VA W4 2025 Form – Are you ready for tax season 2025? It’s time to start preparing now to make the process as smooth as possible. One of the best ways to simplify your tax filing is by using the VA W4 form. This form is specifically designed for Virginia residents and can help you accurately calculate your state tax withholding. By filling out the VA W4 form correctly, you can ensure that you are not overpaying or underpaying your taxes, saving you time and money in the long run.

Prepare Yourself for Tax Season 2025!

As tax season approaches, it’s important to gather all the necessary documents and information to complete your tax return accurately. This includes your W2 forms, 1099s, and any other relevant financial documents. Additionally, take some time to review your financial situation and consider any changes that may impact your tax filing, such as a new job, a raise, or a change in marital status. By being proactive and organized, you can avoid any last-minute stress and ensure that your tax filing goes smoothly.

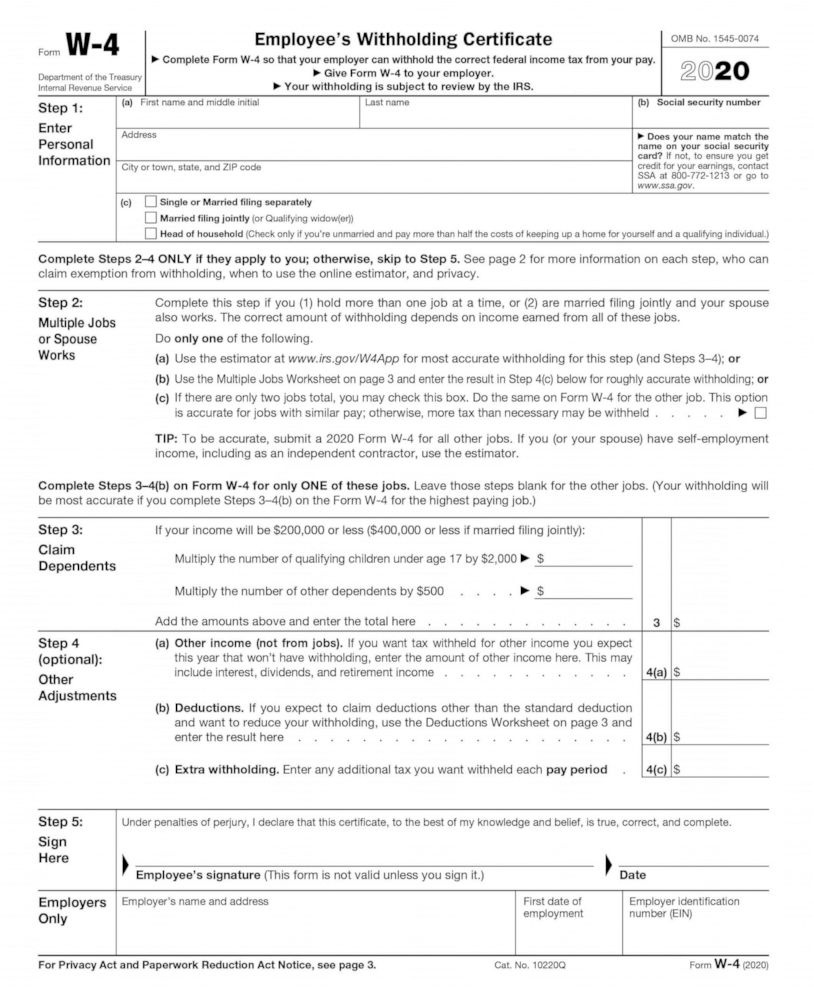

Simplify Your Tax Filing with the VA W4 Form!

The VA W4 form is a valuable tool that can help simplify your tax filing process. By accurately completing this form, you can calculate the correct amount of state tax withholding from your paycheck, ensuring that you do not owe a large sum at tax time. The form also allows you to claim any exemptions or deductions that you may be eligible for, reducing your tax liability. With the VA W4 form in hand, you can navigate the tax season with confidence and ease, knowing that you have taken the necessary steps to accurately file your taxes.

