IL W4 Form 2025 – Are you tired of feeling like you’re paying too much in taxes each year? It’s time to take control of your finances and maximize your tax savings with the IL W4 Form 2025! This updated form is designed to help Illinois residents get the most out of their tax returns by properly adjusting their withholding allowances. By mastering this form, you can ensure that you’re not overpaying on your taxes and keep more money in your pocket where it belongs.

One of the key benefits of using the IL W4 Form 2025 is the ability to customize your tax withholding based on your individual financial situation. Whether you’re a single filer, married with children, or even a small business owner, this form allows you to tailor your withholding allowances to fit your needs. By taking the time to understand the ins and outs of this form, you can make strategic decisions that will ultimately lead to greater tax savings and financial security.

Don’t let tax season stress you out any longer – take charge of your finances and level up your tax game with the IL W4 Form 2025! With the right knowledge and tools at your disposal, you can make smart choices that will help you keep more of your hard-earned money. So why wait? Start mastering the IL W4 Form 2025 today and watch as your tax savings soar to new heights!

Master the IL W4 Form 2025!

When it comes to navigating the world of taxes, knowledge is power – and the IL W4 Form 2025 is your ticket to mastering your tax game. This form is designed to be user-friendly and easy to understand, making it simple for Illinois residents to adjust their withholding allowances with confidence. By taking the time to familiarize yourself with this form, you can ensure that you’re making the best choices for your financial future.

One of the most important aspects of mastering the IL W4 Form 2025 is understanding how different factors can impact your tax liability. From changes in income to adjustments in deductions, there are many variables to consider when filling out this form. By taking a proactive approach to your taxes and staying informed about the latest updates and changes, you can make informed decisions that will benefit you in the long run. So why not take the time to learn more about the IL W4 Form 2025 and start maximizing your tax savings today?

In conclusion, the IL W4 Form 2025 is a powerful tool that can help you level up your tax game and take control of your financial future. By understanding how to properly adjust your withholding allowances and make informed decisions about your taxes, you can ensure that you’re getting the most out of your hard-earned money. So don’t wait any longer – start mastering the IL W4 Form 2025 today and watch as your tax savings grow!

