State W4 Form 2025 – Are you ready to rock and roll with your State W4 Form 2025? This essential document is your key to ensuring that the right amount of taxes are withheld from your paycheck. But don’t worry, we’re here to guide you through the process with ease and a little bit of flair. So put on your dancing shoes and let’s waltz through the world of tax withholdings together!

Let’s Dance Through Your State W4 Form 2025!

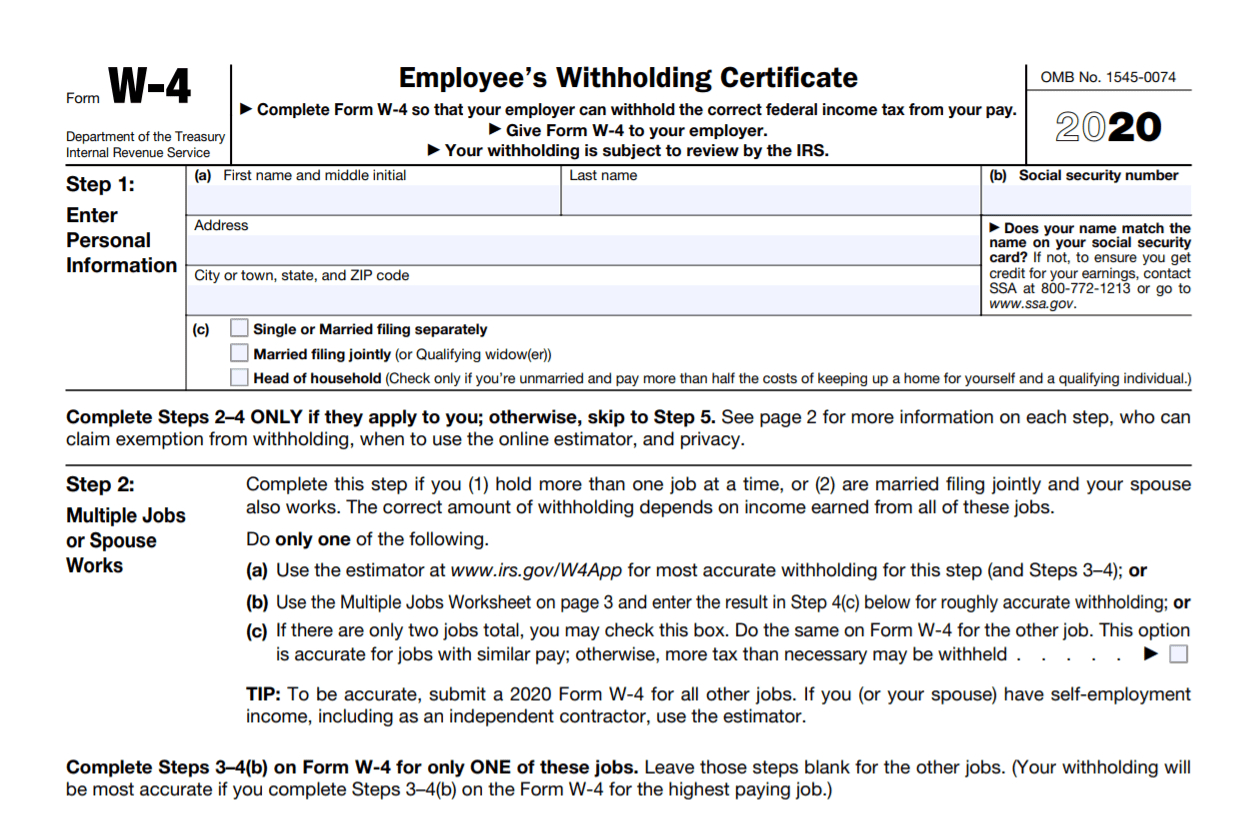

