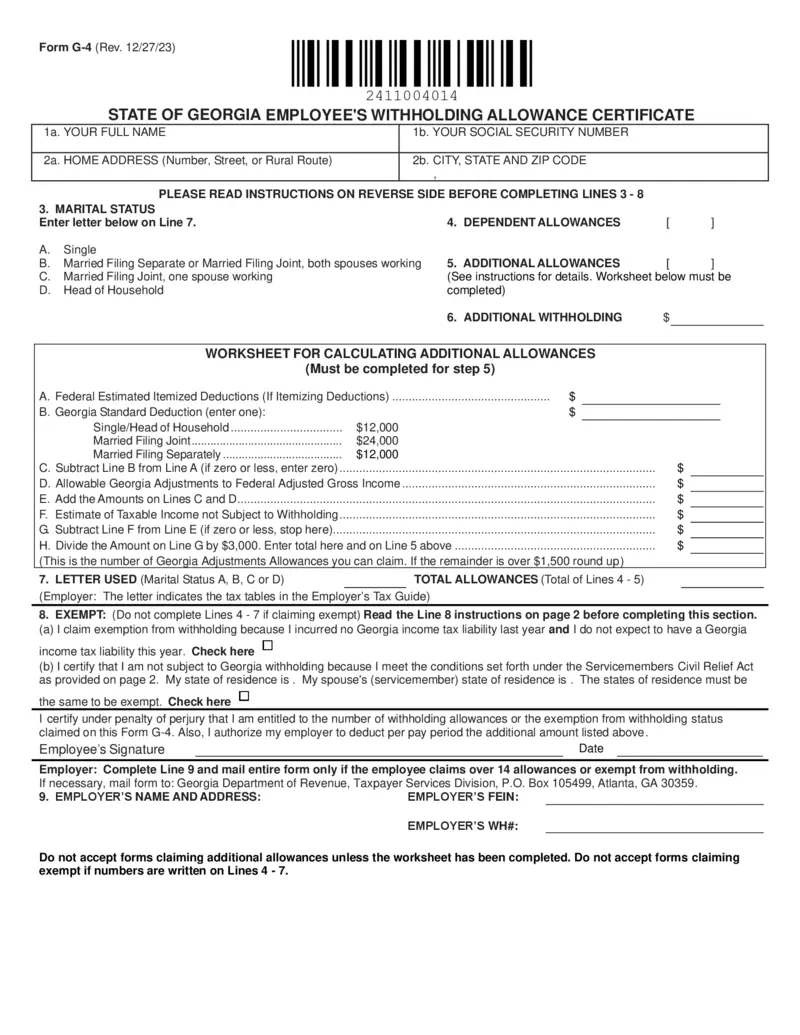

GA W4 Form 2025 – Are you ready to rock your taxes like never before? Say goodbye to the days of stressing over complicated forms and endless calculations. With the GA W4 Form 2025, tax season just got a whole lot easier and more fun! Get ready to unleash your inner rockstar and take charge of your finances like never before.

Unleash Your Inner Rockstar: GA W4 Form 2025 Edition!

It’s time to step into the spotlight and show the world that you mean business when it comes to your taxes. The GA W4 Form 2025 is your ticket to a smoother, more efficient tax season. Say goodbye to the days of scrambling to gather all of your paperwork at the last minute. With this user-friendly form, you’ll be able to breeze through your taxes with ease and confidence.

Don’t be afraid to rock out with your taxes this year. The GA W4 Form 2025 is designed to make the process as painless as possible. Whether you’re a seasoned tax pro or a newbie just getting started, this form is sure to be your new best friend. So grab your guitar, pick up that microphone, and get ready to jam out with your taxes like never before!

Prepare to Jam Out with Your Taxes and GA W4 Form 2025

Get ready to turn up the volume on your tax game with the GA W4 Form 2025. This innovative form is designed to make the tax-filing process a breeze. Say goodbye to confusion and hello to simplicity with this user-friendly document. Whether you’re filing as an individual or a business, this form has got you covered.

So, what are you waiting for? It’s time to grab hold of your finances and rock your taxes like never before. With the GA W4 Form 2025 by your side, there’s no limit to what you can achieve this tax season. So crank up the tunes, get in the groove, and get ready to rock your taxes with style and confidence!

In conclusion, tax season doesn’t have to be a dreaded time of year. With the GA W4 Form 2025, you can take control of your finances and rock your taxes like never before. So don’t be afraid to unleash your inner rockstar and show the world that you mean business when it comes to your taxes. Get ready to jam out with your taxes and make this tax season your best one yet!

