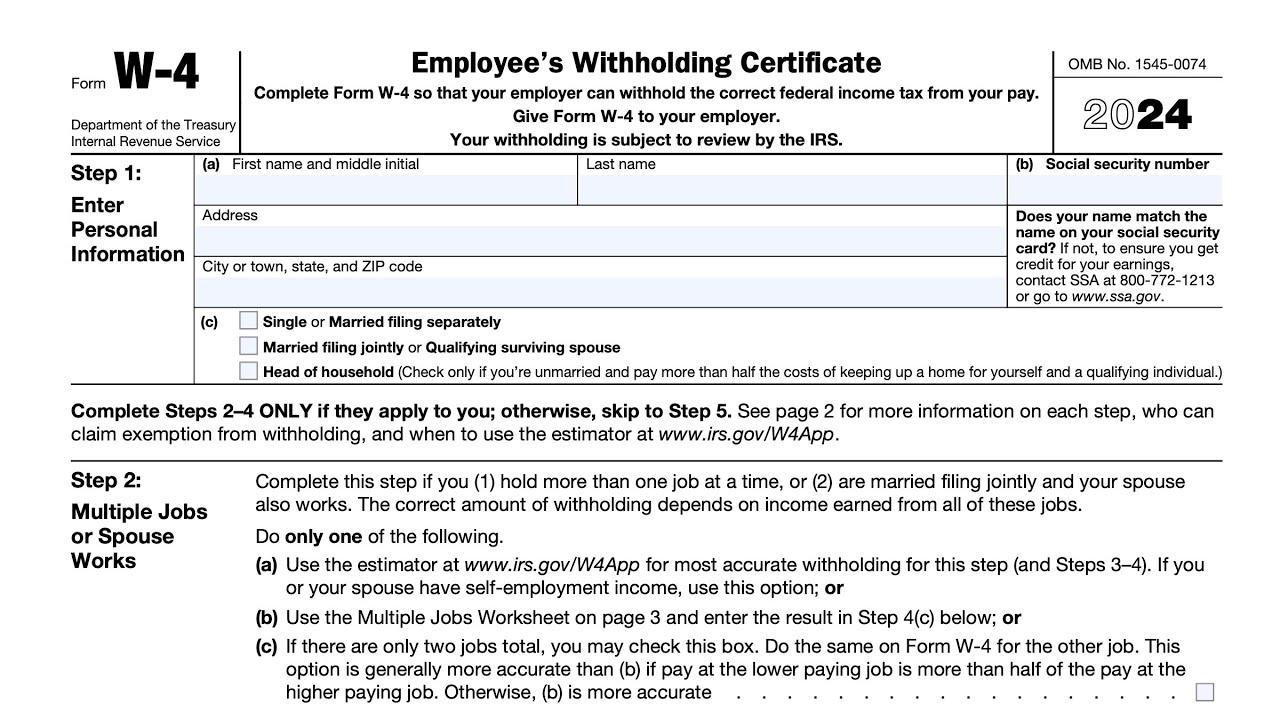

W4 Form 2025 Michigan – Are you ready to take control of your tax savings and maximize your refund come tax season? Look no further than your 2025 Michigan W4 form! This simple yet powerful document holds the key to reducing your tax liability and putting more money back in your pocket. By understanding how to properly fill out your W4 form, you can ensure that you are not overpaying in taxes and are taking advantage of all available credits and deductions.

When you unlock your tax-saving potential, you are opening the door to financial freedom and peace of mind. By carefully reviewing and updating your 2025 Michigan W4 form, you can make sure that you are withholding the right amount of taxes from each paycheck, minimizing any surprises come tax time. Whether you are a single filer, have dependents, or own a home, there are specific strategies you can implement to lower your tax bill and increase your refund. Don’t leave money on the table – take control of your finances today!

Master Your 2025 Michigan W4 Form!