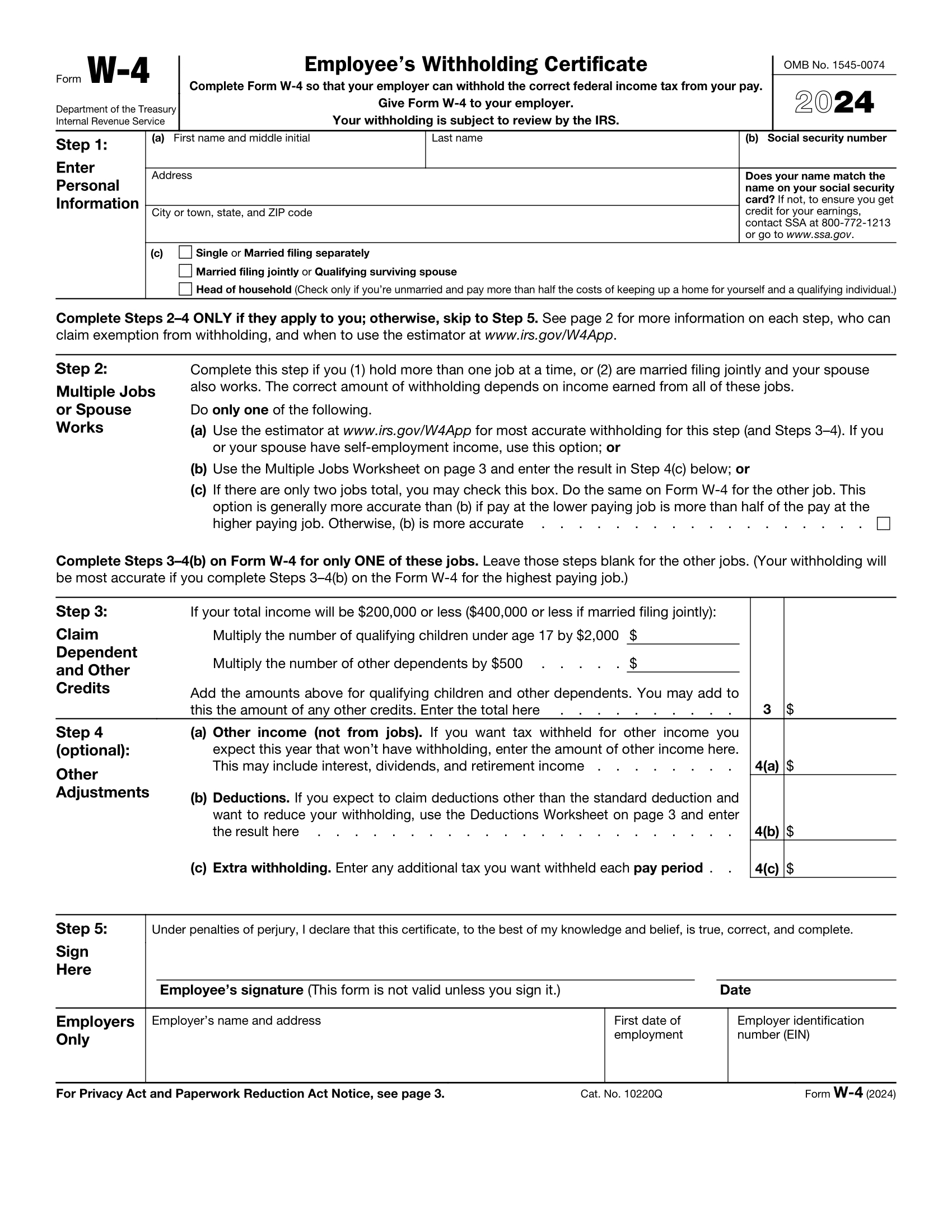

Ah, the State W4 Form 2025 – a document that may seem daunting at first glance, but fear not, it’s actually quite simple once you break it down. The first step is to fill out your personal information, including your name, address, and social security number. Next, you’ll need to indicate your filing status, which can affect how much tax is withheld from your paycheck. Are you single, married, or head of household? Choose the option that best fits your situation.

