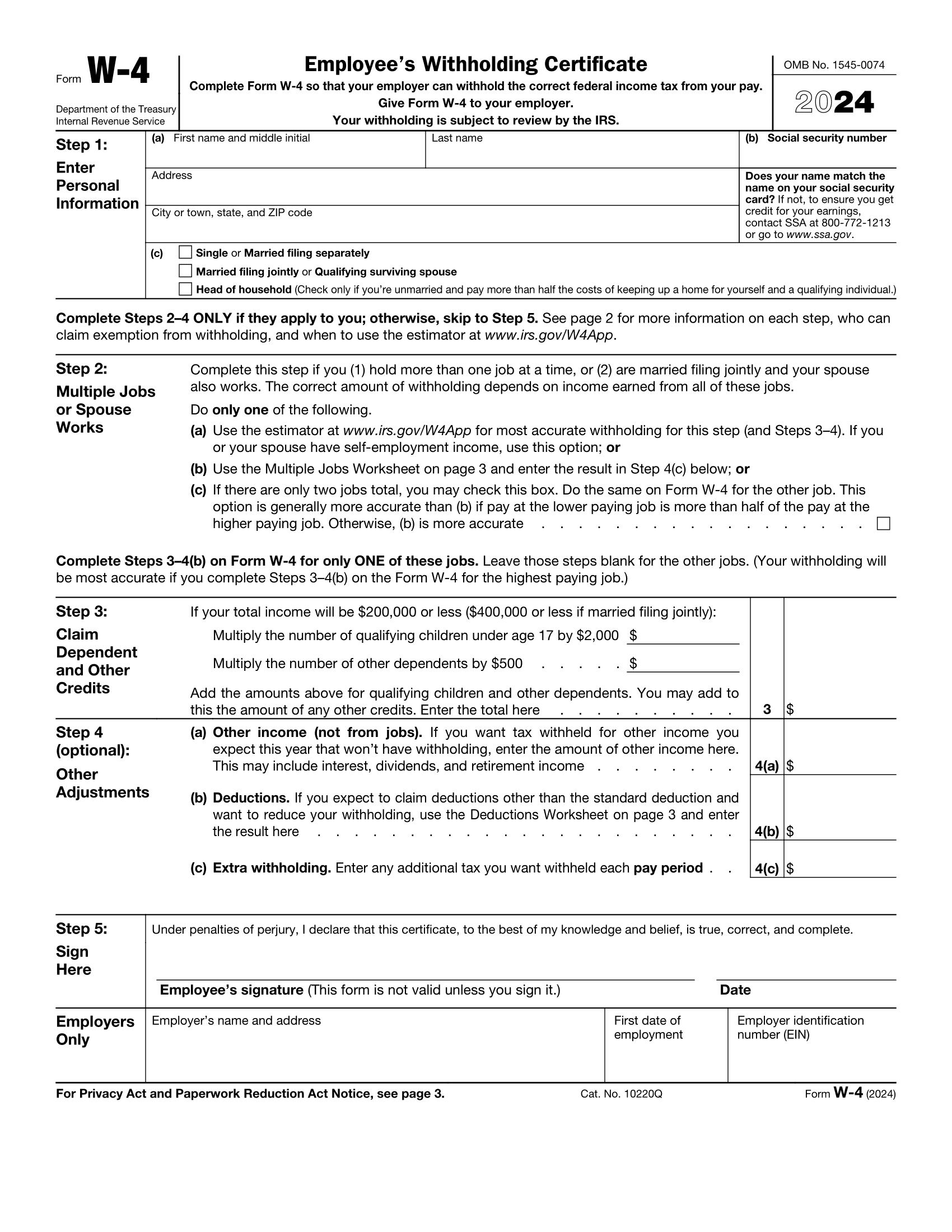

W4 Forms For 2025 – It’s never too early to start thinking about your taxes, especially when it comes to your W4 forms! As we approach 2025, it’s time to get organized and prepared for the upcoming tax season. Your W4 forms play a crucial role in determining how much money is withheld from your paychecks for taxes, so it’s important to make sure they are accurate and up to date. By taking the time to review and update your W4 forms now, you can avoid any surprises come tax time and ensure that you are maximizing your tax savings.

