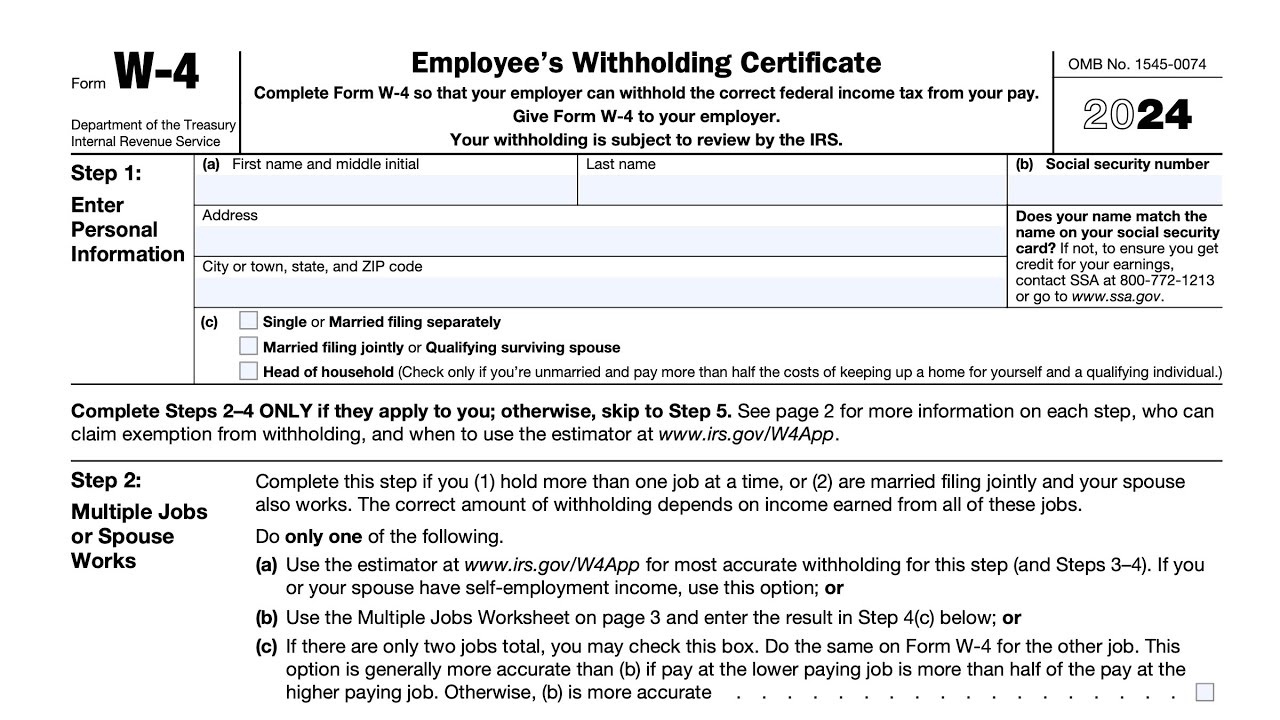

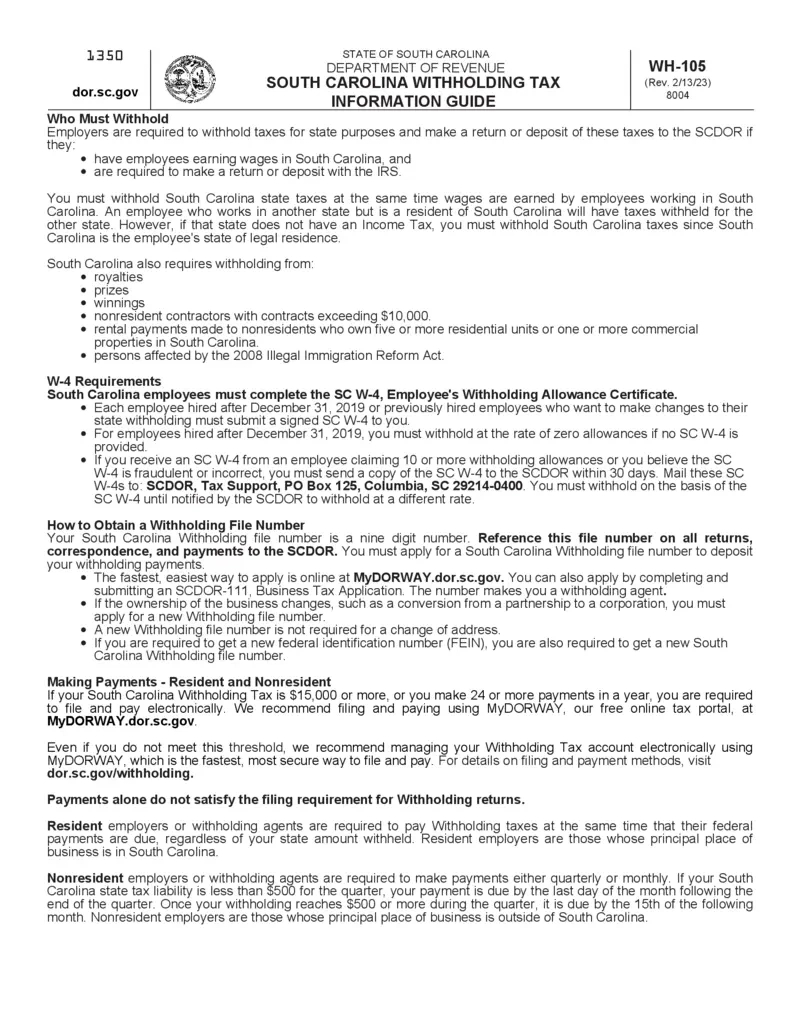

South Carolina W4 Form 2025 – Are you ready to step into the future of tax preparation? Look no further than the South Carolina W4 Form 2025! This innovative form is set to revolutionize the way taxpayers in the Palmetto State file their taxes. With exciting changes and updates, the South Carolina W4 Form 2025 is designed to make the tax filing process simpler and more efficient than ever before.

Discover the Exciting Changes Ahead for Taxpayers!

One of the most exciting changes coming with the South Carolina W4 Form 2025 is the introduction of new tax credits and deductions. Taxpayers will now have access to a wide range of incentives to help them save money on their taxes. From education credits to energy-efficient home improvements, there are plenty of opportunities for South Carolinians to maximize their tax savings.

In addition to new tax credits, the South Carolina W4 Form 2025 will also feature enhanced online filing options. Taxpayers will now have the ability to file their taxes electronically, making the process faster and more convenient than ever before. With just a few clicks of a button, South Carolinians can submit their tax returns and receive their refunds in record time.

The future is bright for taxpayers in South Carolina, thanks to the innovative changes coming with the W4 Form 2025. With new tax credits, enhanced online filing options, and a streamlined process, filing taxes has never been easier. So get ready to embrace the future of tax preparation and discover all the exciting changes ahead with the South Carolina W4 Form 2025!