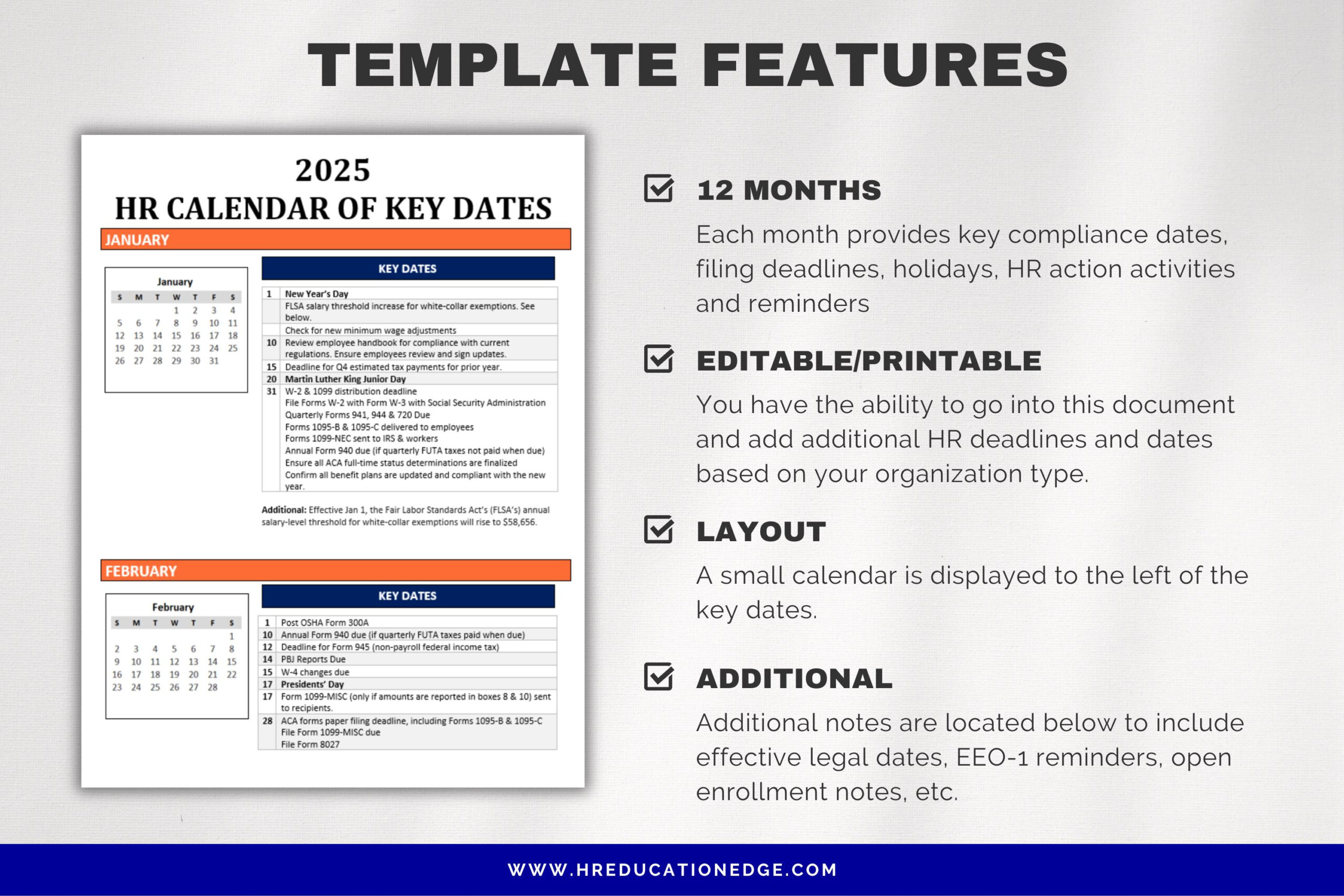

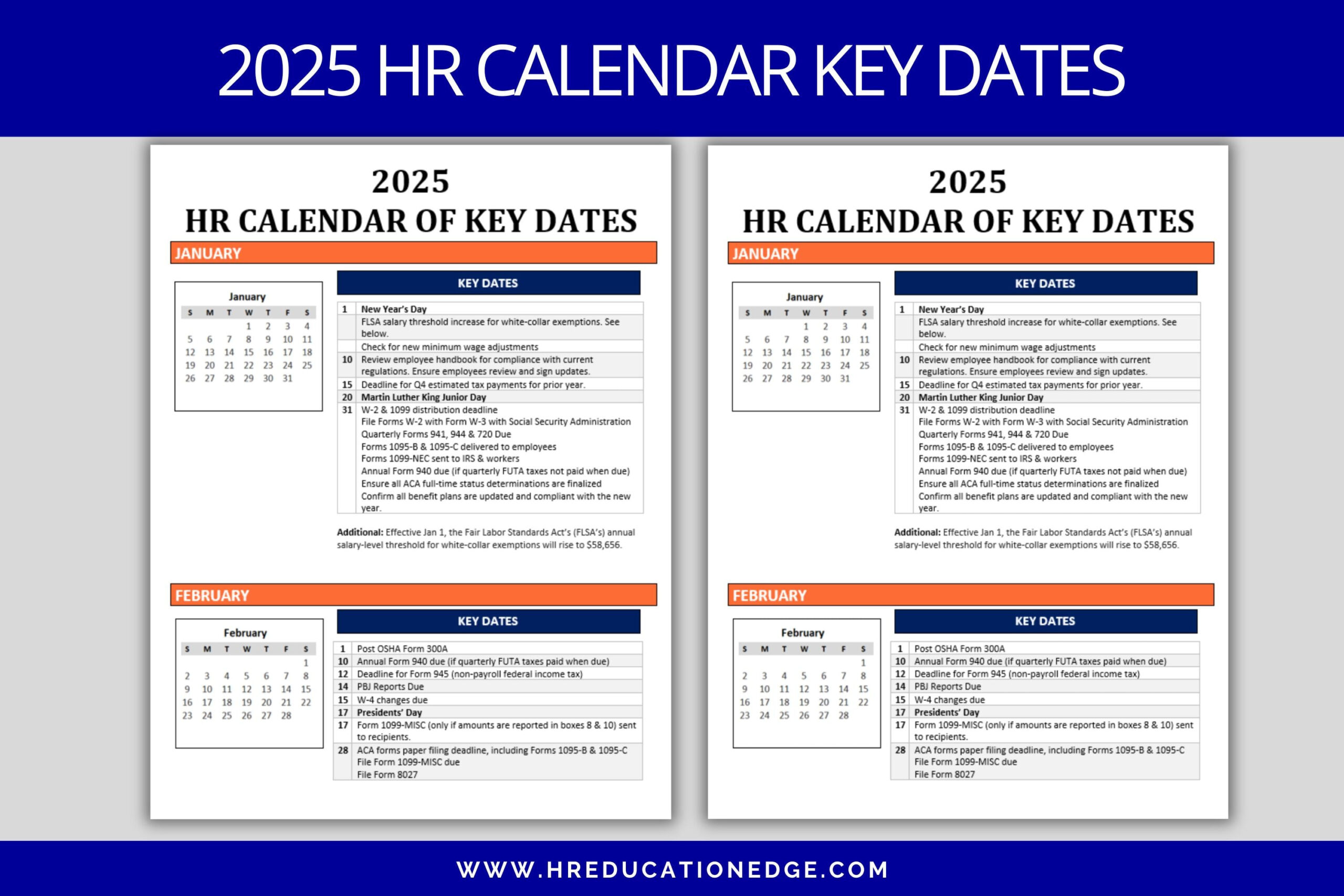

