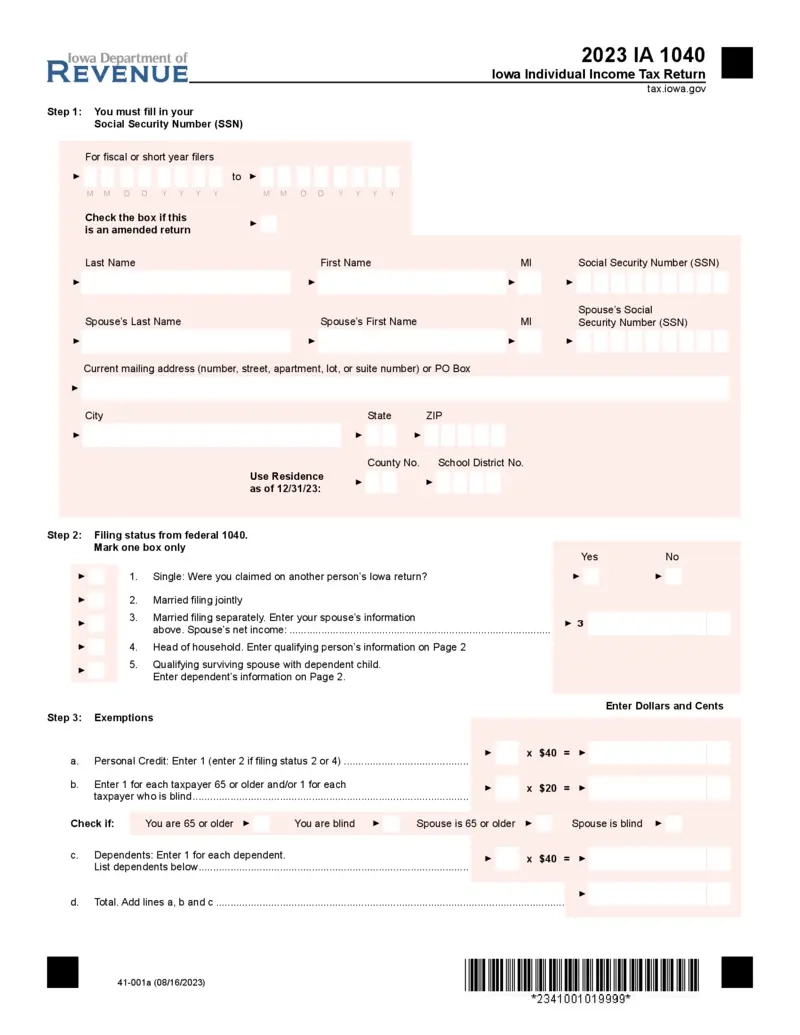

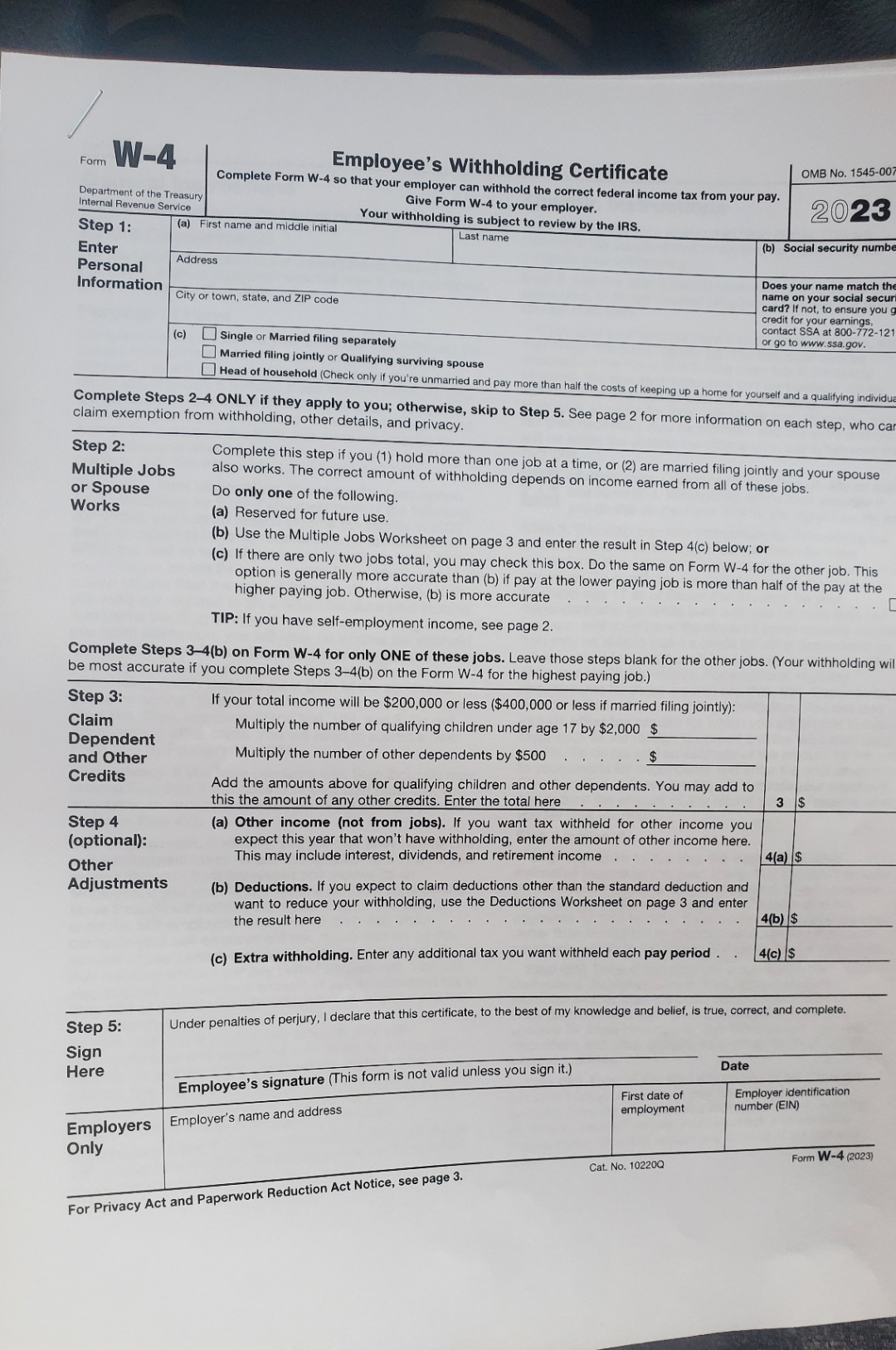

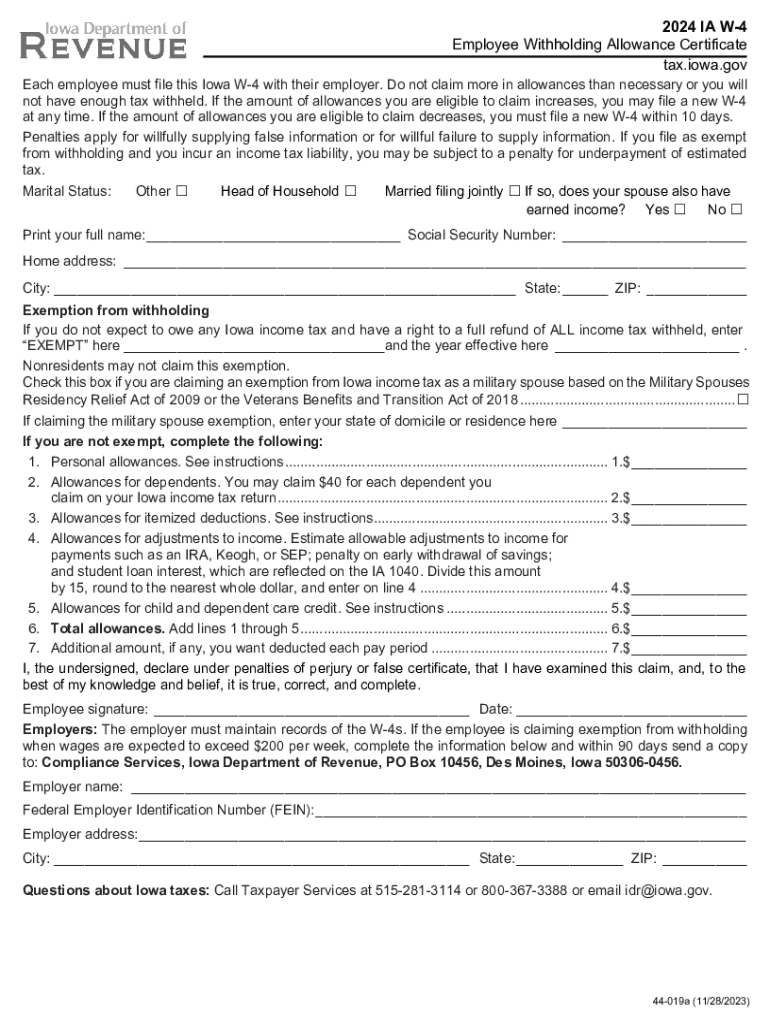

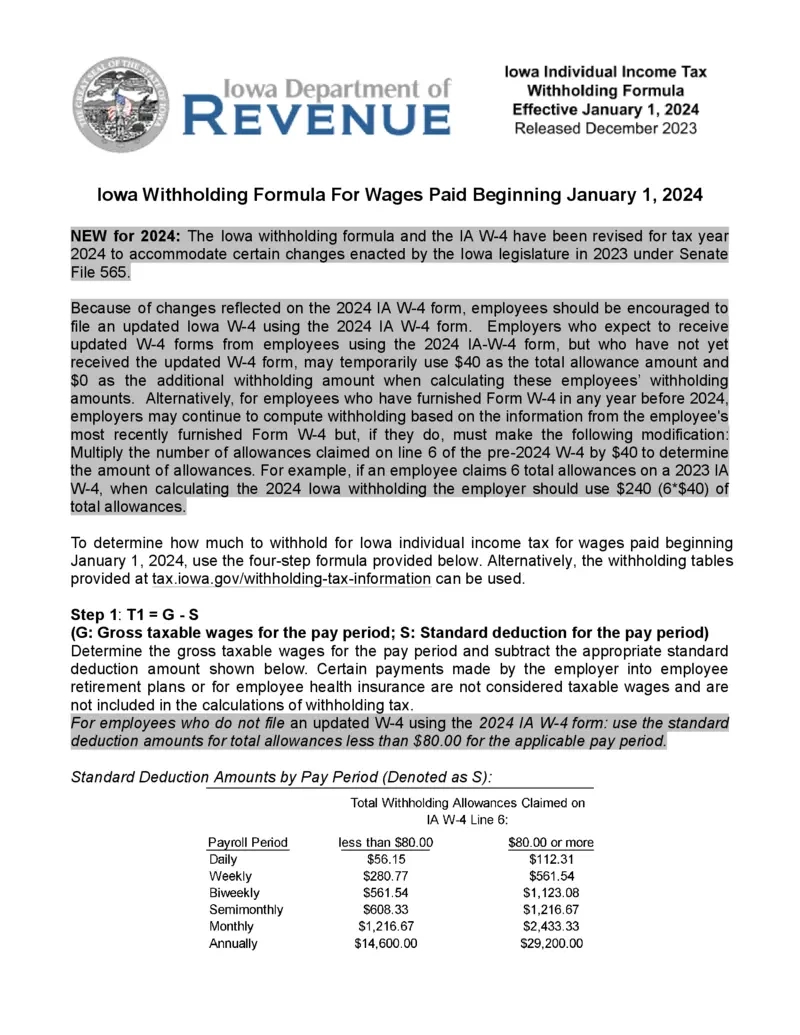

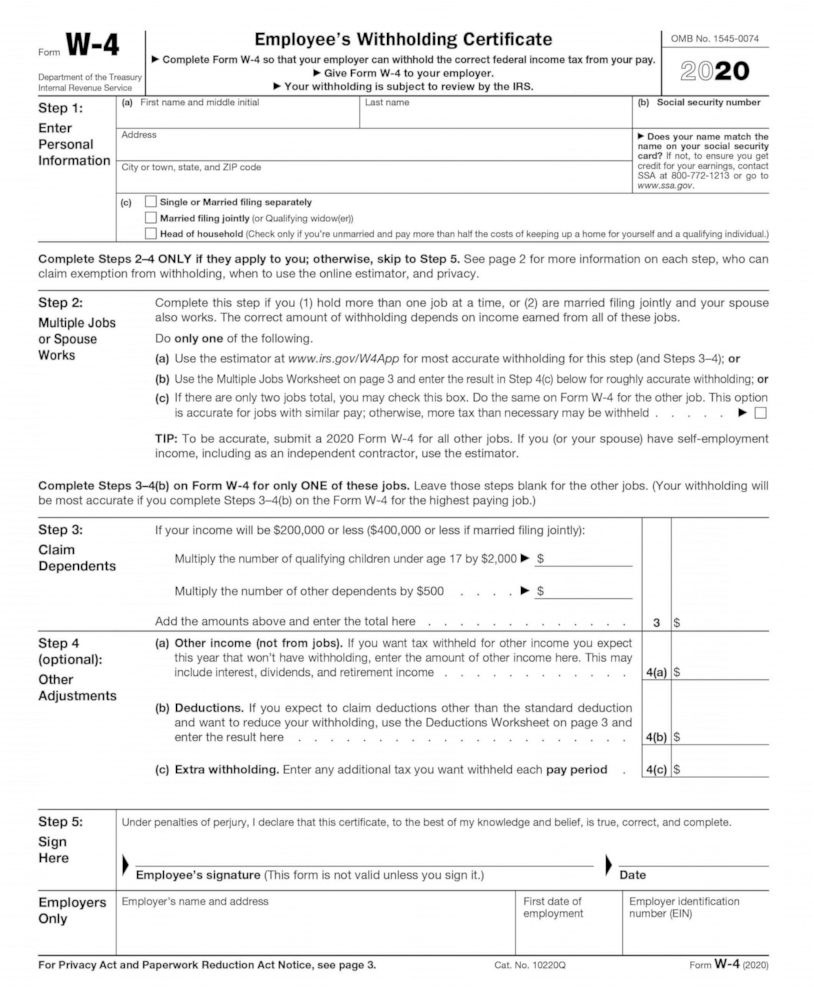

IOWA Form W4 2025 – Are you ready to take charge of your taxes and make the most of your hard-earned income? The new Iowa Form W4 2025 is here to help you do just that! This updated form is designed to simplify the process of withholding taxes from your paycheck, making it easier than ever to navigate through tax season. By diving into the new Iowa Form W4 2025, you can take control of your finances and ensure that you are not paying more than necessary in taxes.