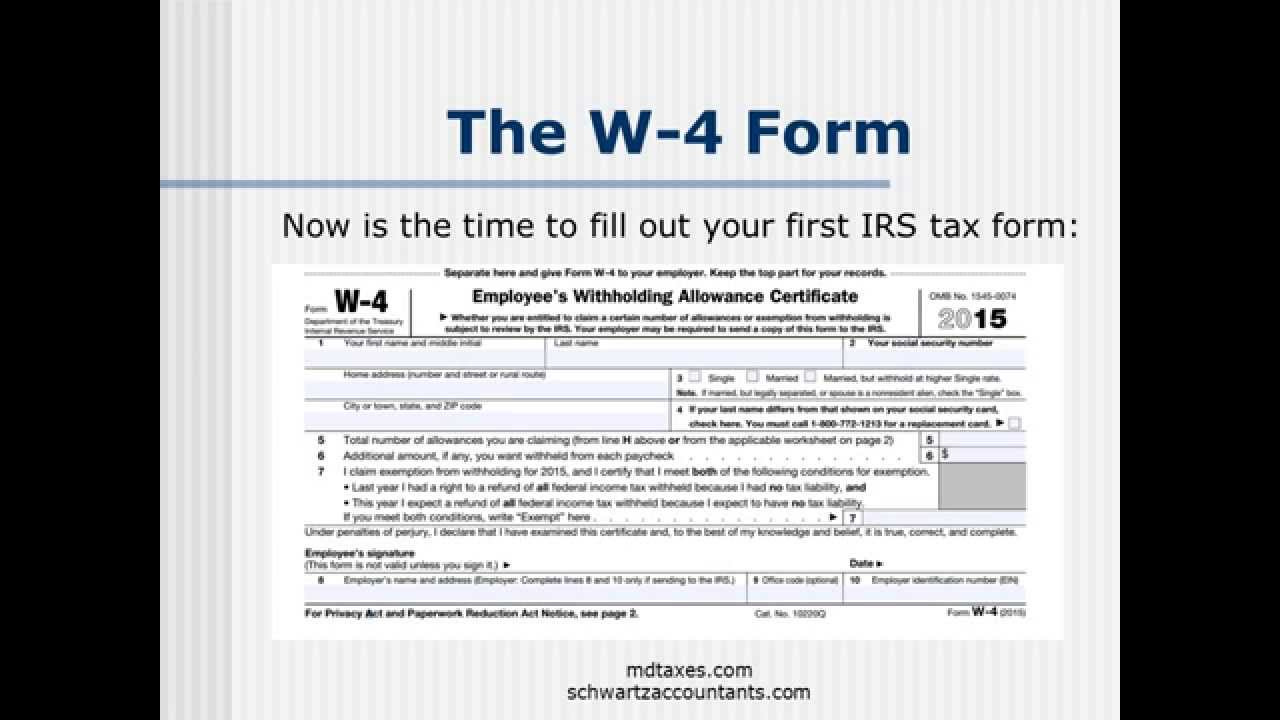

Related Forms…

