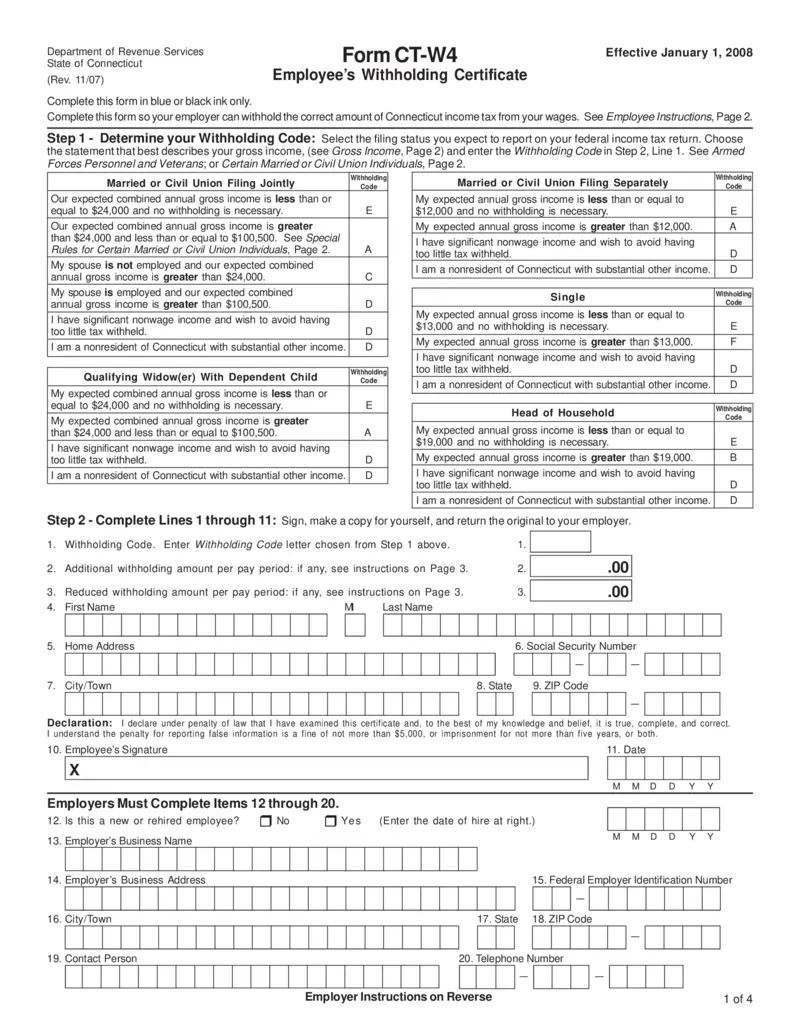

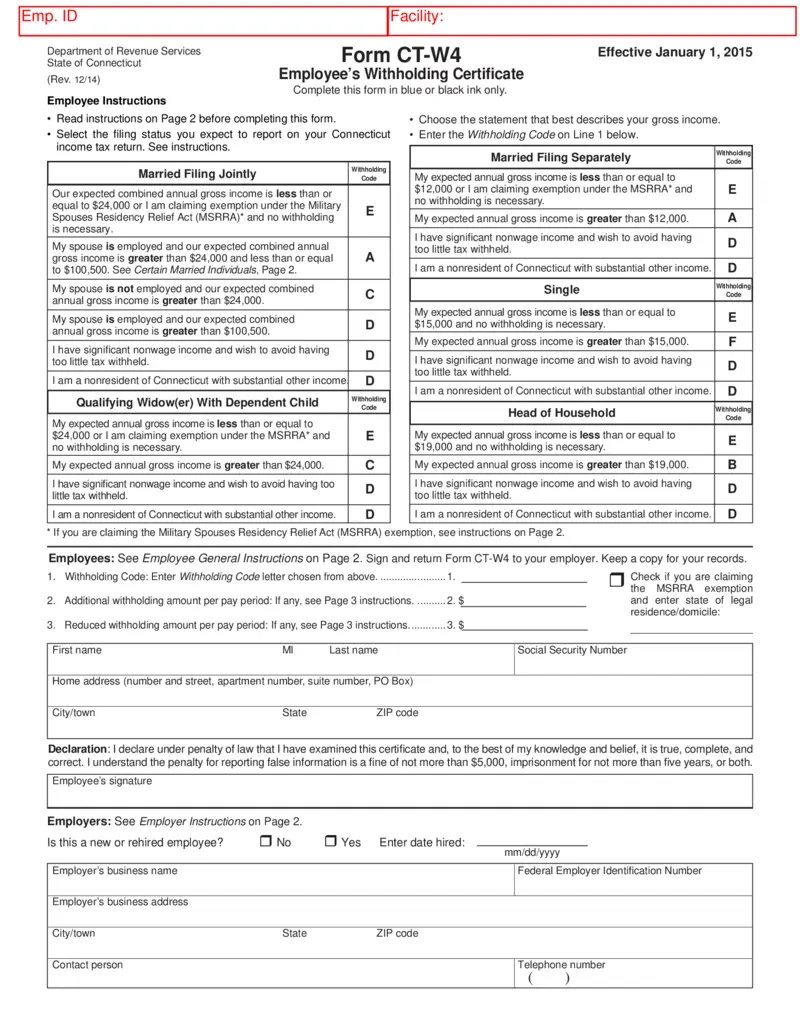

CT W4 Form 2025 – Are you feeling overwhelmed by the thought of filling out your CT W4 Form 2025? Don’t worry, we’re here to help unravel the mystery and guide you through the process with ease! Understanding this form is essential for ensuring accurate tax withholding and avoiding any surprises come tax season.

Unraveling the Mystery of CT W4 Form 2025

The CT W4 Form 2025 may seem daunting at first glance, but it’s actually quite straightforward once you break it down. This form allows you to specify how much federal income tax should be withheld from your paycheck based on your filing status, number of dependents, and other factors. By providing accurate information on this form, you can ensure that you’re not overpaying or underpaying your taxes throughout the year.

Navigating the CT W4 Form 2025 is a key step in taking control of your tax situation. By understanding the different sections and how they impact your withholding, you can make informed decisions that will ultimately lead to tax success. Whether you’re single, married, have children, or are claiming deductions, this form is your ticket to ensuring that your tax obligations are met in a way that works best for you.

Navigate Your Way to Tax Success with CT W4 Form 2025

As you fill out your CT W4 Form 2025, remember that you have the power to make adjustments as needed. If your financial situation changes, such as getting married or having a child, be sure to update your form accordingly to reflect these life changes. By staying proactive and keeping your withholding information up to date, you can avoid any surprises when tax season rolls around.

In conclusion, demystifying the CT W4 Form 2025 is a crucial step in achieving tax success. By understanding how this form works and taking the time to accurately fill it out, you can ensure that your tax withholding aligns with your financial situation. So don’t be intimidated by the form – embrace it as your tool for navigating the world of taxes with confidence and ease!