One of the key features of the new Iowa Form W4 2025 is its user-friendly layout and clear instructions. Whether you are a seasoned tax filer or new to the process, this form is designed to guide you through each section step by step. From determining your filing status to claiming dependents and additional income, the Iowa Form W4 2025 makes it easy to provide accurate information to your employer for proper tax withholding. Say goodbye to confusion and hello to clarity with this updated form!

In addition to its ease of use, the new Iowa Form W4 2025 also offers updated tax tables and calculations to ensure accuracy in withholding. By completing this form accurately, you can avoid over or underpaying your taxes throughout the year, ultimately saving you time and money. With the help of this new form, you can master your taxes and take the stress out of tax season. So don’t wait any longer – dive into the Iowa Form W4 2025 and get started on the path to financial success!

Simplify Your Tax Season with Expert Tips and Tricks

Tax season can be a daunting time for many individuals, but with the new Iowa Form W4 2025, you can simplify the process and make it a breeze. One expert tip to keep in mind when filling out this form is to carefully review your financial situation and make sure all information is accurate. By double-checking your figures and consulting with a tax professional if needed, you can ensure that you are maximizing your tax benefits and minimizing your liabilities.

Another helpful trick to master your taxes with the Iowa Form W4 2025 is to consider any life changes that may impact your tax situation. Whether you have recently gotten married, had a child, or changed jobs, these events can have a significant impact on your tax withholding. By updating your information on the Iowa Form W4 2025, you can adjust your withholding accordingly and avoid any surprises come tax time. Remember, staying informed and proactive is key to mastering your taxes!

In conclusion, the new Iowa Form W4 2025 is a valuable tool that can help you take control of your taxes and streamline the process of tax season. By diving into this form and following expert tips and tricks, you can simplify the process, ensure accuracy in withholding, and ultimately save time and money. So don’t let tax season overwhelm you – embrace the new Iowa Form W4 2025 and make the most of your financial future!

Related Forms…

IOWA Form W4 2025 Images