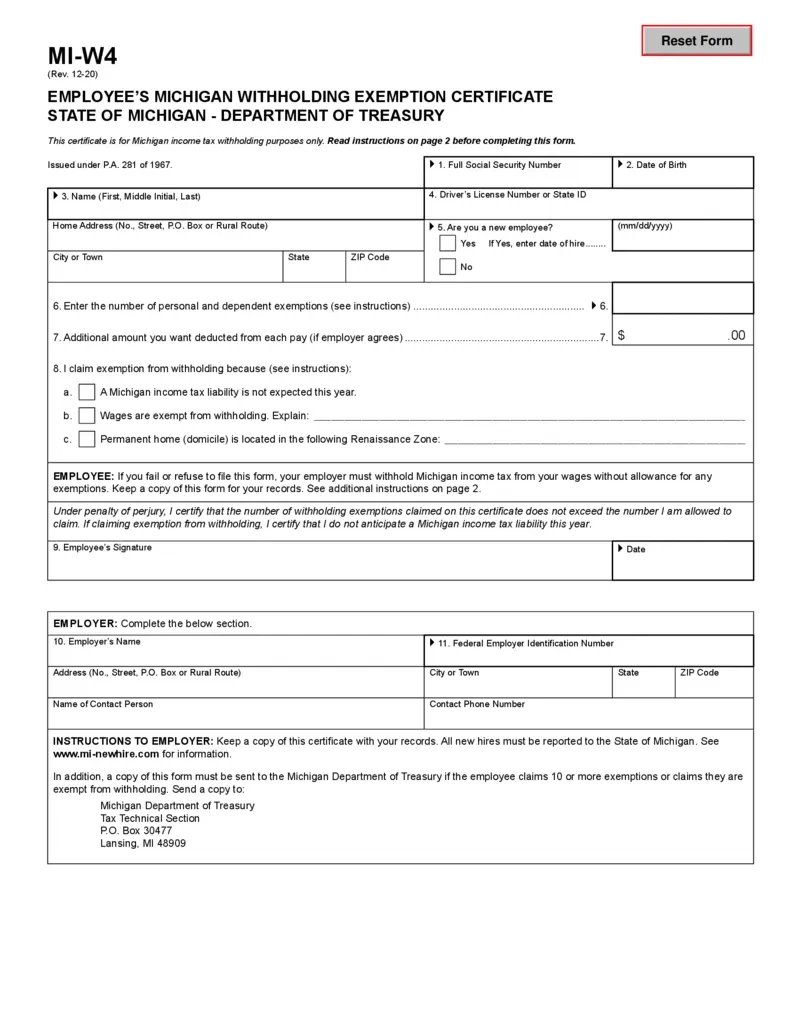

Mastering your 2025 Michigan W4 form is easier than you think! Start by reviewing your current withholding status and making any necessary adjustments based on your personal situation. Are you married? Have you recently had a child? Did you buy a home? These life changes can impact your tax liability and should be reflected on your W4 form. By accurately filling out your form, you can ensure that you are taking advantage of all available tax breaks and credits.

Don’t be intimidated by the thought of tackling your W4 form – with a little guidance and attention to detail, you can become a pro at navigating the tax landscape. Consider seeking out resources such as online tax calculators or consulting with a tax professional to ensure that you are making the most of your tax-saving opportunities. Remember, the more you know about your tax situation, the better equipped you will be to make informed decisions and keep more money in your pocket.

In conclusion, your 2025 Michigan W4 form is a valuable tool that can help you unlock significant tax savings and put more money back in your pocket. By understanding how to properly fill out and update your W4 form, you can take control of your finances and ensure that you are not overpaying in taxes. Don’t let tax season sneak up on you – start mastering your W4 form today and reap the rewards of lower tax liability and increased refunds. Your financial future is in your hands – seize the opportunity to unlock your tax-saving potential now!

