getting the most out of your hard-earned money. By understanding the secrets of the W4 Form 2025, you can optimize your tax situation and keep more money in your pocket.

Maximize Your Tax Benefits with W4 Form 2025!

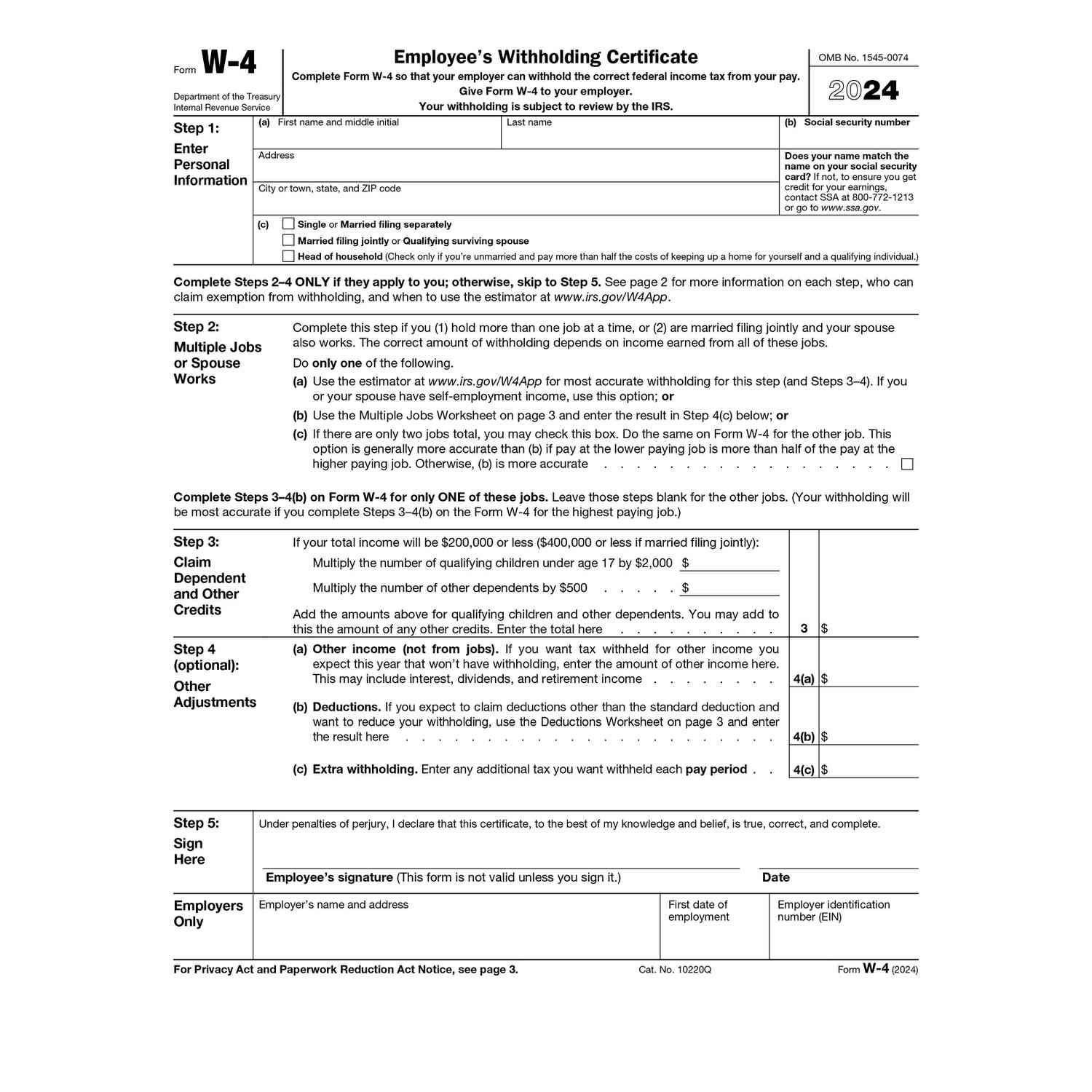

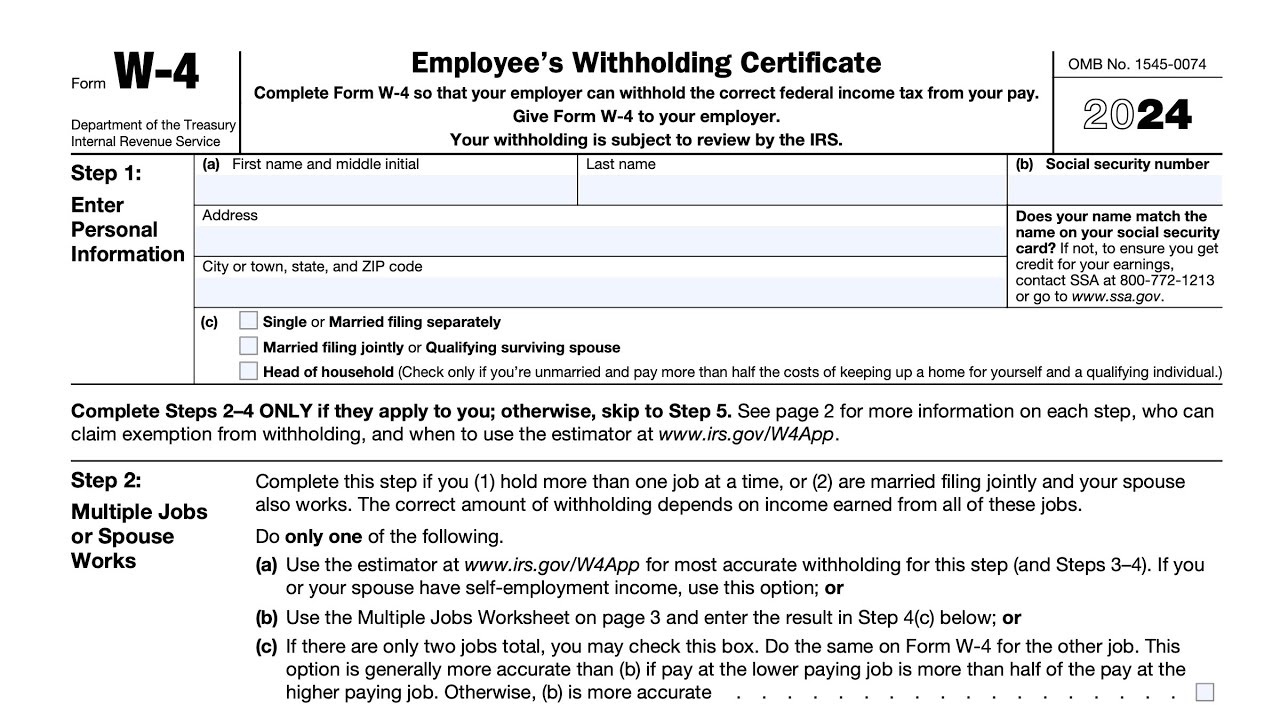

The W4 Form 2025 is not just a simple form to fill out – it is a key to unlocking your tax potential. By carefully filling out this form, you can ensure that you are withholding the right amount of taxes from your paycheck. This means you can avoid overpaying or underpaying taxes throughout the year, leading to a bigger tax refund or more money in your pocket each paycheck. Don’t leave money on the table – take advantage of the W4 Form 2025 to maximize your tax benefits.

When filling out your W4 Form 2025, be sure to take advantage of any tax credits or deductions you may be eligible for. By carefully reviewing your tax situation and adjusting your withholding accordingly, you can ensure that you are getting the most out of your tax benefits. Whether you are a homeowner, parent, or small business owner, there are numerous ways to optimize your tax situation with the help of the W4 Form 2025. Don’t miss out on potential tax savings – unlock your full tax potential today!

Discover the Secrets to Unlocking Your Tax Potential in Illinois

Illinois residents have a unique opportunity to maximize their tax benefits with the W4 Form 2025. By understanding the specific tax laws and regulations in Illinois, you can tailor your withholding to ensure you are taking full advantage of any available tax breaks. From state-specific deductions to credits for education expenses, there are numerous ways to optimize your tax situation in Illinois. Don’t let tax season pass you by without unlocking your full tax potential!