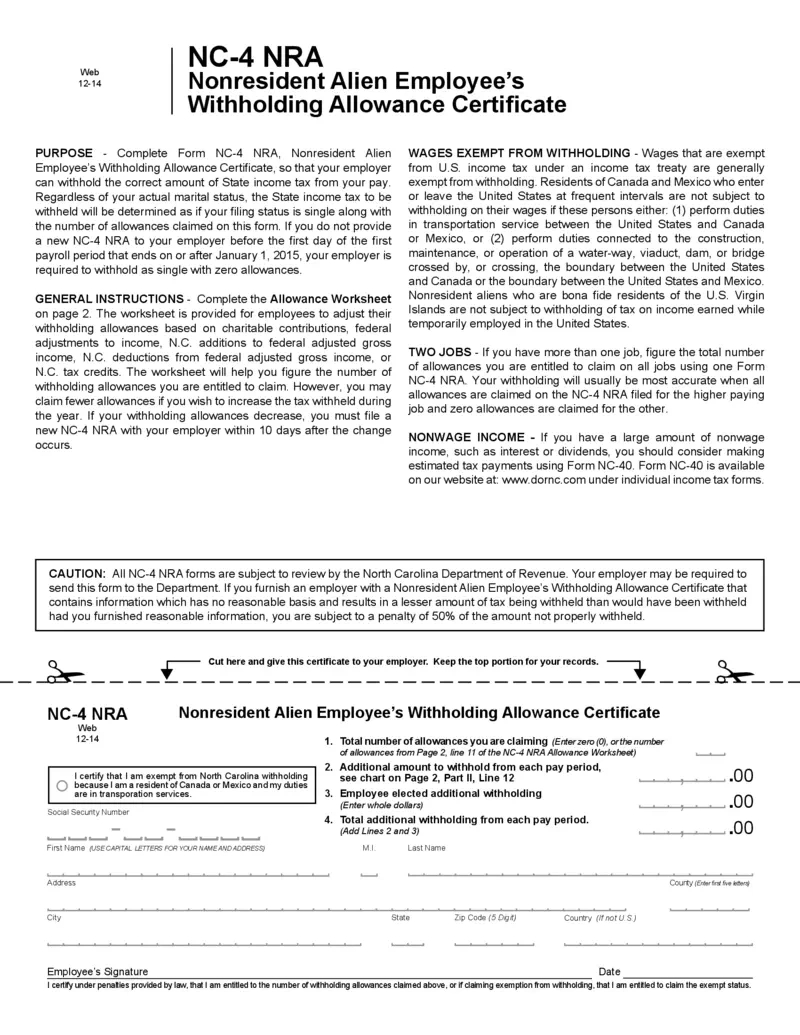

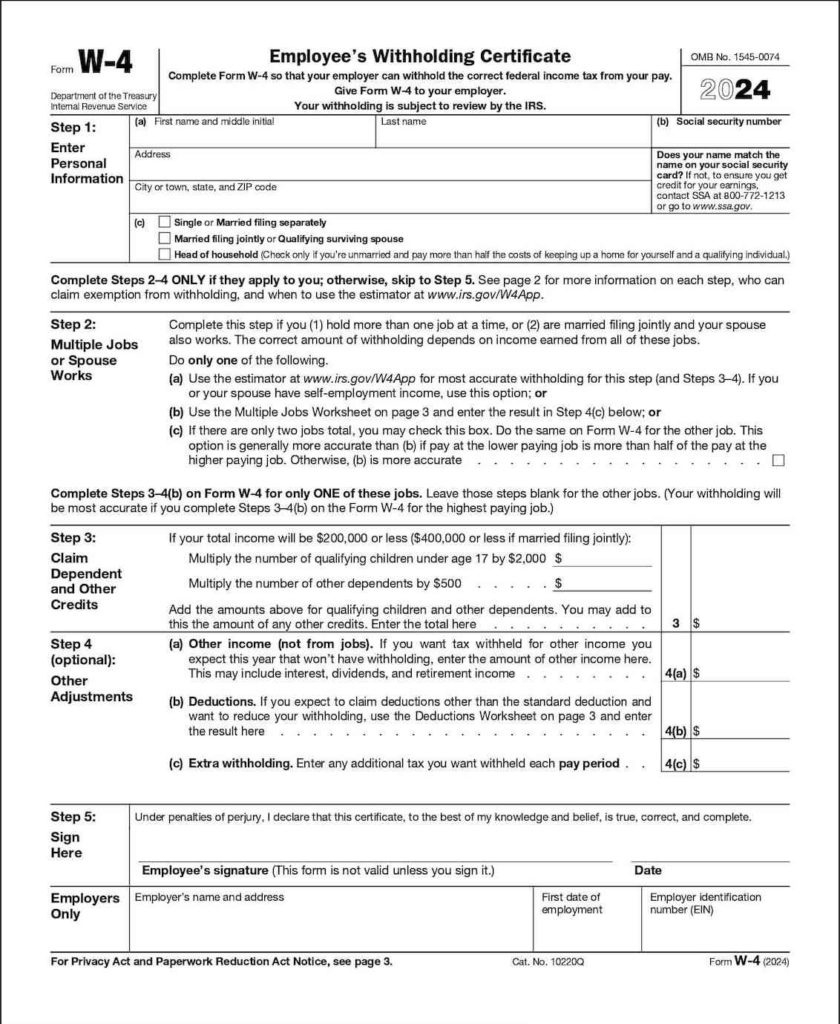