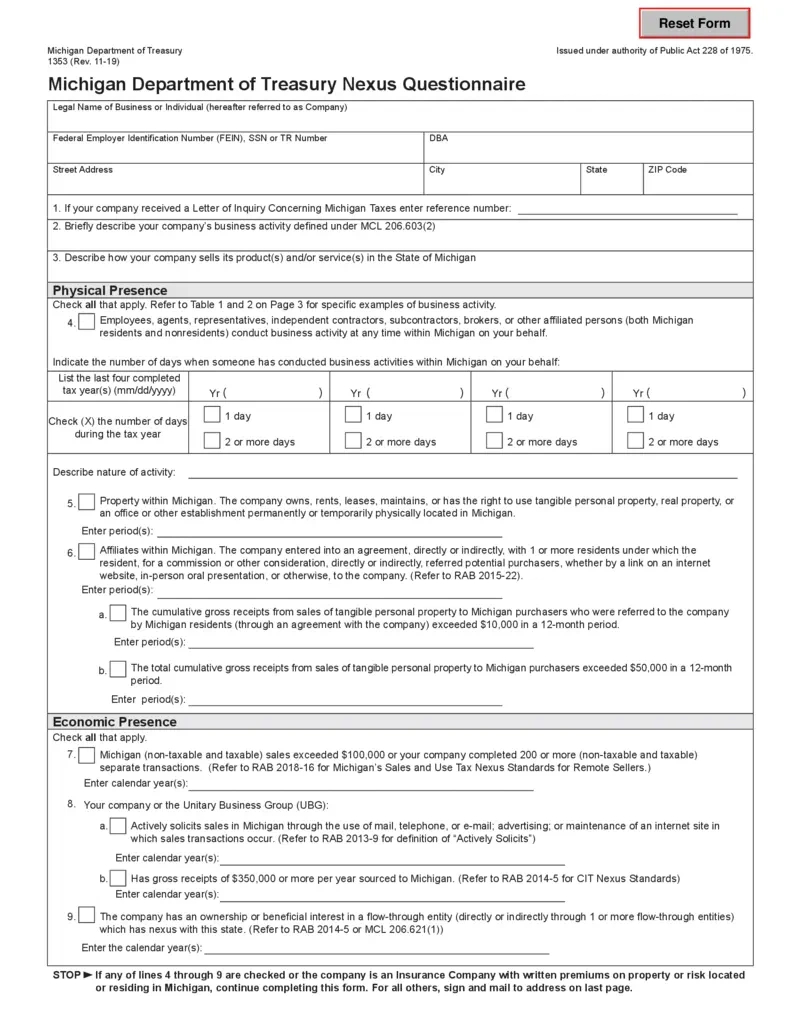

Related Forms…

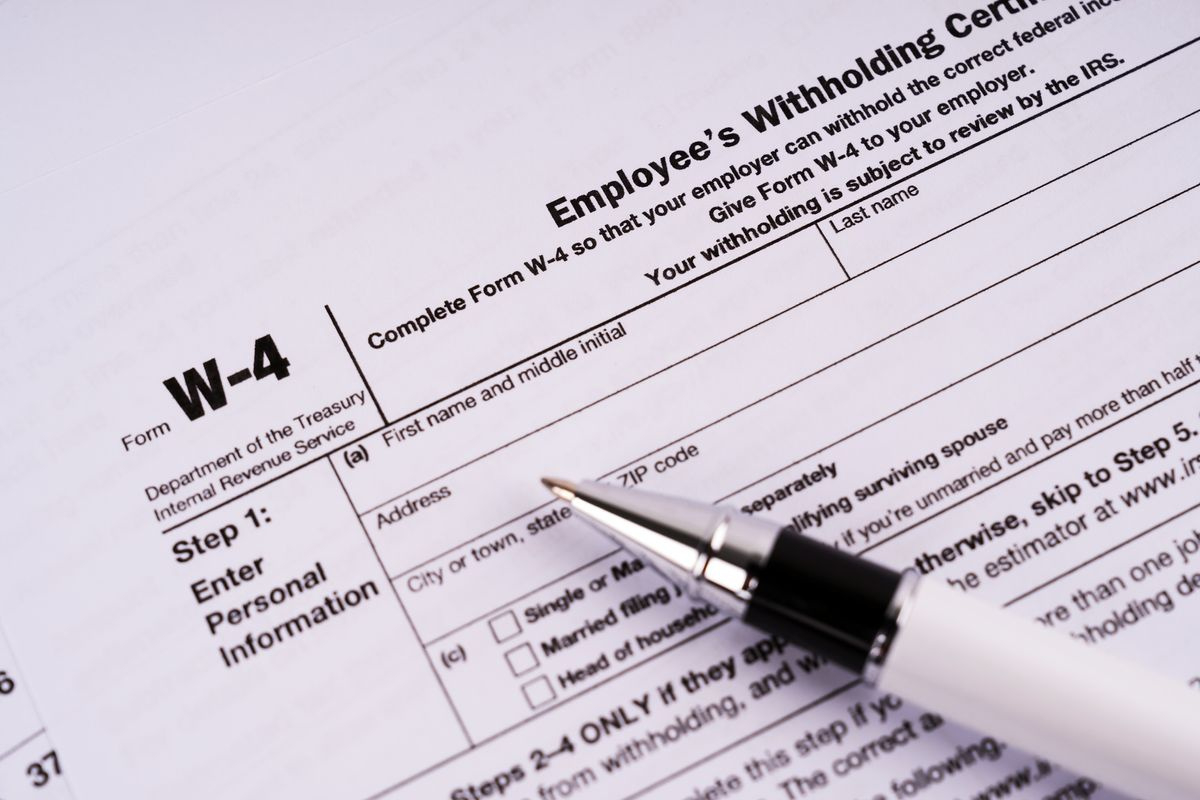

