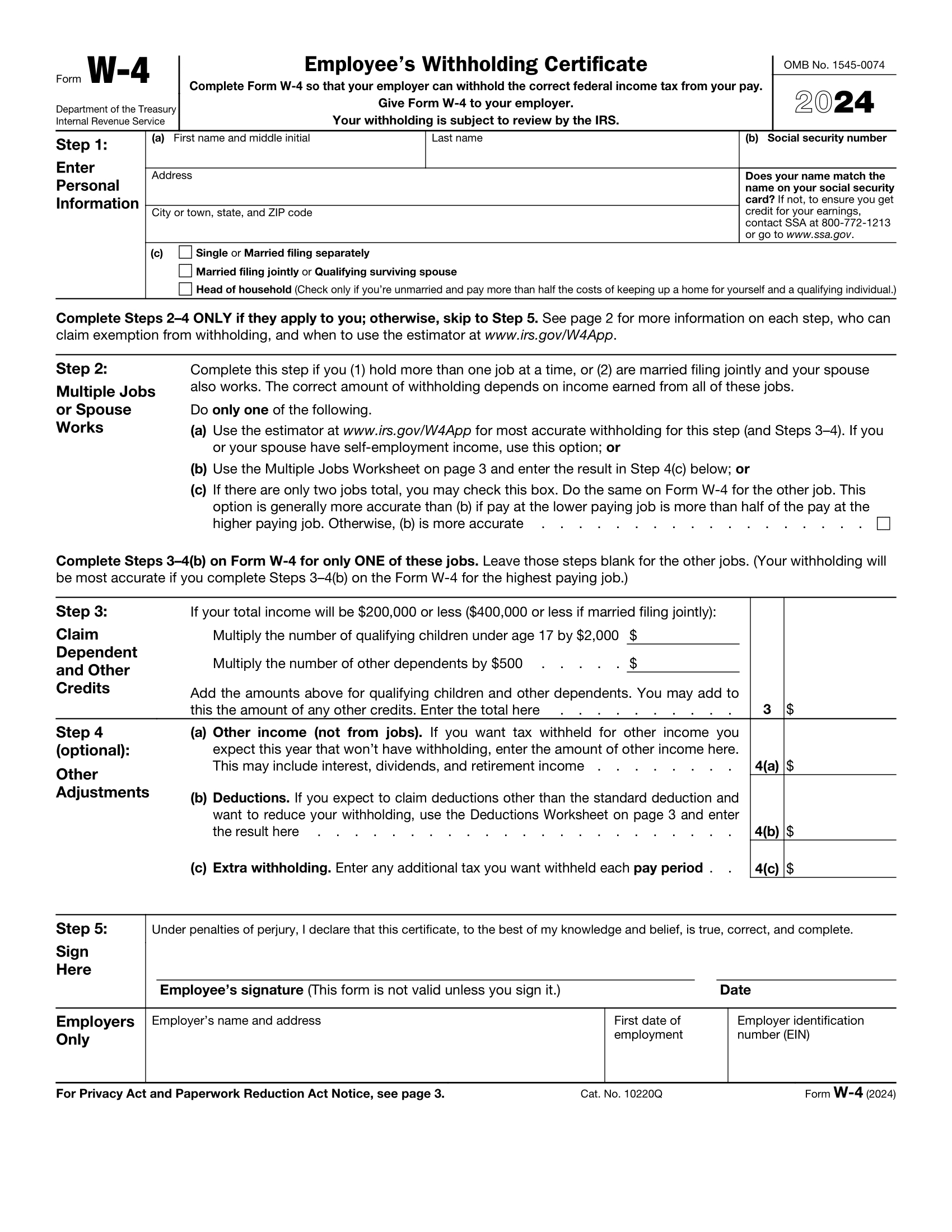

W4 Form 2025 Oregon – In the ever-evolving landscape of tax regulations, change is inevitable. The introduction of the new W4 Form for 2025 brings with it a wave of excitement and anticipation for what lies ahead. Oregon residents can now look forward to a streamlined and user-friendly form that simplifies the process of filing taxes. With this new form, taxpayers can say goodbye to the confusion of outdated forms and welcome a brighter, more efficient future.