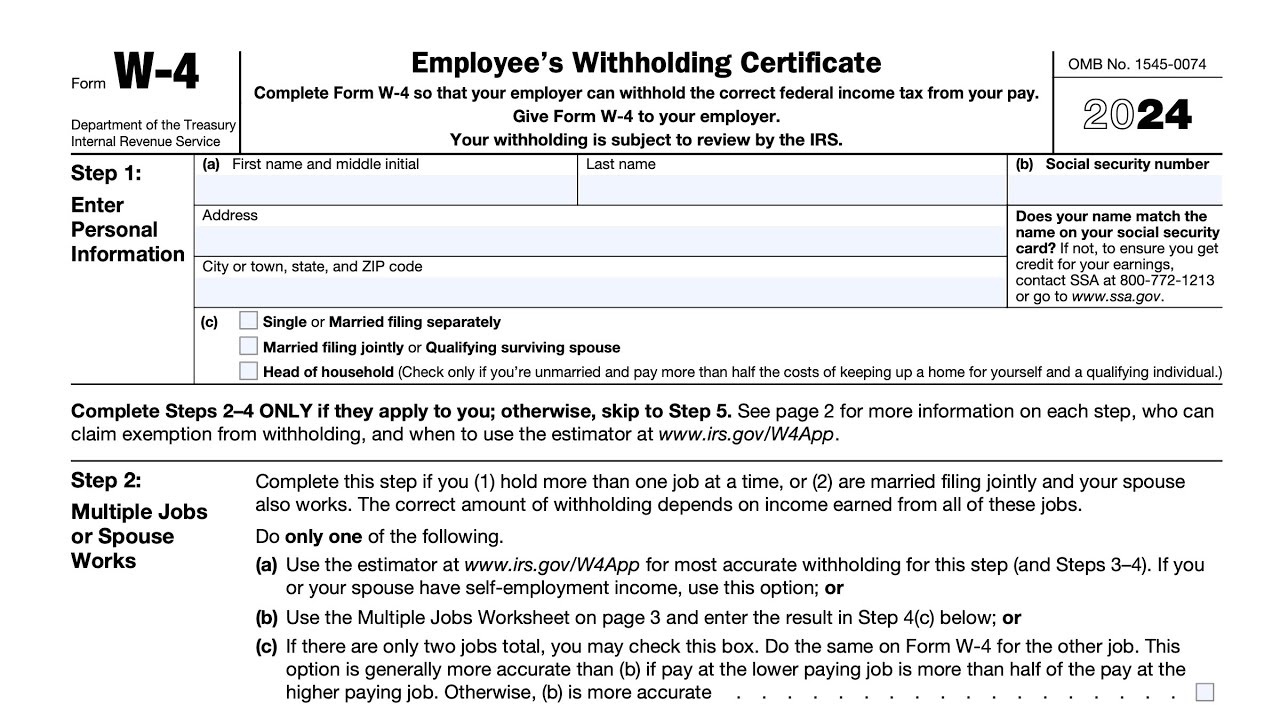