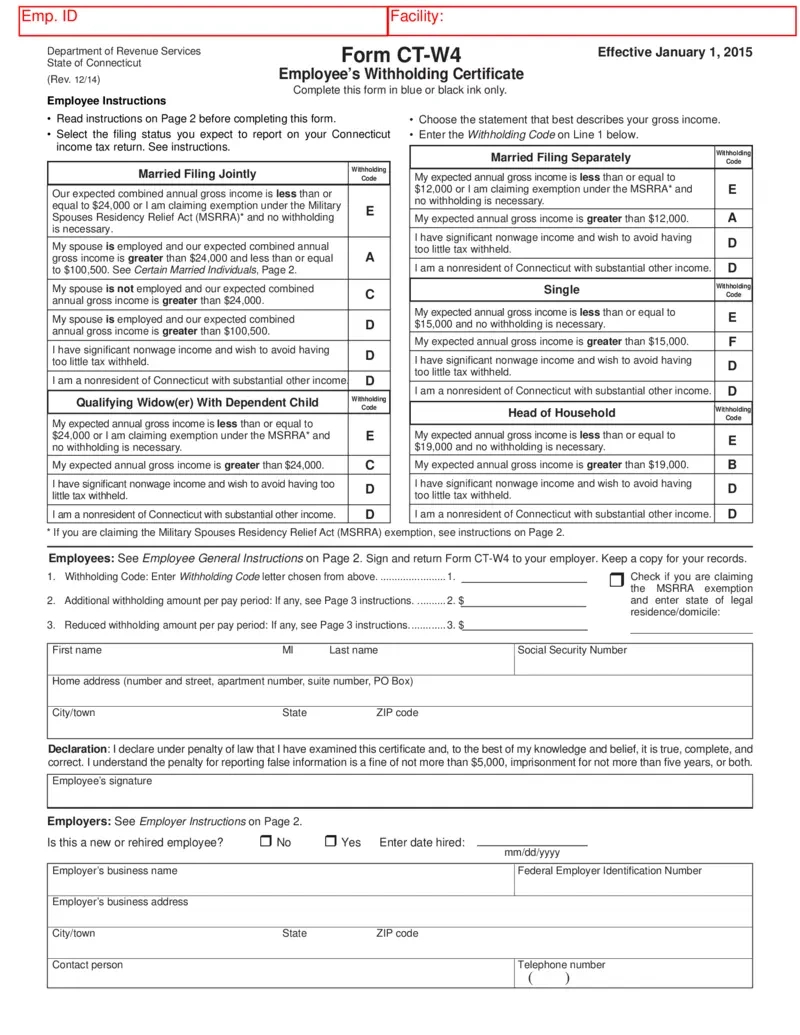

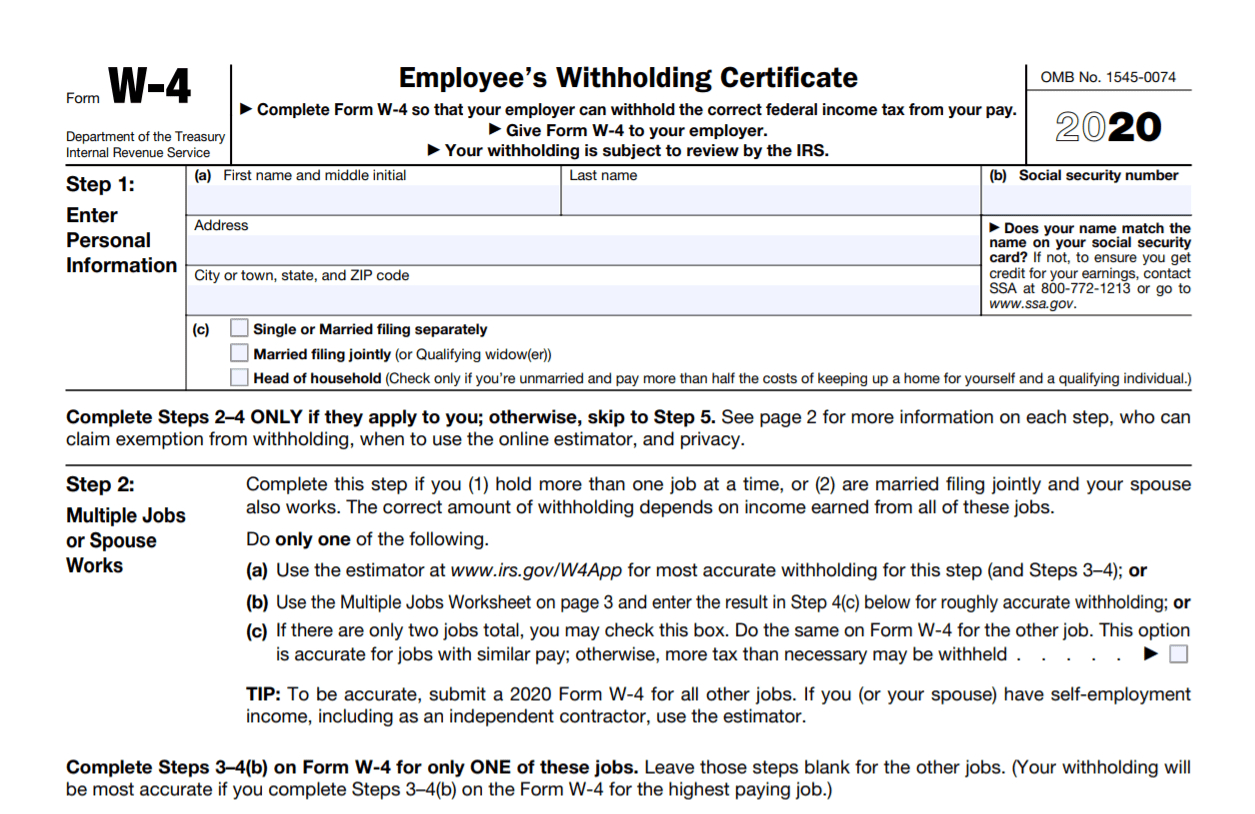

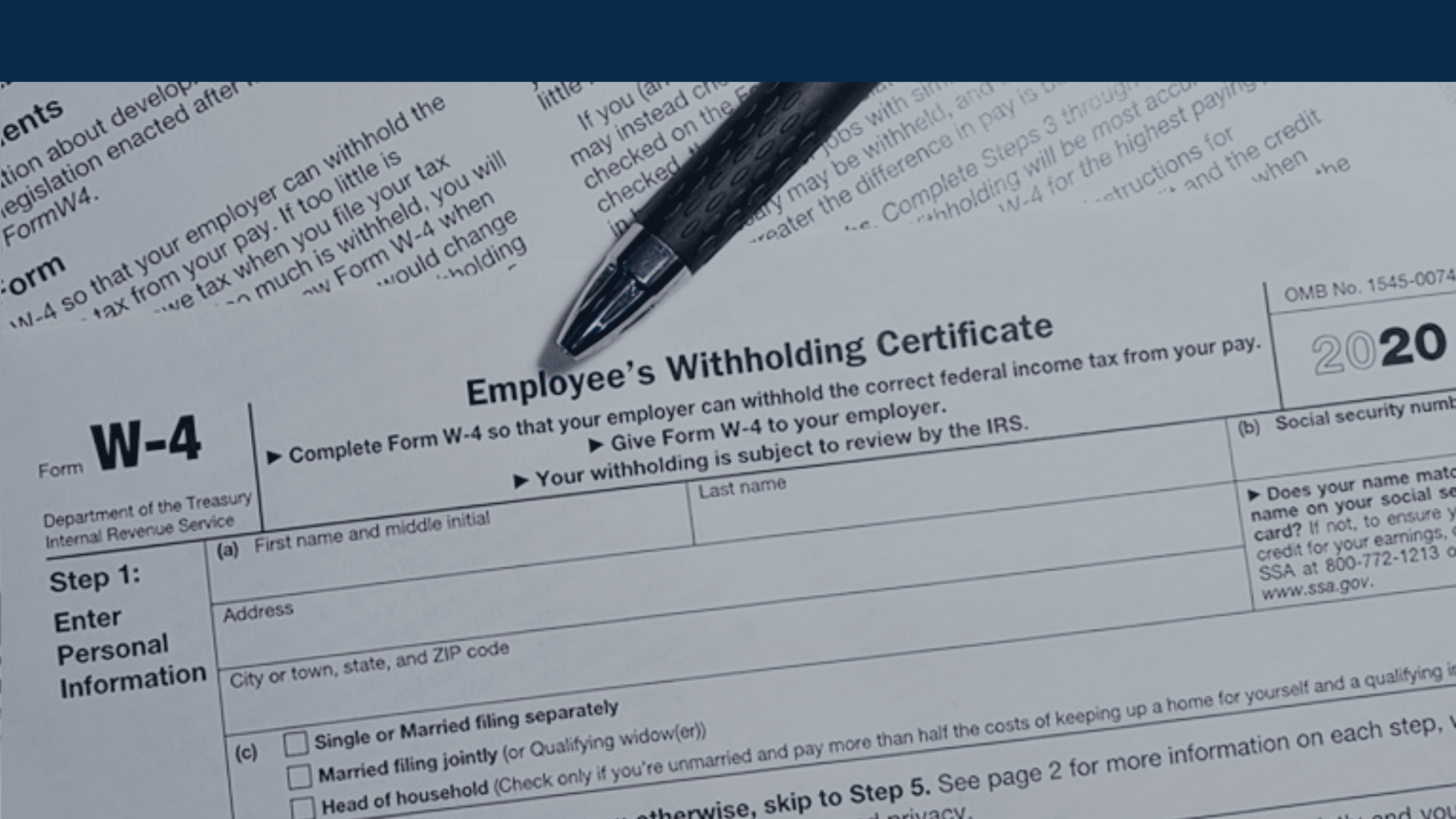

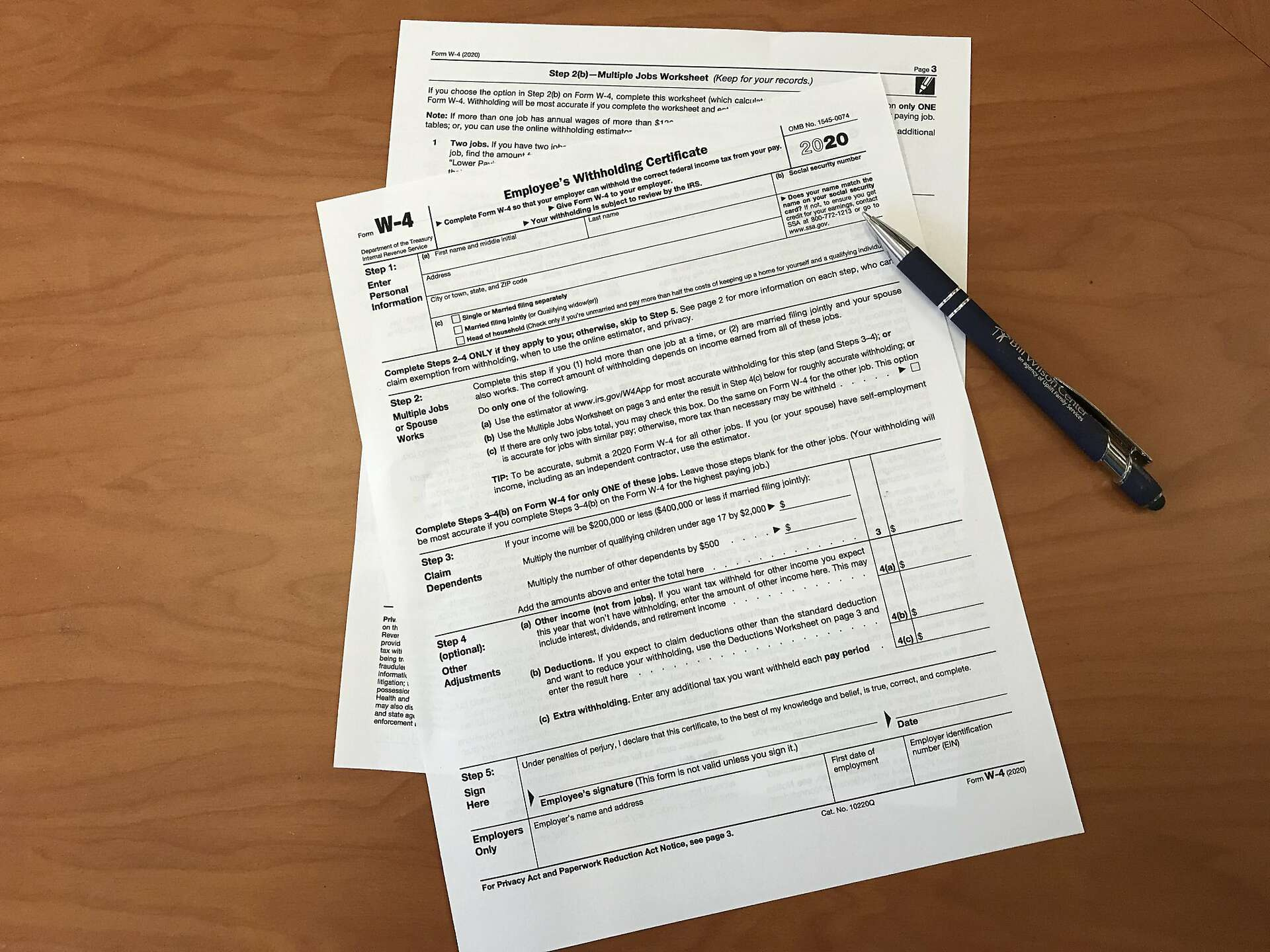

One way to rock your W4 forms in 2025 is to review your current withholding allowances and make any necessary adjustments. Changes in your personal or financial situation, such as getting married, having a child, or buying a home, can all impact how much tax you owe. By updating your W4 forms to reflect these changes, you can ensure that the right amount of taxes is being withheld from your paychecks. This can help prevent underpayment penalties or a large tax bill when you file your taxes next year.

