Illinois W4 2025 Form – Are you ready to make the most out of your tax refund? Look no further than the new and improved Illinois W4 form for 2025! This updated form is designed to help you maximize your refund and take advantage of all the benefits Illinois has to offer. Say goodbye to complicated tax processes and hello to a brighter financial future. With the Illinois W4 2025 form in hand, you’ll be on your way to a bigger refund in no time!

Unleash the Power of the New Illinois W4 Form for 2025

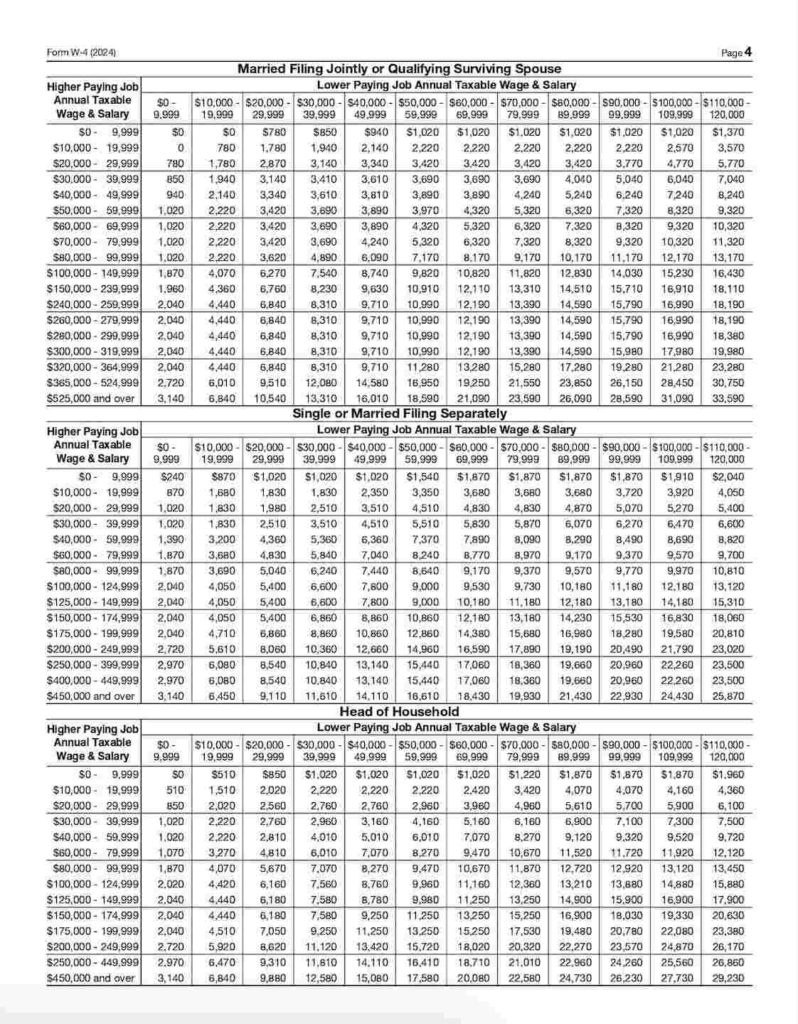

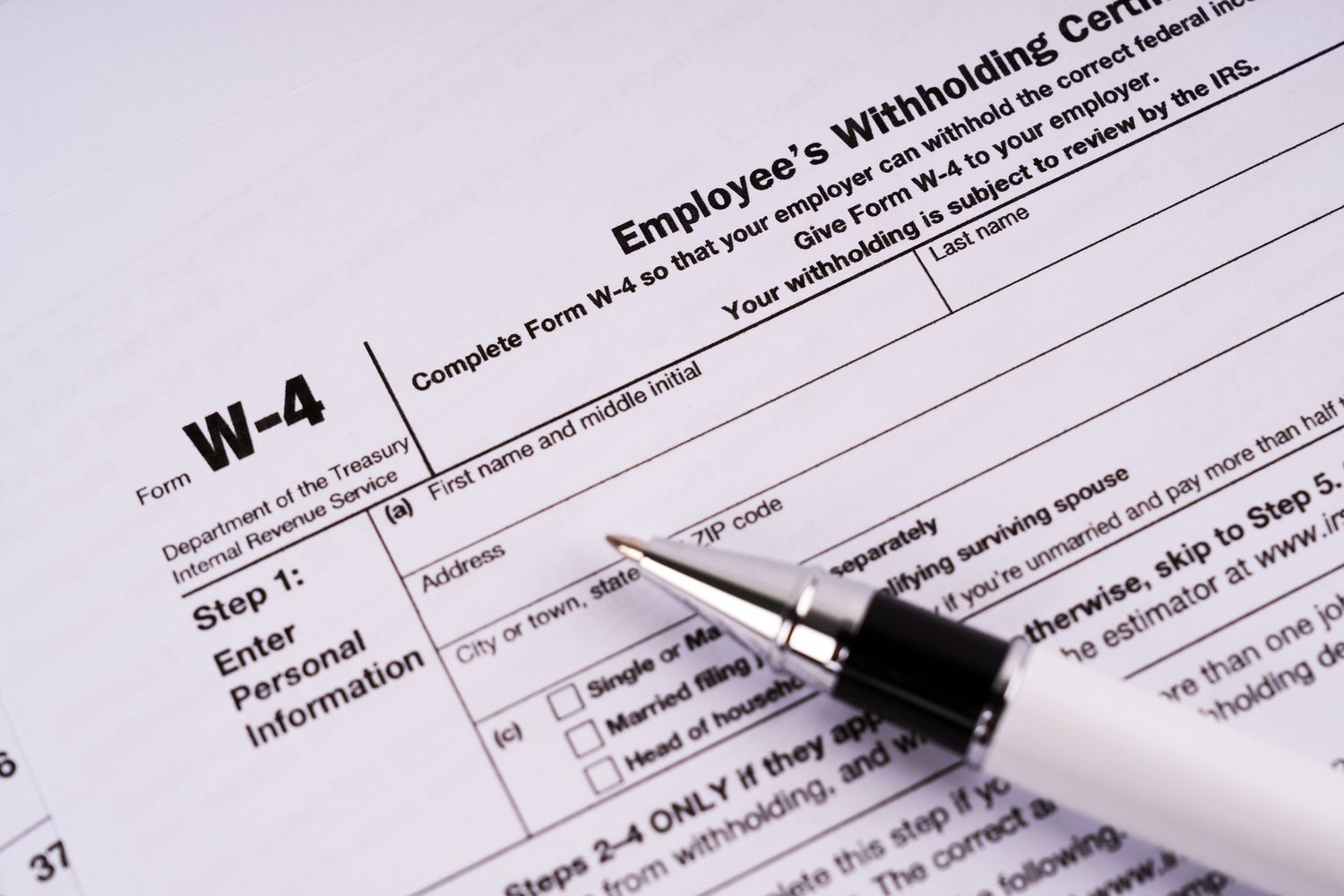

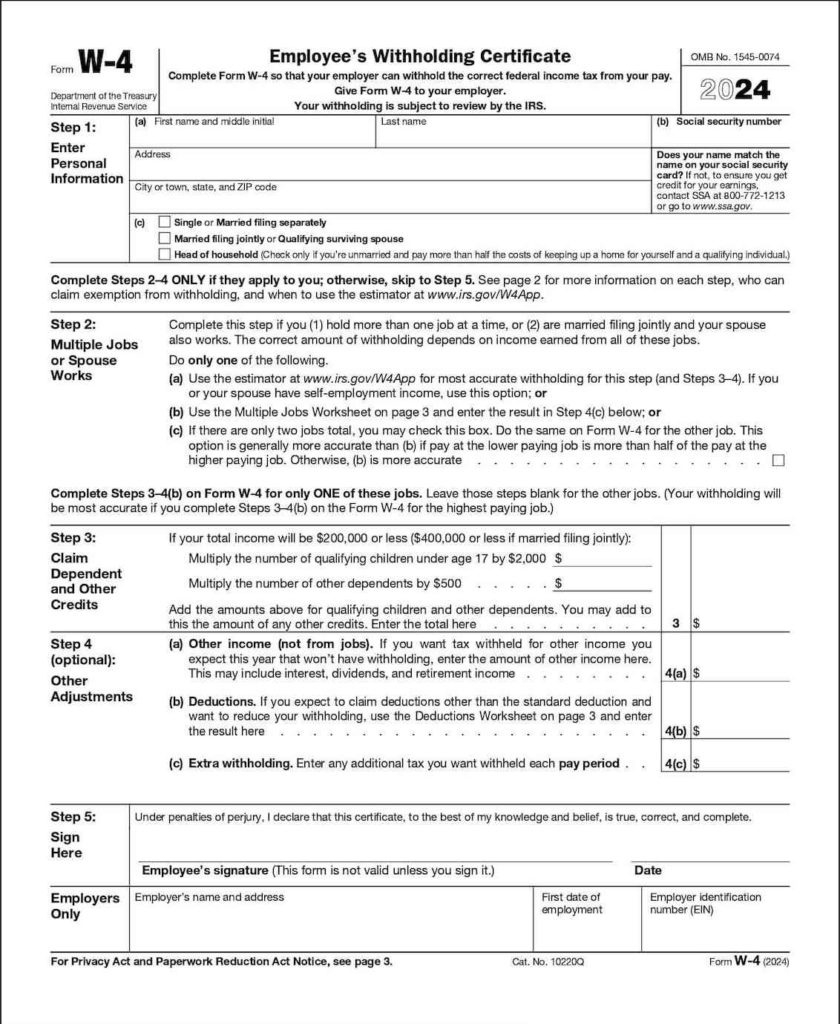

The new Illinois W4 form for 2025 is your key to unlocking a world of tax-saving opportunities. This form is designed to make the tax filing process easier and more efficient, allowing you to take full advantage of all the deductions and credits available to you. By filling out the Illinois W4 form correctly, you can ensure that you are withholding the right amount of taxes from your paycheck, maximizing your refund at the end of the year. Don’t leave money on the table – unleash the power of the new Illinois W4 form and watch your refund grow!

When it comes to taxes, knowledge is power. The Illinois W4 form for 2025 is packed with valuable information and tips to help you navigate the tax filing process with ease. Whether you’re a seasoned tax pro or a first-time filer, this form will guide you through the intricacies of Illinois tax law and ensure that you are taking full advantage of all the deductions and credits available to you. By understanding how to properly fill out the Illinois W4 form, you can position yourself for a bigger refund and a brighter financial future. So don’t wait – unleash the power of the new Illinois W4 form for 2025 and start maximizing your refund today!

In conclusion, the Illinois W4 form for 2025 is your ticket to a bigger refund and a brighter financial future. By taking advantage of the tax-saving opportunities available to you, you can ensure that you are getting the most out of your tax refund and setting yourself up for success. So don’t delay – unleash the power of the new Illinois W4 form and watch your refund grow!