In conclusion, the W4 Form 2025 is a powerful tool that can help you maximize your tax benefits and unlock your full tax potential in Illinois. By carefully filling out this form and taking advantage of all available tax credits and deductions, you can ensure that you are getting the most out of your tax situation. Don’t wait until tax season to start thinking about your taxes – take control of your financial future today with the W4 Form 2025!

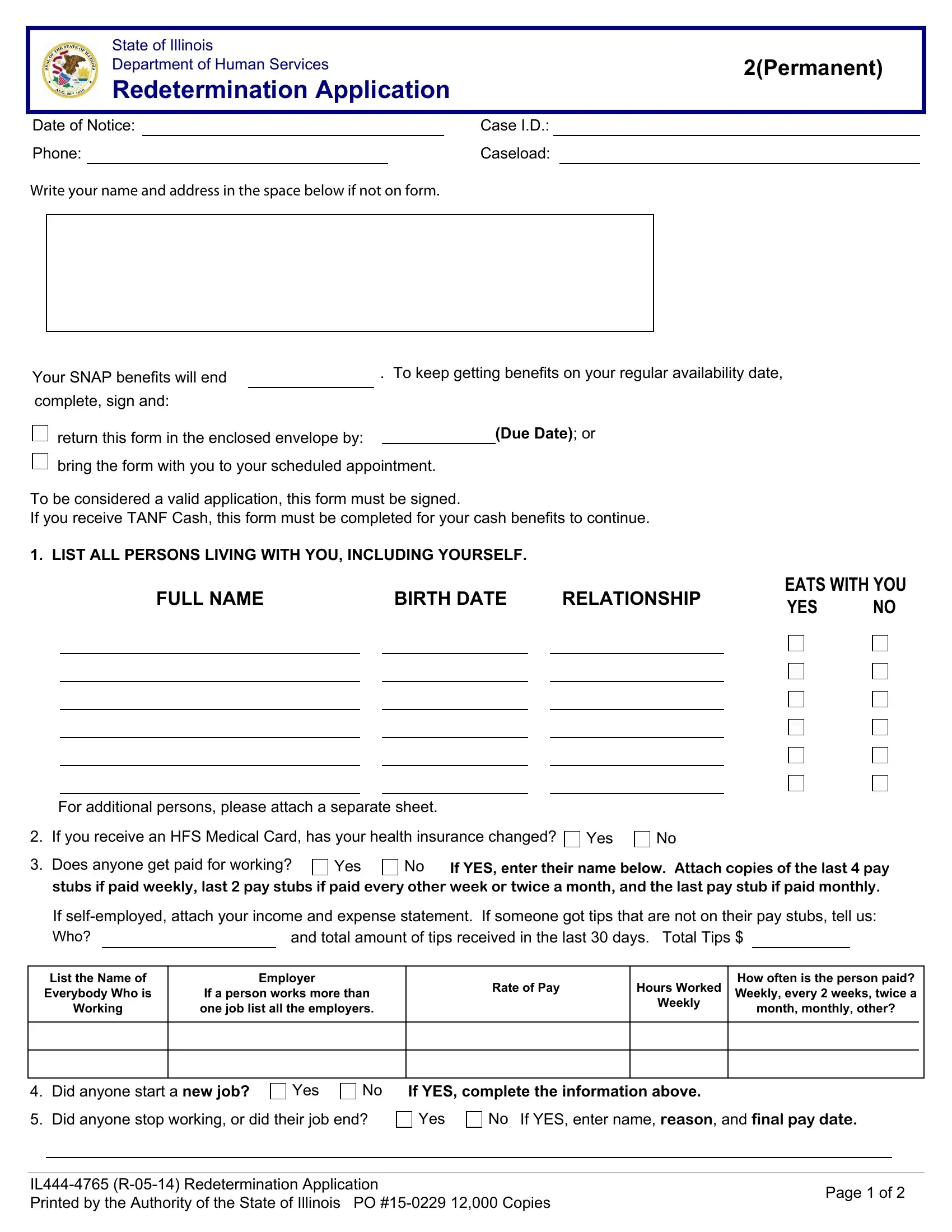

Related Forms…

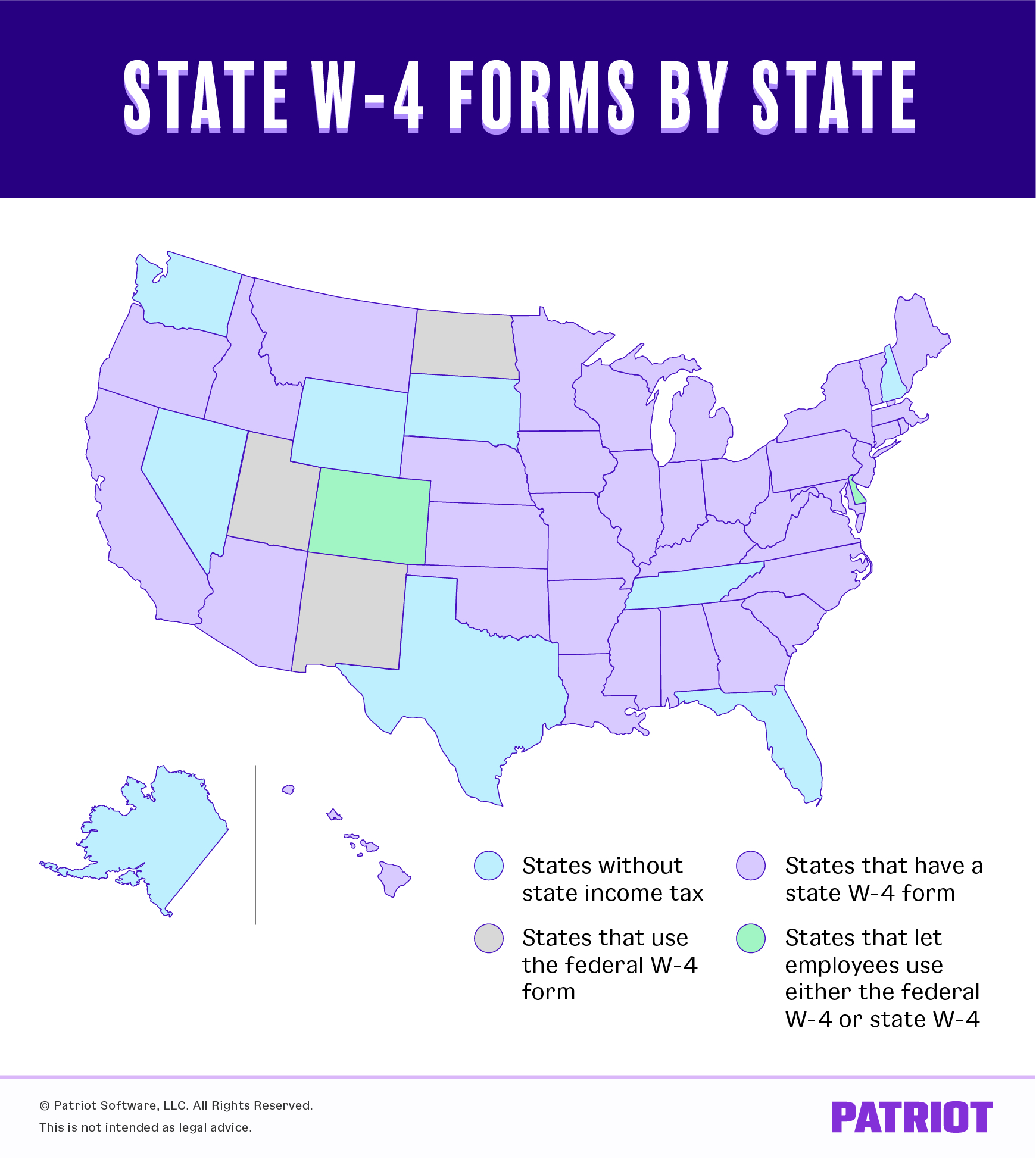

W4 Form 2025 Illinois Images