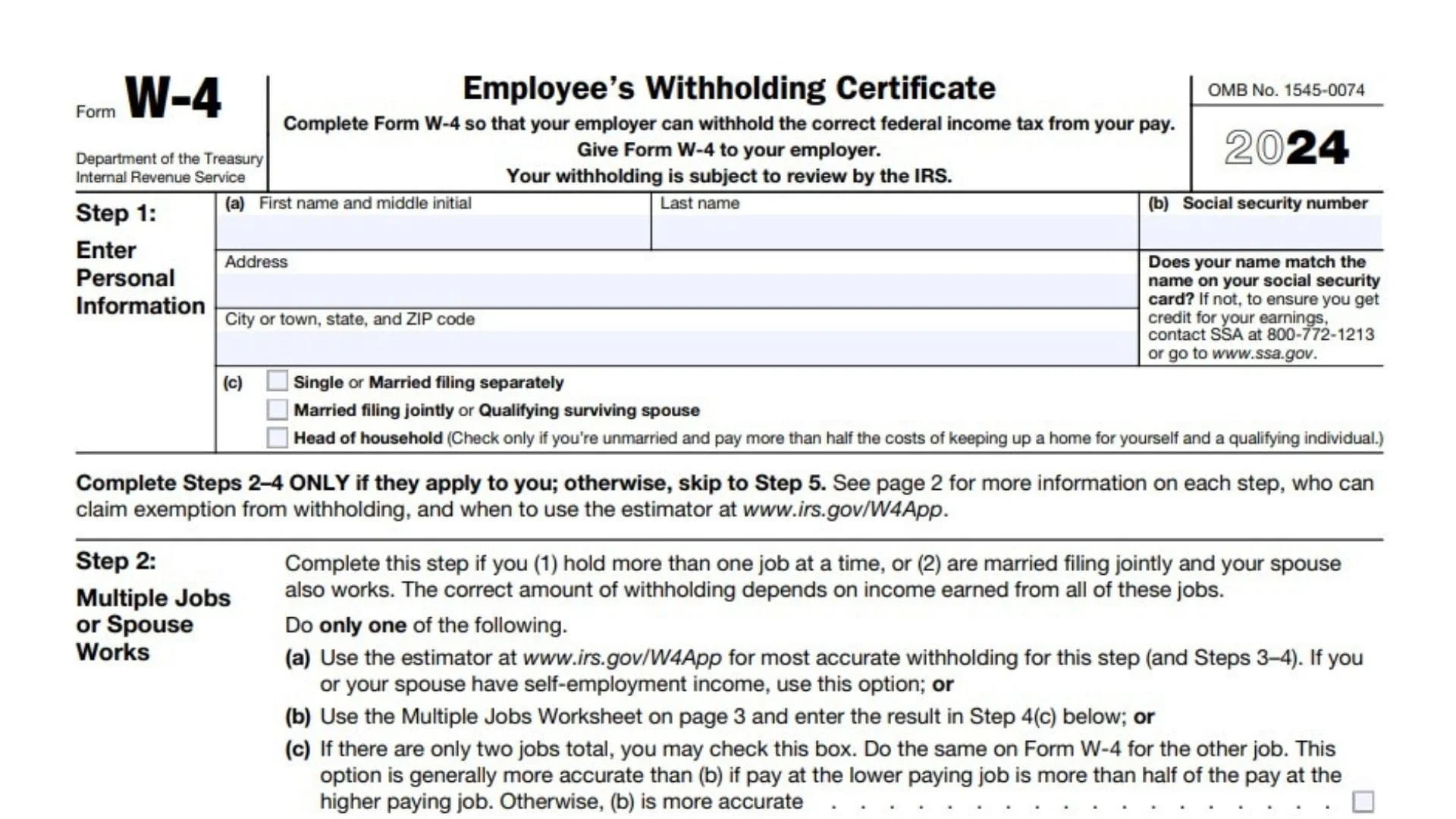

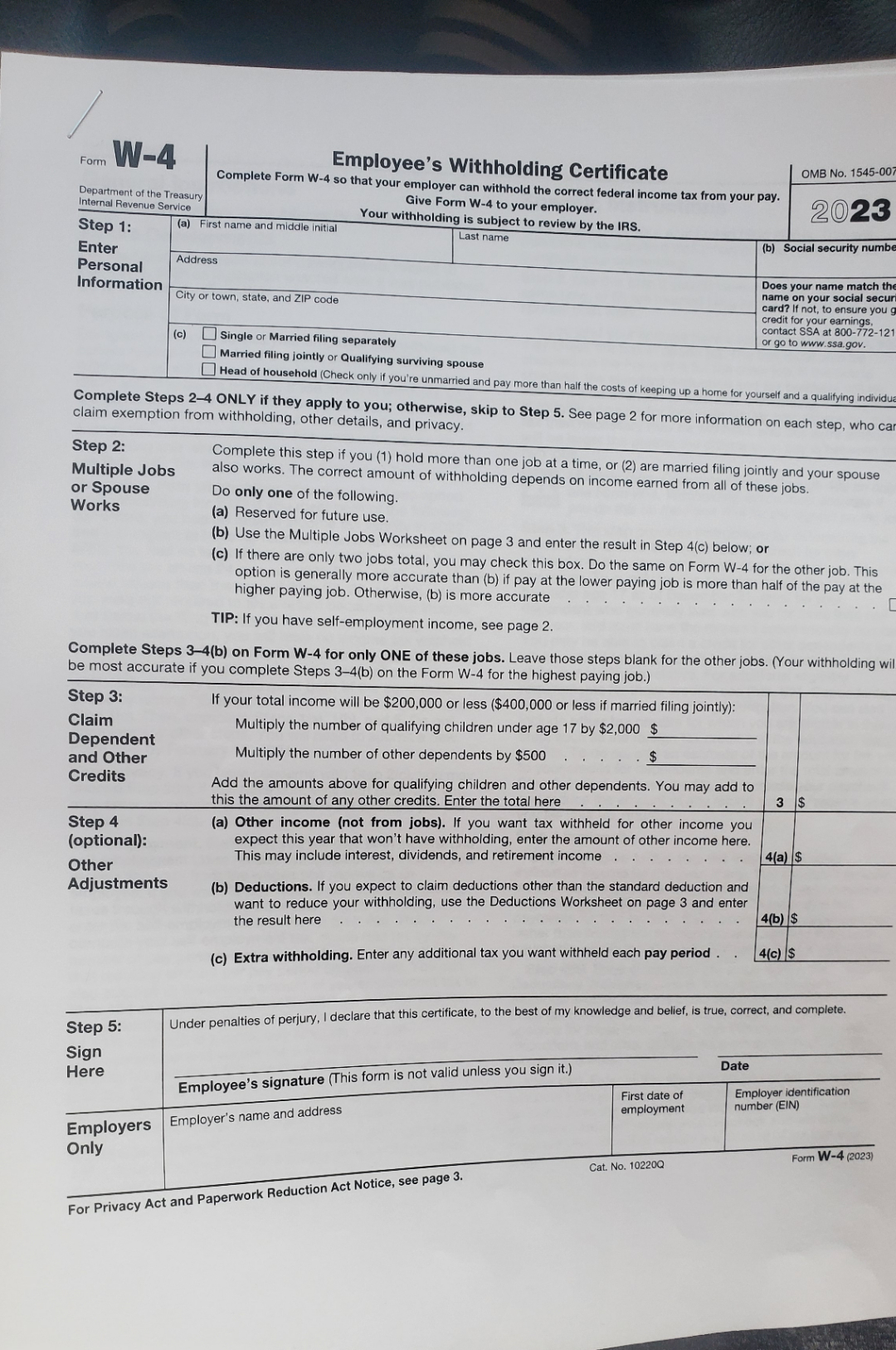

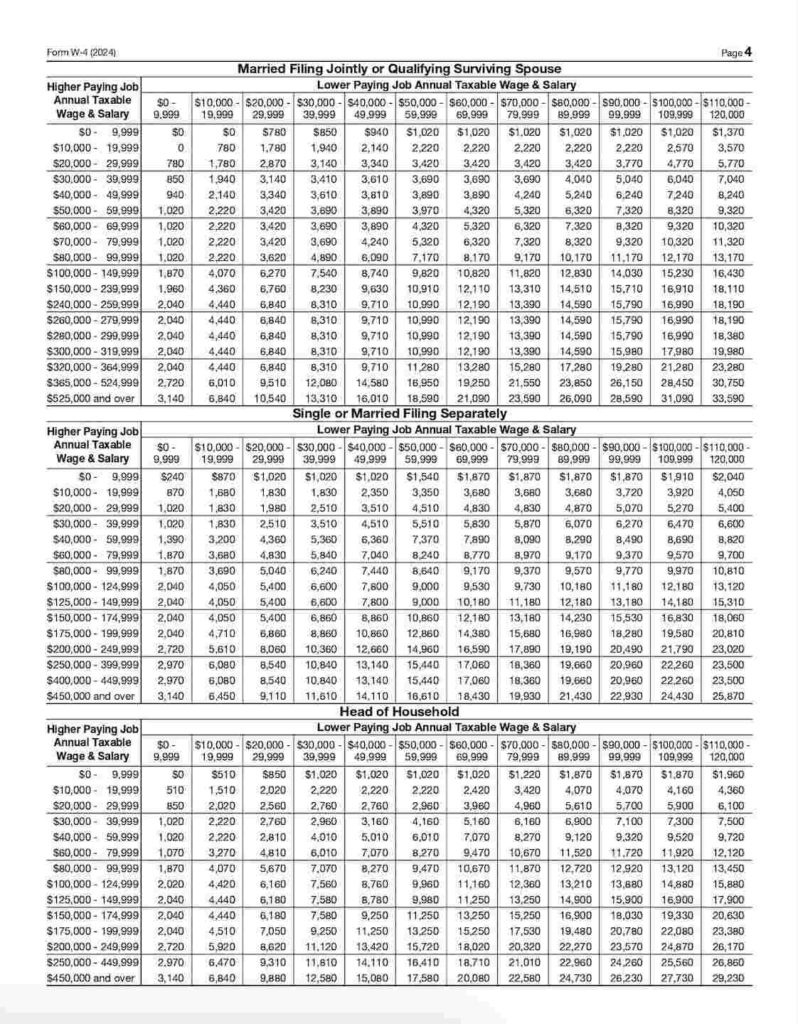

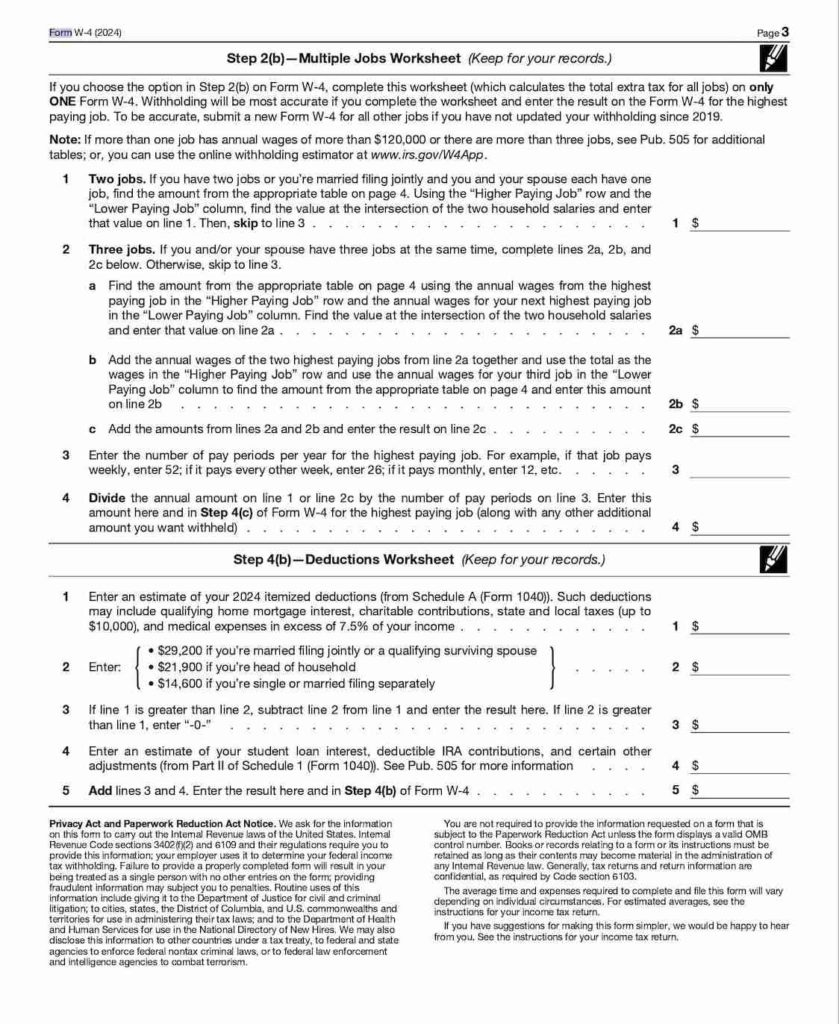

The W4 Form for 2025 is designed to cater to the modern taxpayer, taking into account the diverse financial situations and needs of individuals. This updated form incorporates the latest tax laws and regulations, ensuring that taxpayers are able to accurately report their income and deductions. By providing clear instructions and guidance, the new W4 Form aims to make the tax-filing process a breeze for Oregon residents. Embracing this change is the first step towards a more seamless and stress-free tax season.