Related Forms…

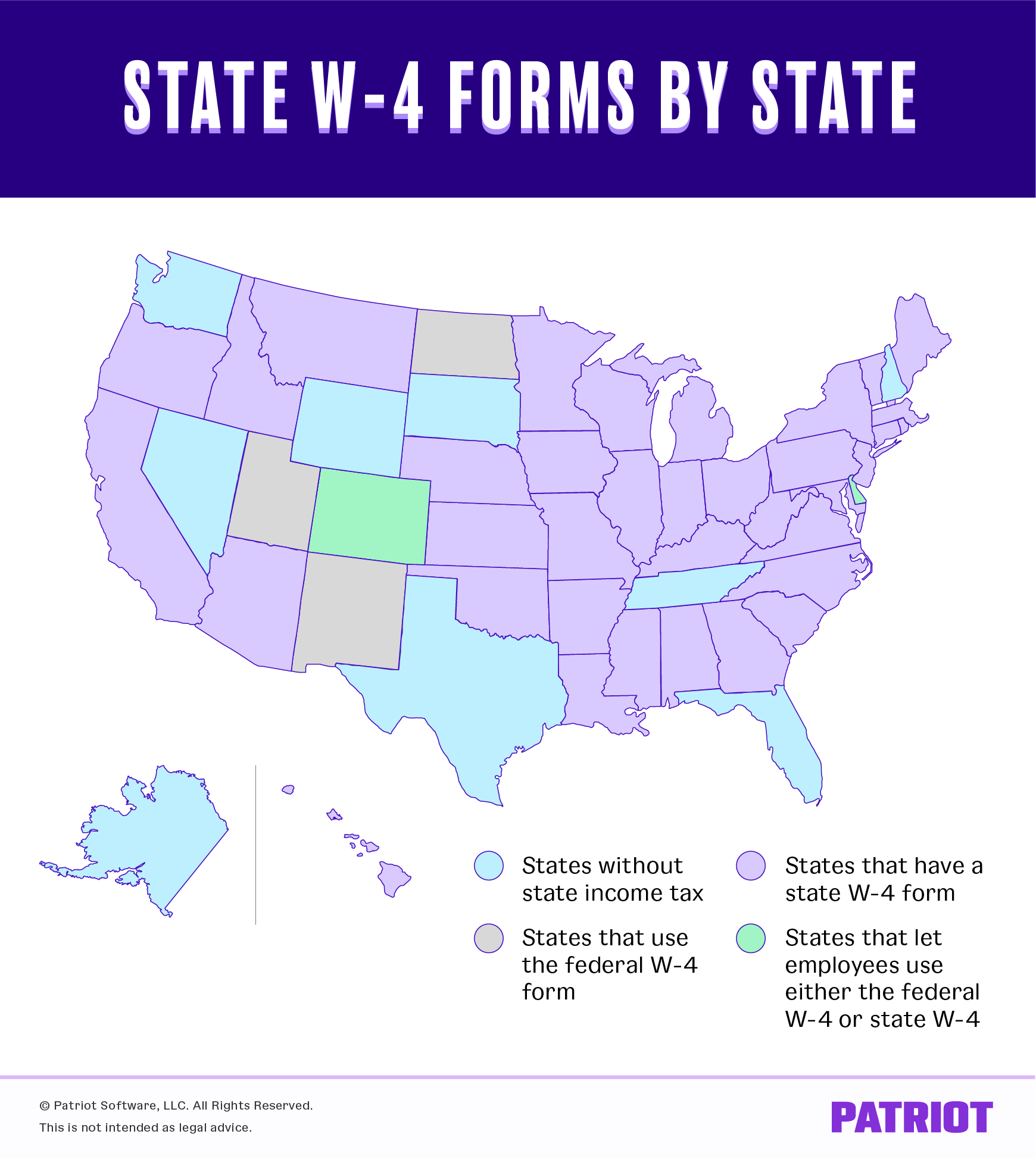

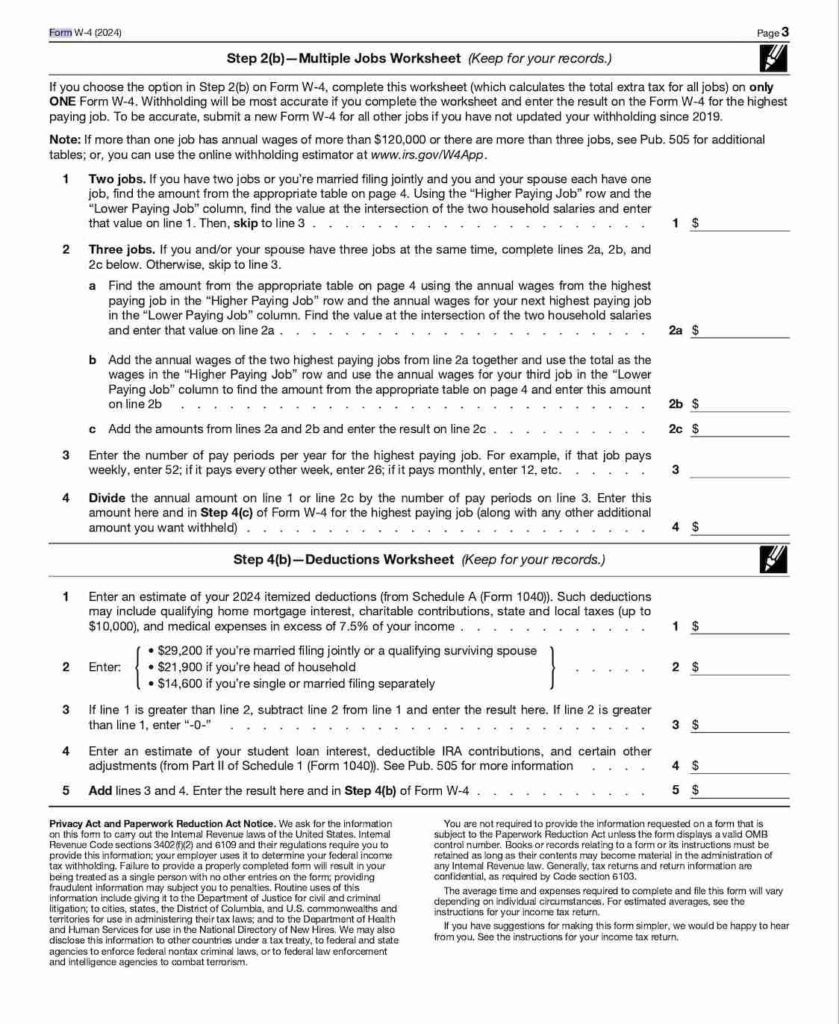

