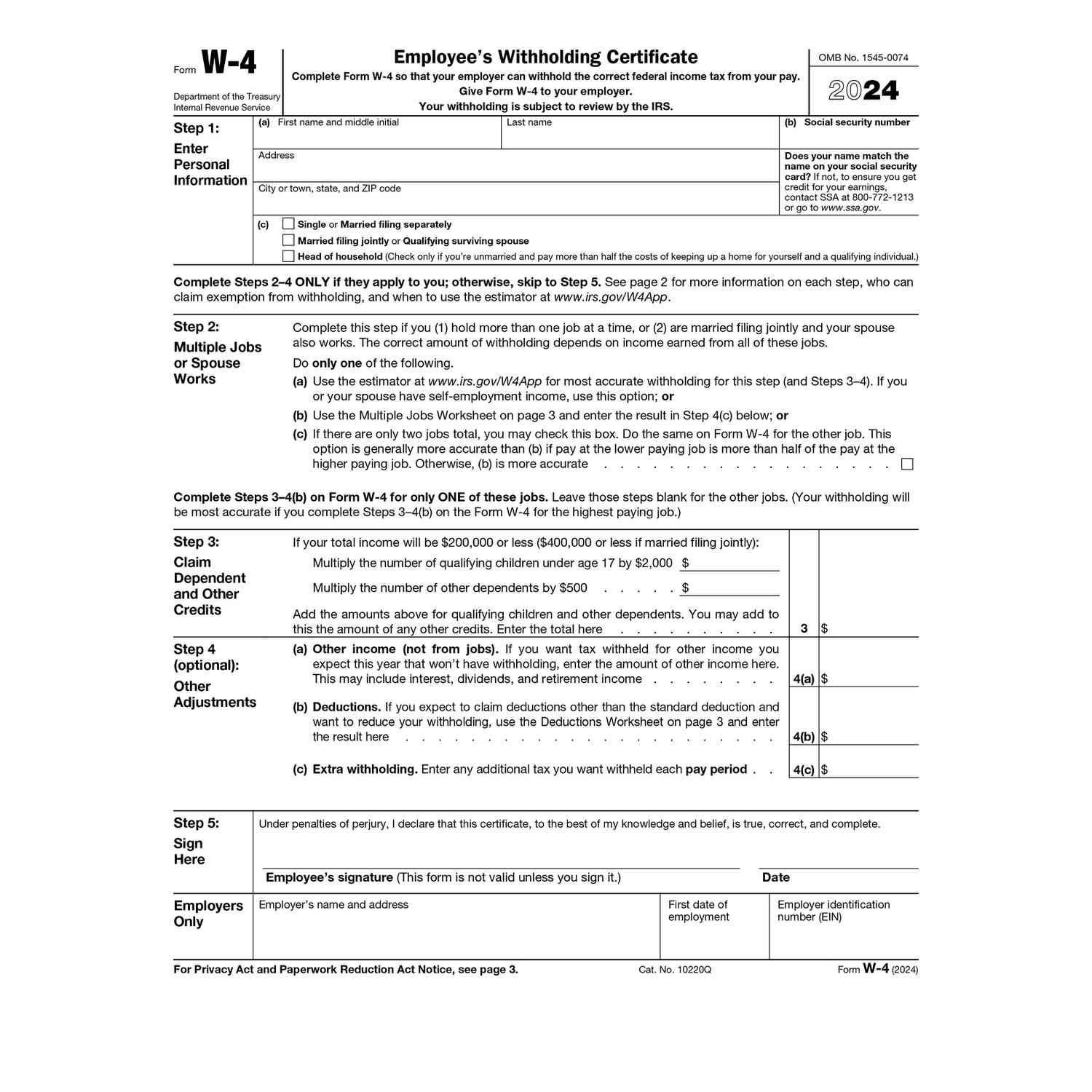

Ca W4 Form 2025

Ca W4 Form 2025 – Are you ready for a bright and exciting future? Get ready to embark on a journey of transformation with the Ca W4 Form 2025! This form is set to revolutionize the way we plan for our financial futures and pave the way for a more secure and prosperous tomorrow. Say … Read more