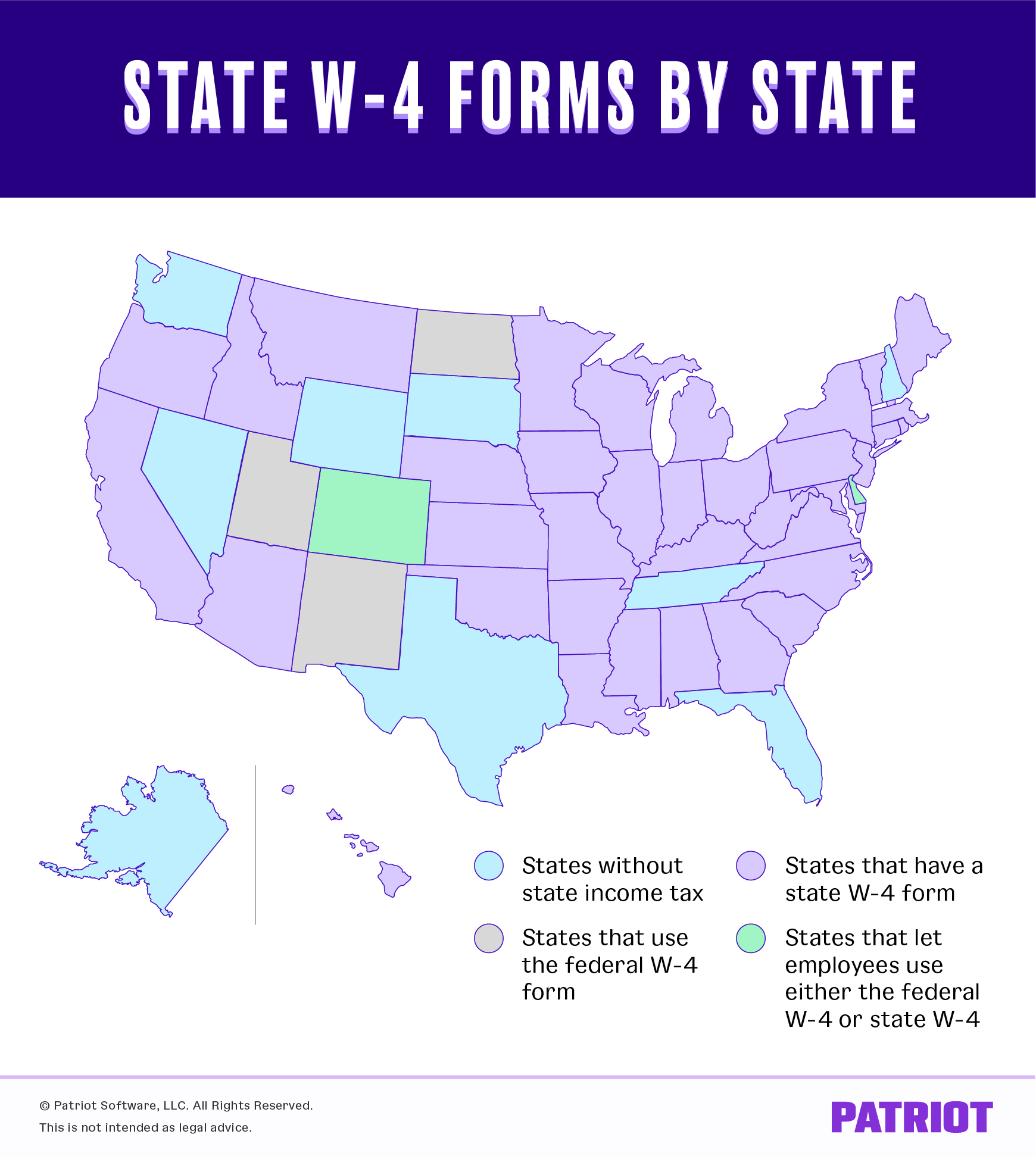