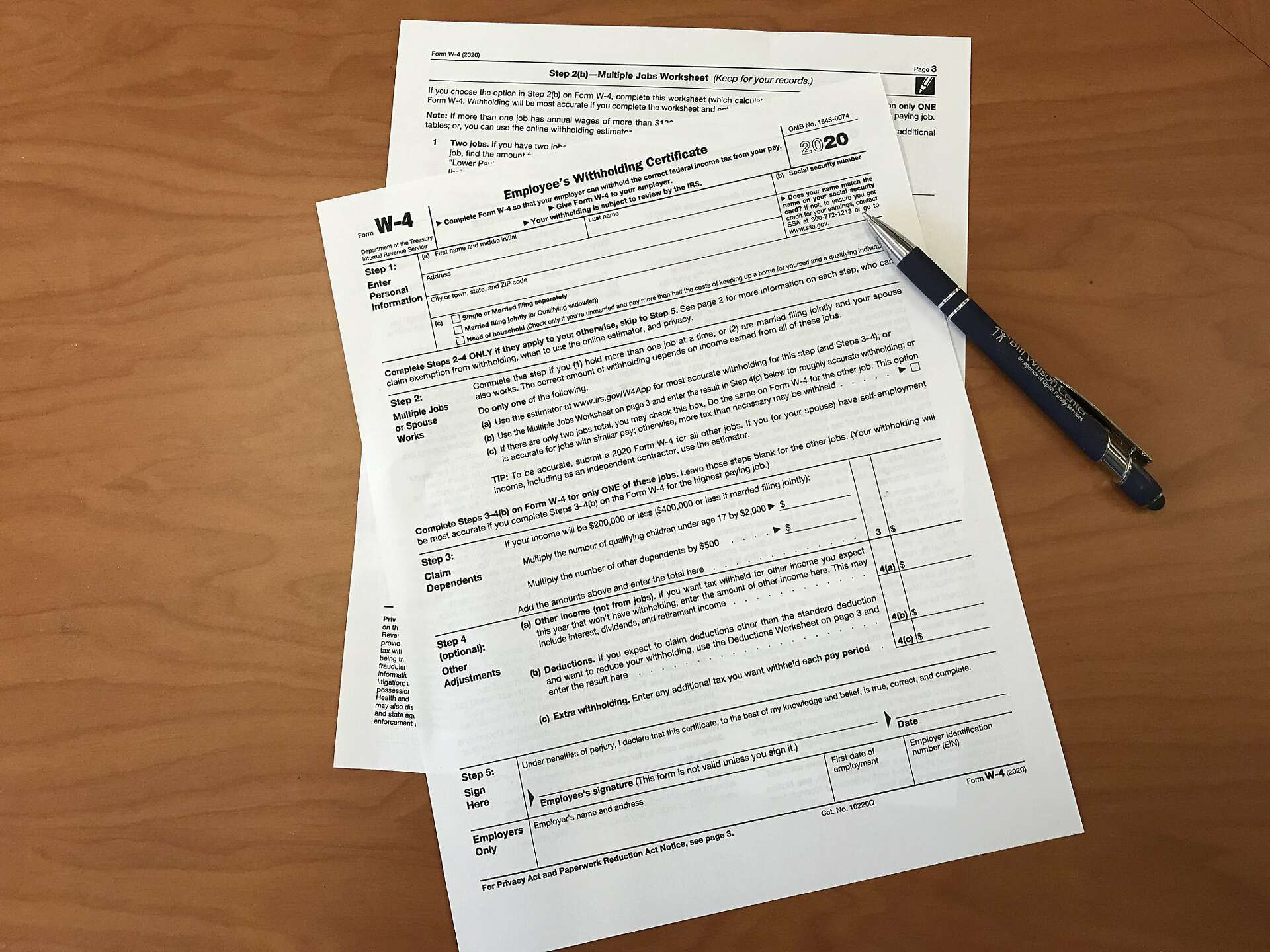

Once you’ve tackled the basics, it’s time to dive into the heart of the State W4 Form 2025 – the withholding allowances. This section allows you to specify how much tax you want withheld from each paycheck. The more allowances you claim, the less tax will be taken out of your pay. But be careful – if you claim too many allowances, you may end up owing taxes when you file your return. It’s a delicate balance, but with a little bit of practice, you’ll be waltzing through this section in no time!