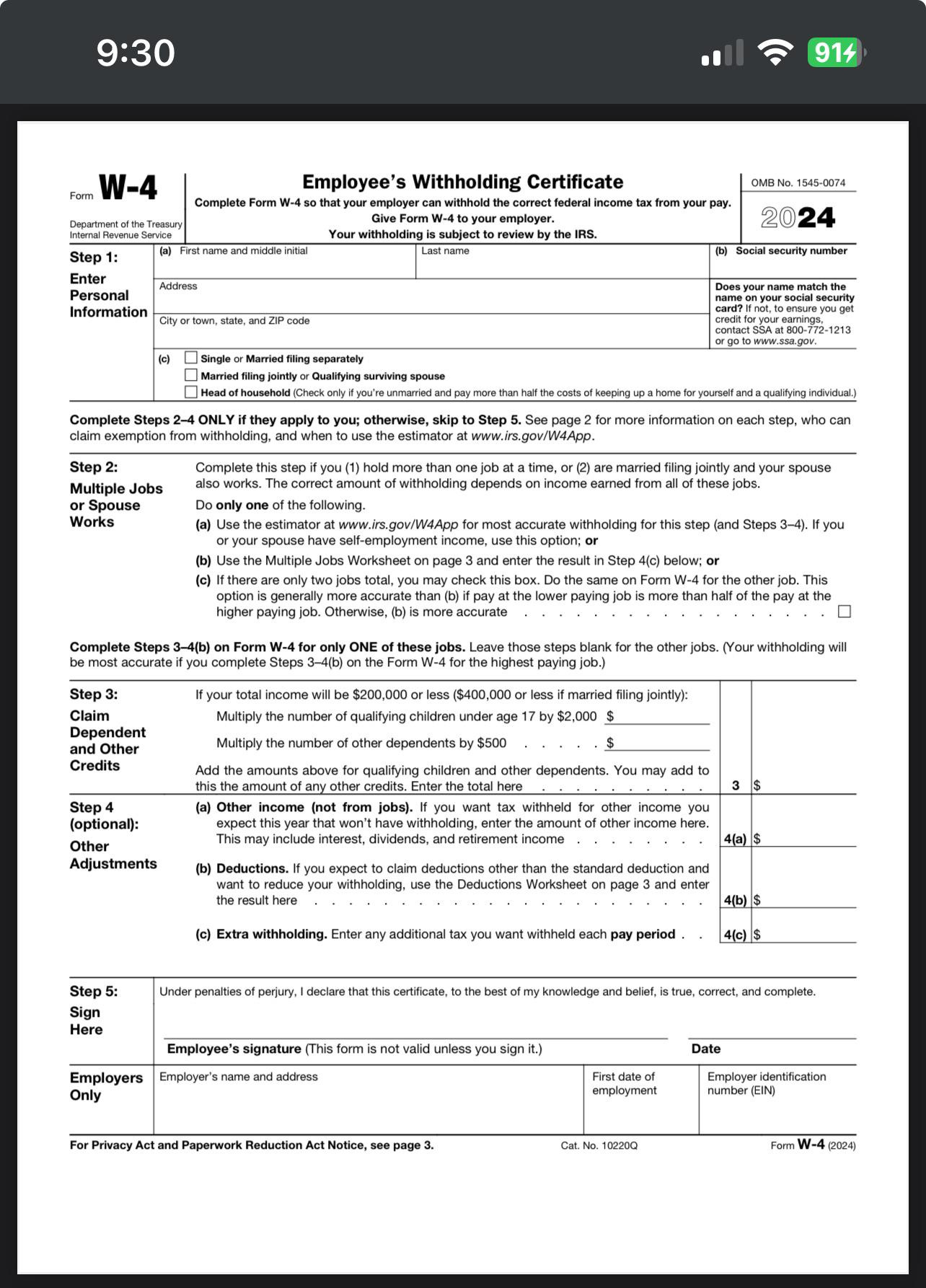

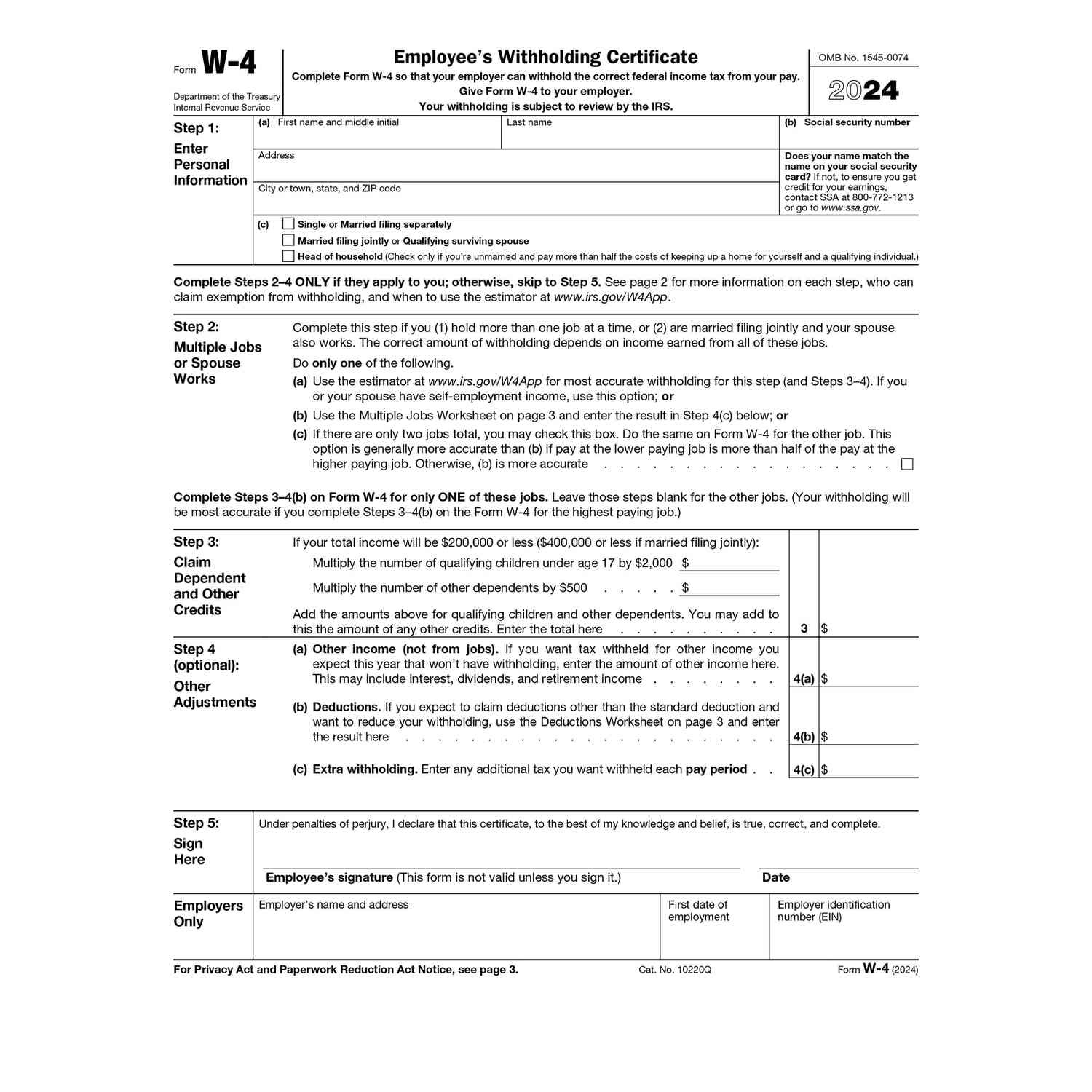