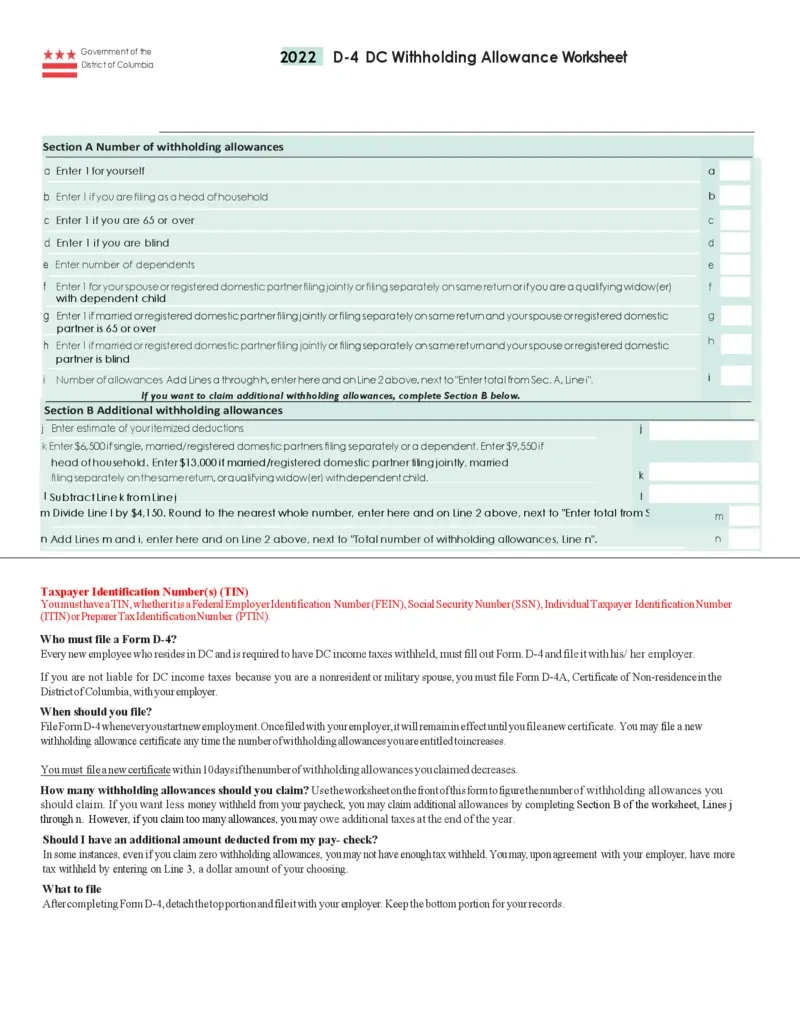

Related Forms…

GA W4 Form 2025 Images