As you reach the final steps of the State W4 Form 2025, don’t forget to sign and date the document before submitting it to your employer. And just like that, you’re all set to w4-k and roll into the next tax year with confidence and ease. So put on your favorite song, grab your pen, and let’s tackle that State W4 Form 2025 like the rockstar taxpayer you are!

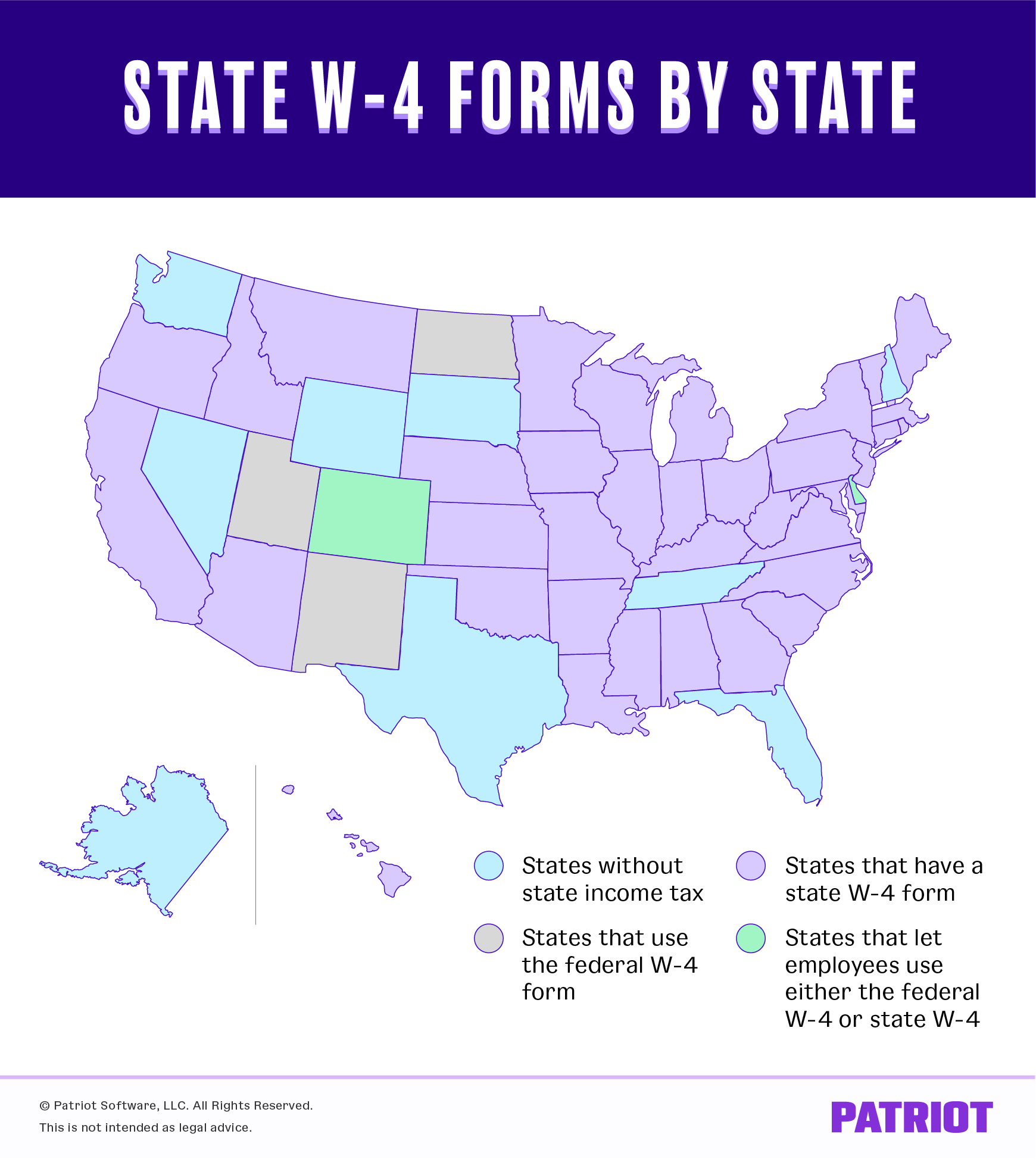

Related Forms…

State W4 Form 2025 Images