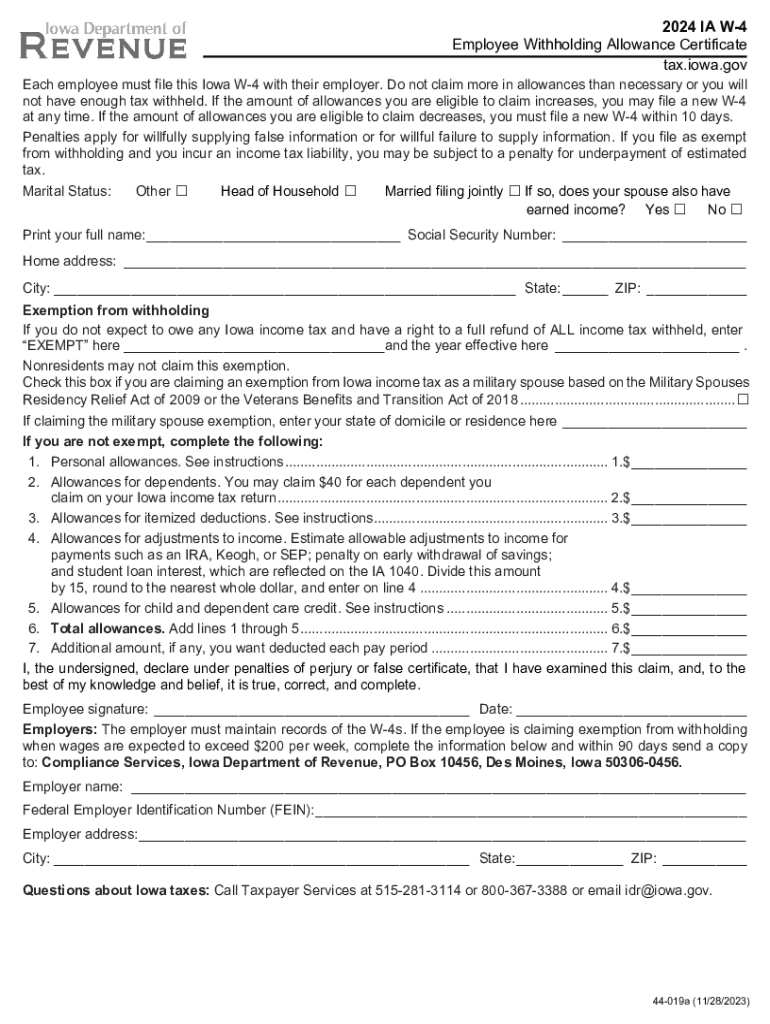

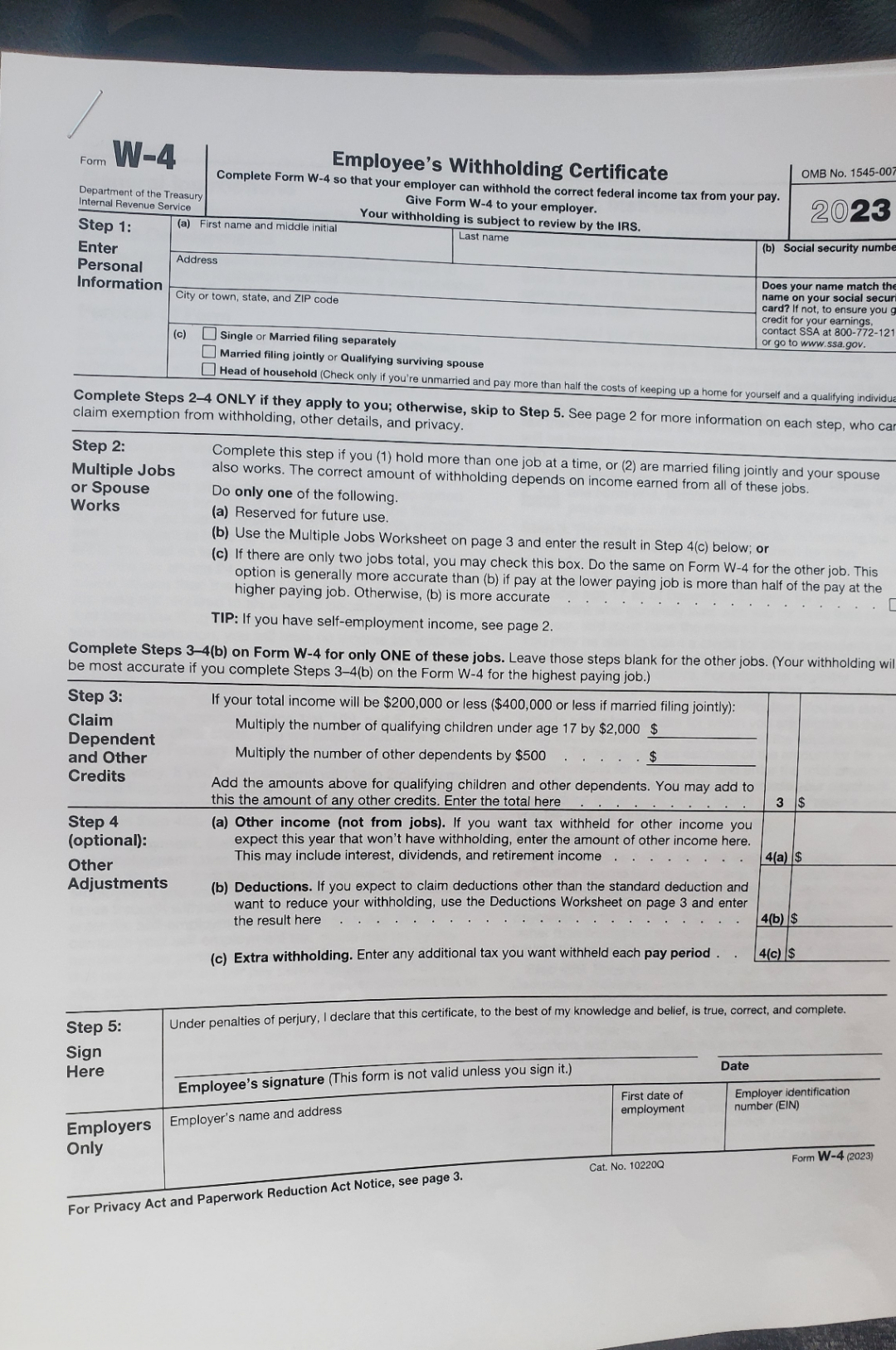

IOWA W4 Form 2025 – Tax season is upon us, and it’s time to start thinking about filing your taxes. One important document you’ll need is the Iowa W4 Form 2025. This form is your ticket to smooth tax filing and ensuring that you get the most out of your tax refund. By properly filling out this form, you can maximize your refund and avoid any potential headaches down the road. So let’s dive in and get ready for tax season with the Iowa W4 Form 2025!

Iowa W4 Form 2025: Your Ticket to Smooth Tax Filing!

The Iowa W4 Form 2025 is a crucial document that determines how much tax is withheld from your paycheck throughout the year. By accurately filling out this form, you can ensure that you are not overpaying or underpaying your taxes. It’s important to review this form each year, especially if your financial situation has changed, such as getting married, having a child, or changing jobs. By staying on top of your W4 form, you can avoid any surprises come tax time and make the filing process much smoother.

When filling out the Iowa W4 Form 2025, make sure to carefully follow the instructions provided. Take your time to review each section and provide accurate information to avoid any errors. If you’re unsure about how to fill out a specific section, don’t hesitate to seek help from a tax professional or utilize online resources. By taking the time to fill out your W4 form correctly, you can maximize your tax refund and ensure that you are in compliance with state tax laws.