As we embrace the new W4 Form for 2025, we also open the door to a world of possibilities and opportunities. Oregon’s bright tax future is on the horizon, promising a more efficient and effective tax system for all. With this new form, taxpayers can look forward to a smoother filing process, allowing them to focus on other aspects of their lives. By simplifying the tax-filing experience, Oregon is paving the way for a brighter future for its residents.

A Glimpse into Oregon’s Bright Tax Future

The unveiling of the W4 Form for 2025 offers a glimpse into Oregon’s bright tax future. With this new form, taxpayers can expect to see significant improvements in the way they file their taxes. The streamlined process and user-friendly interface of the form make it easier than ever for individuals to report their income and claim deductions. Oregon residents can now look forward to a more efficient and effective tax system that meets their needs and simplifies the filing process.

Oregon’s bright tax future is not just about a new form, but about a new approach to taxation. By embracing change and innovation, the state is setting the stage for a more transparent and equitable tax system. The W4 Form for 2025 is just the beginning of a series of reforms aimed at making the tax-filing process more accessible and user-friendly. With these changes, Oregon is creating a brighter future for all its residents, ensuring that everyone can navigate the tax system with ease and confidence.

In conclusion, the W4 Form for 2025 heralds a new era of tax-filing in Oregon, one that is characterized by efficiency, simplicity, and transparency. By embracing this change, taxpayers can look forward to a brighter future where filing taxes is no longer a daunting task, but a seamless process. Oregon’s commitment to innovation and progress is evident in the introduction of this new form, setting the stage for a more user-friendly and effective tax system. As we step into this new era, let us embrace the opportunities and possibilities that lie ahead, confident in the bright tax future that awaits us.

