W4 Form Instructions 2025 – Are you ready to take control of your taxes and maximize your financial success in 2025? Look no further than the W4 form – your key to unlocking a world of tax benefits and savings! By mastering the W4, you can ensure that you’re not only meeting your tax obligations but also taking full advantage of all the deductions and credits available to you. Say goodbye to tax season stress and hello to a brighter financial future!

2025 Tax Success: Mastering the W4 Form with Ease!

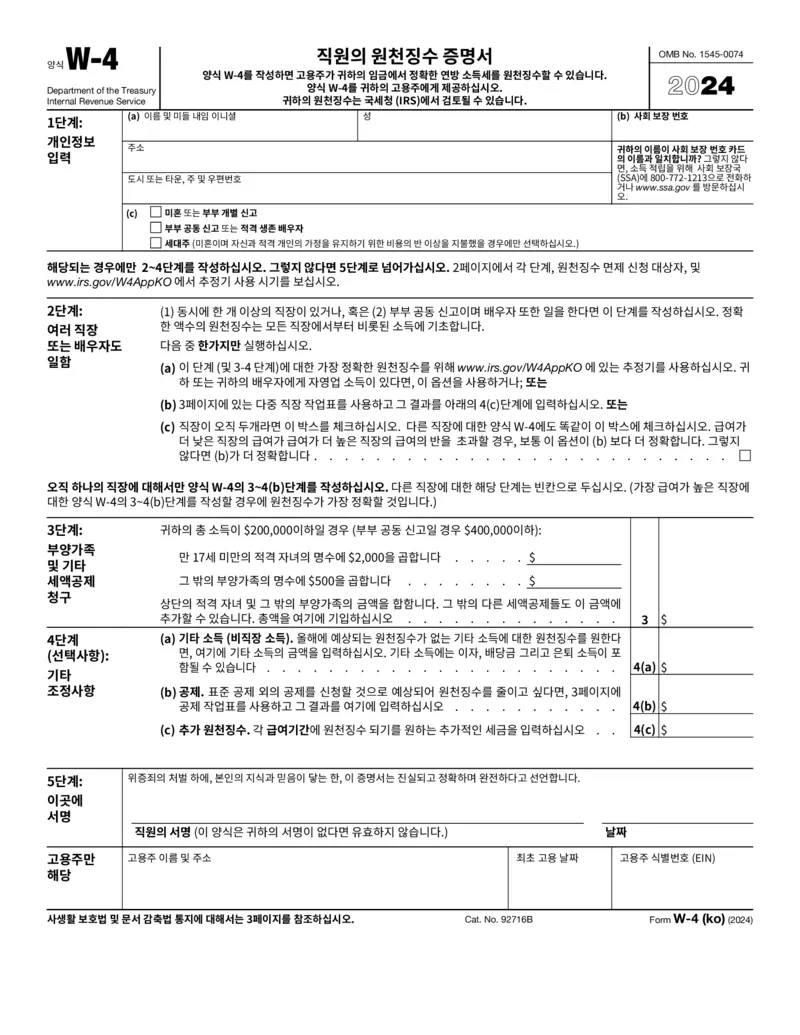

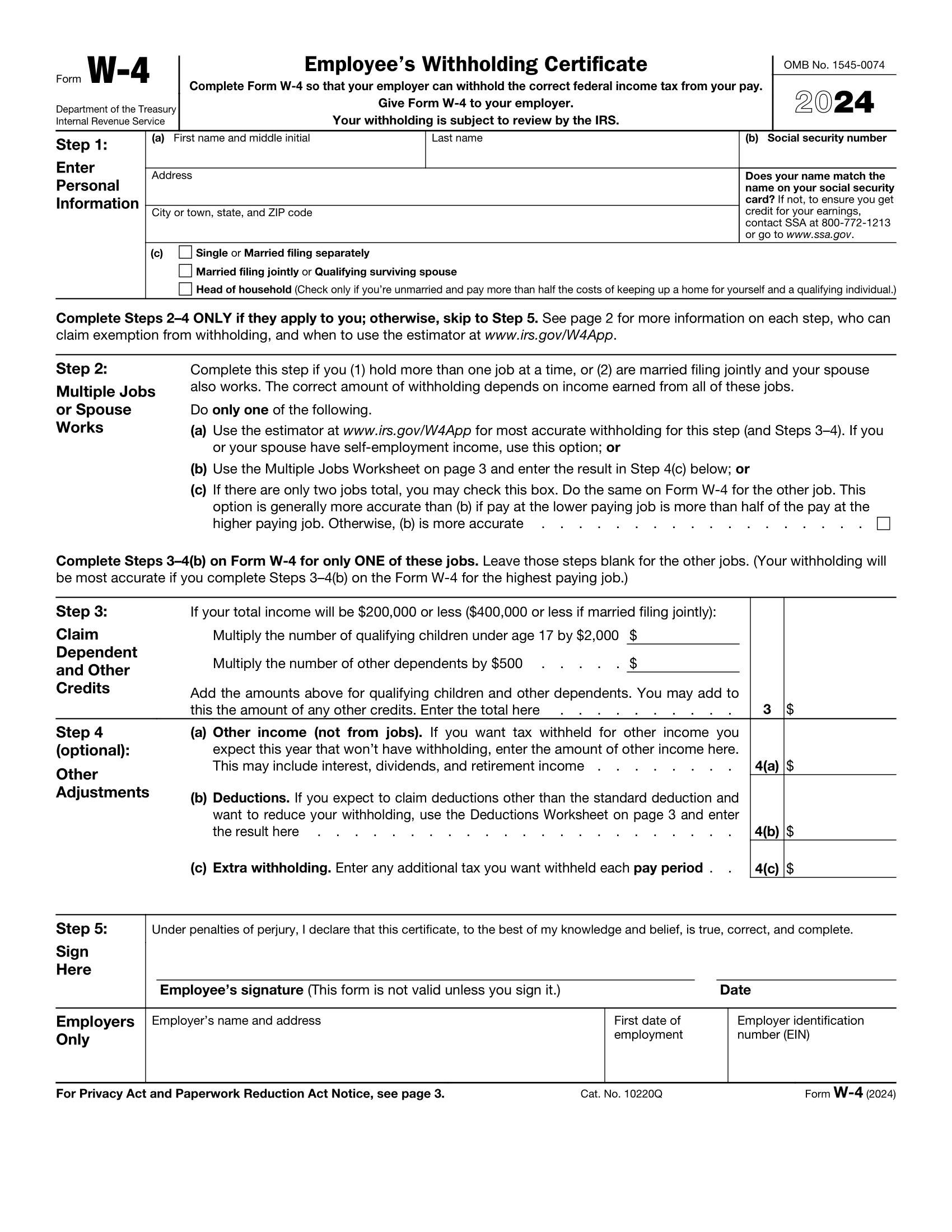

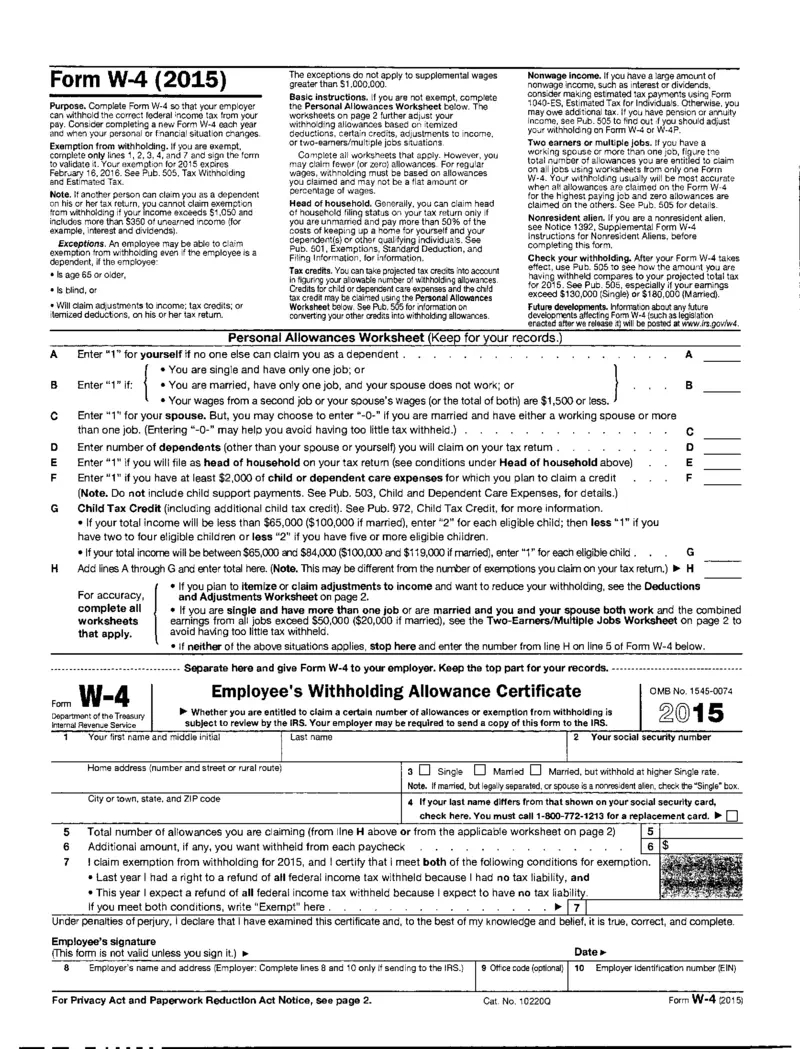

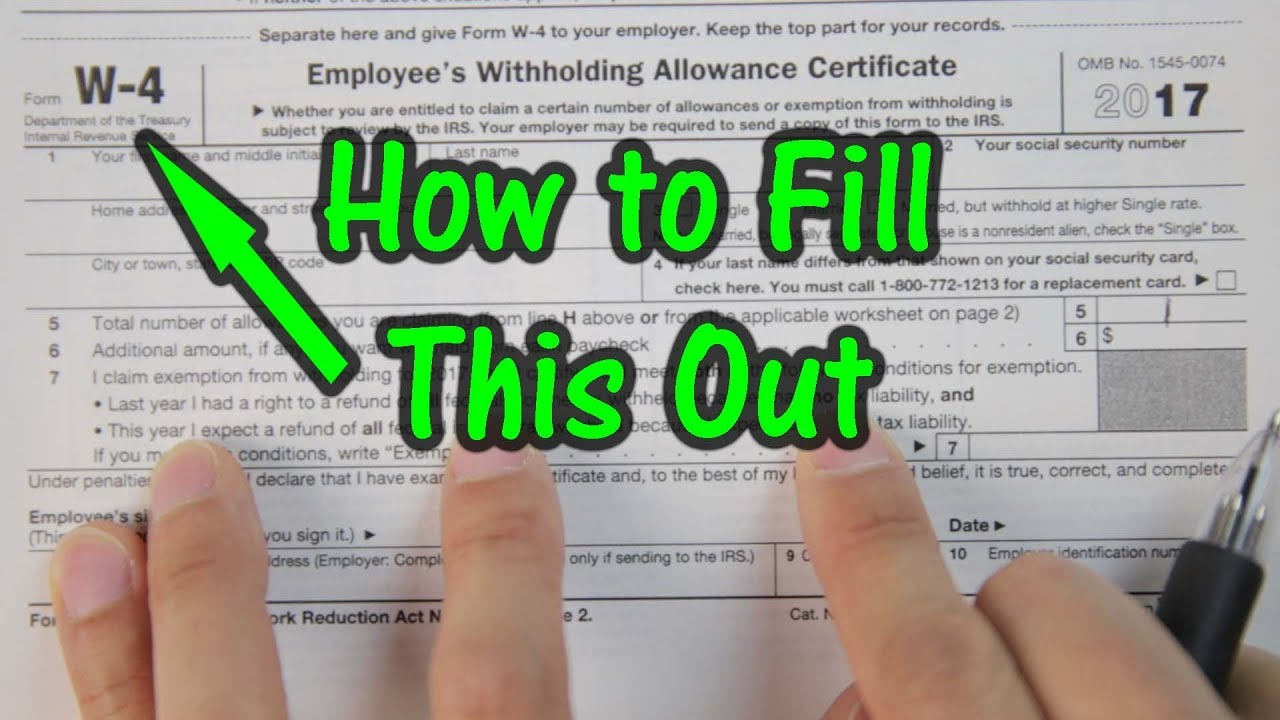

The W4 form may seem intimidating at first glance, but with the right guidance, you’ll be a tax pro in no time! Start by carefully reviewing each section of the form and providing accurate information about your filing status, dependents, and income. Don’t forget to take advantage of any deductions or credits you may be eligible for, such as the child tax credit or education expenses. By filling out your W4 accurately and thoroughly, you can ensure that you’re not overpaying or underpaying your taxes.