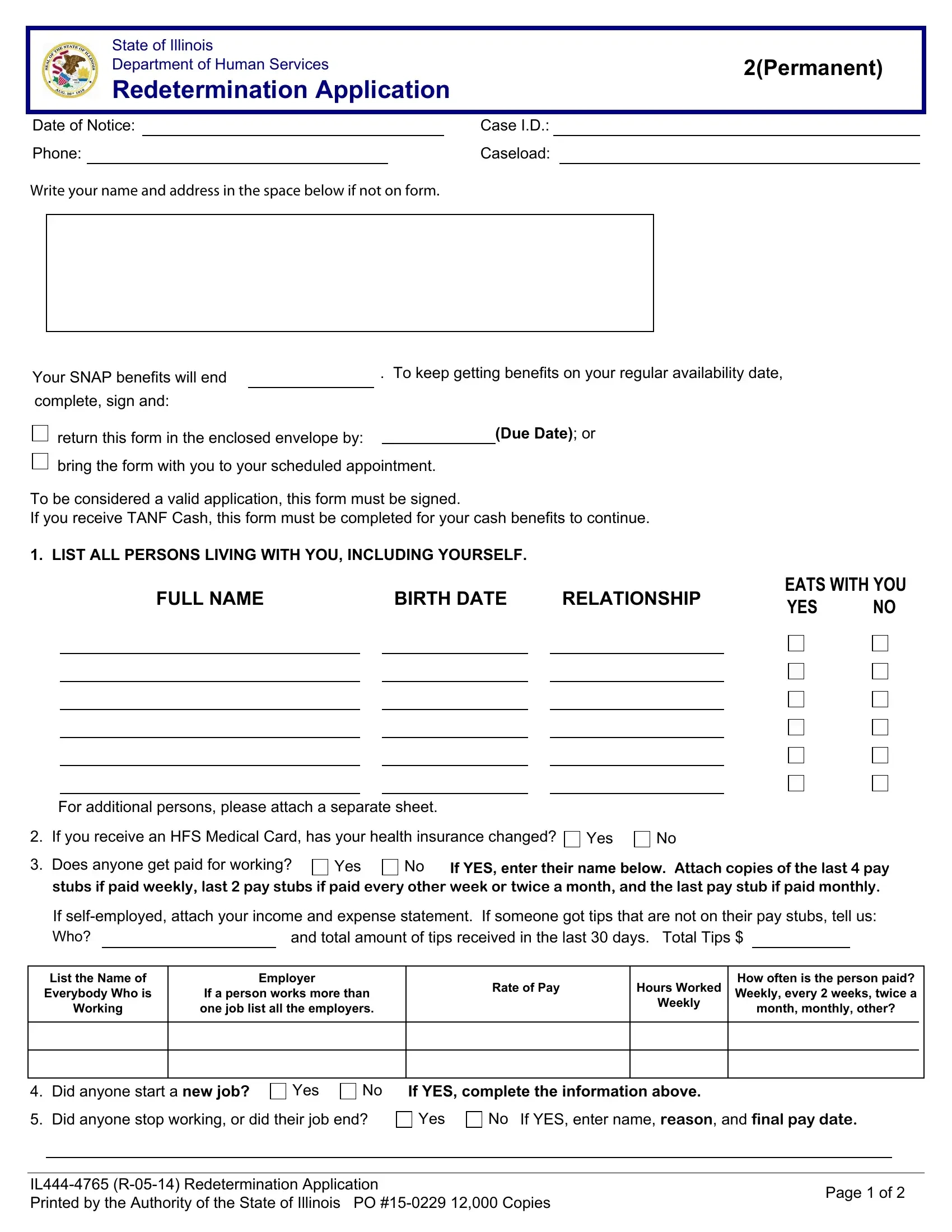

Illinois W4 2025 Form Images