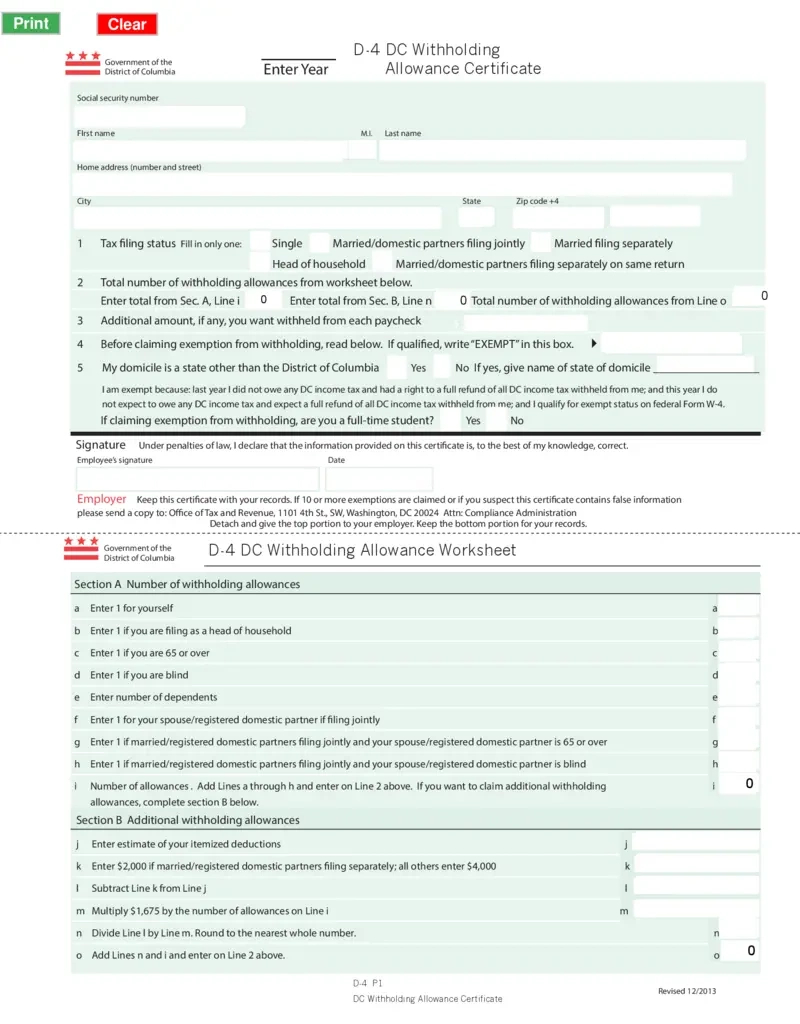

Related Forms…

South Carolina W4 Form 2025 Images