In conclusion, tax season 2025 is just around the corner, and it’s time to start preparing now. By utilizing the VA W4 form, you can simplify your tax filing process and ensure that you are accurately calculating your state tax withholding. So gather your documents, review your financial situation, and fill out the VA W4 form to get ready for tax season 2025!

Related Forms…

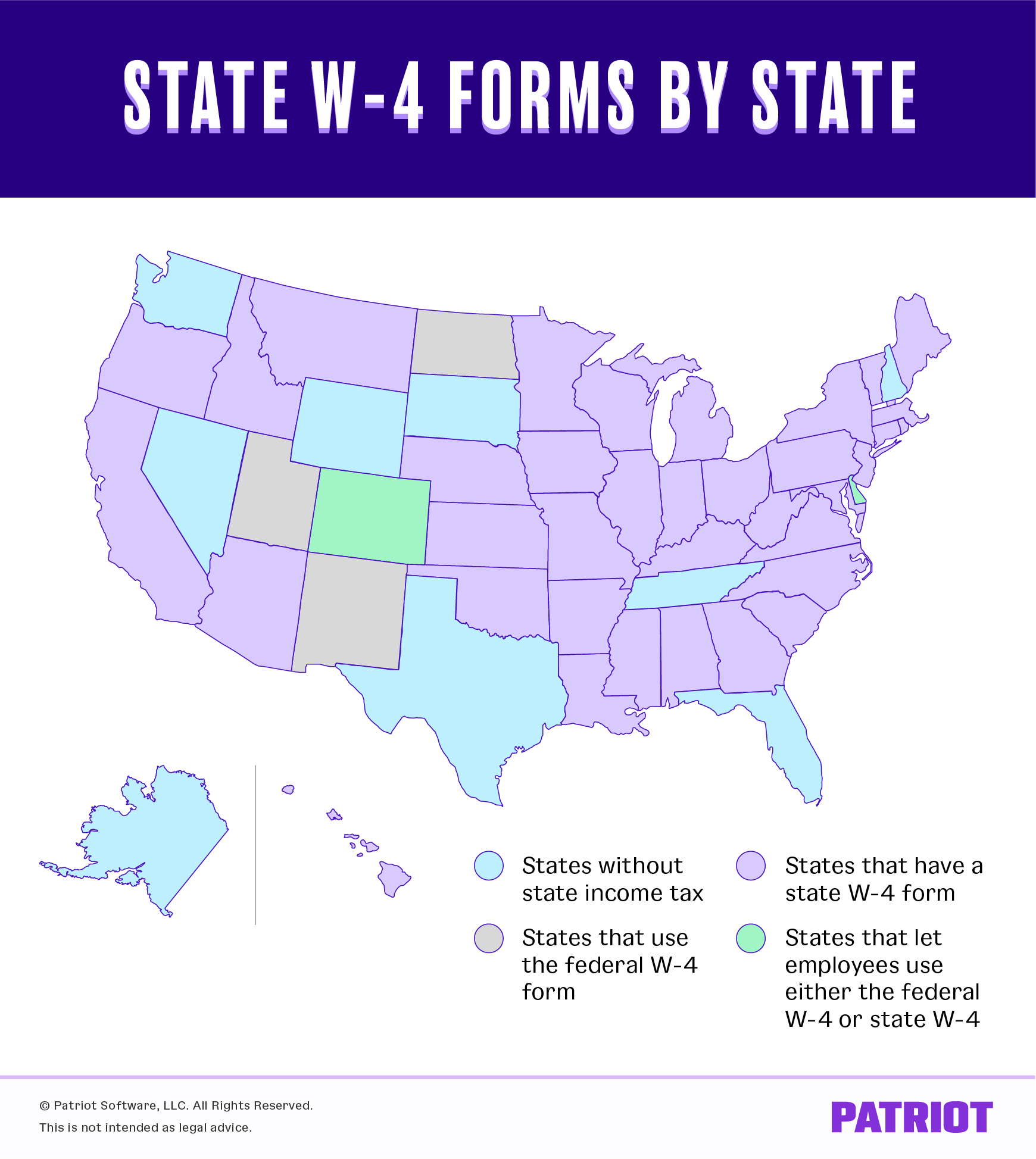

VA W4 2025 Form Images