Once you’ve completed your W4, don’t just set it and forget it! It’s important to revisit your form periodically, especially if there are any significant changes in your financial situation, such as getting married, having a child, or changing jobs. By staying proactive and updating your W4 as needed, you can avoid any surprises come tax time and make sure you’re getting the most out of your tax return. With a little time and effort, you can master the W4 and set yourself up for tax success in 2025 and beyond!

In conclusion, mastering the W4 form is the key to unlocking your full tax potential and ensuring a successful financial future. By taking the time to understand the form, provide accurate information, and stay proactive in updating it as needed, you can maximize your tax benefits and savings. Say goodbye to tax season stress and hello to a brighter financial future by mastering the W4 in 2025!

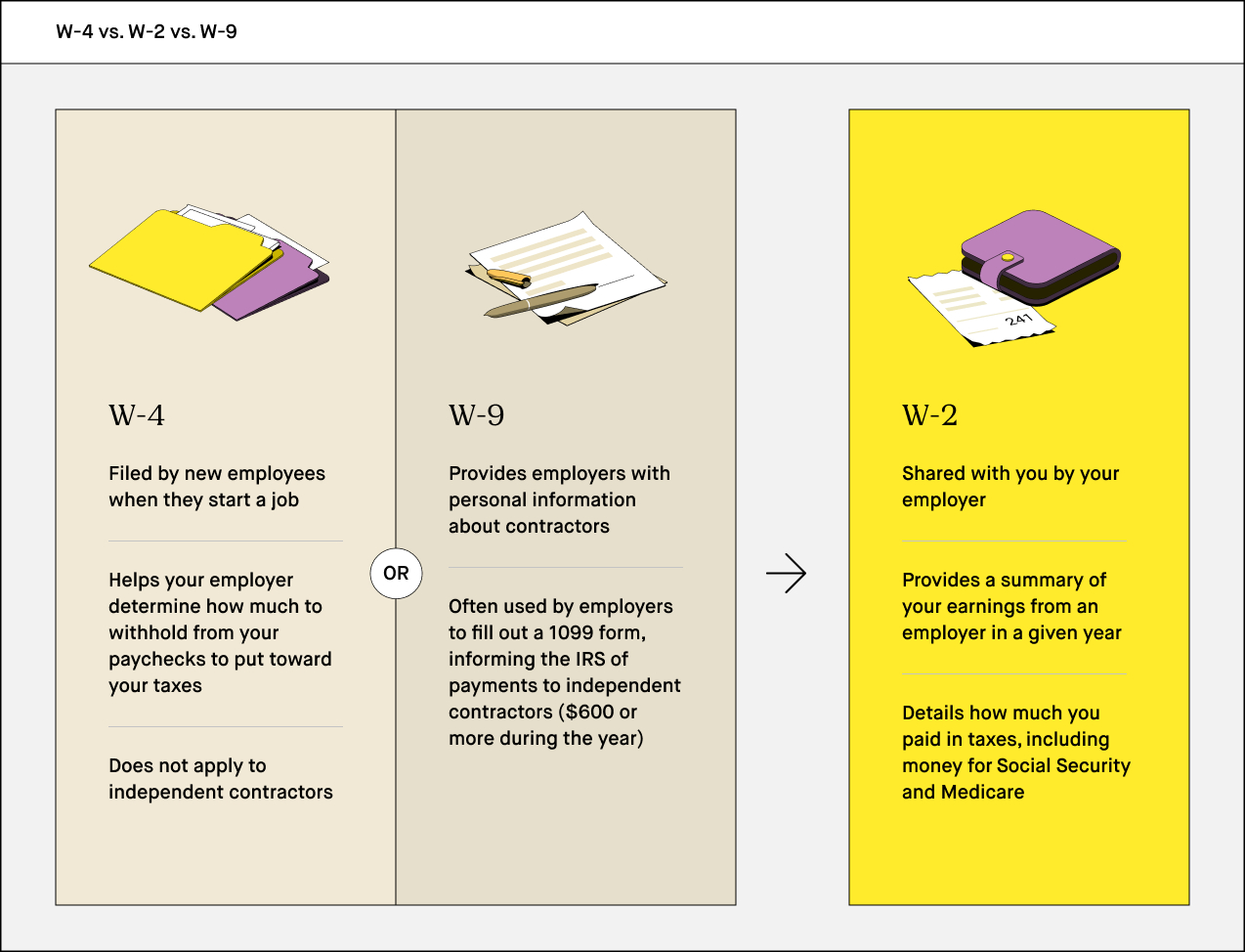

Related Forms…

W4 Form Instructions 2025 Images