Related Forms…

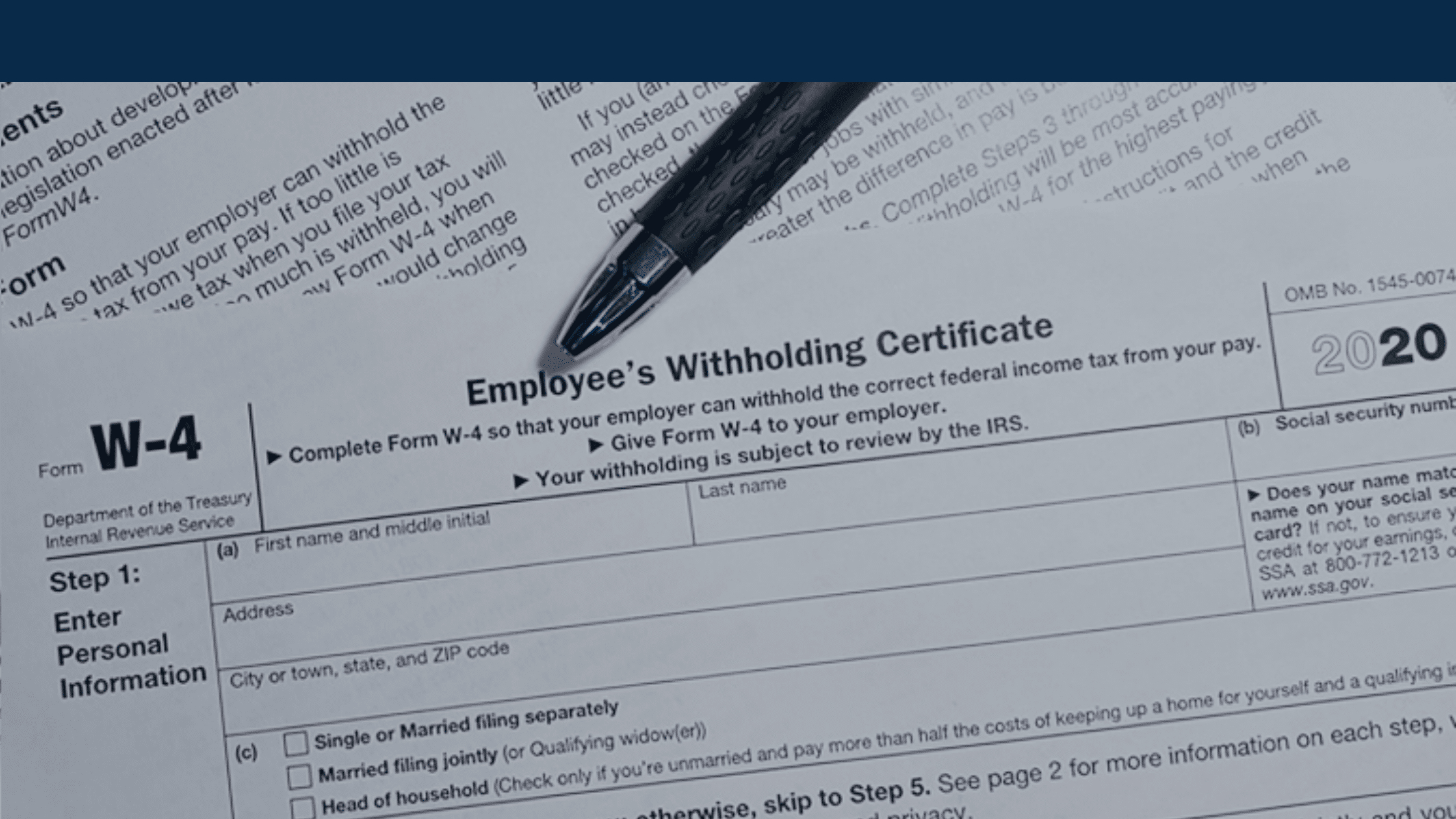

W4 Form 2025 Oregon Images