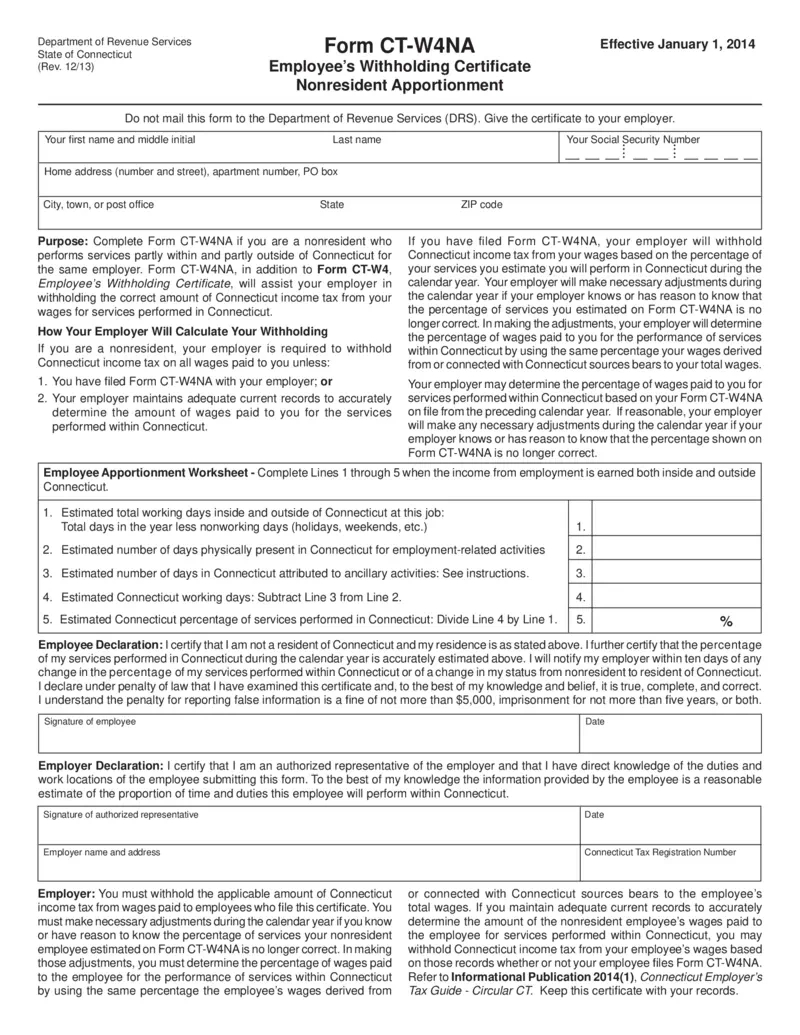

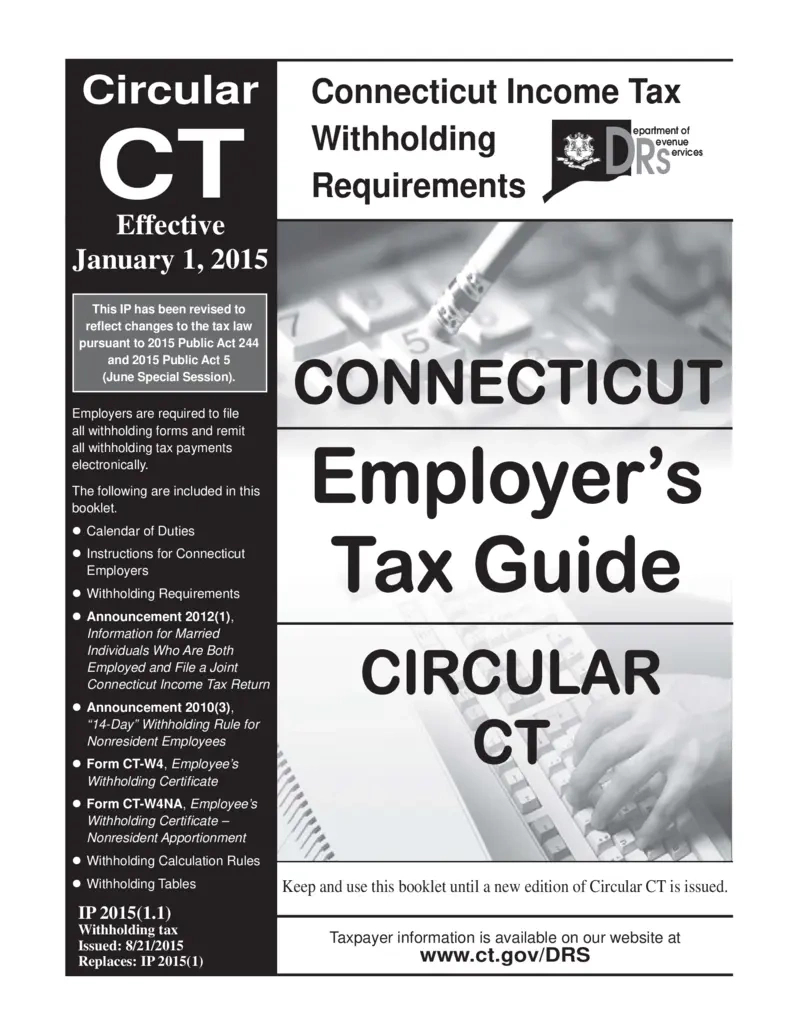