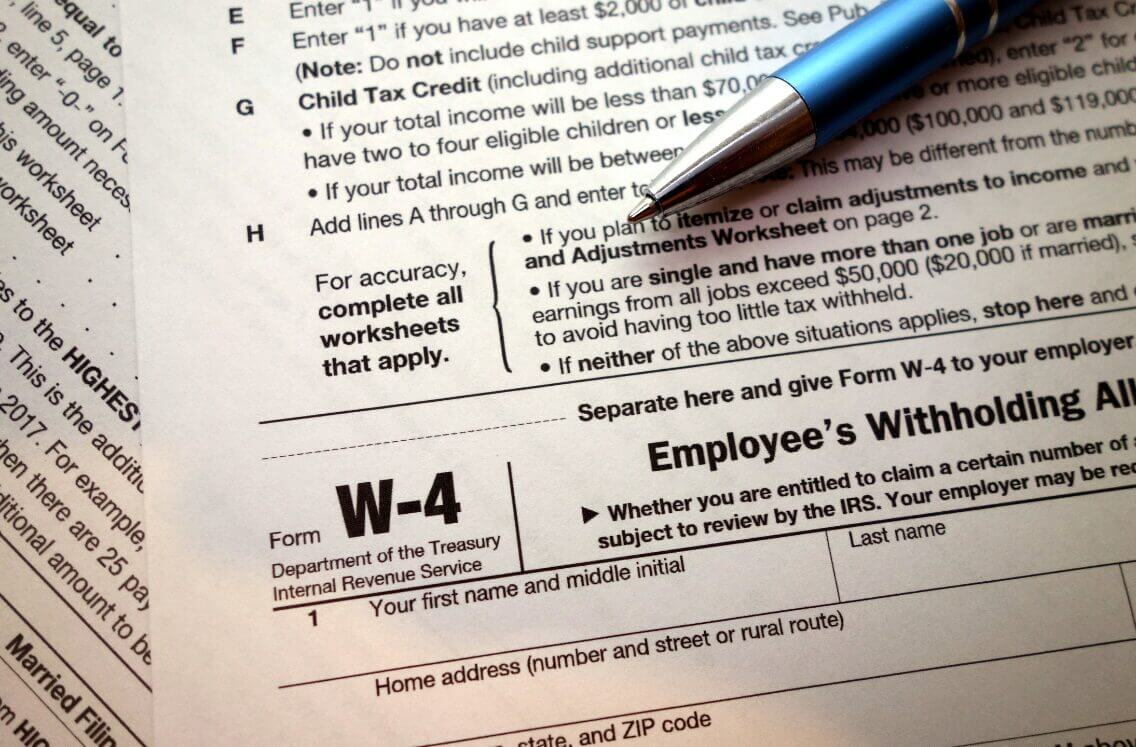

Another way to rock your W4 forms in 2025 is to take advantage of any tax credits or deductions that you may be eligible for. By accurately completing your W4 forms and claiming all available credits and deductions, you can reduce your tax liability and potentially increase your tax refund. Make sure to carefully review the instructions for your W4 forms and consult with a tax professional if you have any questions or need assistance. By being proactive and thorough in completing your W4 forms, you can set yourself up for a successful and stress-free tax season in 2025.

Get a Head Start on Your 2025 Taxes!

As we gear up for 2025, now is the perfect time to get a head start on your taxes by focusing on your W4 forms. By taking the time to review and update your W4 forms early, you can avoid any last-minute scrambling and ensure that your tax withholding is accurate throughout the year. This can help you avoid any surprises when you file your taxes and potentially increase your tax refund. So why wait? Start rocking your W4 forms now and set yourself up for a smooth and successful tax season in 2025!

In addition to reviewing and updating your W4 forms, it’s also important to stay informed about any changes to tax laws or regulations that may impact your tax situation. By staying up to date on the latest tax developments, you can make informed decisions about your finances and take advantage of any new tax-saving opportunities. Consider attending tax workshops or consulting with a tax professional to ensure that you are making the most of your tax situation. By staying proactive and informed, you can maximize your tax savings and rock your W4 forms in 2025!

In conclusion, getting ready to rock your W4 forms in 2025 is all about being proactive, organized, and informed. By reviewing and updating your W4 forms, claiming all available credits and deductions, and staying informed about tax developments, you can set yourself up for a successful tax season and potentially increase your tax savings. So don’t wait until the last minute – start preparing now and get ready to rock your W4 forms in 2025!

Related Forms…

W4 Forms For 2025 Images