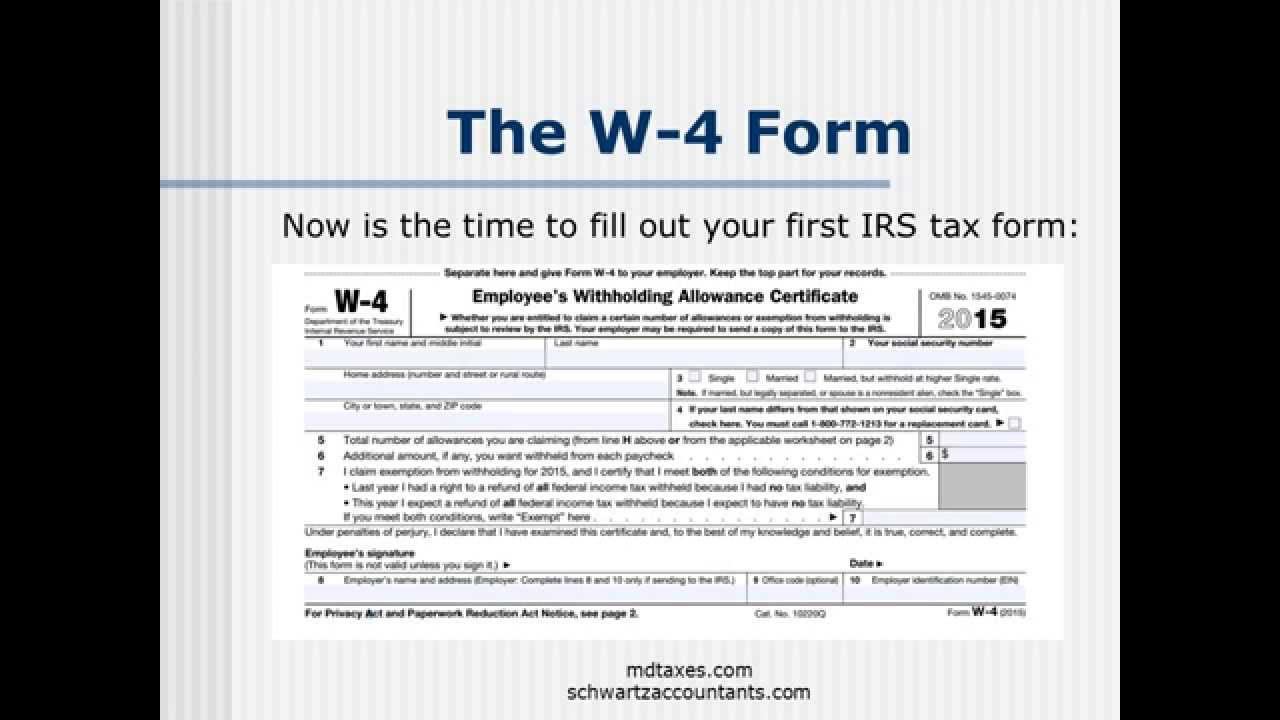

W4 Form 2025 Michigan Images