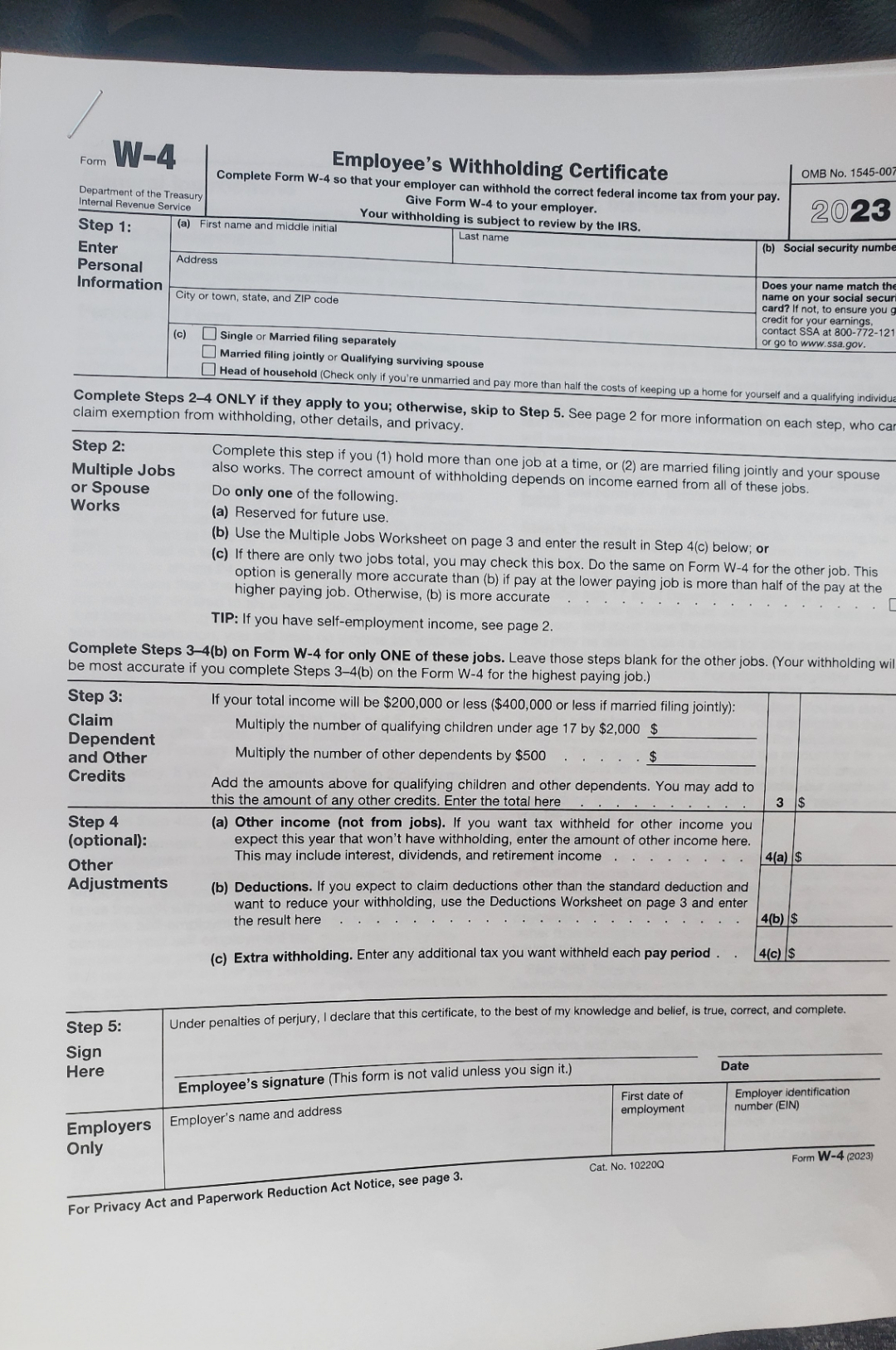

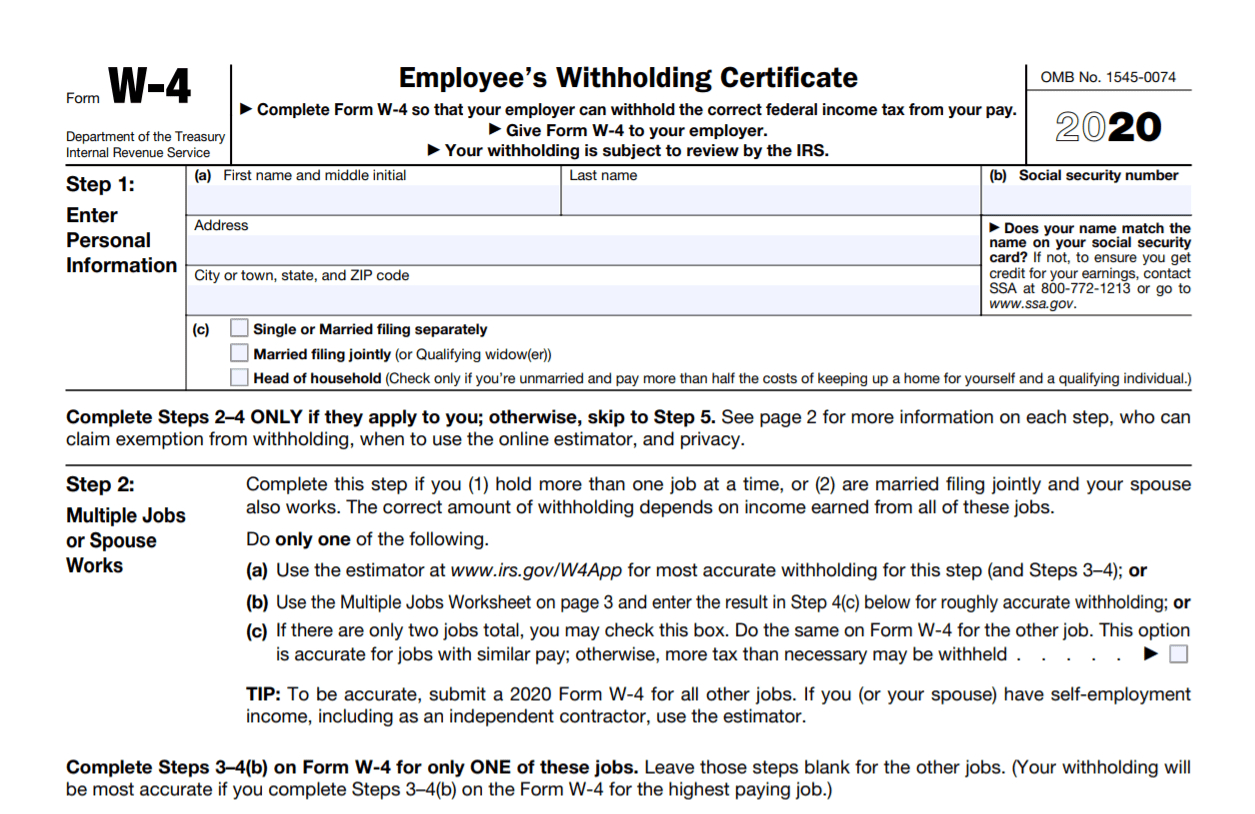