Maximize Your Refund: Tips for Filling Out the Iowa W4 Form

To maximize your tax refund, consider updating your W4 form to reflect any changes in your financial situation. If you’ve recently gotten married, had a child, or purchased a home, these life events can impact your tax liability. By accurately filling out your W4 form, you can adjust your withholding to ensure that you are not overpaying or underpaying your taxes. Additionally, consider consulting with a tax professional to determine if you qualify for any tax credits or deductions that can further maximize your refund.

As you fill out your Iowa W4 Form 2025, be sure to double-check your entries for accuracy. Mistakes on your W4 form can lead to delays in processing your tax return and potentially result in a smaller refund. Take the time to review each section and make any necessary corrections before submitting your form. By being diligent in filling out your W4 form, you can set yourself up for a smooth tax filing experience and maximize your refund potential.

In conclusion, getting ready for tax season with the Iowa W4 Form 2025 is essential for ensuring a smooth and successful tax filing experience. By taking the time to accurately fill out your W4 form and staying on top of any changes in your financial situation, you can maximize your refund and avoid any potential issues with your taxes. So don’t wait until the last minute – start preparing now and make the most out of this tax season!

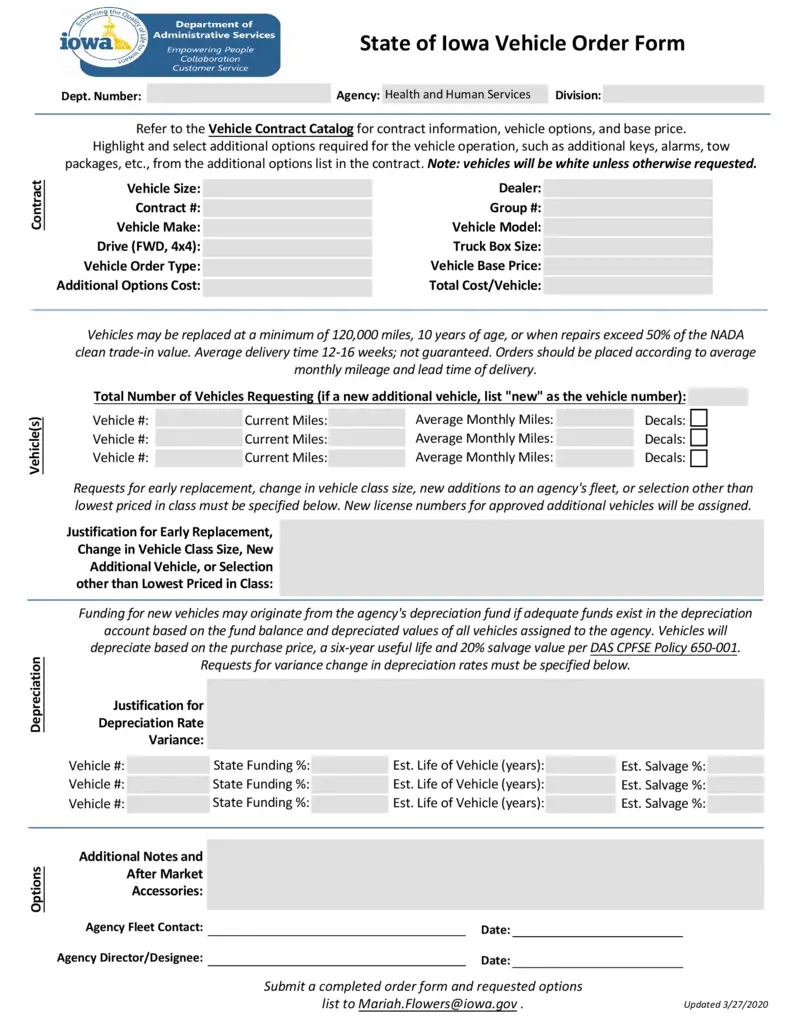

Related Forms…

IOWA W4 Form 2025 Images