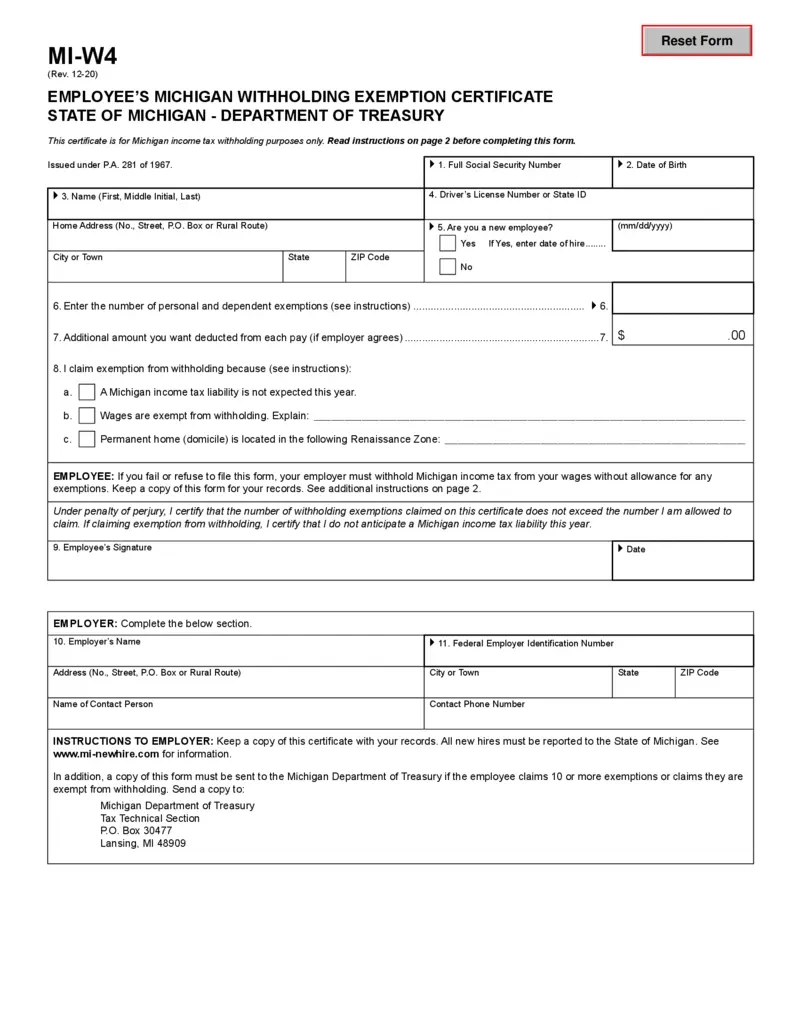

Related Forms…