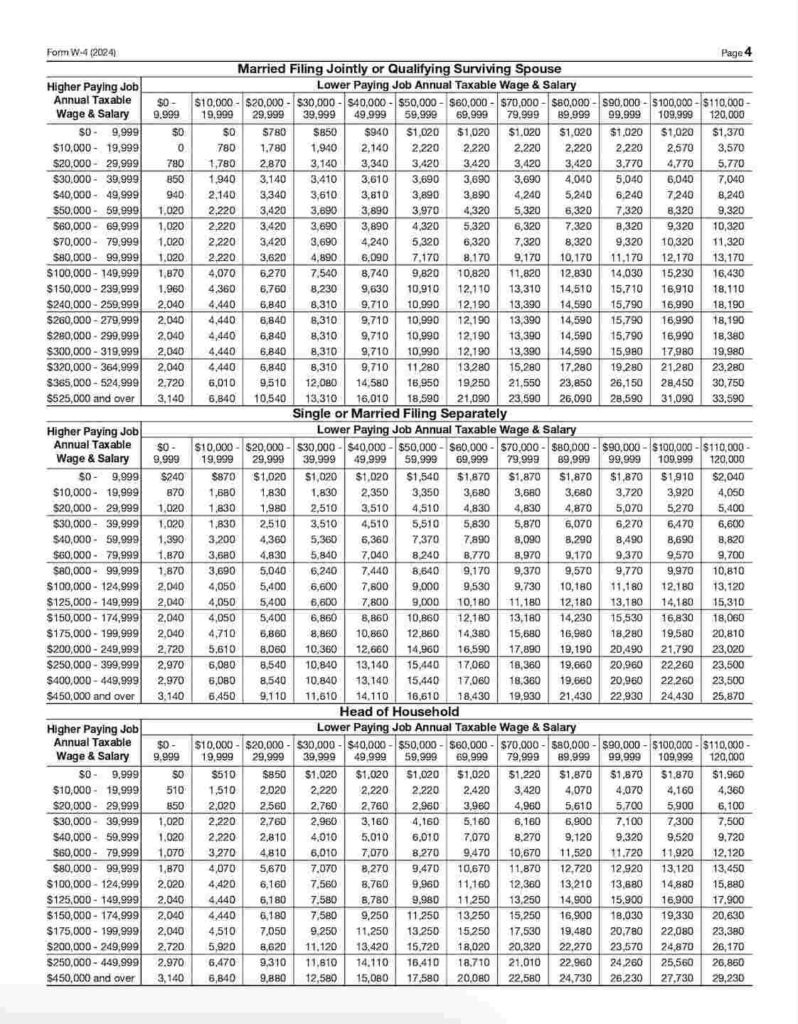

IL W4 Form 2025 Images