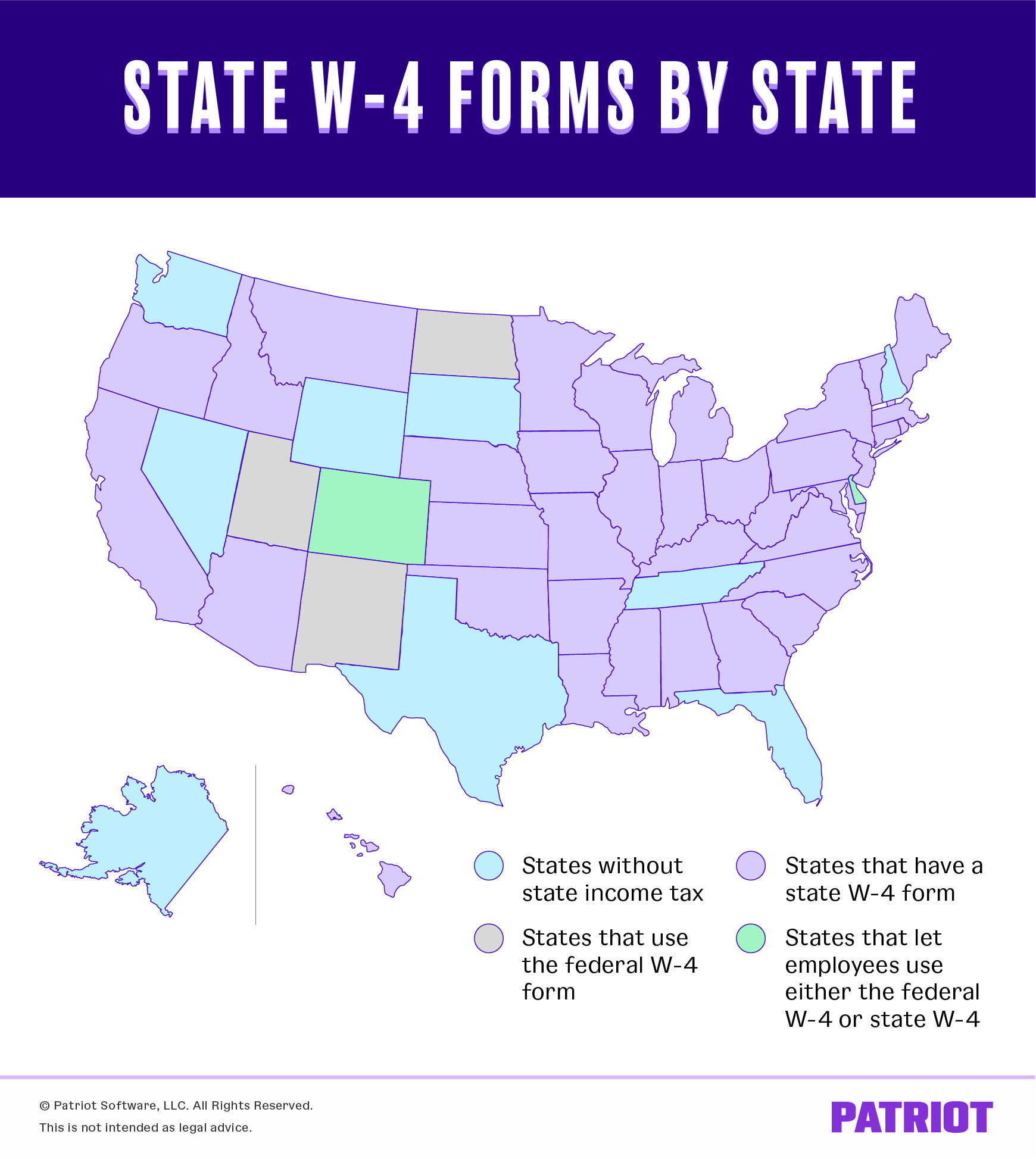

CT W4 Form 2025 Images